Copper Price Predictions 2030 in India

00:00 / 00:00

Every economic era has a metal that quietly defines it. In the early 1900s, steel built nations. In the digital age, silicon-powered innovation. Today, as the world transitions to electrification and increasingly toward AI-driven digital infrastructure, copper has taken center stage.

You may not see copper the way you see gold or oil flashing on your news feed every day. Yet, copper runs beneath cities, inside electric vehicles, across power grids, and through data centres.

Some economists even call it “Doctor Copper” because its price often signals the health of the global economy. The copper’s role in the world is strengthening as electricity and digital infrastructure become core to economic growth rather than cyclical add-ons.

Over the last few years, copper prices have remained high despite the US imposing trade tariffs and on the back of geopolitical tensions. Many might wonder: why is copper becoming so valuable—and what does the copper future price indicate for India and the global economy now?

To understand this shift, we must examine the future of copper and copper price predictions 2030 in India and trace the journey from mines deep underground to smart cities above ground.

Rise of Copper Prices

As we trace this journey, the past five years offer an important clue about how the copper future price has evolved from a cyclical commodity into a strategic one.

The post-pandemic recovery marked a turning point. Governments across the world began accelerating investments in renewable energy, electric mobility, power transmission, and digital networks.

Solar panels, wind farms, electric vehicles, charging infrastructure, and data centres all share one common requirement with large and consistent amounts of copper. What was once demand-driven by construction cycles is now being powered by long-term structural change.

Even over the last year, copper prices have remained elevated despite sharp volatility. In November 2025, the US government added copper to its Critical Minerals list, formally recognising its strategic importance. When this policy shift met an already tight supply environment, the copper future price surged sharply toward the latter part of 2025, reaching record prices above $11,000 per tonne.

Many commodities tend to face oversupply during price upcycles, but copper tells a different story. Declining ore grades, delays in mine approvals, and rising environmental and compliance costs are making copper extraction and production increasingly challenging.

This widening gap between rapidly growing demand above ground and constrained supply below it continues to keep copper prices firmly in the spotlight both globally and within India’s infrastructure-led growth story.

How Copper Becomes a Usable Product

Copper does not arrive in factories ready for use. It begins its journey hidden inside rocks, often in low concentrations of copper content.

1) Exploration and Mining: Companies first locate copper deposits using geological surveys. Once miners identify a viable site, they extract copper ore from the earth. At this stage, the ore is mixed with other metals, it is mostly rock. If there is a decline in ore grades, it can have an impact on the processed per tonne of copper, raising costs and tightening copper supply.

2) Concentration: Miners crush and process the ore to separate copper from waste material. This step upgrades the copper content to around 30% copper concentrate.

3) Smelting and Refining: Smelters heat the concentrate at extremely high temperatures. This process removes impurities and produces blister copper with 90–98% purity. Further refining turns it into copper cathodes with 99.99% purity, which serve as the global benchmark for trade and pricing.

4) Semi-Fabrication: Manufacturers convert refined copper into wires, rods, tubes, and sheets. These semi-products then move into construction sites, automobile factories, power plants, and electronics units.

5) Recycling: Copper never truly dies. As per International Copper, more than 32% of global copper usage comes from recycling, and recycled copper uses nearly 85% less energy than mined copper. The recycling is expected to grow, but it cannot fully offset primary copper demand due to long product life cycles in infrastructure and power systems.

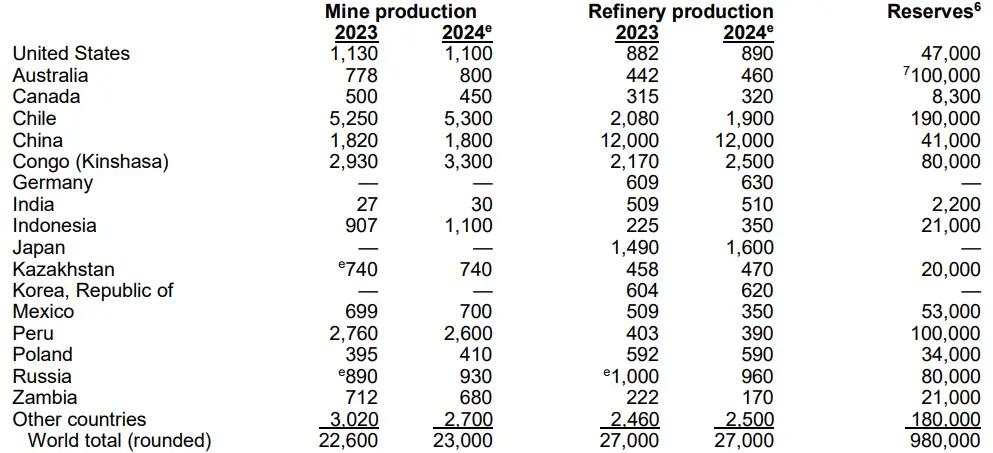

Who Controls Global Copper?

Copper power does not rest with one country, it is split between mining and processing.

Global copper mining leaders like Chile, Peru, the Democratic Republic of Congo (DRC), China, and the United States dominate copper extraction. Chile alone accounts for 23% of mined copper globally.

In global copper refining production, the story looks very different. China controls more than 44% of the world’s copper processing capacity, giving it immense influence over refined copper supply chains. The DRC, Chile, Japan, and Russia follow at a distance.

However, China’s influence is most significant in its consumption, as it currently represents about 58% of the world's refined copper usage. This imbalance means countries rich in copper ore still depend on processors elsewhere, creating vulnerabilities during geopolitical tensions or trade disruptions.

Why Are Copper Prices Moving Up?

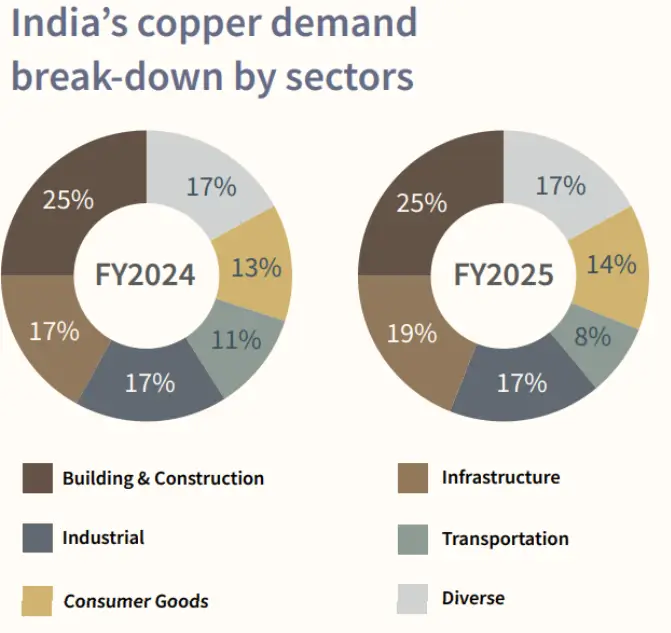

Copper prices are not rising by accident, and structural demand, rather than short-term cycles, now primarily drives the market, especially in India, where consumption rose 9.3% in FY25.

For Indian retail investors, this means sectors like infrastructure, electrification, metro projects, and EV manufacturing are particularly relevant, as they are driving long-term copper demand and may impact related stock and commodity investment opportunities.

According to the International Copper Association India and industry estimates, copper is used in FY25 by:

Building Construction and Infrastructure: 44%

Transportation and Consumer Goods: 22%

Industries: 17%

Diverse sectors: 17%

These numbers show that copper demand no longer depends on just one sector, it spreads across the entire economy.

Massive infrastructure spending, metro rail expansion, railway electrification, and urban housing schemes continue to absorb large volumes of copper. At the same time, consumer durables and automobiles keep demand steady even during economic slowdowns. Diversified demand can reduce downside risk for copper prices.

AI, Electrification, and the New Age Copper Rise

The next wave of copper demand does not come from traditional sectors alone; it is driven by technological shifts and energy transitions.

Power Grids and Data Centres: Artificial intelligence and cloud computing have emerged as new copper consumers. A single AI data centre can consume between 28 to 30 tonnes of copper for wiring, high-capacity power distribution, and cooling systems.

Electric Vehicles and Charging Infrastructure: As per Wood and Mackenzie, the Electric vehicles use around four times more copper than conventional vehicles. Charging stations, batteries, and electric motors all depend heavily on copper wiring.

Renewable Energy: India’s target of 500 GW renewable energy capacity by 2030 will require large-scale transmission expansion. Solar panels, wind turbines, and storage systems all rely on copper-intensive components.

This shift ensures copper demand remains a long-term play.

Can India bridge the supply gap?

While demand accelerates, India’s copper supply is still in progress.

Sterlite Copper (Vedanta): Vedanta’s Sterlite Copper plant has a capacity of around 400 KTPA. However, the Tuticorin smelter has remained shut since 2018 due to environmental issues, removing nearly 36% of India’s refined copper supply.

Hindalco Industries: They operate a 500 ktpa copper smelter and currently meet over 50% of India’s refined copper requirement. Yet even this capacity falls short of rising demand.

Hindustan Copper Limited: They remain India’s only major copper miner, producing about 4 MTPA of ore, and they are planning to increase it to 12.20 MTPA.

India imports around 90-95% of its copper ore and has turned into a net importer of refined copper since FY19.

Kutch Copper, backed by Adani Enterprises Limited, has commissioned a 500 ktpa smelter, offering hope of reducing import dependence.

Future of Copper in India : Copper Price Predictions 2030

The outlook for copper prices through the end of the decade is increasingly defined by a widening disconnect between demand and supply. Major global financial institutions and domestic rating agencies highlighted that the metal has entered a high-price environment driven by long-term structural shifts.

Goldman Sachs: Following record highs of around $13,386 per tonne, Goldman Sachs expects prices to move back around to $11,000 per tonne by the end of December 2026 (source) on the back of the preference for more aluminium usage in EV batteries and other economic slowdown factors. However, in the long term, with structural demand from power grids and AI, they expect the push prices to reach $15,000 per tonne by 2035. (source)

S&P Global: As per Copper in the Age of AI report, global primary copper production is forecast to rise from current levels of 23 million metric tons in 2025 to a peak of 27 million metric tons in 2030 before falling to 22 million metric tons by 2040. Without significant new mine investment or recycling expansion, this decline is expected to result in a 10 million metric ton supply shortfall by 2040.

Taken together, these projections suggest that copper has entered a structurally higher price band, where short-term corrections are possible, but long-term prices remain supported by electrification, grid expansion, and digital infrastructure demand.

Based on current supply-demand trends and institutional forecasts, the copper future price is likely to remain elevated through the next five years. Longer-term scenarios suggest potential further increases if supply constraints persist.

Note: This article is intended for educational purposes only and is based on publicly available information, industry reports, and institutional market analysis. Commodity prices are subject to volatility, and readers should conduct their own research or consult a qualified financial advisor before making any investment decisions.

How Indian Investors Can Gain Exposure to Copper Prices

Investors can gain exposure to copper through MCX Copper futures, which broadly track prices on the London Metal Exchange (LME). Global developments such as mining disruptions in Chile, processing constraints in China, or geopolitical tensions are quickly reflected in MCX prices.

As a result, retail investors following MCX copper should keep a close watch on LME prices for global cues, since international trends often have a stronger influence than domestic news.

Alternatively, investors may consider exposure through copper-producing or copper-linked companies, after analysing their financial health, as stock prices can be influenced by movements in copper prices. Such investments are typically executed through SEBI-registered brokerage platforms; for example, platforms like Rupeezy and other market participants provide access to equity and commodity markets, subject to completion of the required KYC formalities.

Conclusion

Copper has quietly transformed into a strategic asset for the global economy. It sits at the heart of infrastructure, electrification, AI, renewable energy, and transportation.

For India, copper represents both an opportunity and a vulnerability. Demand continues to surge, but supply struggles to keep pace. New plants like Kutch Copper can offer relief, yet import dependence remains a reality.

As the world races toward net-zero goals and digital transformation, the future of copper price will remain closely linked to how quickly economies electrify and digitise. Those who understand its journey from mine to market can help better understand the future of modern economies.

Copper may not shine like gold, but it is an increasingly important metal that powers tomorrow.

Note: Data references include reports from Goldman Sachs, S&P Global, International Copper Association India, and the U.S. Geological Survey.

FAQs:

Q1) What is the future of copper in India 2030?

Analysts from Goldman Sachs project that copper prices will remain structurally elevated through 2030 due to tight supply and rising demand from the energy transition and infrastructure sectors.

Q2) What factors most influence the future of copper in India?

Future copper price movements are driven by demand from electrification, electric vehicles, renewables, data centers, and constrained supply from declining ore grades and slow mine expansions.

Q3) How does supply affect copper price predictions?

Supply disruptions, slower mine growth, and projected deficits relative to demand are expected to support elevated copper prices in the coming years.

Q4) Why is copper demand rising in the age of digital infrastructure and AI?

Copper demand is rising because electrification, AI data centers, and digital infrastructure require significantly more copper for wiring, power distribution, and cooling systems than legacy technologies.

Q5) Can copper be considered a long-term investment metal?

Many investors view copper as a long-term strategic asset due to its indispensable role in global electrification and infrastructure growth, though prices can be volatile.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category