What Is the Settlement Cycle in Stock Markets

00:00 / 00:00

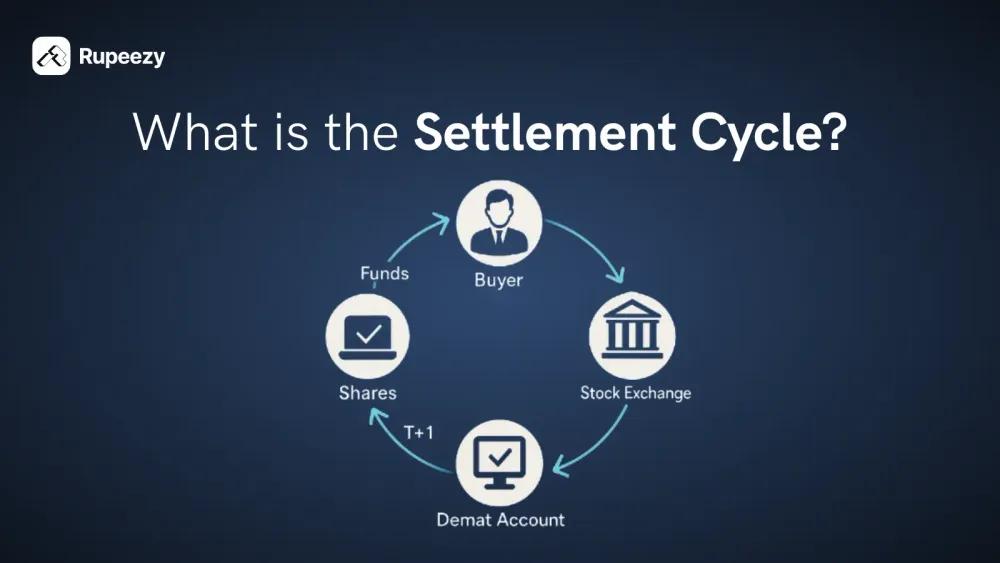

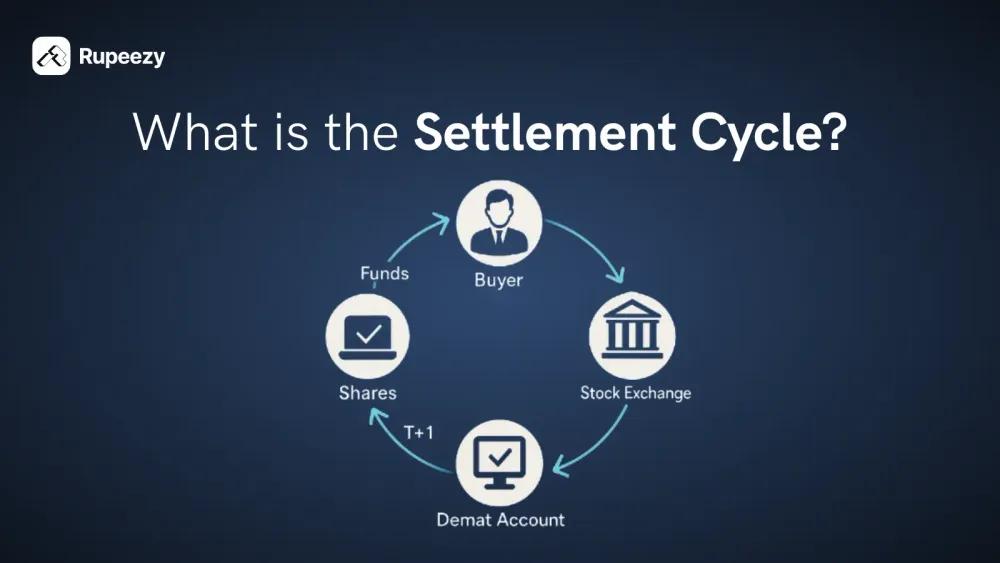

Have you ever wondered why shares don't immediately appear in your Demat account after you buy them? The answer lies in the settlement cycle, the process by which shares and money are transferred between buyer and seller after a trade. Today, India implements the T+1 settlement cycle, making transactions faster and more secure than ever before. In this blog, we'll explore the settlement cycle in the stock market and why it's so important to investors.

What is Settlement?

In the stock market, the settlement cycle is the process by which the buyer receives the shares they purchased and the seller receives their money. Simply put, it's the final step after a trade is completed where ownership changes hands. When you buy shares in a company, they don't immediately appear in your Demat account because the exchange, broker, and clearing corporation work together to ensure that both parties have fulfilled their promises. This process is called clearing and settlement.

The entire process from trade to settlement

The settlement cycle is completed in several stages

Trade Execution: When you buy or sell shares, your order is matched on the stock exchange (NSE/BSE).

Clearing: The clearing corporation (such as NSCCL or ICCL) then calculates who is responsible for how many shares and money.

Settlement: In this stage, shares are transferred to the buyer's Demat account and funds are sent to the seller's bank account.

Custodial: This is the final stage where the shares are permanently recorded in your Demat account and the transaction is considered complete.

For example, if you purchased shares of a company on Monday, under the T+1 cycle, those shares will appear in your Demat account by Tuesday evening.

T, T+1, T+2 - What do they mean?

T (Trade Date) :

This is the day your order is executed on the stock exchange (NSE/BSE). On this day, the trade is only finalized, meaning the deal is confirmed between the buyer and seller. However, the shares and money are not yet transferred. All data and records are sent to a clearing corporation (such as NSCCL or ICCL) so that the next stage of the process can be initiated.

Example: If you purchased Infosys shares on Monday, Monday would be called "T" day.

T+1 Settlement Cycle :

Fully implemented in India from January 2023. This means that settlement will be completed on the next business day after the trade. That is, if you purchased shares on Monday (T), they will be credited to your Demat account on Tuesday (T+1) and the seller will receive the money. Prior to this system, India operated on T+2, but SEBI implemented T+1 to make it faster.

T+2 Settlement Cycle :

Previously, in India and many other countries, settlements occurred two days after a trade. For example, if you placed a trade on Monday, it would be completed on Wednesday. Although this model lasted for a long time, it had two major problems:

Risk Exposure : If one party did not receive funds or shares on time, the risk of default increased.

Delayed Liquidity : Investors had to wait two days to receive their money or shares.

For these reasons, SEBI gradually phased this out and implemented T+1.

T+0 (Upcoming Future) :

India is now moving towards a T+0 settlement cycle, or "same-day settlement," which will allow for instant transfer of shares and funds. SEBI launched a pilot project for this in March 2024.

Key participants in the settlement Cycle

The settlement process is completed through coordination between several institutions.

Participant | Role |

Investor | Places an order to buy or sell shares and makes funds/shares available. |

Broker | Acts as an intermediary between the investor and the exchange, executing orders. |

Stock Exchange (NSE/BSE) | Platform where buyer and seller orders are matched. |

Clearing Corporation | Ensures matching, liability determination, and settlement guarantees for all trades. |

Depository (NSDL/CDSL) | Holds shares in electronic form and transfers them between the Demat accounts of the buyer and seller. |

Banks / Payment Gateways | Fund transfers ensure timely payments are completed. |

Evolution of the Settlement Cycle in India

The speed and transparency that India's stock market is known for today didn't happen overnight. It's a long journey spanning three decades of change, technological advancements, and regulatory reforms. Let's explore how the settlement cycle in India gradually evolved, leading to T+1 and now T+0.

From Paper to Digital :

Before the 1990s, the buying and selling of shares in India was entirely based on paper certificates.

Investors had to send physical share certificates, get them signed, and make payments by check or draft.

This process took days, sometimes up to two weeks.

Settlement times were so long that periods like T+14 were common in the market.

The Harshad Mehta scam that occurred after 1992 made it clear that this old structure severely lacked transparency and security. After this, India moved towards an electronic system.

From T+5 to T+3 (2001–2002) :

In 2001, SEBI implemented the T+5 settlement system for the first time in India settlement five working days after the trade. However, to make the market more efficient, it was reduced to T+3 in April 2002. This reform :

Reduced the time between trade and settlement.

Increased confidence in the transfer of funds and shares.

Reduced investors' exposure time, thereby reducing risk.

T+2 Settlement (2003) :

In April 2003, India adopted the T+2 settlement cycle settlement two working days after the trade. This reform brought the Indian market closer to international standards.

Settlement speed increased and brokers' cash flow accelerated.

Clearing and reconciliation became completely electronic.

Investors began receiving their money and shares quickly.

This was the time when India's stock market gradually became technology-driven.

The Demat and Automation Revolution :

After the T+2 model, the real revolution came with dematerialization.

Shares ceased to be physical and were now held electronically.

Depositories like NSDL (1996) and CDSL (1999) simplified and secured this process.

Automation, broker-depository integration, and online settlement systems made the entire process transparent.

Investors could now see shares in their accounts within a few days of a trade, without paperwork or bank visits.

This change laid a strong foundation for India's digital market structure.

T+1 Settlement (2022–2023) :

In September 2021, SEBI approved the implementation of the T+1 Settlement Cycle, that is, settlement on the next business day of the trade.

This system was implemented in a phased manner Starting with small-cap stocks in March 2022, all equity stocks were included in the T+1 system by January 2023.

Now, if an investor trades on Monday, the shares are credited to their Demat account by Tuesday, and the seller is paid.

India took this step before any major market in the world, making it a global leader.

T+0 Settlement (2024–2025) :

Now, India is moving towards the next milestone T+0, i.e., Same-Day Settlement.

In March 2024, SEBI launched a pilot project on 25 selected stocks.

In December 2024, it was announced that the top 500 stocks would be gradually included in the system (100 new stocks every month) from January 1, 2025.

The aim is to ensure that trades made in the morning are fully settled by the evening of the same day.

Although this is currently optional, it will make the Indian market one of the first systems in the world to work towards real-time settlement.

Benefits of a Shorter Settlement Cycle

When settlement cycles are shortened in a market, such as India's T+1 model, it makes the entire financial system more efficient, transparent, and investor-friendly.

Faster Fund Availability

In the T+1 model, the transfer of shares and funds is completed the very next day of the trade. This gives investors a quicker opportunity to reinvest their funds. Funds that previously remained locked for two days are now available the very next day. This increases capital flow in the market and allows investors to manage their portfolios with greater flexibility.

Reduced Counterparty & Market Risk

Shorter settlement cycles reduce market risk because obligations between buyers and sellers are settled more quickly. If a party's financial situation or technical system malfunctions, the impact is limited. This reduces the likelihood of defaults or failed settlements in the market and strengthens investor confidence.

Improved Market Liquidity

Shortening settlement times increases market liquidity as funds and shares circulate more quickly. This reduces the gap between purchases and sales, making trading more active and transparent. This improvement is beneficial not only for large investors but also for small retail investors, allowing them to access their funds and shares more quickly.

Higher Operational Efficiency

Faster settlement systems make broker, exchange, and clearinghouse operations more automated and accurate. Manual errors are reduced, ensuring smoother processes. Furthermore, since funds and shares are transferred more quickly, the capital burden involved in clearing also decreases, leading to lower system costs overall.

Stronger Investor Confidence & Global Competitiveness

India's T+1 settlement cycle is being recognized globally as a significant achievement. Fast and reliable settlement has boosted foreign investor confidence and established India as a modern, technologically advanced market. This is increasing international investor participation and positioning India as a leading example in global markets.

Risks and Challenges in the Settlement Cycle

While the settlement cycle makes the market faster and more efficient, it also poses some operational, technical, and global challenges.

Limited Time and Operational Pressures

The T+1 settlement cycle requires the entire transaction process to be completed very quickly. Brokers, clearing houses, and investors must have funds and shares ready on time. Even a slight delay or technical error can disrupt settlement. This timeline can sometimes prove challenging, especially for smaller brokers and retail investors.

Fund Shortages & Settlement Failures

If the buyer's account lacks sufficient funds on time, or the seller lacks shares, settlement cannot be completed. This situation is called a settlement failure. In such a situation, the exchange must conduct a buy-in auction, which can lead to both delays and financial losses.

Challenges for Foreign Investors

The T+1 cycle can sometimes prove complex for foreign institutional investors (FPIs) because their countries have different time zones. This can delay fund transfers and confirmations. Furthermore, currency exchange processes are often not completed immediately, making compliance difficult for some global investors.

Technology Dependency & Downtime Risk

Fast settlement means the entire system is technology-dependent. If a technical glitch occurs in a clearing corporation, depository, or payment network, the entire settlement could be halted. Events such as system downtime or cyberattacks can cause temporary imbalances, impacting the market.

Liquidity Management Pressure

The T+1 model requires brokers and institutional investors to have their funds and shares ready a day in advance. This puts additional pressure on their liquidity management. Even a small delay at banks and clearing can impact the entire chain.

Conclusion

The settlement cycle is the stock market's unseen engine that makes every trade successful. India has taken it to new heights in the past few years. The transition from T+2 to T+1 and now to T+0 (same-day settlement) is an example for the entire world. Fast, transparent, and technologically advanced settlement systems have made the Indian market more reliable. This speed and efficiency will propel India towards global financial leadership in the future.

Leveraging Faster Settlement with MTF

With the T+1 and upcoming T+0 settlement cycles, investors can now access funds and shares much faster. By using a Margin Trading Facility (MTF), investors can leverage their capital to take larger positions in stocks without waiting for full fund availability. This allows you to make timely investment decisions, capitalize on short-term opportunities, and maximize potential returns, all while the faster settlement cycles minimize liquidity delays and risks.

FAQs

Q1. What is a settlement cycle in the stock market?

It is the process by which shares are transferred to the buyer and money to the seller after a trade.

Q2. What does T+1 mean in the settlement cycle?

It means that full settlement will occur on the next working day of the trade.

Q3. Is India using T+1 settlement now?

Yes, India has fully implemented the T+1 system from January 2023.

Q4. What is the difference between T+1 and T+2 settlement?

In T+1, settlement occurs the next day, while in T+2, it takes two working days.

Q5. What is T+0 or same-day settlement?

T+0 means that shares and money will be transferred on the same day the trade occurred.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category