Sacheerome IPO Allotment Status, Allotment Date, and GMP

00:00 / 00:00

The Sacheerome IPO allotment status will be available on Thursday, June 12, 2025. Investors can check their allotment status on the NSE website or the official registrar’s website, MUFG Intime India Private Limited. The IPO opened on June 9, 2025, and by the end of Day 3, it was subscribed 312.94 times. Follow the simple steps below to check your Sacheerome IPO allotment status.

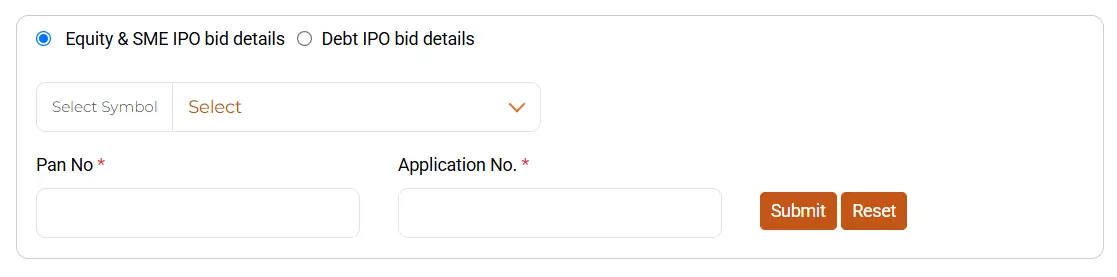

How to Check the Sacheerome IPO Allotment Status on NSE

Below are the steps to follow to check the Sacheerome IPO allotment status on NSE:

Step 1: Visit the NSE website page “Verify IPO Bids”

Step 2: Select the IPO symbol SACHEEROME from the dropdown menu.

Step 3: Enter the PAN No. and Application No

Step 4: Click Submit,

Step 5: Once submitted, check the "Allotment Details" section in the bid details to view the Sacheerome IPO allotment status.

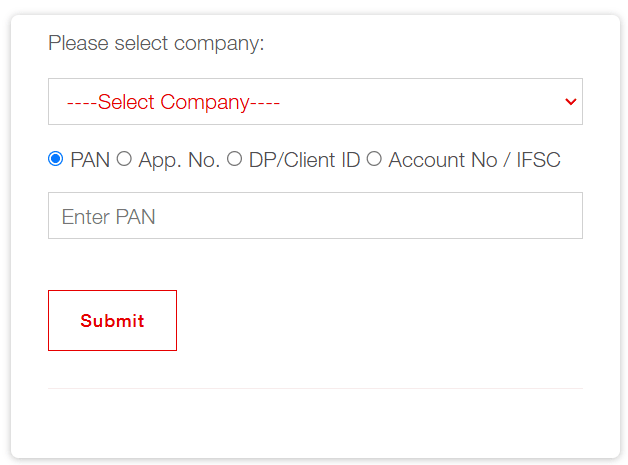

How to Check Sacheerome IPO Allotment on MUFG Website

Below are the steps to check the Sacheerome IPO allotment status on the MUFG Intime India website:

Step 1: Go to the “MUFG IPO Status” page on the “MUFG Intime India Private Limited” website.

Step 2: Select “Sacheerome Limited” from the drop-down menu to select a company.

Step 3: Enter your PAN correctly.

Step 4: Click on “Submit” to check the Sacheerome IPO allotment status.

Sacheerome IPO Subscription

By the end of Day 3, the Sacheerome IPO was oversubscribed by 312.94 times. The Qualified Institutional Buyers (QIB) portion was subscribed 173.15 times, while Non-Institutional Investors (NII) showed strong demand with a subscription of 808.56 times. The Retail Individual Investors (RII) segment was also heavily subscribed at 180.28 times.

Category | Subscription Times |

Qualified Institutional Buyers | 173.15x |

Non-Institutional Investors | 808.56x |

Retail Individual Investors | 180.28x |

Total | 312.94x |

Last updated at 11:07 PM on 12 June 2025

Sacheerome IPO Allotment Date and Other Key Details

Event | Date |

Open Date | Monday, 9th June 2025 |

Close Date | Wednesday, 11th June 2025 |

Expected Allotment Date | Thursday, 12th June 2025 |

Initiation of Refunds | Friday, 13th June 2025 |

Credit of Shares to Demat | Friday, 13th June 2025 |

Listing Date | Monday, 16th June 2025 |

The Sacheerome IPO has a total issue size of Rs. 61.62 crore, consisting entirely of a fresh issue. The IPO is priced at Rs. 102 per share, with a minimum lot size of 1200 shares.

Sacheerome IPO GMP

As per Investorgain, the Sacheerome IPO GMP indicates positive returns for investors. The latest GMP for Sacheerome is 39.22%, which suggests the shares are expected to list at around Rs. 142 per share.

Company Overview of Sacheerome IPO

Sacheerome Limited was founded in 1992 by Mr. Manoj Arora, a third-generation entrepreneur with over four decades of experience in the fragrance and flavour industry. The company began its journey as a fragrance manufacturer and later diversified into flavours in 2014, establishing a dedicated unit with a team of skilled flavourists, an application centre, and a state-of-the-art R&D facility.

Today, Sacheerome operates as a B2B partner, catering to leading food and non-food FMCG companies across India and in several international markets. Its product offerings span a wide range of industries.

On the fragrance side, Sacheerome serves segments including personal care and wash, body care, hair care and wash, fabric care, home care, baby care, fine fragrance, air care, pet care, men’s grooming, hygiene, and wellness. In the flavours segment, its solutions are used in beverages, bakery, confectionery, dairy products, health and nutrition, oral care, shisha, meat products, dry flavours, seasonings, and more.

The company operates through its manufacturing facility in New Delhi, with an annual production capacity of 760,000 kg. This production capability is backed by Sacheerome’s R&D team, which comprises 54 specialists with expertise in fragrance and flavour design, driven by strong market-focused innovation.

Quick Steps to Invest in IPOs with Rupeezy

Step 1: Download the Rupeezy Trading App

Step 2: Register and Complete Verification

Step 3: Open the app and navigate to the IPO Section

Step 4: Select “Sacheerome”

Step 5: Click on Apply

Disclaimer: The GMP (Grey Market Premium) numbers mentioned above are unverified and based on media reports, not the official price. It is provided for informational purposes only. Investors should conduct their own research and consider all relevant factors before making any investment decisions. Rupeezy is not associated with this price and has not participated in any GMP-related trades or deals. We do not recommend trading based on this information.

All Category