Is Aequs IPO Good or Bad – Detailed Aequs IPO Review

00:00 / 00:00

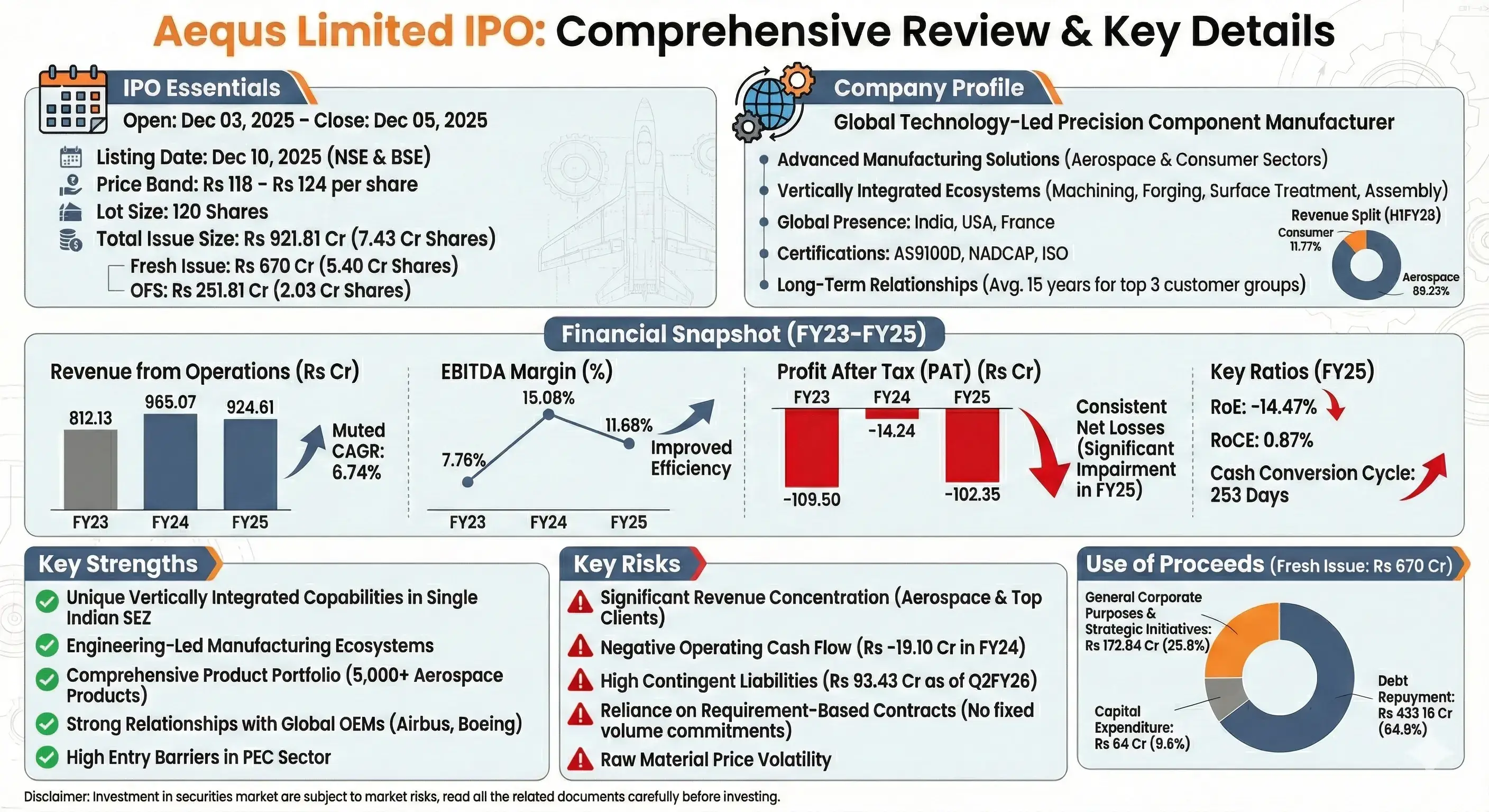

Aequs Limited’s IPO is set to open its initial public offering from December 03, 2025, to December 05, 2025. When considering applying for this IPO, potential investors might have questions about whether the Aequs IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Aequs IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Aequs IPO Review

Aequs Limited's IPO is open for subscription from December 03, 2025, to December 05, 2025, with listing expected on December 10, 2025, on NSE and BSE.

The company is a global, technology-led precision component manufacturer offering advanced manufacturing solutions primarily to large enterprise customers globally in the aerospace and consumer sectors worldwide. It specialises in deep domain expertise in precision machining up to 5-axis, forging, metal forming, and advanced surface treatments to design, develop, and implement regulatory-compliant, secure, and highly scalable manufacturing processes for complex components, structures, and sub-systems.

The company has a significant global presence with manufacturing facilities across India, the US, and France. Its core operational strength is maintaining long-term relationships, with the average tenure for its top three customer groups standing at 15 years as of September 30, 2025. The promoters hold an aggregate of 63.82% of the pre-offer paid-up equity share capital.

The company operates within the highly specialized and competitive global Precision Engineered Components (PEC) sector, offering solutions across Aerospace and Consumer verticals. The Global Precision Manufacturing Market, Aequs's primary domain, was valued at approximately USD 852.90 billion in 2024 and is projected to grow at a global CAGR of 7.09% to reach USD 1,286.58 billion by 2030. Concurrently, the Global Aerospace Manufacturing Market is projected to grow from USD 188.04 billion in CY24 to USD 272.56 billion in CY30 at a CAGR of 6.38%.

Aequs’s financial performance from FY23 to FY25 reflects mixed top-line growth coupled with volatile profitability. Revenue from operations grew from Rs 812.13 crores in FY23 to Rs 924.61 crores in FY25 (a muted CAGR of 6.74%).

Profit After Tax (PAT) has been consistently negative, with a Net Loss of Rs (102.35) crores in Fiscal 2025 (down from a loss of Rs (14.24) crores in FY24) due to a substantial one-time impairment charge. Operating efficiency showed expansion, with the EBITDA margin improving from 7.76% in FY23 to 11.68% in FY25 (peaking at 15.08% in FY24). The Return on Capital Employed (RoCE) was 0.87% in FY25 (peaking at 2.84% in FY24), and the Return on Equity (RoE) was -14.47% in FY25.

Strengths include Advanced and Vertically Integrated Precision Manufacturing Capabilities (the only manufacturer in a single Indian SEZ to offer end-to-end solutions for Aerospace), Operations in Unique, Engineering-Led Manufacturing Ecosystems, a Comprehensive Precision Product Portfolio (over 5,000 products in Aerospace), and Long-Standing Relationships with High Entry Barrier Global Customers (such as Airbus and Boeing).

Risks include Significant Revenue Concentration (Aerospace accounted for 88.23% of revenue for H1FY26; Top 10 customers accounted for 82.51%), Negative Cash Flow from Operating Activities (Rs -19.10 crores for FY24) with a long working capital cycle (253 days in FY25), Contingent Liabilities (Rs 93.43 crores as of Q2FY26), and High Reliance on Requirement-Based Contracts which lack fixed volume commitment.

The IPO consists of a total issue of 7,43,39,651 shares valued at Rs 921.81 crores, comprising an Offer for Sale (OFS) of 2,03,07,393 shares (Rs 251.81 crores) and a Fresh Issue of 5,40,32,258 shares (Rs 670 crores). The fresh issue proceeds will be primarily used for repayment or prepayment of certain outstanding borrowings (Rs 433.16 crores), capital expenditure (Rs 64 crores) and general corporate purposes.

The shares are priced in the band of Rs 118 to Rs 124 per share, with a lot size of 120 shares.

Company Overview of Aequs IPO

Aequs is a global, technology-led precision component manufacturer offering advanced manufacturing solutions primarily to large enterprise customers in the aerospace and consumer sectors worldwide. The core focus is on advanced, vertically integrated precision manufacturing to design, develop, and implement regulatory-compliant, secure, and highly scalable manufacturing processes for complex components, structures, and sub-systems.

The company is driven by a mix of deep domain expertise in precision machining up to 5-axis, forging, metal forming, and advanced surface treatments. This vertical depth is rooted in the specific needs of commercial aviation with Tier-1 supplier status, D2P (Detail Parts Partner) recognition by Airbus and high-quality consumer goods, serving global Original Equipment Manufacturers (OEMs) across regulated markets like the US and Europe.

Aequs operates units in three engineering-led vertically integrated manufacturing ecosystems in India, with locations in Belagavi, Hubballi, and Koppal and two dedicated facilities in the US and France, maintaining globally recognised certifications such as ISO, AS9100, and NADCAP, which are core to its commitment to quality and consistency.

Its core business strength is built around an integrated suite of capabilities that enables end-to-end component manufacturing within a single location.

This product portfolio supports customers across its main business segments, including:

Aerospace Segment: Engine systems, landing systems, cargo and interiors, structures, assemblies, and turning systems.

Consumer Segment: Components for portable computers and smart devices, plastic toys and vehicles, and consumer durables such as cookware.

The company is recognised for cultivating long-term relationships, with the average tenure for its top ten customer groups standing at 11 years. The company maintains a significant global footprint with manufacturing presence across three countries - India, the U.S., and France, catering to global OEM customers.

The geographic split of the revenue from operations for the six months ended September 30, 2025, is detailed below:

Particulars | Amount (in Rs Cr) | % of Revenue from Operations |

India | 61.49 | 11.45% |

North America (USA) | 131.29 | 24.44% |

Europe (France, UK, Germany, Sweden) | 265.67 | 49.46% |

Asia-Pacific, the Middle East and Africa and Rest of World (Hong Kong, Others) | 78.72 | 14.66% |

Total Revenue from Operations | 537.16 | 100.00% |

In the business-wise segment, they have 2 categories (based on the six months ended September 30, 2025):

Aerospace Segment - 88.23%

Consumer Segment - 11.77%

The Company’s Promoters are Aravind Shivaputrappa Melligeri, Aequs Manufacturing Investments Private Limited, Melligeri Private Family Foundation, and The Melligeri Foundation.

Aravind Shivaputrappa Melligeri serves as the Executive Chairman and Chief Executive Officer, and Rajeev Kaul is the Managing Director. Dinesh Venkatachalam Iyer is the Chief Financial Officer. The promoters hold an aggregate of 63.82% of the pre-offer paid-up equity share capital.

Industry Overview of Aequs IPO

Aequs Limited operates within the highly specialized and competitive global Precision Engineered Components (PEC) sector, offering advanced manufacturing solutions across the Aerospace and Consumer verticals. The industry is undergoing a significant transformation, driven by global supply chain diversification with China+1 or Europe+1 push, a strong emphasis on sustainability, and aggressive demands for technological advancement and component miniaturization.

The Global Precision Manufacturing Market, a primary Total Addressable Market (TAM) for Aequs, which includes Aerospace and Defense, Energy and Power, and Medical Devices PECs, was valued at approximately USD 852.90 billion in 2024 and is projected to reach USD 1,286.58 billion by 2030, reflecting a solid CAGR of 7.09%.

Concurrently, the Indian PEC Market is expanding rapidly, valued at Rs 299 lakh crore in 2024 and expected to grow at a CAGR of 8.74% to Rs 494 lakh crore by 2030. A key market driver within this is the Global Aerospace Manufacturing Market, which is commercial aircraft, projected to grow from USD 188.04 billion in CY24 to USD 272.56 billion in CY30 at a CAGR of 6.38%.

The sector is characterized by intense regulatory scrutiny, deep technological requirements, and a shift towards integrated, strategic partnership models as opposed to traditional transactional models for improved supply chain resilience and lower carbon footprint. Aequs differentiates itself through its extensive capabilities, such as:

Vertical Integration: Aequs is the only precision component manufacturer operating within a single Special Economic Zone in India to offer fully vertically integrated capabilities such as machining, forging, surface treatment, and assembly for the Aerospace Segment.

Global Compliance: Aequs's facilities maintain globally recognised certifications core to the Aerospace supply chain, including AS9100D and NADCAP.

The Aerospace Component Value Chain and the broader PEC sector face several structural challenges, such as:

Growing Miniaturization and Tighter Tolerances: The demand for smaller, more energy-efficient components, particularly in consumer electronics and advanced aerospace systems, necessitates extremely high precision (up to 4 microns for aerospace) and continuous technological upgrades.

Raw Material Price Volatility: The sector is exposed to price fluctuations and supply disruptions related to key advanced materials such as titanium, specialty alloys, and composites.

Quality Control and Entry Barriers: The lengthy and rigorous process for initial supplier certification and adherence to uncompromising quality standards, such as FAA or EASA creates significant barriers to entry for new market players, thereby protecting established manufacturers.

Skill Shortages: The sector faces a persistent shortage of skilled labour, especially in advanced machining and technical roles, leading to increased pressure on employee costs.

Financial Overview of Aequs IPO

Particulars | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from Operations | 924.61 | 965.07 | 812.13 |

EBITDA Margin | 11.68% | 15.08% | 7.76% |

Profit after tax (PAT) | -102.35 | -14.24 | -109.5 |

PAT Margin | -11.07% | -1.48% | -13.48% |

Return on Equity (RoE) | -14.47% | -1.49% | -40.68% |

Return on Capital Employed (RoCE) | 0.87% | 2.84% | -3.72% |

Cash Conversion Cycle (Days) | 253 | 203 | 157 |

Revenue from Operations has demonstrated volatility across the periods, reflecting mixed market conditions in its core segments. Revenue rose from Rs 812.13 crore in FY23 to Rs 965.07 crore in FY24, but subsequently declined to Rs 924.61 crore in FY25. This trend represents a muted CAGR of 6.74% over the period, largely influenced by a slowdown in the Consumer Segment.

EBITDA Margin reflects improved profitability at the operating level, consistent with efficiency gains from scaling operations. The margin expanded significantly from 7.76% in FY23 to a peak of 15.08% in FY24. It stabilised at 11.68% in FY25, demonstrating the company's ability to drive value from its vertically integrated manufacturing ecosystems.

Profit After Tax (PAT) has been consistently negative, indicating the significant financial burden of depreciation and interest costs. Net Loss was Rs (109.50) crore in FY23, which reduced to Rs (14.24) crore in FY24. However, the loss widened sharply to Rs (102.35) crore in FY25, due to a substantial one-time impairment charge in the consumer segment.

PAT Margin reflects the financial stress on the net income level. The margin showed an improvement from -13.48% in FY23 to -1.48% in FY24, reflecting operational recovery. It deteriorated again to -11.07% in FY25, demonstrating sensitivity to exceptional items and high fixed costs.

Return on Equity (RoE) demonstrates consistent capital erosion rather than generation capability. RoE was deeply negative at -40.68% in FY23 and slightly improved to -1.49% in FY24. The returns went down again to -14.30% in FY25, reflecting sustained net losses impacting shareholder funds.

Return on Capital Employed (RoCE) mirrors the low efficiency in utilising total deployed capital. RoCE followed a similar negative pattern, starting at -3.72% in FY23 and improving to 2.84% in FY24. It remained marginal at 0.87% in FY25, reflecting the high capital intensity of the business.

Cash Conversion Cycle has consistently lengthened, indicating a rising requirement for investment in working capital. The cycle moved from 157 days in FY23 to 203 days in FY24 and further to 253 days in FY25.

Strengths and Risks of Aequs IPO

Let's examine the strengths and weaknesses to determine if the Aequs IPO is a good or bad investment for investors.

Strengths

Advanced and Vertically Integrated Precision Manufacturing Capabilities: Aequs is the leading company within a single Special Economic Zone in India to offer fully vertically integrated manufacturing capabilities such as machining, forging, surface treatment, and assembly for the Aerospace Segment. This includes over 200 CNC machines and 161 molding machines as of September 30, 2025.

Operations in Unique, Engineering-Led Manufacturing Ecosystems: The Company operates in three unique, engineering-led, vertically integrated precision manufacturing ecosystems in India, which foster end-to-end solutions, driving operational efficiency, cost reduction, and superior quality management, thereby positioning the Company favourably to leverage the shift towards vertically integrated suppliers.

Manufacturing Presence Across Three Continents: Aequs has a strategic manufacturing presence across India, the U.S., and France. This global footprint, achieved through organic growth and strategic acquisitions, enables specialized capabilities, closer relationships with key customers, and positioning for near-shoring opportunities in North America and Europe.

Comprehensive Precision Product Portfolio: The Company produces over 5,000 products within the Aerospace Segment, positioning it with one of the largest portfolios in India as of March 31, 2025. This diversity spans high-value components for engine systems, landing systems, and structures, as well as high-precision consumer electronics components.

Long-Standing Relationships with High Entry Barrier Global Customers: Aequs has maintained strong relationships with marquee global OEM customers such as Airbus and Boeing. The average tenure for its three largest customer groups is 15 years as of September 30, 2025, reflecting high client stickiness due to stringent quality standards and collaborative engineering processes.

Risks

Significant Revenue Concentration and Dependency: The business is heavily dependent on the Aerospace Segment, which constituted 88.23% of its net external revenue for the six months ended September 30, 2025. Any decrease in demand in this sector would adversely affect the business. Furthermore, the ten largest customer groups accounted for 82.51% of revenue from operations for the same period.

Negative Cash Flow from Operating Activities: The Company recorded negative cash flows from operating activities in past periods (Rs -19.10 crores for FY24) and faces the risk of continuing to have negative cash flows in the future, which could adversely affect liquidity and the ability to fund proposed business expansions.

Contingent Liabilities and Indebtedness: The Company has significant contingent liabilities, totalling Rs 93.43 crores as of September 30, 2025, which are primarily related to tax and labour matters. Furthermore, total borrowings amounted to Rs 630.86 crores as of October 31, 2025, subjecting the Company to interest rate and currency fluctuation risks (39.90% of total borrowings were foreign exchange borrowings as of September 30, 2025).

Reliance on Requirement-Based Contracts: Contracts with OEM customers are typically requirement-based, meaning they do not obligate customers to place a fixed quantity of orders within a fixed timeframe. Any cancellation or decline in production requirements could significantly affect revenue.

Raw Material Price and Supply Chain Volatility: The business is subject to fluctuations in prices and potential disruptions in the availability of raw materials such as aluminium, steel, titanium, leading to cost increases that may only be partially passed on to customers or could strain profit margins.

Strategies of Aequs IPO

Increase Wallet Share and Diversify in Aerospace Segment: The core strategy is to increase the share of business from existing customers by moving up the manufacturing value chain, focusing on higher-value and more complex parts such as engines, landing systems, and actuation components. This is coupled with a strategy to diversify the customer base within the Aerospace Segment.

Growing Portfolio of Consumer Electronics: Aequs aims to diversify revenue by expanding its portfolio in the Consumer Segment, specifically by scaling up the manufacturing of high-precision components for portable computers and smart devices, which is consumer electronics, by leveraging existing aerospace machining capabilities.

Improve Margins Through Operational Efficiencies: The strategy includes improving operational efficiencies by increasing asset and capacity utilization across all segments and focusing on improving margins through the localization of the supply chain in India and by ensuring a product mix focused on higher value-added manufacturing.

Leverage Existing Capabilities for Market Expansion: Aequs intends to leverage its precision engineering capabilities and integrated ecosystems to increase market share in related precision-driven sectors (capability and sector adjacencies), capitalizing on the Government of India's push towards local manufacturing and opportunities arising from geopolitical shifts such as the China+1 push.

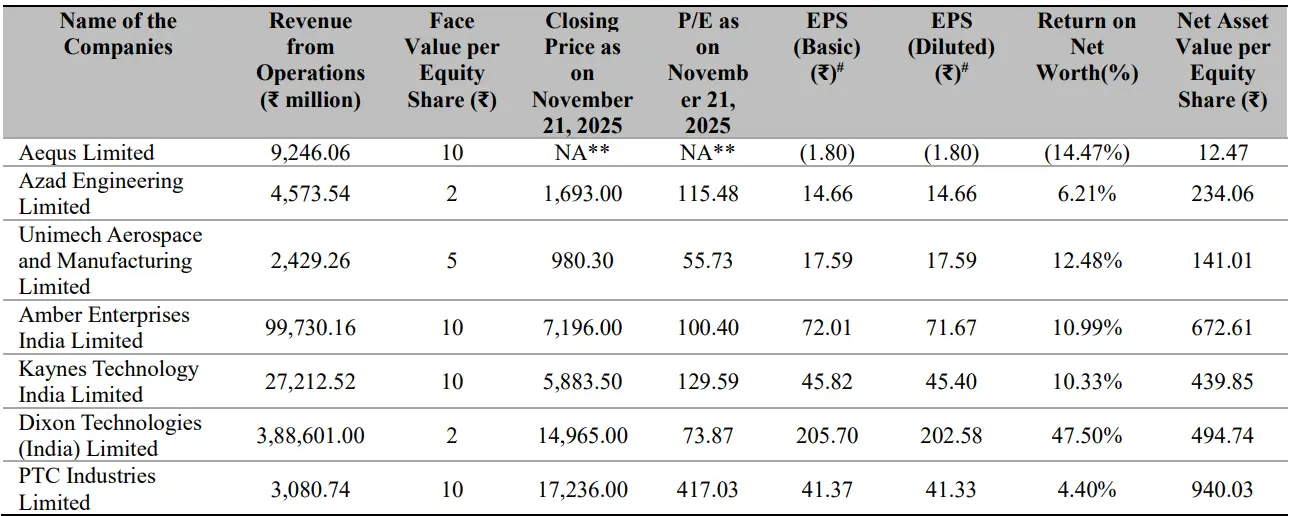

Aequs IPO vs Peers - A Comparison

In terms of core profitability, Aequs's EBITDA Margin of 11.68% in FY25 is higher than high-volume assemblers like Dixon Technologies (3.93%) and Amber Enterprises (7.98%), but falls below specialised component manufacturers such as Unimech Aerospace (37.90%) and PTC Industries (35.51%).

The Company’s financial performance is challenged at the net level, as demonstrated by its -11.07% PAT Margin, significantly trailing all key peers who reported positive net margins, including Unimech Aerospace with 34.35% and Kaynes Technology India with 10.78%.

The Company's capital-intensive, loss-making status is starkly reflected in its returns profile. Aequs recorded a negative Return on Equity (RoE) of -14.47% and a marginal Return on Capital Employed (RoCE) of 0.87% in FY25.

This contrasts sharply with the peer group, where positive, double-digit returns are the norm. For instance, Dixon Technologies achieved an RoE of 47.50% and RoCE of 48.50%, while Kaynes Technology delivered an RoE of 19.40% and RoCE of 19.20%. Aequs’s unique positioning as a vertically integrated Aerospace component manufacturer, operating under capital expenditure cycles, accounts for this difference in financial maturity compared to the more profitable peers.

Objectives of Aequs IPO

The offering consists of a total of 7,43,39,651 shares worth Rs 921.81 crores, out of which the offer for sale of 2,03,07,393 shares is valued at Rs 251.81 crores, and the fresh issue of 5,40,32,258 shares is valued at Rs 670 crores. The selling shareholders in this IPO are:

Amicus Capital Private Equity I LLP, Amicus Capital Partners India Fund II, Melligeri Private Family Foundation, Amicus Capital Partners India Fund I, Raman Subramanian, will receive the offer for sale proceeds.

However, the fresh issue proceeds will be used for the following objectives:

1) Repayment or prepayment, in full or in part, of certain outstanding borrowings and prepayment for the companies stated below totalling Rs 433.16 crores.

- Aequs Limited (Rs 17.56 crores)

- AeroStructures Manufacturing India Private Limited (Subsidiary) (Rs 174.82 crores)

- Aequs Consumer Products Private Limited (Subsidiary) (Rs 231.15 crores)

- Aequs Engineered Plastics Private Limited (Subsidiary) (Rs 9.63 crores)

2) Capital Expenditure towards machine and equipment procurement for the companies stated below totalling Rs 64 crores.

- Aequs Limited (Rs 8.11 crores)

- AeroStructures Manufacturing India Private Limited (Subsidiary) (Rs 55.88 crores)

3) Funding Inorganic growth, Acquisitions and Strategic Initiatives and General Corporate Purposes totalling Rs 172.84 crores.

Aequs IPO Details

IPO Dates

Aequs IPO will be open for subscription from December 03, 2025, to December 05, 2025. The allotment of shares to investors will take place on December 08, 2025, and the company is expected to be listed on the NSE and BSE on December 10, 2025.

IPO Issue Price

Aequs is offering its shares in the price band of Rs 118 to Rs 124 per share. This means you would require an investment of Rs. 14,880 per lot (120 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Aequs is issuing a total number of 7,43,39,651 shares valued at Rs 921.81 crores, out of which the fresh issue comprises 5,40,32,258 shares worth Rs 670 crores and the remaining 2,03,07,393 shares worth Rs 251.81 crores will be received by the selling shareholders in this IPO.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on December 08, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Aequs are expected to be listed on the NSE and BSE on December 10, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | December 03, 2025 to December 05, 2025 |

Allotment Date | December 08, 2025 |

Listing Date | December 10, 2025 |

Issue Price | Rs 118 to Rs 124 per share |

Lot Size | 120 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category