Understanding Gamma Scalping in Options Trading

00:00 / 00:00

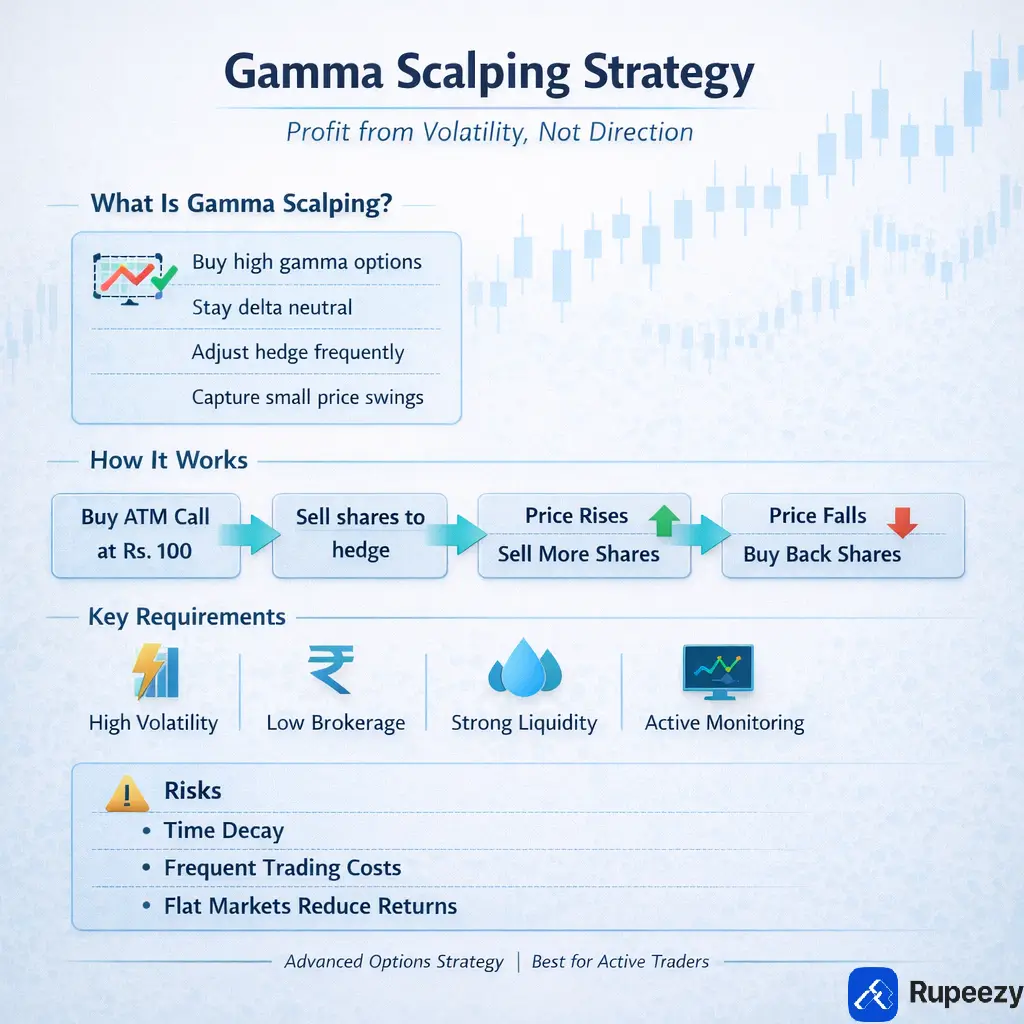

Options trading strategies are not only about predicting direction. In fact, some strategies focus more on volatility than trend. Gamma scalping is one such advanced approach. Traders use it to capture small profits from price swings while holding an options position.

While this is a great strategy, you need to understand this in detail before using it. So, let us understand what gamma scalping is here.

What Is Gamma Scalping?

Gamma scalping is a strategy where a trader buys options with high gamma. Then they continuously adjust their position in the underlying asset to remain delta neutral.

The core idea is simple. When the market moves, the delta of the option changes. This is due to gamma. By adjusting the hedge, the trader can buy low and sell high. This is in small increments. Over time, these small adjustments can generate profits, especially in volatile markets.

Hence, the focus is on capturing price fluctuations.

Key Concepts

Delta: Measures how much an option price changes. It is for every Rs. 1 move in the underlying asset.

Gamma: Measures how quickly delta changes when the underlying price moves. Higher gamma means a need for more hedging.

Delta Neutral Position: Allows to offset option delta by buying or selling the underlying asset. This is to reduce directional risk.

Volatility Focus: The strategy depends more on price movement frequency. It is not based on predicting direction.

Time Decay: Since the trader usually buys options, time decay works against the position. Hence, you must offset through active adjustments.

Key Features

Uses long options like the money contracts with higher gamma.

Need more buying and selling of the underlying asset.

Focuses on profits from market movements and not predictions.

Demands continuous monitoring during market hours.

Better for liquid markets due to brokerage and spread.

Pros

Allows profits from volatility without relying on direction.

Reduces large directional exposure through hedging.

Gaining multiple gains from the market is possible.

Offers flexibility to adapt to changing price conditions.

Cons

Time decay reduces option value daily.

Frequent hedging leads to a high cost of transaction.

Requires discipline and fast execution.

Flat markets can result in losses if volatility is low.

How Gamma Scalping Works With Example

Gamma scalping follows a clear sequence of actions. Each step is connected, and the trader keeps repeating the adjustment process as long as volatility continues.

Step 1: Buy a High Gamma Option

Say a stock is trading at Rs. 100. You buy one at the money call option with a delta of 0.50. This means the option works like 50 shares of the stock.

Step 2: Create a Delta Neutral Position

Now, you need to remove directional risk. So, sell 50 shares of the stock. Now your position is balanced. This means small price moves will not heavily impact you in one direction.

Step 3: Adjust When Price Rises

If the stock moves to Rs. 103, the delta may increase to 0.65. This is due to gamma. You now sell 15 more shares to maintain neutrality.

Step 4: Adjust When Price Falls

If the stock drops to Rs. 101 and the delta falls to 0.55. Now, you buy back 10 shares to rebalance.

Step 5: Repeat During Volatility

This way, you capture small gains. These gains must exceed time decay and transaction costs to have profits.

Who Should Use Gamma Scalping

Gamma scalping is a bit hard strategy. It requires active monitoring and understanding of option Greeks. So, to use it, you must be:

Experienced options traders.

Comfortable maintaining delta neutral positions.

Active participant in the market throughout trading hours.

Fine with short-term volatility.

Access to low brokerage and high liquidity instruments.

Tips for Gamma Scalping

If you are new, this trading strategy might sound a bit confusing. But with the right tips and direction, you can master it easily. So, here are some tips that you should definitely consider:

Trade in highly liquid stocks or indices only.

Ensure to check the spread as this leads to smooth execution.

Compare stocks based on volatility, average daily range, and liquidity before selecting the underlying asset.

Avoid overtrading to eliminate the increased brokerage costs.

Enter when volatility is expected, not when markets are completely flat.

Monitor positions actively during market hours to maintain delta neutrality.

Track time decay carefully because theta can slowly reduce option value.

Conclusion

Gamma scalping focuses on profiting from market volatility and not direction. This is by maintaining a delta-neutral position. It helps with small gains. Platforms like Rupeezy help traders understand better. Learn such advanced strategies better and trade with confidence.

FAQs

What is gamma scalping?

Gamma scalping is a strategy where traders profit from price swings by frequently adjusting a delta-neutral options position.

Is gamma scalping risky?

Yes. Time decay, transaction costs, and sharp market moves can reduce profits. It can create losses.

Does gamma scalping work in a sideways market?

It works best in volatile markets with frequent price swings, not in completely flat markets.

Do beginners use gamma scalping?

It is generally not recommended for beginners because it requires strong knowledge of option Greeks.

What is the main benefit of gamma scalping?

The main benefit is the ability to profit from volatility instead of depending only on price direction.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category