Is Highway Infrastructure IPO Good or Bad – Detailed Review

00:00 / 00:00

Highway Infrastructure Limited’s IPO is kicking off its initial public offering, which will be open from August 05, 2025, to August 07, 2025. While considering applying for this IPO, certain questions may arise in your mind, including whether the Highway Infrastructure IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive Highway Infrastructure IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice.

Highway Infrastructure IPO Review

Highway Infrastructure Limited's IPO comprises a fresh issue of approximately Rs 97.52 crore and an Offer for Sale (OFS) of Rs 32.48 crore by promoters Arun Kumar Jain and Anoop Agrawal. The IPO is open for subscription from August 5 to August 7, 2025, with a price band of Rs 65 to Rs 70 per share and a lot size of 211 shares. The company plans to use the fresh issue proceeds primarily for working capital requirements and general corporate purposes.

Highway Infrastructure Limited (HIL) operates in three main business segments such as tollway collection, EPC infrastructure, and real estate. The company, established in 1995, has a strong presence in the Indian infrastructure sector, with a track record of successfully executing tollway and EPC projects. As of May 31, 2025, the company had a consolidated order book of Rs 666.30 crore, with the majority coming from its EPC business. HIL also leverages technology, such as Automatic Number Plate Recognition (ANPR), in its toll collection operations.

Financially, HIL has shown a mixed trend. While revenue from operations decreased by 13.56% in FY25 to Rs 495.72 crore, it had previously seen a significant increase of 26% in FY24. However, the company has consistently grown its Profit After Tax (PAT), which increased from Rs 13.8 crore in FY23 to Rs 22.4 crore in FY25, representing a CAGR of 27.40%. The company's debt-to-equity ratio has also improved, decreasing from 0.85 in FY23 to 0.61 in FY25, indicating a reduction in leverage.

Key strengths of the company include its nearly three decades of industry experience, a strong and diversified revenue base, an experienced management team, and a robust order book that provides revenue visibility. However, potential investors should be aware of certain risks. These include a reliance on a limited number of public sector customers, a geographical concentration of projects in a few states, and the risks of a tender-based business model. The company has also experienced negative cash flows in past years. The IPO presents an opportunity for the company to improve its working capital and continue its growth trajectory in India's expanding infrastructure space.

Company Overview of Highway Infrastructure Limited

Highway Infrastructure Limited (HIL) was originally established as a partnership firm in 1995 and subsequently became a public limited company in May 2018. The company operates in three main business segments such as tollway collection, EPC Infra, and real estate.

The company's tollway collection business involves operating and managing toll systems on highway projects through a competitive bidding process. As of May 31, 2025, HIL has completed 27 tollway collection projects and is currently operating four. They have an order book of Rs 666.30 crore, comprising Rs 59.53 crore in the tollway collection business and Rs 606.77 crore in the EPC infra business. It uses Electronic Tollway Collection (ETC) systems, leveraging RFID tags and digital payments, and is one of the few operators to have managed toll collection based on Automatic Number Plate Recognition (ANPR) technology on the Delhi-Meerut Expressway.

In the EPC Infra segment, the company executes construction and development projects such as roads, bridges, and civil buildings for both public and private clients. As of May 31, 2025, it has completed 66 projects and has 24 projects under execution, primarily in Madhya Pradesh, Maharashtra, Haryana, and Uttar Pradesh. The real estate segment is the smallest part of its business, where it develops and sells commercial and residential properties, including gated communities. HIL earns 77.14% of operational revenue from Tollway Collection, 21.28% from EPC Infra, and the remaining 1.58% from Real Estate for fiscal year 2025. The company's promoters are Arun Kumar Jain, Anoop Agrawal, and Riddharth Jain.

Industry Overview of Highway Infrastructure Limited

The Indian road network is the second-largest in the world, with a length of approximately 6.3 million kilometers. This includes 1,46,204 kilometers of National Highways, a network that has grown by 60% since 2014. The average pace of National Highway construction has surged by around 193%, reaching approximately 34 kilometers per day in 2025, up from 11.6 kilometers per day in 2014. Toll collection has seen significant growth, with revenue increasing from Rs 25,154.8 crore in FY19 to Rs 64,809.9 crore in FY24, according to PIB and CareEdge Research. The adoption of FASTag has contributed to this growth, with 110 million FASTags issued as of May 2025.

The market for toll management services is projected to grow at a CAGR of 21% from FY21 to FY29, driven by national highway construction and government initiatives. The outlook for toll traffic remains positive, supported by schemes like the Bharatmala Pariyojana, which aims to develop 34,800 kilometers of roads, and a plan to create a separate authority for expressways. The government has allocated significant funds for national highway development, with an expenditure of Rs 2,78,000 crore budgeted for FY25.

The EPC infrastructure sector is also a key growth area, fuelled by initiatives like the National Infrastructure Pipeline (NIP), which projects investments of around Rs 1,11,00,000 crore for FY20 to FY25. The real estate sector, particularly residential construction, is also expanding, with a CAGR of 11.2% from Rs 31,200 crore in FY20 to Rs 53,090 crore in FY25.

Financial Overview of Highway Infrastructure Limited

Particulars | March 31, 2025 | March 31, 2024 | March 31, 2023 |

Revenue from Operations (Rs in Crores) | 495.72 | 573.45 | 455.13 |

EBITDA (Rs in Crores) | 31.32 | 38.44 | 27.69 |

EBITDA Margin (%) | 6.32% | 6.70% | 6.08% |

PAT (Rs in Crores) | 22.4 | 21.41 | 13.8 |

PAT Margin (%) | 4.44% | 3.71% | 3.02% |

RoE (%) | 19.03% | 21.37% | 18.45% |

RoCE (%) | 16.56% | 24.45% | 19.47% |

Debt to Equity Ratio | 0.61 | 0.69 | 0.85 |

The financial performance of Highway Infrastructure Limited over the three fiscal years ending March 31, 2025, shows a mixed trend of revenue and profitability.

Revenue from operations decreased by 13.56% from Rs 573.45 crore in Fiscal 2024 to Rs 495.72 crore in Fiscal 2025, primarily due to a decrease in tollway collection receipts. However, there was a significant increase in revenue from operations of 26%, from Rs 455.13 crore in fiscal 2023 to Rs 573.45 crore in fiscal 2024.

Profit after Tax (PAT) has shown consistent growth, increasing from Rs 13.8 crore in Fiscal 2023 to Rs 21.41 crore in Fiscal 2024 and further to Rs 22.4 crore in Fiscal 2025. This represents a CAGR of 27.40% from fiscal 2023 to fiscal 2025. The PAT margin also improved over the period, rising from 3.02% in Fiscal 2023 to 4.44% in Fiscal 2025.

The company's debt-to-equity ratio has shown a positive trend, decreasing from 0.85 in fiscal 2023 to 0.61 in fiscal 2025, indicating a reduction in leverage. The Return on Equity (RoE) stood at 19.03% in Fiscal 2025, compared to 21.37% in Fiscal 2024 and 18.45% in Fiscal 2023, respectively.

Overall, the company has demonstrated an ability to grow its profitability and reduce its debt, despite fluctuations in its top-line revenue.

Strengths of Highway Infrastructure Limited

Strong Execution Capabilities with Industry Experience: The company has nearly three decades of experience in tollway collection and EPC Infra projects across 11 states and one union territory. It has successfully managed tolls on major expressways and utilises advanced technologies like ANPR and Electronic Toll Collection (ETC) systems.

Experienced Management Team: The company is led by a management team with extensive experience in the infrastructure industry. The Managing Director, Arun Kumar Jain, has over 31 years of experience, while the Whole-time Director and CFO, Anoop Agrawal, has 22 years of experience. The team is supported by key managerial personnel with relevant technical and commercial expertise.

Diversified Revenue Base and Portfolio: The company operates in three distinct sectors, such as tollway collection, EPC Infra, and real estate. This diversification reduces reliance on a single sector and allows the company to leverage its skills and assets across different business verticals.

Strong Order Book: As of May 31, 2025, the company had a consolidated order book of Rs 666.30 crore, with a significant portion coming from EPC Infra projects. This provides a clear roadmap for future revenue generation and operational planning.

Risks of Highway Infrastructure Limited

Reliance on a Limited Number of Customers: A significant portion of the company's revenue from the tollway collection business is derived from projects awarded by the NHAI, and most of its EPC Infra revenue comes from public sector customers. The loss of any of these contracts can have an adverse effect on the company's business and financial results.

Geographical Concentration: The company's ongoing projects are concentrated in specific states such as Madhya Pradesh, Maharashtra, Haryana, and Uttar Pradesh. Any adverse developments or policy changes in these regions could negatively impact its business, results of operations, and financial condition.

Competition and Tender Bidding Risks: The company operates in a highly competitive industry where projects are awarded through a tender bidding process. Its inability to successfully bid for or win new projects, or to compete effectively with other players, could adversely affect its growth and profitability.

Dependence on Promoters and Key Personnel: The company's success is heavily dependent on its promoters and key managerial personnel. The loss of their services could materially and adversely affect the business, as finding suitable replacements in a timely manner may be challenging due to the specific knowledge and skill sets required.

Negative Cash Flow: The company has experienced negative cash flow from operating activities in previous fiscal years. Sustained negative cash flow can adversely impact its ability to meet debt payments, fund working capital, and make new investments

Strategies of Highway Infrastructure Limited IPO

Focus on Core Business Verticals: The company plans to continue focusing on growing its tollway collection and EPC Infra businesses, leveraging its experience and knowledge to bid for new and larger projects. It also aims to expand its use of advanced technologies like ANPR.

Penetrating New Geographies: To mitigate geographical concentration risk, the company intends to expand its presence to additional states, subject to business and financial viability. It plans to capitalise on opportunities arising from national initiatives like the National Infrastructure Pipeline.

Exploring Associated Business Verticals: The company plans to use its current expertise to explore new business areas linked to its operations, such as roadside amenities along highways and Hybrid Annuity Model (HAM) projects.

Leveraging Technology and Innovation: The company's strategy involves the continued use of modern equipment and technology to improve operational efficiency and cost management. This includes leveraging its in-house resources for project execution and exploring new technological advancements in the industry.

Highway Infrastructure Limited IPO Peer Comparison

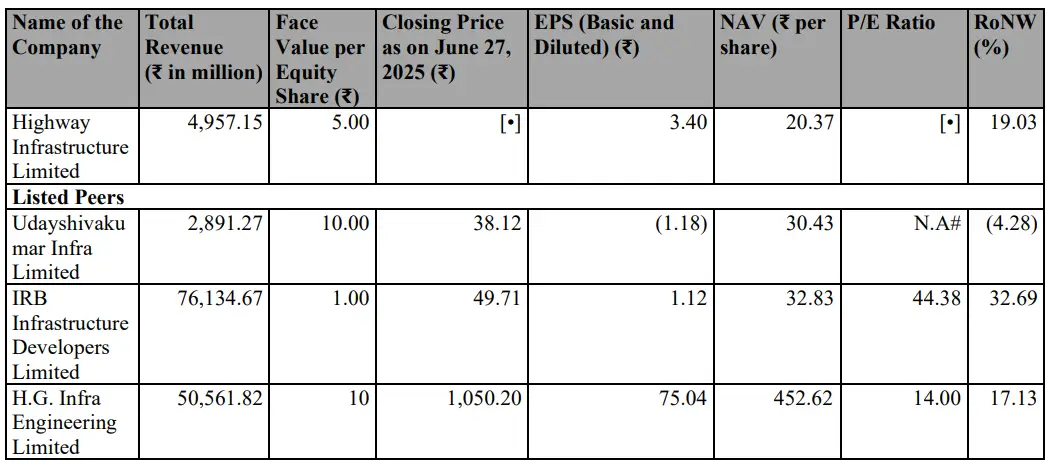

In Fiscal 2025, Highway Infrastructure reported revenue from operations of Rs 495.72 crores, which is lower than its assessed peers, such as IRB Infrastructure Developers Limited of Rs 7,613.47 crores and H.G. Infra Engineering Limited of Rs 5,056.18 crores. However, the Profit After Tax (PAT) margin across the peers varied significantly for FY25, but considering previous years, HIL's margins are low.

Highway Infrastructure's RoCE and RoE for Fiscal 2025 were 16.56% and 19.03%, respectively. These figures are lower in RoE but higher in RoCE compared to those of IRB Infrastructure Developers Limited, which reported an RoE of 32.69% and an RoCE of 6.58%, and H.G. Infra Engineering Limited, with an RoE of 17.13% and an RoCE of 13.37%.

Highway Infrastructure stands out for its diversified business model encompassing tollway collection, EPC Infra, and real estate, which helps mitigate risk by reducing dependence on a single sector. The company has also demonstrated strong technological adoption, such as managing toll collection on the Delhi-Meerut Expressway using ANPR technology. The company's debt-to-equity ratio is better compared to some of IRB Infra and H.G.Infra but higher than Udayshivakumar Infra. Overall, HIL showed a notable improvement, decreasing from 0.85 in fiscal 2023 to 0.61 in fiscal 2025.

Objectives of Highway Infrastructure IPO

The total issue size stands at Rs 130 crore, out of which Rs 97.52 crore is fresh issue and the remaining Rs 32.48 crore is an offer for sale. The selling shareholders in the offer for sale include the company’s promoters, Arun Kumar Jain and Anoop Agrawal.

The funds raised through the fresh issue are to be utilised for,

Rs 65 crore towards funding the working capital requirements of the company.

General Corporate Purposes.

Highway Infrastructure IPO Details

IPO Dates

Highway Infrastructure IPO will be open for subscription from August 05, 2025, to August 07, 2025. The allotment of shares to investors is expected to take place on August 08, 2025, and the company is expected to be listed on the NSE and BSE on August 12, 2025.

IPO Issue Price

Highway Infrastructure is offering its shares in the price band of Rs 65 to Rs 70 per share. This means you would require an investment of Rs. 14,770 per lot (211 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Highway Infrastructure is issuing a total issue of Rs 130 crore, out of which Rs 97.52 crore is a fresh issue and the remaining Rs 32.48 crore is through an offer for sale.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on August 08, 2025, through the registrar's website, Bigshare Services Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Highway Infrastructure will be listed on the NSE and BSE on August 12, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Highway Infrastructure IPO

Important IPO Details | |

Bidding Date | August 05, 2025 to August 07, 2025 |

Allotment Date | August 08, 2025 |

Listing Date | August 12, 2025 |

Issue Price | Rs 65 to Rs 70 per share |

Lot Size | 211 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category