Is Vishal Mega Mart IPO Worth Buying? Detailed Review

00:00 / 00:00

Vishal Mega Mart IPO is kicking off its initial public offering which will be open from December 11, 2024, to December 13, 2024. While considering applying for this IPO, certain questions may arise in your mind, some of which include whether the Vishal Mega Mart IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article provides a detailed Vishal Mega Mart IPO review, analyzing its business fundamentals, market prospects, and key financial metrics to help you make a well-informed investment decision.

Company Overview of Vishal Mega Mart IPO

Incorporated in 2018, Vishal Mega Mart Limited is a one-stop destination for middle and lower-middle income consumers across India. The company curates a diverse range of merchandise through its portfolio of own brands and third-party brands. Vishal Mega Mart operates a pan-India network of 645 Vishal Mega Mart stores, as well as a mobile application and website.

Through its expansive network, the company offers products across three major categories: apparel, general merchandise, and fast-moving consumer goods (FMCG). Products sold at Vishal Mega Mart stores are either manufactured for the company by vendors located across India or sourced from select third-party brands.Vishal Mega Mart ranks among the top two offline-first diversified retailers in India based on the number of cities that offer same-day delivery.

Vishal Mega Mart is the fastest-growing leading offline-first diversified retailer in India based on profit after tax (PAT) growth between FY2021 and FY2024. The company also reports the highest adjusted return on capital employed (ROCE) among its peers.

As of September 30, 2024, Vishal Mega Mart's business operations were concentrated in 18 states and 3 union territories across India. The company derived a majority of its revenue from the states of Uttar Pradesh, Bihar, and Maharashtra. Vishal Mega Mart believes these states offer significant growth potential due to favorable demographics, a growing middle class, increasing disposable incomes, and a preference for value-based retail.

Industry Overview of Vishal Mega Mart IPO

Vishal Mega Mart is entering the Indian retail market through its IPO.This market is quite large at Rs.68-72 trillion (US$820-870 Billion) and it's expected to grow to Rs.104-112 trillion (US$ 1,250-1,350 Billion) by 2028. This growth is fueled by multiple factors in the Indian economy. The middle class is expanding and people are moving into cities more frequently. More women are joining the workforce, meaning more disposable income for families.

The industry is also shifting away from small, independent shops towards larger, organised retailers. This is happening for several reasons. Customers today are demanding higher quality goods and a more diverse selection of products. Organised retailers are better positioned to meet those demands, as they often have their own brands and supply chains. They can also offer better prices, particularly for everyday items, because they buy in bulk. This means companies like Vishal Mega Mart are poised to benefit from this ongoing shift in consumer behaviour.

Vishal Mega Mart is positioned well within the aspirational retail market. They are one of the top three offline-first diversified retailers in India, measured by retail space. They are also the fastest growing in this category when looking at their profit after tax growth (PAT). Vishal Mega Mart accomplishes this by offering a wide range of products across apparel, general merchandise, and fast-moving consumer goods. This variety makes them a one-stop shop for consumers looking for both everyday needs and aspirational products.

Financial Overview of Vishal Mega Mart IPO

In FY24, Vishal Mega Mart achieved revenue from operations of Rs.8,911.95 crores, a growth of 17.6% compared to Rs.7,586.03 crores in FY23. This growth reflects the company’s focus on increasing its store network and driving sales across existing locations.

The company reported EBITDA of Rs.1,248.60 crores in FY24, a rise of 22.3% from Rs.1,020.25 crores in FY23. Additionally, the net profit rose by 43.7% to Rs.461.94 crores in FY24, showcasing the company's ability to effectively manage costs and improve profitability alongside revenue growth.

Cash flow generation was another strong point for Vishal Mega Mart in FY24. The net cash flow from operating activities grew to Rs.829.67 crores, compared to Rs.635.53 crores in the previous year, signaling better working capital management and strong operational cash flow.

Vishal Mega Mart's Return on Net Worth (RoNW) of 8.18%. This suggests that Vishal Mega Mart is less efficient in using shareholder equity to generate profits, which could be a concern for investors seeking efficient capital utilization and strong returns.

Strengths of Vishal Mega Mart IPO

Vishal Mega Mart caters to a large and rapidly growing segment of India's population - the middle and lower-middle income shoppers. As these groups have more money to spend, Vishal Mega Mart offers a wide selection of products at prices they can afford.

Vishal Mega Mart provides the convenience of finding everything you need in one place - from clothes and household items to groceries. This makes shopping easier and quicker, especially for busy people.

Vishal Mega Mart uses technology to make its operations smoother and improve customer satisfaction. For instance, they offer same-day delivery in many cities, showing they have a good system for managing stock and deliveries.

There's a lot of potential for growth in smaller cities where organized retail is not as common. Vishal Mega Mart is focusing on expanding into these areas to reach new customers and grow their business.

Risk Factors of Vishal Mega Mart IPO

A large number of Vishal Mega Mart's stores are located in the North and East of India. If there are problems in these regions, such as an economic downturn, it could significantly affect the company's sales and profits.

The retail industry in India is highly competitive, with many companies fighting for the same customer base. Vishal Mega Mart needs to adapt to changing customer preferences, offer new and exciting products, and keep prices competitive to avoid losing business to rivals like online stores or other large retail chains.

Vishal Mega Mart uses third-party companies for their same-day delivery service, meaning they depend on these companies for timely and efficient deliveries. If these partners encounter issues like delays or poor service, it could lead to unhappy customers and harm the company's reputation, resulting in lost sales.

Vishal Mega Mart operates in a regulated environment and is subject to various laws and regulations. Any changes in these laws, such as those related to taxation, labor, or environmental compliance, could increase the company's operating costs or create legal challenges.

Strategies of Vishal Mega Mart IPO

Vishal Mega Mart plans to open more stores all over India, especially in areas with a population of over 50,000 people. They want to be in more cities and towns, giving people easier access to their products.

The company aims to increase sales in their existing stores by adding more types of products. They will introduce new items in clothing, home goods, and everyday necessities, always striving to offer the lowest starting prices.

Vishal Mega Mart is working on making their products available online and through local delivery. They have a website and mobile app where people can order items. They are also expanding same-day delivery to more cities, making shopping more convenient for customers.

Vishal Mega Mart wants to use technology to better understand what customers like and need. This will help them suggest products, make it easier to find items, and create a more enjoyable shopping experience. They believe this will lead to more sales and happy customers.

Vishal Mega Mart Vs Peers

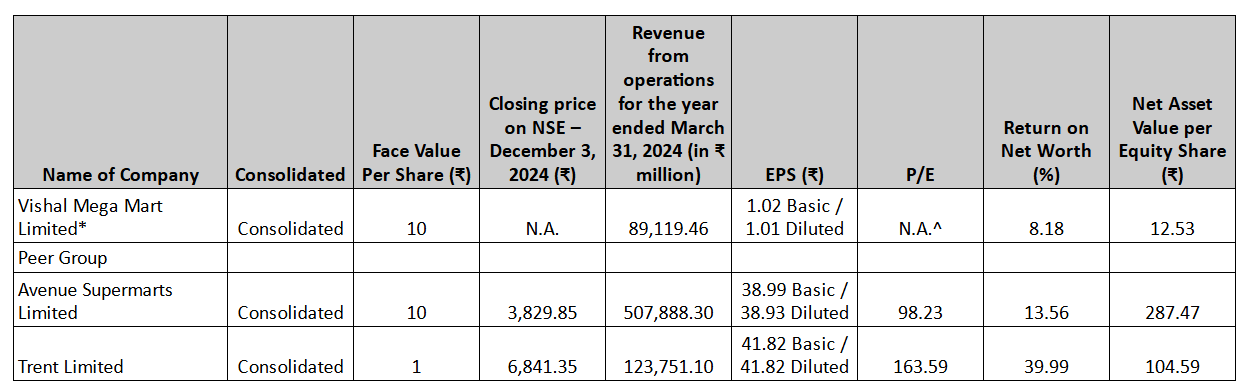

Below is the image showing a comparison of Vishal Mega Mart with its listed industry peers as of FY24:

Vishal Mega Mart reported revenue from operations of Rs.8,911.95 crores, which is lower compared to Avenue Supermarts, which recorded Rs.50,788.83 crores, and Trent Limited at Rs.12,375.13 crores. This indicates that while Vishal Mega Mart has grown, it operates on a smaller scale compared to its larger peers.

Regarding the Earnings Per Share (EPS), Vishal Mega Mart posted only Rs.1.02 (Basic), far behind Avenue Supermarts, which reported Rs.38.99, and Trent Limited at Rs.41.82. This highlights a potential area for improvement in profitability on a per-share basis for Vishal Mega Mart.

In terms of Return on Net Worth (RoNW), Vishal Mega Mart recorded 8.18%, which is lower compared to Avenue Supermarts at 13.56% and Trent Limited's remarkable 39.99%. This indicates that its peers are utilizing their equity more efficiently to generate returns for shareholders.

The Net Asset Value (NAV) per Equity Share, stood at Rs.12.53 for Vishal Mega Mart, substantially lower than Avenue Supermarts' Rs.287.47 and Trent Limited's Rs.104.59. This showcases that the peer companies have a stronger asset base relative to their equity.

Vishal Mega Mart has grown but is still smaller compared to its competitors, Avenue Supermarts and Trent Limited. It earns less revenue and profits per share, gives lower returns to its shareholders, and has a weaker asset base.

Objective Of Vishal Mega Mart IPO

Vishal Mega Mart IPO, the company itself won't get any money from the sale of shares. All the money raised from selling these shares will go to the promoter who is selling them, after paying for any costs related to the sale and taxes.

Vishal Mega Mart IPO Details

IPO Date

Vishal Mega Mart IPO is open to subscription from December 11, 2024, to December 13, 2024. The shares will be allocated to investors on December 16, 2024, and the company will be listed in the NSE and BSE on December 18, 2024.

IPO Issue Price

Vishal Mega Mart IPO is offering its shares in the price band of Rs.74 to Rs.78 per share. This means you would require an investment of Rs.14,820 per lot (190 shares) if you are bidding for the IPO at the upper price band.

IPO Size

The Vishal Mega Mart IPO is offering a total of 1,025,641,025 shares, amounting to Rs. 8,000 Crores which will be completely offered through an offer for sale.

IPO GMP

Many investors look at the Grey Market Premium (GMP) before applying for Vishal Mega Mart. The GMP gives an idea of market sentiment and can hint at the possible listing price. However, it should be noted that it does not reflect how financially strong Vishal Mega Mart is. Thus, it is important to financially analyze the stock before investing in it.

IPO Allotment Status

The shares from Vishal Mega Mart IPO will be allotted to its investors on December 16, 2024. One can check the allotment status for the IPO from its registrar Kfin Technologies Limited Private Limited, the BSE website, or your broking platform where you have applied for the IPO.

IPO Application Link

Open a demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free. Click on the apply link below to get started.

Apply for Vishal Mega Mart IPO

Vishal Mega Mart IPO is Good or Bad?

Vishal Mega Mart’s IPO highlights strong growth in revenue and profits, showing the company’s focus on expanding its operations and improving efficiency. However, it remains smaller and less profitable than major competitors like Avenue Supermarts and Trent Limited, with lower returns and asset strength. While the company has good potential to grow over the long term, investors should also consider the risks associated with it before an investment decision.

For those interested in investing in such IPOs, you can open a demat account with Rupeezy. Our trading platform allows you to participate in various investment opportunities including initial public offerings.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category