Is GNG Electronics IPO Good or Bad – Detailed Review

00:00 / 00:00

GNG Electronics Limited’s IPO is set to open its initial public offering from July 23, 2025, to July 25, 2025. When considering applying for this IPO, potential investors might have questions about whether the GNG Electronics IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive GNG Electronics IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

GNG Electronics IPO Review

GNG Electronics Limited's IPO opens on July 23 and ends on July 25, 2025. It operates under the brand name "Electronics Bazaar." The company specialises in refurbishing ICT devices like laptops and smartphones, offering them with warranties at lower prices. It boasts a global presence across 38 countries with 4,154 touchpoints and five refurbishing facilities, serving as India's largest Microsoft Authorised Refurbisher. The founder, Sharad Khandelwal, has 29 years of experience in the industry and leads the company as the managing director.

The refurbished electronics market is experiencing significant growth, with the global segment projected to grow at a 17.4% CAGR (2024-2029) and the Indian market at 30% CAGR (2025-2030). GNG's financial performance shows strong revenue growth (CAGR of 46.3% from FY23 to FY25), improving gross and EBITDA margins, and consistent PAT growth. RoE and RoCE remain robust.

Key strengths include market leadership, a comprehensive value chain, global presence, experienced management, and a strong financial track record. Risks involve high revenue concentration from laptops, reliance on key customers, foreign currency fluctuations, and competition from the unorganised sector. The IPO aims to raise Rs 400 crore for debt repayment and general corporate purposes. Shares are priced at Rs 225 to Rs 237, with listing expected on July 30, 2025.

Company Overview of GNG Electronics IPO

GNG Electronics Limited operates under the brand "Electronics Bazaar." It specialises in refurbishing ICT (Information and Communication Technology) Devices such as laptops, desktops, tablets, servers, premium smartphones, mobile workstations, and accessories. The company offers products that are functionally and aesthetically similar to new devices, often at a significantly lower price, backed by a 1 to 3-year warranty.

The company has a strong global presence, with sales in 38 countries and 4,154 touchpoints across North America, South America, Asia, Asia Pacific, Europe, Africa, and the Middle East, supported by five refurbishing facilities in India, the USA, and the UAE. The company is India’s largest Microsoft Authorised Refurbisher and a certified refurbishment partner with Lenovo and HP. It also serves as an IT asset disposition (ITAD) partner for leasing companies, IT consulting companies, and banks.

GNG Electronics' comprehensive refurbishment process includes screening, parts repair, motherboard repairs, and cosmetic work, along with data sanitisation using industry-standard protocols. The company's leadership is led by its founder and managing director, Sharad Khandelwal, who has 29 years of experience in the ICT industry. As of March 31, 2025, they earn 75.59% from the sale of laptops and 24.41% from other sources. Currently, they have 5,840 SKUs (stock keeping units).

Industry Overview of GNG Electronics IPO

GNG Electronics operates in the global and Indian refurbished electronics market. There are 2 aspects: one is the used and refurbished electronics market, and another is only refurbished electronics market.

The global used and refurbished electronics market grew from USD 159.2 billion in CY18 (Calendar Year) to USD 212.1 billion in CY24 at a CAGR of 4.9%. It is projected to reach USD 352.4 billion by CY29, growing at a CAGR of 10.7%. The global refurbished electronics segment specifically is expected to grow at a 17.4% CAGR from CY24 to CY29.

The Indian used and refurbished electronics market grew from USD 11.3 billion in FY19 to USD 19.8 billion in FY25 and is projected to reach USD 40.7 billion by FY30, with a CAGR of 15.6%. Similarly, the Indian refurbished market went from USD 0.2 billion in FY19 to USD 1 billion in FY25, at a 28% CAGR, and is expected to reach USD 4 billion by FY30, at a 30% CAGR. There is an increasing preference for refurbished devices over "as-is used" devices in both Indian and global markets.

The organised segment of the Indian refurbished PC market is rapidly growing, with its share increasing from 5.2% in FY19 to 13.2% in FY25 and projected to reach 40% by FY30. Currently, the unorganised market of refurbished laptops in the personal computer market is around 86.8% as of FY25. This growth is driven by national sustainability goals, increasing digitalisation, demand for affordable technology, and rising consumer trust due to quality assurance and warranty programs.

Financial Overview of GNG Electronics IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Revenue from Operations | 1,411.11 | 1,138.14 | 659.54 |

Gross Margin | 252.47 | 140.15 | 101.15 |

Gross Margin (%) | 17.89% | 12.31% | 15.34% |

EBITDA | 126.14 | 84.90 | 50.04 |

EBITDA Margin (%) | 8.94% | 7.46% | 7.59% |

PAT | 69.03 | 52.30 | 32.43 |

PAT Margin (%) | 4.89% | 4.60% | 4.92% |

RoE (%) | 30.40% | 31.96% | 28.97% |

ROCE (%) | 17.31% | 16.72% | 17.91% |

The financial performance of the company of GNG Electronics over the three fiscal years ending March 31, 2023, 2024, and 2025 reflects strong top-line growth and improving profitability, driven by increased product sales and efficient cost management.

Revenue from operations has shown a significant upward trend, increasing from Rs 659.542 crore in FY23 to Rs 1,138.138 crore in FY24 and further to Rs 1,411.11 crore in FY25. This consistent growth highlights robust operational execution and expanding market reach.

Gross margin has demonstrated recovery and improvement. After moderating from 15.34% in FY23 to 12.31% in FY24, it significantly improved to 17.89% in FY25. In absolute terms, gross margin grew from Rs 101.15 crore in FY23 to Rs 140.15 crore in FY24 and substantially to Rs 252.47 crore in FY25, indicating better control over the cost of goods sold.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) has seen a considerable increase, reflecting improved operational efficiency. It rose from Rs 50.04 crore in FY23 to Rs 84.90 crore in FY24, and further to Rs 126.14 crore in FY25. The EBITDA margin also improved, from 7.59% in FY23 to 7.46% in FY24, and then notably to 8.94% in FY25, showcasing effective cost management and scaling benefits.

Profit After Tax (PAT) has consistently grown, demonstrating the company's ability to translate revenue growth into bottom-line profitability. PAT increased from Rs 32.43 crore in FY23 to Rs 52.30 crore in FY24 and further to Rs 69.03 crore in FY25. The PAT margin remained relatively stable and healthy, standing at 4.92% in FY23, slightly moderating to 4.60% in FY24, and then improving to 4.89% in FY25.

In terms of return metrics, the company has maintained strong performance. Return on Equity (RoE) remained robust, staying above 28% throughout the period. It was 28.97% in FY23 and increased to 31.96% in FY24, and then slightly moderated to 30.40% in FY25, indicating efficient utilisation of shareholders' capital.

Return on Capital Employed (RoCE) also reflects efficient capital deployment. It was 17.91% in FY23, slightly decreased to 16.72% in FY24, but then improved to 17.31% in FY25, demonstrating the company's ability to generate returns from its total capital employed.

Strengths and Risks of GNG Electronics IPO

Let's delve into the strengths and weaknesses to assess if the GNG Electronics IPO is good or bad for investors.

Strengths

Market Leadership: GNG Electronics is India’s largest refurbisher of laptops and desktops and among the largest refurbishers of ICT devices globally, based on value as of March 31, 2025.

Comprehensive Value Chain: The company operates across the full refurbishment value chain, including sourcing, refurbishment, sales, and after-sales services with a warranty.

Global Presence and Supply Chain: It has a sales presence in 38 countries with 4,154 touchpoints and five refurbishing facilities strategically located in India, the USA, and the UAE, supported by a multi-channel global procurement network of 557 suppliers.

Experienced Management Team: The company is led by a team with extensive industry experience, including founder Sharad Khandelwal (29 years of experience), contributing to operational excellence and strategic growth.

Strong Financial Track Record: The company has a consistent track record of profitability and growth in revenue from operations, EBITDA, and PAT over the last three fiscal years.

ESG Focus: The company is well-positioned to benefit from the global shift towards sustainability and ESG, actively promoting reuse and reducing e-waste.

Risks

Concentration of Revenue from Laptops: A significant portion of operational revenue, which is 75.59% in FY25, is derived solely from laptop sales, making the business vulnerable to declines in laptop demand.

Reliance on Key Customers and Suppliers: A substantial portion of revenue is dependent on its top 10 customers, which stand at around 46.59% in FY25, and inventory relies on a limited number of suppliers, posing risks if these relationships are disrupted.

Foreign Currency Exchange Rate Fluctuations: Significant revenue is generated from outside India, which is 75.53% in Fiscal 2025, exposing the company to foreign currency risks.

Dependence on Leased Premises: Business operations are primarily conducted on leased properties, and the inability to renew leases on favourable terms could adversely affect operations.

Competition from the Unorganised Sector: The refurbished PC market in India is heavily dominated by unorganised players, creating pricing pressures and challenges in maintaining competitive positioning.

Fluctuations in B2C Sales: The company has experienced a reduction in B2C sales in recent fiscal years due to a reduced focus on third-party online portals.

Strategies of GNG Electronics IPO

Expanding Footprint and Market Presence: This involves penetrating deeper into existing geographies, establishing new customer relationships, and diversifying its customer base by exploring new channels and use cases.

Enhancing Procurement and Strengthening Brand Relationships: The company plans to expand its procurement network globally by leveraging existing relationships, building new ones, and communicating its value proposition to a wider audience. This also includes strengthening associations with major brands like HP and Lenovo to run efficient buyback programs and improve procurement.

Focus on ESG Standards and Expanding OEM Opportunities: GNG Electronics is committed to maintaining high Environmental, Social, and Governance (ESG) standards, aligning with global sustainability efforts. This focus allows them to capitalise on evolving business opportunities in ESG-driven markets and expand partnerships with Original Equipment Manufacturers (OEMs).

Improving Offerings and Customer Experience: The company intends to encourage repeat business and expand its customer base by improving its product offerings, providing a seamless customer experience, and strengthening relationships through improved customized product features and extended service offerings like warranties, maintenance plans, and flexible financing.

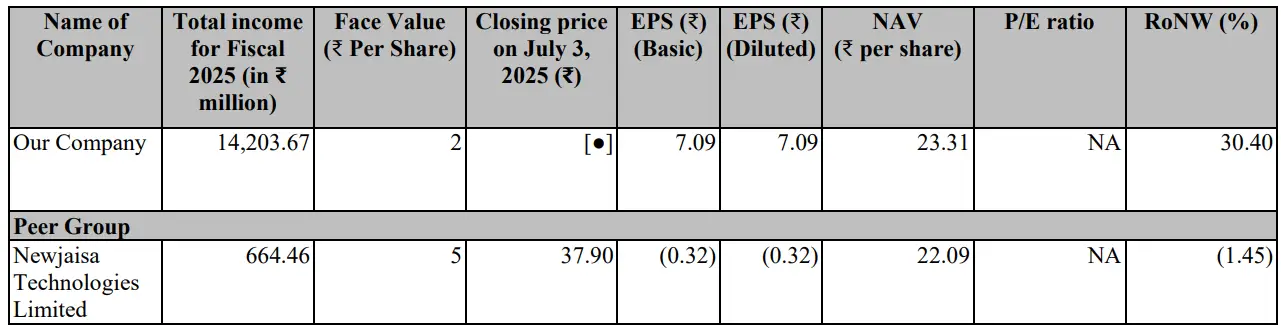

GNG Electronics IPO vs. Peers

GNG Electronics Limited significantly outperforms Newjaisa Technologies Limited across key financial and operational metrics for fiscal years 2023 to 2025. GNG demonstrated superior revenue growth, reaching Rs 1,411.10 crore in FY25, compared to Newjaisa's Rs 65.65 crore. This highlights GNG's dominant market position.

GNG consistently achieved healthy profitability, with an 8.94% EBITDA margin and 4.89% PAT margin in Fiscal 2025. In contrast, Newjaisa reported negative margins in the same period, indicating operational challenges. GNG also showcased strong capital efficiency, with RoCE at 17.31% and RoE at 30.40% in FY25, while Newjaisa's returns were negative.

Operationally, GNG boasts a significant global footprint, generating around Rs 1,065.78 crore from outside India in FY25. It also refurbished a substantial 5,90,787 devices and expanded its procurement partners to 557. Newjaisa operates on a much smaller scale with primarily domestic revenue. Overall, GNG Electronics exhibits robust financial health and operational strength, positioning it as a clear leader in the electronics sector compared to Newjaisa.

GNG Electronics’ revenue from operations increased at a CAGR of 46.3% from FY23 to 25, compared to the global refurbished consumer electronics devices market growth of 10.7% over the same period.

Objectives of GNG Electronics IPO

The offer comprises a fresh issue and an offer for sale. The selling shareholders will receive proceeds from the offer for sale component. The net proceeds from the fresh issue of Rs 400 crore are proposed to be utilised for:

Prepayment and/or repayment, in full or in part, of certain outstanding borrowings availed by GNG Electronics Limited and its material subsidiary, Electronics Bazaar FZC, worth Rs 320 crore.

General corporate purposes.

GNG Electronics IPO Details

IPO Dates

GNG Electronics IPO will be open for subscription from July 23, 2025, to July 25, 2025. The allotment of shares to investors will take place on July 28, 2025, and the company is expected to be listed on the NSE and BSE on July 30, 2025.

IPO Issue Price

GNG Electronics is offering its shares in the price band of Rs 225 to Rs 237 per share. This means you would require an investment of Rs. 14,931 per lot (63 shares) if you are bidding for the IPO at the upper price band.

IPO Size

GNG Electronics is issuing a total offer for sale of 1,94,27,637 shares, which are worth Rs 460.43 crores. Out of which 1,68,77,637 shares of fresh issue are worth Rs 400 crore, and the remaining 25,50,000 shares are offer for sale by the selling shareholders and worth Rs 60.44 crore.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on July 28, 2025, through the registrar's website, Bigshare Services Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of GNG Electronics will be listed on the NSE and BSE on July 30, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | July 23, 2025 to July 25, 2025 |

Allotment Date | July 28, 2025 |

Listing Date | July 30, 2025 |

Issue Price | Rs 225 to Rs 237 per share |

Lot Size | 63 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category