Is Billionbrains Garage Ventures (Groww) IPO Good or Bad – Detailed Review

00:00 / 00:00

Billionbrains Garage Ventures Limited’s (Groww) IPO is set to open its initial public offering from November 04, 2025, to November 07, 2025. When considering applying for this IPO, potential investors might have questions about whether the Billionbrains Garage Ventures IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Billionbrains Garage Ventures IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Billionbrains Garage Ventures IPO Review

Billionbrains Garage Ventures Limited's IPO is open for subscription from November 04, 2025, to November 07, 2025, with listing expected on November 12, 2025, on NSE and BSE.

The company is a market leader in digital investment platforms and is India's largest and fastest-growing investment platform by active users on NSE as of June 30, 2025. It specializes in wealth creation opportunities through a comprehensive suite of financial products. Its core business focus is on Broking Services (Stocks and Derivatives), which constituted 79.49% of its revenue for the three months ended June 30, 2025. The platform served 14.38 crore Active Users as of June 30, 2025, leveraging a customer-first, technology-led, and asset-light business model with deep penetration across 98.36% of all Indian pin-codes. The promoters collectively hold a 26.62% stake prior to the offer.

The company operates within the high-growth Indian Investment & Wealth Management Market, which is undergoing rapid digital transformation. The Total Addressable Market (TAM) is estimated at approximately Rs 1.1 lakh crores as of March 2025 and is projected to grow at a CAGR of 15% to 17% between Fiscal 2025 and Fiscal 2030, reaching around Rs 2.2 lakh crores to Rs 2.6 lakh crores. This growth is structurally fuelled by India's robust economic expansion, favorable demographics (young workforce), and the low penetration of active broking accounts (around 5% of the adult population as of CY2024), indicating massive untapped potential.

Billionbrains Garage Ventures financial performance from FY23 to FY25 reflects massive top-line growth and consistently increasing profitability. Revenue from Operations grew from Rs 1,141.53 crores in FY23 to Rs 3,901.72 crores in FY25, achieving an approximate 84.88% CAGR over the period. Profit After Tax (PAT) demonstrated powerful underlying growth, increasing from Rs 457.72 crores in FY23 to Rs 1,824.37 crores in FY25. Operating efficiency is high, with the Adjusted EBITDA Margin consistently improving to a robust 59.11% in FY25. The company maintains superior capital efficiency, evidenced by the Return on Equity (RoE) accelerating to 37.57% in FY25, reinforcing its strong financial health. Total Customer Assets rapidly expanded from Rs 47,804.3 crores in FY23 to Rs 2,16,811.58 crores in FY25.

Key strengths include Market Leadership and Brand Command as the largest and fastest-growing investment platform, Customer-Centric Growth and High Retention (77.70% retention for three-year cohorts), Cost-Effective Customer Acquisition (83.16% organic in Q1 FY26), and Strong Financial Performance with high and increasing profitability. Risks involve Regulatory and Policy Changes Impacting Core Revenue (e.g., changes to derivatives framework), Reliance on Broking Services (79.49% of Q1 FY26 revenue), Market Volatility and External Economic Factors, and Risks to Sustained Growth of Subsidiaries.

The IPO consists of a total issue of 66,32,30,051 shares valued at Rs 6,632.30 crores, comprising an Offer for Sale (OFS) of 55,72,30,051 shares (Rs 5,572.30 crores) and a Fresh Issue of 10,60,00,000 shares (Rs 1,060 crores). The proceeds from the Fresh Issue will be used to Invest in Cloud Infrastructure (Rs 152.5 crores), Strengthen Brand and Performance Marketing (Rs 225 crores), Expand Credit Business Capacity in its NBFC subsidiary (Rs 205 crores), Fund Margin Trading Facility (MTF) Business in its investment tech subsidiary (Rs 167.5 crores), and fund Unidentified Inorganic Acquisitions and General Corporate Purposes (Rs 310 crores). Shares are priced in the band of Rs 95 to Rs 100 per share, with a Lot Size of 150 Shares.

Company Overview of Billionbrains Garage Ventures IPO

Billionbrains Garage Ventures Limited, a market leader in digital investment platforms with a strong growth trajectory, specializes in providing customers with wealth creation opportunities through a comprehensive suite of financial products and services. The company is India's largest and fastest-growing investment platform by active users on NSE as of June 30, 2025.

Its core business focus is on Broking Services (Stocks and Derivatives), which constituted 79.49% of its revenue from operations for the three months ended June 30, 2025. The diversified product portfolio includes stocks (including IPOs), derivatives, mutual funds (Groww Mutual Fund), bonds, Margin Trading Facility (MTF), and personal loans. The platform served 14.38 crores Active Users as of June 30, 2025.

The core operational strength is built around a customer-first, technology-led, and asset-light business model with a consistent commitment to user experience and stability. This strength is demonstrated by its in-house technology stack capable of handling approximately 50 million orders per day and facilitating high organic customer acquisition with 83.16% for the three months ended June 30, 2025. Furthermore, the company boasts strong customer retention, with 77.70% of Active User cohorts having completed three years remaining on the platform.

The company operates a highly penetrated distribution network across India, leveraging digital accessibility to reach Active Users in 98.36% of all Indian pin-codes as of June 30, 2025. The promoters, Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, collectively hold a 26.62% stake prior to the offer, maintaining a significant collective interest. The company has no holding company. Key leadership includes Lalit Keshre (Whole-time Director and Chief Executive Officer), Harsh Jain (Whole-time Director and Chief Operating Officer), Ishan Bansal (Whole-time Director and Chief Financial Officer), and Neeraj Singh (Whole-time Director and Chief Technology Officer).

Industry Overview of Billionbrains Garage Ventures IPO

Billionbrains Garage Ventures Limited operates within the high-growth Indian Investment and Wealth Management Market, a financial sector undergoing rapid digital transformation, primarily driven by mass adoption of technology, favorable demographics, and evolving investor behavior. The Total Addressable Market (TAM) for Investment and Wealth Management is estimated at approximately Rs 1.1 lakh crores as of March 2025. This strong trajectory is projected to continue, with the overall market expected to grow at a Compound Annual Growth Rate (CAGR) of 15% to 17% between Fiscal 2025 and Fiscal 2030, reaching around Rs 2.2 lakh crores to Rs 2.6 lakh crores by Fiscal 2030.

The market growth is structurally fuelled by India's robust economic expansion, such as:

Supported by a large and young workforce with a median age of around 28 years as of CY2024.

The inversion of the income pyramid, with the upper middle-class, high-income, and ultra-high-income segments expected to reach 608 million individuals by CY2029.

Accelerated financial inclusion powered by the India Stack and high internet penetration.

Crucially, the penetration of active broking accounts in India is still only around 5% of the adult population as of CY2024, significantly lower than in the advanced economies, indicating massive untapped potential.

Meanwhile, the Mutual Fund AUM-to-GDP ratio stands at around 19.9% for the FY25.

A primary driver of recent growth is the dominance of digital-first platforms, which accounted for 76-78% of active clients on the NSE in Fiscal 2025, having disrupted the market by simplifying access, improving transparency, and lowering costs. This momentum is supported by increasing household savings allocated to financial assets, with growth across broking (especially Derivatives) and asset management.

Within this intensely competitive and regulated environment, the industry is navigating challenges such as market volatility driven by macroeconomic and geopolitical factors, cybersecurity and technology risks, and changing laws and regulations. Recent regulatory measures related to Derivatives and brokerage fee structures like "True to Label" have directly impacted industry revenue and operational complexities.

Financial Overview of Billionbrains Garage Ventures IPO

Particulars | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from operations | 3,901.72 | 2,609.28 | 1,141.53 |

Adjusted EBITDA | 2,306.36 | 1,470.91 | 416.3 |

Adjusted EBITDA Margin | 59.11% | 56.37% | 36.47% |

Profit/(Loss) after tax | 1,824.37 | -805.45 | 457.72 |

PAT Margin | 44.92% | -28.81% | 36.30% |

Return on Equity (RoE) | 37.57% | -31.66% | 13.80% |

Total Customer Assets | 2,16,811.58 | 1,21,375.97 | 47,804.3 |

Revenue from Operations has shown massive growth, driven by a continually expanding Active User base and high transaction volumes from its Broking Services segment. Revenue increased from Rs 1,141.52 crores in FY23 to Rs 2,609.28 crores in FY24, and accelerated to Rs 3,901.72 crores in FY25, achieving an approximate CAGR of 84.88% over the period.

In the Operating Efficiency part, core business profitability is seen through increasing margins, derived from leveraging its scalable digital platform and low-cost customer acquisition model. The Adjusted EBITDA Margin highlighted an upward trajectory when adjusted for one-time costs, improving from 36.47% in FY23 to 56.37% in FY24, and achieving a robust 59.11% in FY25. This showcases strong business fundamentals and operating leverage.

Profit After Tax (PAT) has demonstrated powerful underlying growth, though in one year there was an exceptional item. PAT increased from Rs 457.66 crores in FY23 to Rs 1,824.37 crores in FY25. The reported loss in FY24 of Rs 805.45 crores was primarily caused by an Exceptional Item (taxes) of Rs 1,339.68 crores related to the US tax implications of the cross-border merger with Groww Inc., excluding this non-operational charge, the core profit was positive and growing.

The Return on Equity (RoE) highlights efficient utilization of shareholders capital. They reported 13.80% in FY23 and accelerated to 37.57% in FY25. The negative RoE of (31.66%) in FY24 directly correlates with the large one-time exceptional tax expense.

The Total Customer Assets rapidly expanded, from Rs 47,804.31 crores in FY23 to Rs 2,16,811.58 crores in FY25. The company maintains a very strong capital structure supported by significant equity. Total Equity grew from Rs 3,316.77 crores in FY23 to Rs 4,855.44 crores in FY25. The net change in its capital position in FY24 was due to an exceptional tax item.

Strengths and Risks of Billionbrains Garage Ventures IPO

Let's delve into the strengths and weaknesses to assess if the Billionbrains Garage Ventures IPO is good or bad for investors.

Strengths

Market Leadership and Brand Command: Billionbrains Garage Ventures (Groww) is India's largest and fastest-growing investment platform by active users on NSE as of June 30, 2025. The "Groww" brand is recognized across cities, towns, and villages in India, with Active Users in 98.36% of pin-codes as of June 30, 2025.

Customer-Centric Growth and High Retention: The business benefits from strong customer retention, with 77.70% of Active Users cohorts who completed three years on the platform remaining with the company. As per RHP, the User engagement is high, based on the Daily Active User (DAU) to Monthly Active User (MAU) ratio for Transacting Users of 56.29% in Fiscal 2025.

Cost-Effective Customer Acquisition: A significant majority of new customers are acquired organically, with 83.16% of new customers acquired organically in the three months ended June 30, 2025. This approach results in a lower Cost to Grow ,which is marketing and business promotion expenses as a percentage of revenue from operations, which was 11.99% forthe quarter ended June 30, 2025.

Operational Leverage and Efficient Technology: The core operational strength is built on an in-house technology stack designed for speed, stability, and scale. This digital-led approach yields operating leverage, reflected by the fact that the Adjusted Cost to Operate as a percentage of Revenue from operations declined from 26.32% in Fiscal 2023 to 13.77% in Fiscal 2025.

Strong Financial Performance: The company is consistently profitable, reporting a Profit of Rs 378.36 crores for the three months ended June 30, 2025 and Rs 1,824.37 crores for Fiscal 2025. The Adjusted EBITDA Margin for the three months ended June 30, 2025, was 56.08%.

Risks

Regulatory and Policy Changes Impacting Core Revenue: The business is vulnerable to sudden changes in regulations, such as the new framework for derivatives and the "True to Label" circular introduced by SEBI in 2024. These changes directly contributed to a decline in Broking Transacting Users and Orders per User in the three months ended June 30, 2025, compared to the same period in 2024.

Reliance on Broking Services: A significant portion of revenue is derived from Broking Services, which contributed 79.49% of revenue from operations in the three months ended June 30, 2025. Any downturn in customer willingness to use these services could materially affect financial results.

Market Volatility and External Economic Factors: Financial performance is inherently linked to the health of financial markets and investor sentiment. Market slowdowns, driven by macroeconomic factors like the US-China Trade War or monetary policy changes, can directly lead to a decline in New Transacting Users (NTUs), as seen in the three months ended June 30, 2025.

Inability to Sustain Growth of Subsidiaries: The Group relies significantly on its Subsidiaries, Groww Invest Tech Private Limited and Groww Creditserv Technology Private Limited, which accounted for 93.04% and 5.83%, respectively, of consolidated revenue from operations for the quarter ended June 30, 2025. Downturns in their performance pose a consolidated risk.

Uncertainty with New Products: The Company plans to continuously launch new products like 'W by Groww' (Wealth Management) and Loans Against Security (LAS). There is no assurance that these new offerings will achieve wide customer acceptance or yield expected returns.

Strategies of Billionbrains Garage Ventures IPO

Invest in Cloud Infrastructure: A substantial portion of the fresh issue proceeds is dedicated to expenditure towards cloud infrastructure (Rs 1,525 crores). This ongoing investment aims to enhance data management, improve operational efficiency, and maintain platform speed and reliability.

Strengthen Brand and Performance Marketing: The Company intends to utilize Rs 2,250 crores from the Fresh Issue for Brand building and performance marketing activities. This strategy is aimed at sustaining efficient customer acquisition, building increased brand awareness, and creating distinct sub-brands like "W by Groww" for Affluent Users.

Expand Credit Business Capacity: Proceeds will be used for Investment in Groww Creditserv Technology Private Limited (GCS), the NBFC subsidiary (Rs 2,050 crores), to augment its capital base. This will expand lending capacity for existing personal loans and support the scaling of new credit products like LAS.

Fund Margin Trading Facility (MTF) Business: The Company plans to allocate Rs 1,675 crores to Groww Invest Tech Private Limited (GIT) to fund its MTF business. This move is intended to expand access to MTF, strengthen the Stocks product value proposition, and diversify income streams through increased interest earned.

Pursue Strategic Inorganic Growth: The balance of the Proceeds are proposed for funding inorganic growth through unidentified acquisitions and general corporate purposes. This includes strategically acquiring or investing in companies that offer industry expertise, expanded product offerings, or enhanced customer experience.

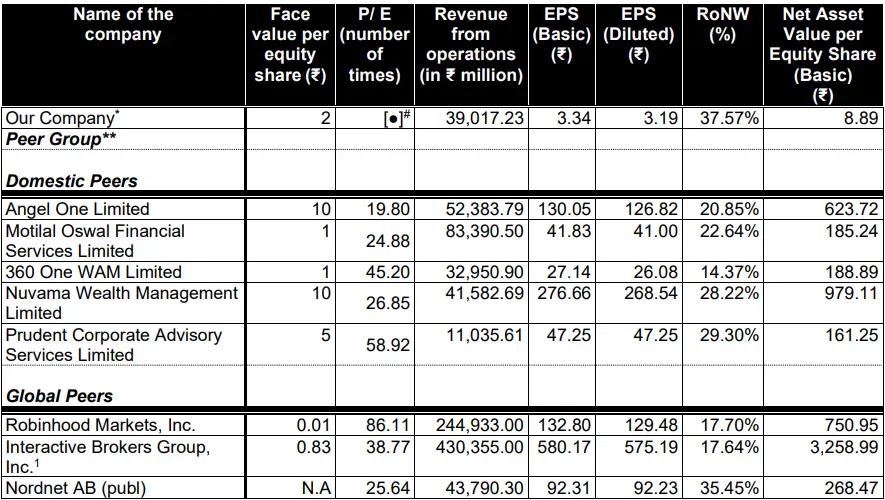

Billionbrains Garage Ventures IPO vs. Peers

Groww achieved high profitability and superior returns in FY25. The Company delivered a PAT Margin of 44.92% in FY25, a figure that demonstrates significant operating leverage derived from its digital-first, low-cost model. This core efficiency also supports a strong Return on Equity (RoE) of 37.57% in FY25, which ranks highly against major listed peers such as Angel One Limited (20.85%) and Motilal Oswal Financial Services Limited (22.64%) in the same fiscal year. Furthermore, the company maintains robust operational efficiency, supported by an Adjusted EBITDA Margin of 59.11% in Fiscal 2025.

Operationally, Groww commands market leadership and broad penetration. It holds the position as India's largest broker by NSE Active Clients with 12.58 million active clients as of June 30, 2025, commanding a 26.27% market share. It also demonstrates strong retail focus in the Mutual Funds space, holding around 13% market share in SIP inflows as of June 2025 as per Redseer Report. As of March 31, 2025, the company's Total Customer Assets stood at Rs 2,16,811.58 crores, underscoring substantial scale and investor trust within the rapidly evolving digital financial services market.

Objectives of Billionbrains Garage Ventures IPO

The offering consists of total shares of 66,32,30,051 worth Rs 6,632.30 crores, out of which the offer for sale of 55,72,30,051 shares is valued at Rs 5,572.30 crores, and the fresh issue of 10,60,00,000 shares is valued at Rs 1,060 crores, respectively. The selling shareholders in this IPO are:

Peak XV Partners Investments VI-1, YC Holdings II, LLC, Ribbit Capital V, GW-E Ribbit Opportunity V LLC, Internet Fund VI Pte. Ltd, Kauffman Fellows Fund, Alkeon Innovation Master Fund II, Alkeon Innovation Master Fund II, Private Series, Propel Venture Partners Global US, and Sequoia Capital Global Growth Fund III – U.S./India Annex Fund will receive the offer for sale proceeds.

However, the fresh issue proceeds will be used for the following objectives:

Expenditure towards cloud infrastructure (Rs 152.5 crores)

Brand building and performance marketing activities (Rs 225 crores)

Investment in GCS (Subsidiary), an NBFC, for augmenting its capital base (Rs 205 crores)

Investment in GIT (Subsidiary), for funding its MTF business (Rs 167.5 crores)

Unidentified Inorganic Acquisitions and General Corporate Purposes (Rs 310 crores)

Billionbrains Garage Ventures IPO Details

IPO Dates

Billionbrains Garage Ventures IPO will be open for subscription from November 04, 2025, to November 07, 2025. The allotment of shares to investors will take place on November 10, 2025, and the company is expected to be listed on the NSE and BSE on November 12, 2025.

IPO Issue Price

Billionbrains Garage Ventures is offering its shares in the price band of Rs 95 to Rs 100 per share. This means you would require an investment of Rs. 15,000 per lot (150 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Billionbrains Garage Ventures is issuing a total number of 66,32,30,051 shares valued at Rs 6,632.30 crores, out of which the offer for sale comprises 55,72,30,051 shares, worth Rs 5,572.30 crores, of which the selling shareholders will receive the proceeds. The remaining 10,60,00,000 shares worth Rs 1,060 crores will be of fresh issue used for the objects of the issue.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on November 11, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Billionbrains Garage Ventures will be listed on the NSE and BSE on November 12, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Billionbrains Garage Ventures IPO

Important IPO Details | |

Bidding Date | November 04, 2025 to November 07, 2025 |

Allotment Date | November 10, 2025 |

Listing Date | November 12, 2025 |

Issue Price | Rs 95 to Rs 100 per share |

Lot Size | 150 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category