Can Silver Prices Cross Rs 2,50,000/kg in 2026?

00:00 / 00:00

The Silver price on MCX has surged approximately 4% today, reflecting robust momentum amid global rallies. Global silver spot prices approached $66 per ounce, driven by persistent supply shortages and heightened demand. The gold-silver ratio stands at around 65:1, signalling silver's relative strength against gold.

MCX Silver Surge in India

MCX Silver prices climbed sharply today, surging nearly 4%, reaching the day’s high price of Rs 2,06,111, mirroring global silver prices and domestic demand from investors and industries. India faces acute supply constraints, with rising global shortages due to various geopolitical challenges and investment buying. Rupee depreciation against the dollar increased these pressures, delivering higher returns.

Industrial applications, especially in solar panels and electronics, account for significant silver demand, while investors increasingly gain exposure through digital avenues such as ETFs and mutual funds. The performances of silver mutual funds, can be viewed on the Rupeezy platform.

Global Silver Rally Drivers

Global silver prices crossed $66 per ounce, propelled by a fifth consecutive year of supply deficits as mining output fails to keep pace with demand. Industrial sectors, especially green energy transitions like photovoltaics, reach record volumes, outstripping refined supply from primary and by-product sources. Chinese inventories have hit decade lows since 2015, which can force export restrictions.

Macroeconomic shifts accelerate the surge, with US Federal Reserve rate cuts weakening the dollar and lowering opportunity costs for holding precious metals. A softening US jobs report, showing unemployment at 4.6% in November 2025, drives investors toward silver as a risk hedge amid economic uncertainty. Geopolitical tensions, including de-dollarisation efforts by nations like China and other nations, spur central bank and retail accumulation of physical bars.

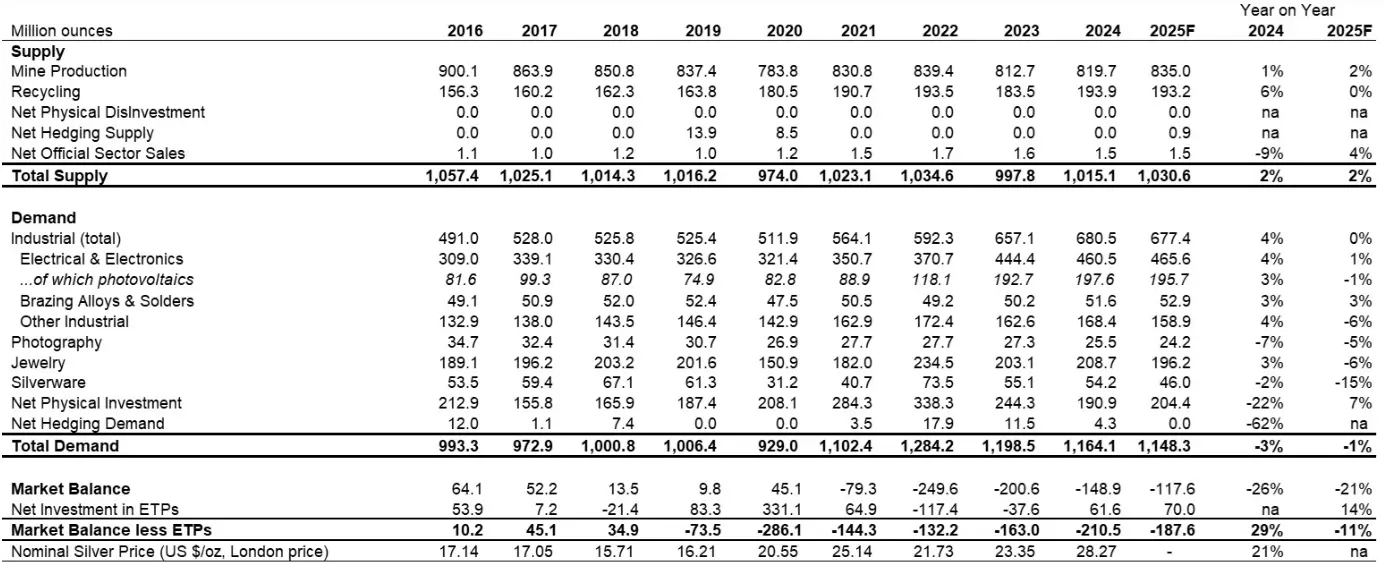

Persistent borrowing rate highs and ETF inflows underscore bottlenecks, as retail delivery demands pull metal from markets. These fundamentals cement silver's case, with multiple analysts eyeing sustained gains into 2026. The image below represents the summary of silver supply and demand done by the Silver Institute.

Gold-Silver Ratio Insights

As per TradingView, the gold-silver ratio hovers around 65.48, calculated from gold at roughly $4,336 per ounce and silver nearing $66.21. This compression from historical averages indicates silver outperforms gold, often signalling undervaluation in the white metal. Investors track it closely, as ratios above 80 historically mean silver can rally. As per various sources, the gold-to-silver ratio's long-term average is 60. Falling ratios reflect silver's dual role as an industrial metal and an investment vehicle.

Can Silver Reach Rs 2,50,000?

Analysts project MCX silver could hit Rs 2,40,000 to Rs 2,50,000 by late 2026. Motilal Oswal forecasts Rs 2.40 lakh by end-2026, rising to Rs 2.46 lakh amid the rupee weakening further to Rs 95 per USD and increasing demand across industries.

Currently, the silver price have surged around 135% YTD and breached Rs 2,00,000/kg, and it is currently trading at Rs 2,05,523/kg, with eyes reaching Rs 2,50,000 next year on various demand factors.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category