Zinc Future Price Predictions Till 2030

00:00 / 00:00

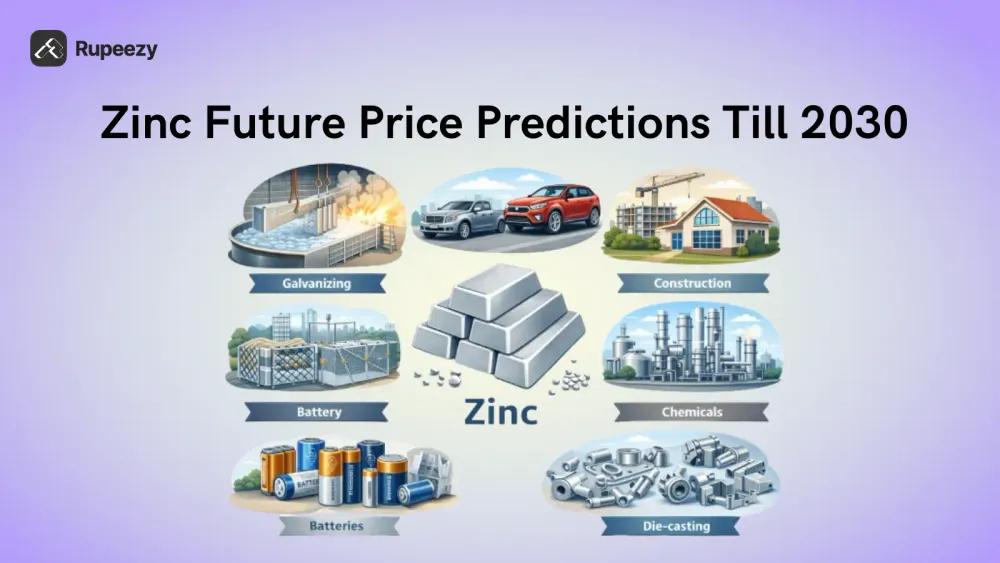

Zinc rarely grabs headlines like gold or crude oil. But it is one of the commodities traded widely across industries. This includes automobile, infrastructure, construction, and manufacturing. From galvanizing steel to protecting large-scale industrial projects from corrosion, the demand for zinc is increasing rapidly.

But as we move ahead, the biggest question we need to answer is the future price of zinc. This is one of the primary questions that investors ask. In this guide, we break down the zinc future price prediction and the key market drivers that are impacting it.

So, let us get started and understand everything you need to know about the zinc future price forecast.

Rise in Zinc Price - Historical Trend

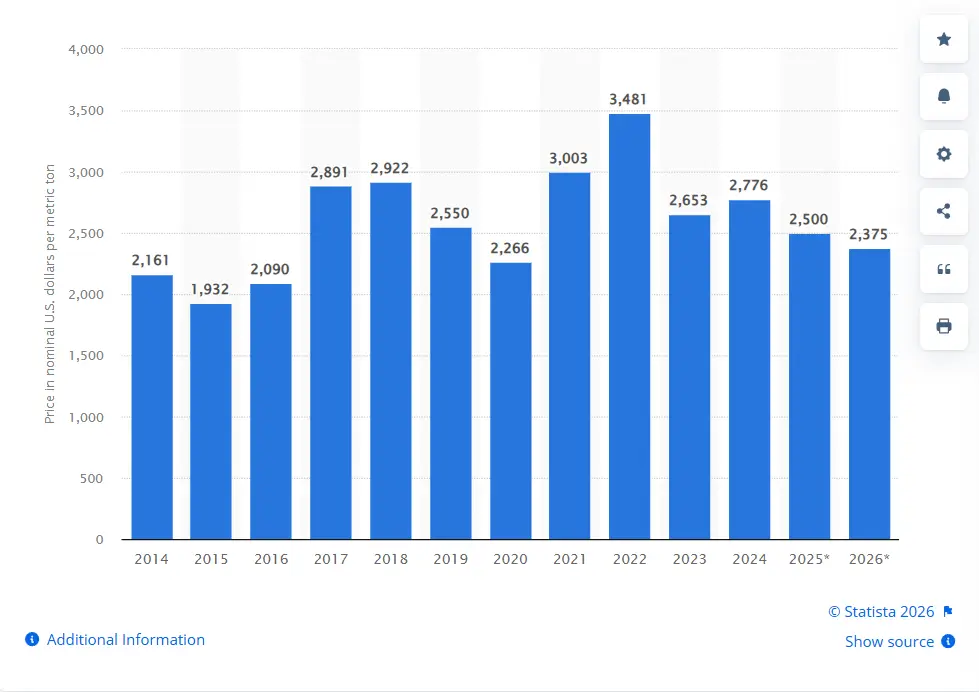

Before forecasting zinc future prices till 2030, it is important to understand how the metal behaved over the last five years. The pattern clearly shows a sharp rally, a strong correction, and then a gradual recovery phase. In fact, zinc is also part of the critical raw mineral list, which is boosting its demand.

From 2019 to 2020, zinc prices were in the range of 2,300 to 2,600 USD per ton. This was a sign that the prices are moving to a stable pre-pandemic base. In 2021 and 2022, prices surged dramatically. Post-COVID, there was strong industrial demand, especially from China. This was one of the primary reasons for this.

It was also then combined with high European energy costs that forced smelter shutdowns, pushed prices above 4,000 USD per ton at the 2022 peak. Annual averages during this period crossed 3,500 USD per ton, marking a multi-year high.

However, late 2022 and 2023 saw a correction. As energy markets stabilised and supply improved, prices declined toward the mid-2,000 USD range. Slower construction activity and the weaker demand for infrastructure were the prime reasons for this.

Through 2024 and into 2025, zinc traded between 2,400 and 3,100 USD per ton. By late 2025, prices were near 2,900 to 3,000 USD per ton. This shows a moderate recovery and not a bull cycle.

The chart below reflects the same in a well-defined manner.

To better understand zinc’s long-term outlook, check this YoY outlook.

Year | Average Price (USD per ton) | What Was Happening in the Market |

2019 | Around 2,500 to 2,600 | A fairly steady year. Demand and supply were largely balanced before the global disruption. |

2020 | Around 2,300 to 2,400 | COVID hit industrial activity hard. The zinc prices softened as construction and manufacturing slowed. |

2021 | Around 2,900 to 3,000 | A strong rebound year. Factories restarted, China’s demand picked up, and metals rallied broadly. |

2022 | Around 3,600 to 3,700 | The standout year. Energy costs in Europe forced smelter cuts, inventories tightened, and prices briefly crossed 4,000. |

2023 | Around 2,700 to 2,800 | Reality check. Supply improved, and global growth concerns pulled prices back down. |

2024 | Roughly 2,500 to 2,800 | More range-bound movement. No extreme highs, but steady volatility through the year. |

2025 | Close to 2,900 to 3,000 | A modest recovery from 2023 lows. But it is still nowhere near the 2022 spike. |

How Zinc Becomes a Usable Product

Zinc goes through a structured industrial journey. Once the same is done, it reaches construction sites, automobile plants, or manufacturing units. Each stage adds value. This is why it is important to understand these stages. It also introduces cost elements that influence overall zinc pricing.

Stage | What Happens | Why It Matters |

Mining | Zinc ore, mainly zinc sulfide, is extracted from underground or open-pit mines. | This is the starting point. Ore quality and mine output are key. They directly affect global supply. |

Crushing and Concentration | The ore is crushed. Then it is processed through flotation. This helps to produce zinc concentrate with higher purity. | Concentrate typically contains 50 to 60% zinc. This makes it suitable for smelting. |

Smelting | The concentrate is heated at high temperatures. This is to remove sulfur and impurities. | This stage is energy-intensive. High power costs can reduce output and push prices up. |

Refining | Further purification produces high-grade refined zinc metal. | Refined zinc is what enters global trade and industrial use. |

Fabrication and End Use | Zinc is used for galvanizing steel, alloys like brass, die casting, and batteries. | Final demand is from construction, autos, and infrastructure. This determines long-term price trends. |

Global Zinc Production

Global zinc production comes mostly from mining. At the same time, recycling is making up a smaller share. Production levels affect how balanced the market is and how the prices will move. Here’s a snapshot of recent zinc output and the key producers.

Country | Mine Production 2023 (Thousand tons) | Mine Production 2024 (Thousand tons) | Reserves (Thousand tons) |

United States | 767 | 750 | 9,200 |

Australia | 1,090 | 1,100 | 64,000 |

Bolivia | 492 | 510 | NA |

China | 4,060 | 4,000 | 46,000 |

India | 854 | 860.00 | 9,800.00 |

Kazakhstan | 340 | 370.00 | 7,600.00 |

Mexico | 584.00 | 700.00 | 14,000.00 |

Peru | 1,470.00 | 1,300.00 | 20,000.00 |

Russia | 300.00 | 310 | 29,000.00 |

South Africa | 198.00 | 120.00 | 5,900.00 |

Sweden | 218.00 | 240.00 | 3,900.00 |

Other countries | 1,690.00 | 1,700.00 | 25,000.00 |

World Total (Rounded) | 12,100 | 12,000.00 | 230,000.00 |

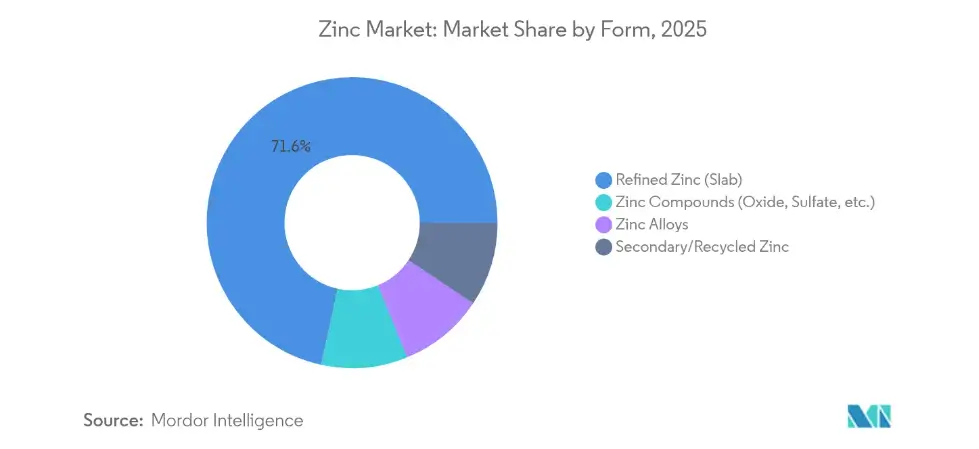

Zinc Market Share by Form in 2025

In 2025, the largest share of zinc demand continues to come from galvanized zinc. It is primarily used to coat steel and prevent corrosion. This segment dominates because construction, infrastructure, and automobile manufacturing rely heavily on galvanized steel.

Other forms, such as zinc alloys, zinc oxide, and rolled zinc, also contribute meaningfully. Alloys are widely used in die casting and automotive components. But the zinc oxide plays a role in rubber, chemicals, and ceramics.

Zinc Market Share by End User Industry, 2025

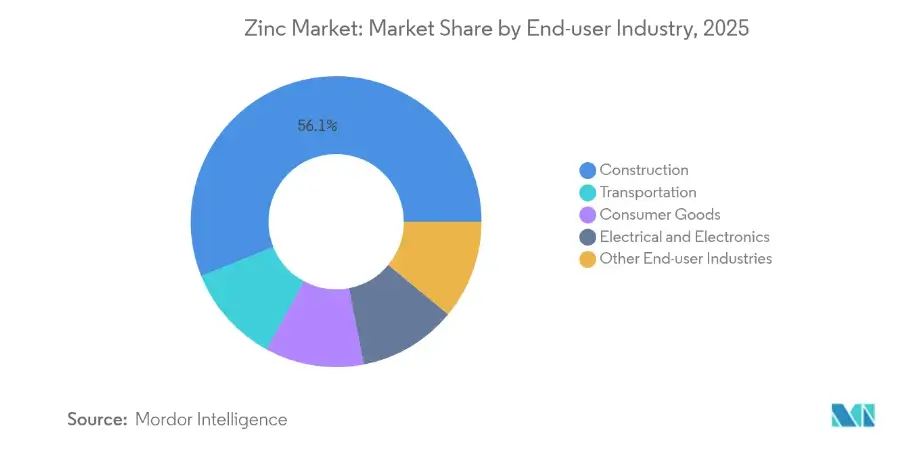

Beyond form, it is equally important to understand where zinc is ultimately consumed. End-user industries give a clearer view of demand concentration.

Construction clearly dominates, with more than half of the total zinc demand. Transportation, consumer goods, and electrical and electronics follow. Also, the rest of the industries make up the remaining share. This heavy reliance on construction reinforces how closely zinc prices are moving.

Zinc’s Rising Importance in India

Zinc has steadily gained strategic importance in India’s growth story. Recent industry reports show that the zinc demand is increasingly structural, not just cyclical.

India consumed a record 783 kt of zinc in FY2025. (Source) It is largely driven by galvanized steel, the automobile sector, solar PV, and renewables.

The Union Budget 2025–26 has increased capital expenditure. It is around ?11.20 trillion. This marks a 9.8% YoY rise. Large allocations toward roads, railways, PMAY housing, and Smart Cities are the key factors for this rising demand. (Source)

According to IMARC Group’s latest zinc price trend analysis, corrections follow. It highlights that zinc price movements are closely tied to raw material availability, smelting costs, and global macroeconomic conditions. Also, there is a consistent demand from construction, automotive manufacturing, and infrastructure projects.

Company Highlight

Hindustan Zinc Ltd controls over 75% of India’s zinc market. It continues to shape the sector’s trajectory. In Q3 FY26, the company shared the following:

EBITDA of ?6,087 crore

PAT of ?3,916 crore

This is supported by strong zinc prices and low production costs.

It also announced a ?1,400 crore debenture raise. This is for expansion and unveiled zinc-ion battery prototypes for renewables. It is signaling long-term growth and technological diversification. (Source)

Zinc Price Predictions till 2030

The long-term outlook for zinc suggests stability> it expects that the price will move in a range only.

IMARC Group: Projects zinc to average around $2,900–3,100 per tonne by 2030 with moderate volatility.

Research and Markets: It suggested that the global zinc market will be around $29–33 billion by 2030. This is all amid Asia-Pacific demand strength.

Grand View Research: Expects zinc mining output to grow around 2% annually through 2030 and price around $3,000 per tonne.

Overall, consensus points toward zinc averaging close to $2,900–3,000 per tonne by 2030.

Note: Educational content is only based on public reports. Commodity prices are volatile. Consult advisors before investing.

Conclusion

Zinc may not always make headlines. But its role is quite important and worth noting. With a rise in demand, the prices are expected to reach a high level and stabilize soon. And if you are an investor, then register on Rupeezy to gain more insights and details.

FAQs

What is the expected zinc price by 2030?

Most forecasts suggest zinc could average around $2,900–3,000 per tonne by 2030. This is based on the demand and supply conditions.

What factors will influence zinc prices the most?

The key factors that can impact the zinc prices include the industrial demand, production needs, price, and others.

Is zinc demand expected to grow in India?

Yes. This is driven by infrastructure expansion, steel production growth, and domestic manufacturing momentum.

Can renewable energy impact zinc prices?

Yes, zinc is used in galvanizing. It is also used for solar infrastructure and has potential in zinc-ion battery technology.

Is zinc a good long-term commodity to track?

Zinc is closely tied to industrial growth. This makes it a steady metal to monitor for long-term macro and infrastructure trends.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category