Lowest MTF Interest Rate Brokers in India 2026 - MTF Brokers

00:00 / 00:00

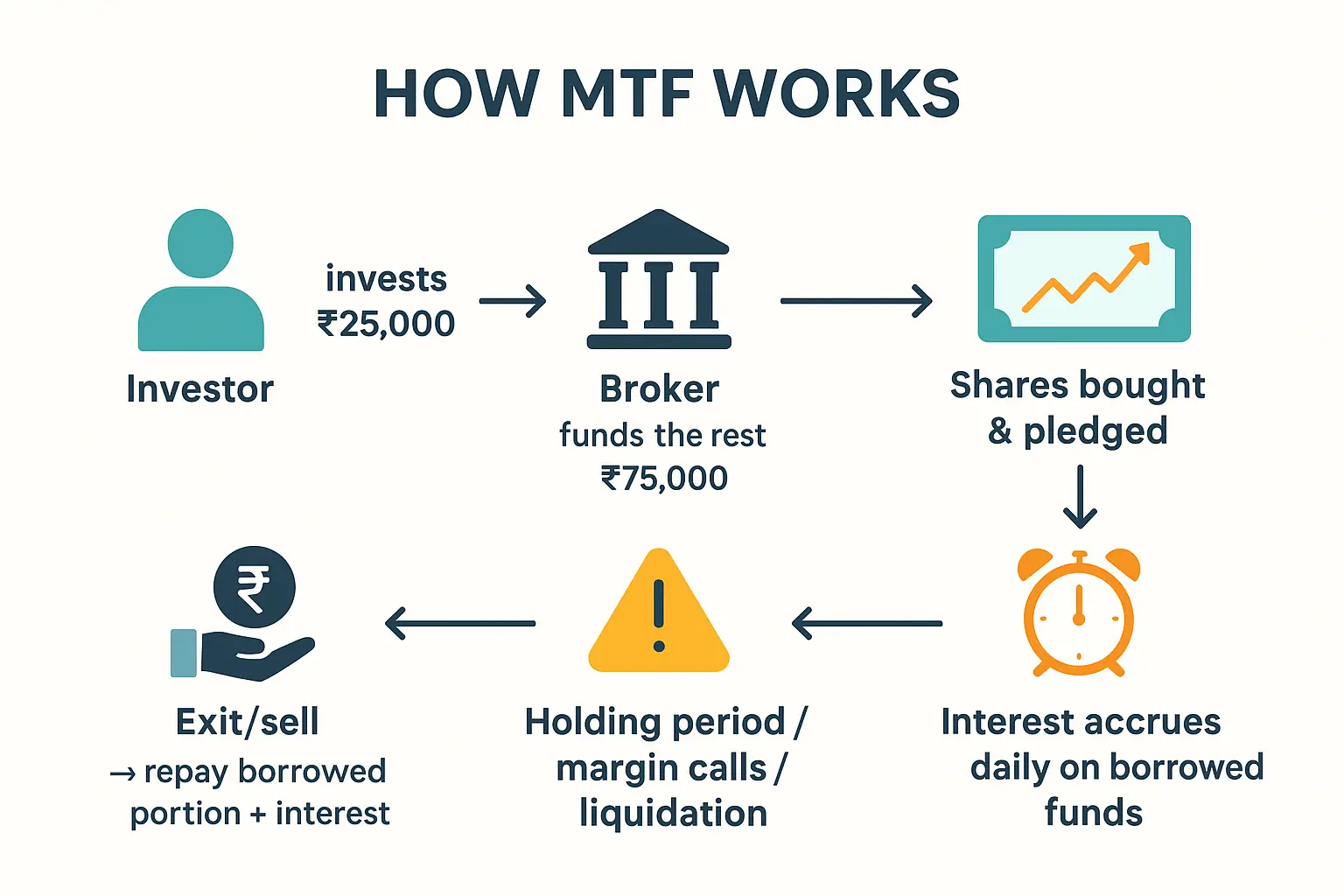

Margin Trading Facility (MTF) is a SEBI and Exchange approved product that allows you to trade in the stock market using borrowed money. You only need to pay a small percentage of the total capital required, while your broker lends you the rest. You will pay interest on the amount you borrow.

As mentioned, brokers charge interest on the amount you borrow, making it a crucial aspect of the Margin Trading Facility. In this blog post, we delve into a detailed comparison of the top 10+ lowest MTF interest rate brokers in India 2026 to help you find the best broker for MTF trading by analyzing their annual interest rates on margins.

Understanding MTF Interest Rates

MTF interest rates are the rates brokers charge on funds borrowed by traders to execute margin trades. These rates vary across brokers and are influenced by factors such as market conditions, regulatory requirements, and the broker’s business model. Brokers who borrow money from third-party lenders tend to charge a higher rate of interest.

Importance of Low MTF Interest Rates

Low MTF interest rates are advantageous for traders as they reduce the cost of borrowing and increase the potential profitability of margin trades. Choosing an MTF broker in India with competitive MTF rates can significantly impact a trader’s bottom line.

When to use Margin Trading Facility?

Margin Trading Facility (MTF) can be useful for traders in certain situations. Here are some scenarios when utilizing MTF may be appropriate:

Capital Enhancement: The MTF facility allows you to trade with a higher quantum of funds and enhance your profit potential even when with a fraction of capital. It can be particularly beneficial for traders with limited capital looking to access larger positions in the stock market.

Short-Term Trading Opportunities(Swing Trading): Traders may use MTF to capitalize on short-term trading opportunities like swing trading that require quick execution. By borrowing funds through MTF, traders can seize opportunities for profit without waiting for their own funds to settle.

Diversification Strategy: Indian traders may employ MTF to broaden their investment portfolios beyond their current financial capabilities. Diversification is crucial for mitigating risk, and MTF allows traders to access a broader array of securities, potentially enhancing overall portfolio performance.

Criteria for Selection

When evaluating brokers for their MTF interest rates, several factors should be considered:

Interest Rate Transparency: Brokers should clearly disclose their MTF interest rates to traders.

Margin Requirements: Lower margin requirements can result in lower borrowing costs.

Broker Reputation: Established brokers with a track record of reliability may offer more competitive rates.

Additional Services: Consideration of other services offered by the broker, such as trading platforms and customer support.

List of Top 21 Lowest MTF Interest Rates Brokers in India 2026

Rupeezy is the best broker for MTF trading, offering one of the lowest MTF interest rate in India at just 0.03% or Rs. 30 per day per lakh. This is often lower than personal loan interest rates from banks. Rupeezy’s competitive rates are made possible through prudent capital use and advanced technology for efficient capital management. Below is a list of interest rates charged by other brokers for comparison.

MTF Brokers | Interest Rate | Per Day Charges per Lakh |

Rupeezy | 0,03% per day (10.99% p.a.) | Rs. 30 (flat) |

Paytm Money | 0.026% to 0.041% per day (9.75% to 14.99% p.a.) - varies based on slab | Rs. 26 to Rs. 41 |

ICICI Direct | 0.026% to 0.049% per day (9.65% to 17.99% p.a) varies based on brokerage plans | Rs. 26 to Rs. 49 |

Kotak Securities | 0.026% to 0.041 per day (9.75% p.a.) varies based on brokerage plans | Rs. 26 |

Lemonn | 0.0273% per day (9.99% p.a.) | Rs. 27.3 |

HDFC Securities | 0.032% per day (12% p.a.) | Rs. 32 |

Dhan | 0.034% to 0.045% per day (12.49% to 16.49% p.a.) varies based on Gross Holdings | Rs. 34 to Rs. 45 |

Axis Direct | 0.038% to 0.049% per day (13.99% to 18% p.a) varies based on brokerage plans | Rs. 38 to Rs. 49 |

Zerodha | 0.04% per day (14.6% p.a.) | Rs. 40 |

INDmoney | 0.04% per day (14.6% p.a.) | Rs. 40 |

Angel One | 0.041% per day (14.99% p.a.) | Rs. 41 |

Groww | 0.041% per day (14.95% p.a.) | Rs. 41 |

IDBI Direct | 0.044% per day (16% p.a.) | Rs. 44 |

5paisa | 0.045% per day (16.4% p.a.) | Rs. 45 |

Sharekhan | 0.049% per day (18% p.a.) | Rs. 49 |

Arihant Capital | 0.049% per day (18% p.a.) | Rs. 49 |

Alice Blue | 0.049% per day (18% p.a.) | Rs. 49 |

BlinkX | 0.049% per day (18% p.a.) | Rs. 49 |

Fyers | 0.0493% per day (17.99% p.a.) | Rs. 49.3 |

Upstox | Rs 20/day for every slab of Rs 40,000 taken as MTF | Rs. 60 |

Motilal Oswal | 0.053% per day (19.5% p.a.) | Rs. 53.42 |

Conclusion

Choosing the right broker with the lowest MTF interest rates is essential for traders looking to optimize their trading costs and maximize their returns. By considering factors such as interest rate transparency, margin requirements, and additional services offered, traders can identify the best MTF brokers offering the most competitive MTF rates. Whether opting for a discount broker like Rupeezy or a full-service broker like HDFC Securities, traders should conduct thorough research and due diligence to make an informed decision that aligns with their trading objectives and risk tolerance.

Start your journey to lower your mtf trading costs with Rupeezy! Open an account today and take advantage of our competitive MTF rates.

All Category