Tenneco Clean Air India IPO Good or Bad

00:00 / 00:00

Tenneco Clean Air India Limited is launching its initial public offering (IPO), which will be open from November 12, 2025, to November 14, 2025. When considering applying for this IPO, you may have several questions such as whether the Tenneco Clean Air India IPO is good or bad, whether investing is worth it, and whether it might be a good option for the long term. This article brings you a detailed Tenneco Clean Air India IPO review, covering the company's business model, financials, and fundamentals so you can make an informed investment decision.

Tenneco Clean Air India IPO Review

Tenneco Clean Air India Limited's initial public offering (IPO) is a book-build issue of Rs.3,600 crore, offered entirely as an offer for sale (OFS). The IPO will be open for subscription from November 12, 2025, to November 14, 2025, with a price band of Rs.378 to Rs.397 per share and a lot size of 37 shares. The company designs and manufactures clean air and powertrain solutions for the automotive sector in India. Its business focuses on vehicle emission control and advanced suspension systems. In FY2025, the company's revenue was Rs.4,931.45 crore, while PAT increased by 33% to Rs.553.14 crore. The company's ROE was 42.65% and EBITDA margin was 16.67%. Its promoters include Tenneco Mauritius Holdings Limited and Federal-Mogul Investments B.V. The company is a leading clean technology supplier in India, with strong R&D capabilities and 12 manufacturing plants. However, since this issue is entirely an OFS, the company will not receive any new capital.

Company Overview of Tenneco Clean Air India Ltd

Established in 2018, Tenneco Clean Air India Limited is a subsidiary of Tenneco Inc., a global leader in the design and manufacturing of clean air and powertrain products. The company's core business focuses on emission control and after-treatment systems for vehicles, helping to meet India's rising environmental standards, such as Bharat Stage VI.

Tenneco Clean Air India Limited's product portfolio includes catalytic converters, diesel particulate filters (DPF), mufflers, and exhaust pipes. Additionally, the company has 12 state-of-the-art manufacturing facilities located across seven states and one union territory in India, supporting leading automobile OEMs and tier-1 customers across the country.

The company's R&D and engineering team comprises 145 specialized employees focused on new technologies, innovation, and sustainable development. Tenneco Clean Air India Limited is known for its global technology and solutions tailored to the needs of the Indian market, making it a strong and trusted player in the Indian automotive industry.

Industry Overview of Tenneco Clean Air India Ltd

The Indian automotive emission control and powertrain solutions industry is expected to witness significant growth in the coming years, primarily due to the growing population, rapid urbanization, rising income levels, and increasing awareness about environmental protection. The rapidly increasing number of vehicles in India is driving a steady increase in demand for emission control technologies. The Indian government has implemented stringent emission standards such as Bharat Stage VI (BS-VI), further increasing the need for clean air technologies and after-treatment systems. India is currently one of the world's largest vehicle producers, and this market is expected to expand further in the coming years. Globally, the automotive emission systems industry is steadily growing in size, and India is playing a key role in this growth. Furthermore, the increasing use of electric and hybrid vehicles is driving a sharp increase in demand for advanced powertrain solutions. In India, government policies on green mobility and sustainable manufacturing are further strengthening the sector. Overall, the future of the Indian clean air and powertrain industry looks extremely positive, with companies focused on technological innovation, sustainability and environmental compliance, such as Tenneco Clean Air India Ltd, expected to lead the growth in the coming years.

Financial Overview of Tenneco Clean Air India Ltd

Tenneco Clean Air India Limited reported strong financial performance in FY2025, highlighting both the company's operational efficiency and profitability. Although total income declined slightly, profitability increased significantly, driven by improved cost management and higher efficiency.

The company's total revenue in FY2025 was Rs.4,931.45 crore, a decline of approximately 11% compared to Rs.5,537.39 crore in the previous year. Despite this, net profit (PAT) increased 33% to Rs.553.14 crore, compared to Rs.416.79 crore in the previous year. The company's EBITDA stood at Rs.815.24 crore, with an EBITDA margin of 16.67%.

In terms of financial ratios, the company's ROE (Return on Equity) was 42.65%, ROCE (Return on Capital Employed) was 56.78%, and PAT margin was 11.31%, reflecting its high capital efficiency and profitability. Furthermore, it recorded a net worth of Rs. 1,255.09 crore and total assets of Rs. 2,831.58 crore.

Tenneco Clean Air India Limited's financial stability is evident from the fact that it has maintained strong operating profits and cash flow despite declining revenues. This is a result of the company's global R&D and local manufacturing strengths, which have made it a strong player in the Indian automotive component industry.

Financial Indicators (FY) | 2023 | 2024 | 2025 |

Total Income (Rs. Crore) | 4,886.96 | 5,537.39 | 4,931.45 |

PAT (Rs. Crore) | 381.04 | 416.79 | 553.14 |

EBITDA (Rs. crore) | 570.63 | 612.09 | 815.24 |

ROE (%) | - | - | 42.65 |

ROCE (%) | - | - | 56.78 |

PAT Margin (%) | - | - | 11.31 |

EBITDA Margin (%) | - | - | 16.67 |

Net Worth (Rs. Crore) | 1,378.82 | 1,116.59 | 1,255.09 |

Strengths of Tenneco Clean Air India Ltd

Leading Auto Component Supplier in India and Globally :

Tenneco Clean Air India Ltd. is a leading provider of clean air, powertrain, and suspension solutions to major Original Equipment Manufacturers (OEMs) in the automobile sector, both in India and globally. The company's products are known for their high technical efficiency and reliable quality.

Global R&D Network and Innovation-Driven Approach :

The company benefits from the global research and development network of its parent company, Tenneco Inc. This collaboration enables Tenneco Clean Air India to develop cutting-edge, modular, and customized products tailored to the Indian market. This focus on innovation helps the company maintain its technological edge in a competitive market.

Strategically Located Manufacturing Network :

The company has 12 state-of-the-art manufacturing units in India 7 dedicated to clean air and powertrain solutions and 5 to Advanced Ride Technologies. These units are located across 7 states and 1 union territory in India, enabling the company to provide rapid and efficient supply to its OEM and Tier-1 customers.

Advanced Product Portfolio and Technological Excellence :

The company's product portfolio is equipped with cutting-edge technologies, including catalytic converters, diesel particulate filters (DPF), mufflers, and exhaust pipes. Additionally, the company's Advanced Ride Technologies Division specializes in the manufacture of shock absorbers, struts, and suspension systems.

High Financial Performance and Capital Efficiency :

In FY2025, the company recorded a ROE of 42.65%, ROCE of 56.78%, and EBITDA margin of 16.67% reflecting its efficient management and strong operational performance. Despite a slight decline in revenue, the company's PAT increased by 33% to Rs. 553.14 crore, indicating that Tenneco Clean Air India has maintained its profitability through cost control and productivity improvements.

Strong Local Supply Chain and Automation-Based Production :

The company's manufacturing system is highly automated and is supported by an excellent local supply chain. This has led to continuous improvements in production quality, cost control, and delivery speed, making it a strong player in a competitive market.

Risks of Tenneco Clean Air India Ltd

Entire IPO as an Offer for Sale (OFS) Only :

The entire issue of Tenneco Clean Air India Limited is being offered as an Offer for Sale (OFS), which means the company will not receive any new capital from this IPO. Consequently, the company will not receive direct benefits for expansion, debt repayment, or investment in new projects.

Dependence on Automotive OEM Cycle :

The company's revenue depends primarily on automobile manufacturers (OEMs). If vehicle production or sales decline, it could directly impact Tenneco's sales and profits. This dependence poses a major risk to the company's business model.

Growing Impact of Electric Vehicles (EVs) :

Demand for electric vehicles is growing rapidly in India and globally. Since many of Tenneco Clean Air's products are linked to emissions control of conventional fuel-based vehicles, increasing EV adoption could impact demand for its products in the future.

Competitive Market and Pricing Pressures :

The auto component industry is highly competitive, with numerous national and international players. Constant price reduction demands from OEMs and contract terms may increase margin pressure on the company, impacting profitability.

Currency and Raw Material Price Fluctuations :

A portion of the company's revenue depends on imported raw materials and transactions conducted in foreign currency. Volatility in currency exchange rates or increases in the prices of raw materials, such as metals, may increase production costs, negatively impacting the company's margins.

Strategies of Tenneco Clean Air India Ltd

Leveraging Global R&D Capabilities :

Tenneco Clean Air India Limited leverages the global research and development (R&D) network of its parent company, Tenneco Inc. The company aims to develop affordable, innovation-based, and high-quality clean air and powertrain solutions for the Indian market to meet the country's rising emission standards.

Focus on Sustainability and Advanced Emission Technologies :

The company's primary goal is to reduce vehicle emissions through sustainable technologies. Tenneco Clean Air is continuously working on advanced exhaust systems, after-treatment technologies, and hybrid vehicle solutions that improve performance while protecting the environment.

Expanding Indian and Global OEM Customers :

The company maintains strong relationships with leading automobile manufacturers in India and is now expanding its reach internationally. Tenneco Clean Air aims to further expand its customer base to maintain its leadership position in both the Indian and international markets.

Operational Excellence through Automation and Local Supply Chain :

Tenneco Clean Air India's 12 manufacturing units are equipped with state-of-the-art automation and a local supply chain network. The company follows lean manufacturing practices to enhance production quality, reduce costs, and ensure faster delivery.

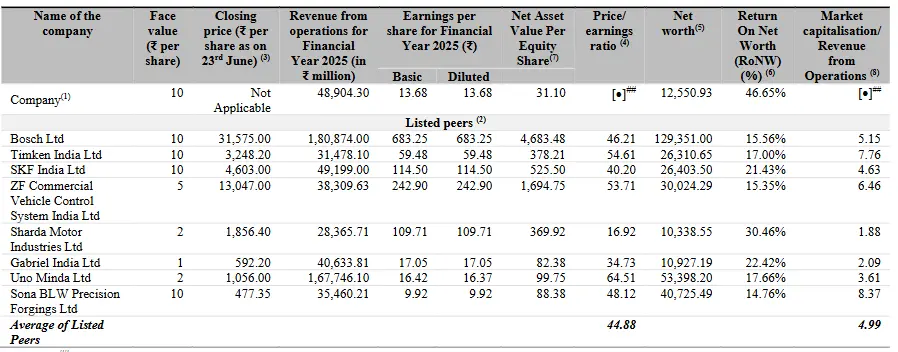

Tenneco Clean Air India Ltd IPO Peer Comparison

Tenneco Clean Air India Limited's performance appears strong compared to other major companies in its sector. The company's price-to-earnings (P/E) ratio as of FY2025 is 28.97x on a pre-IPO basis and 23.83x on a post-IPO basis, making it affordable compared to the industry average of 44.88x. This indicates that the company's valuation is balanced and attractive compared to its peers.

Tenneco's earnings per share (EPS) in FY2025 was Rs.13.68, while its net worth was Rs.12,550.93 million. The company's return on net worth (RoNW) is 46.65%, significantly better than many of its peers such as Bosch Ltd (15.56%), SKF India Ltd (21.43%), and ZF Commercial Vehicle Control Systems (15.35%).

The company's margin performance and capital efficiency (return ratios) place it at the forefront of the Indian auto component industry. Tenneco's focus on high-performance technical products, clean air systems, and powertrain solutions makes it technologically stronger than other listed competitors such as Sona BLW Precision Forgings Ltd., Gabriel India Ltd., and Uno Minda Ltd.

Overall, Tenneco Clean Air India's financial performance, valuation, and return ratios indicate that the company holds a strong position in its industry and could present an attractive opportunity for investors.

Objectives of Tenneco Clean Air India Ltd IPO

No Capital Raising Through an Offer for Sale :

Tenneco Clean Air India Ltd.'s entire IPO is being conducted as an Offer for Sale (OFS). This means that the company will not receive any new capital from this issue. The proceeds from this issue will be entirely from the sale of promoter and promoter group shares.

Exit Opportunity for Promoters and Investors :

The primary objective of this issue is to provide the company's existing promoter shareholders—such as Tenneco Mauritius Holdings Limited, Tenneco (Mauritius) Limited, Federal-Mogul Investments B.V., Federal-Mogul Pty Ltd, and Tenneco LLC with a partial exit opportunity. This will allow the promoters to monetize a portion of their investment.

Increased Transparency and Credibility with Stock Market Listing :

After listing on the BSE and NSE, the company will gain greater visibility, brand value, and corporate transparency as a publicly listed entity. This step will help enhance the company's credibility and strengthen long-term investor confidence.

Improving Share Liquidity and Increasing Investor Participation :

The IPO will enhance the market liquidity of the company's shares, making it easier for retail and institutional investors to buy and sell shares. This will help build a healthy and active investor base for the company.

Tenneco Clean Air India IPO Details

IPO Dates :

The Tenneco Clean Air India Ltd. IPO will be open for investment from November 12, 2025, to November 14, 2025. Share allotment for this IPO is expected on November 17, 2025, while its listing on the BSE and NSE is scheduled for November 19, 2025.

IPO Issue Price :

The company has fixed the price band for its shares at Rs. 378 to Rs. 397 per share. An investor applying at the upper price band will have to invest Rs. 14,689 for one lot (37 shares). The sNII category will have to invest approximately Rs. 205,646 for 14 lots (518 shares) and the bNII category will have to invest approximately Rs. 69 for 2,553 shares. An investment of Rs.10,13,541 will be required.

IPO Size :

Tenneco Clean Air India Ltd. is raising capital through an issue of Rs.3,600 crore. The issue will be entirely an Offer for Sale (OFS), with 90.7 million shares being sold. The company will not receive any new capital from this IPO, as it is a sale of shares held by existing promoter shareholders.

IPO Reservation :

The issue has a maximum of 50% reserved for the QIB category, a minimum of 35% for retail investors, and a minimum of 15% for the NII (HNI) category.

IPO Allotment Status :

Investors who have applied for this IPO will be able to check their IPO allotment status starting November 17, 2025, on the company's registrar's website, the BSE/NSE portal, or through their stockbroker platform.

IPO Listing Date :

Tenneco Clean Air India Ltd. shares are scheduled to be listed on the BSE and NSE on November 19, 2025.

IPO Application Link :

If you want to invest in this IPO, open your demat account with Rupeezy and enjoy a simple, secure, and fast IPO application experience. Rupeezy's platform helps make the investment process seamless and hassle-free.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category