Oswal Pumps IPO Allotment Status, Allotment Date, and GMP

00:00 / 00:00

The Oswal Pumps Limited IPO allotment status will be available on Wednesday, June 18, 2025. Investors can check their allotment status on the NSE, BSE or the official registrar’s website, MUFG Intime India Private Limited. The IPO opened on June 13, 2025, and by the end of Day 3, it was subscribed 34.42 times. Follow the simple steps below to check Oswal Pumps IPO allotment status.

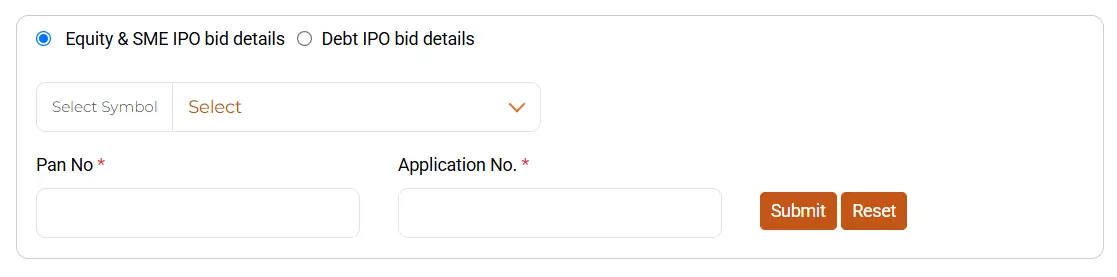

How to Check Oswal Pumps IPO Allotment Status on NSE

Below are the steps to check the Oswal Pumps IPO allotment status on NSE:

Step 1: Visit the NSE website page “Verify IPO Bids”

Step 2: Select the IPO symbol "OSWALPUMPS" from the dropdown menu.

Step 3: Enter the PAN No. and Application No

Step 4: Click Submit.

Step 5: Once submitted, check the "Allotment Details" section in the bid details.

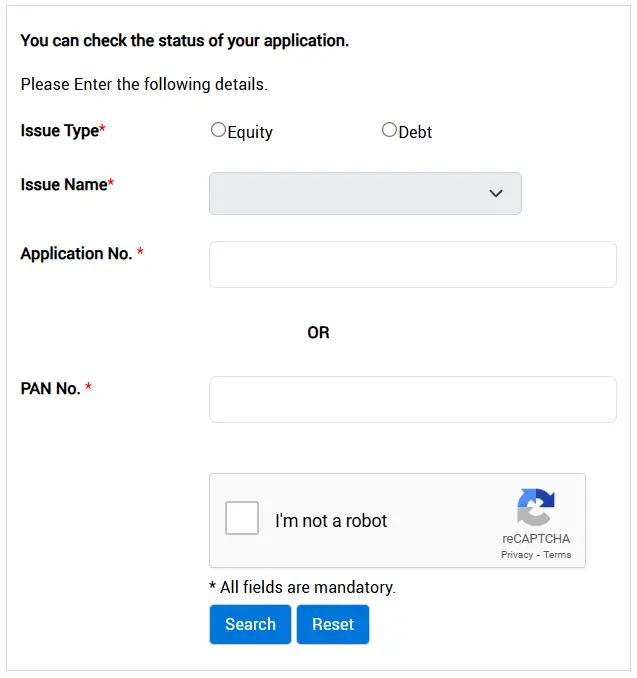

How to Check Oswal Pumps IPO Allotment Status on BSE

Follow these simple steps to check the Oswal Pumps IPO allotment status on BSE:

Step 1: Visit the BSE “Status of Issue Application” page.

Step 2: Select the issue type as “Equity.”

Step 3: Choose "Oswal Pumps Limited" from the issue name section.

Step 4: Enter your IPO Application number or PAN number.

Step 5: Tick the “I’m not a robot” box to verify your identity.

Step 6: Click the “Search” button to view the IPO allotment status.

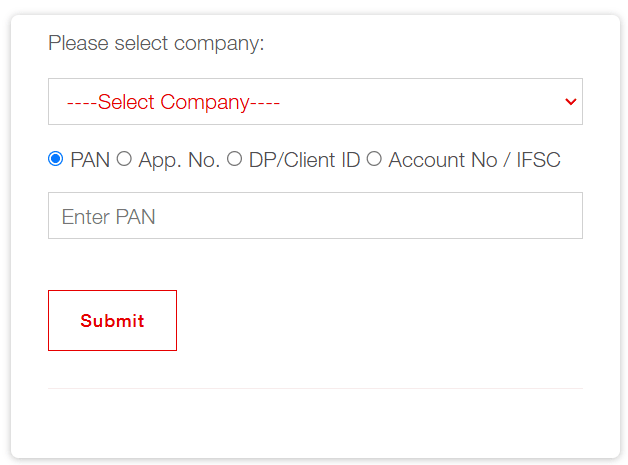

How to Check Oswal Pumps IPO Allotment on MUFG Website

Below are the steps to check the Oswal Pumps IPO allotment status on the MUFG Intime India website:

Step 1: Go to the “MUFG IPO Status” page on the “MUFG Intime India Private Limited” website.

Step 2: Select “Oswal Pumps Limited” from the drop-down menu to select a company.

Step 3: Enter your PAN number correctly.

Step 4: Click on “Submit” to check the Oswal Pumps IPO allotment status.

Oswal Pumps IPO Subscription

By the end of Day 3, the Oswal Pumps IPO was subscribed 34.42 times overall. QIBs led with 88.08x, followed by NIIs at 36.70x, and RIIs at 3.60x.

Category | Subscription Times |

Qualified Institutions | 88.08x |

Non-Institutional Investors | 36.70x |

Retail Individual Investors | 3.60x |

Total | 34.42x |

Oswal Pumps IPO Allotment Details

IPO Open Date: Friday, 13th June 2025

IPO Close Date: Tuesday, 17th June 2025

Allotment Date: Wednesday, 18th June 2025

Initiation of Refunds: Thursday, 19th June 2025

Credit of Shares to Demat: Thursday, 19th June 2025

Listing Date: Friday, 20th June 2025

The Oswal Pumps IPO has a total issue size of Rs. 1,387.34 crore, consisting of a fresh issue of Rs. 890.00 crore and an offer for sale of Rs. 497.34 crore. The IPO is priced at Rs. 614 per share, with a minimum lot size of 24 shares.

Oswal Pumps IPO GMP

As per Investorgain, the latest GMP for the Oswal Pumps IPO is 9.45%. Based on this, the shares are expected to list at around Rs. 672 per share.

Company Overview of Oswal Pumps IPO

Oswal Pumps began its operations in 2003 with the manufacturing of low-speed monoblock pumps and has since expanded to produce grid-connected and solar-powered submersible and monoblock pumps, electric motors, and solar modules under the ‘Oswal’ brand. With over 22 years of experience, the company serves diverse sectors including agriculture, residential, commercial, and industrial applications.

In 2019, Oswal entered the solar pump segment through the PM Kusum Scheme, and by 2021, began offering complete turnkey solar pumping systems, including pumps, modules, mounting structures, controllers, and installation services. By December 31, 2024, it had executed 38,132 such systems across states like Haryana, Rajasthan, Uttar Pradesh, and Maharashtra, becoming one of the largest suppliers under the scheme in just four years.

The company’s revenue grew at a CAGR of 45.07% from FY22 to FY24, supported by operational efficiency, sustainability efforts like recycling scrap metal for components, and innovation in smart pump controllers with mobile-based features. Its Karnal-based facility, spanning over 41,000 sq. m., is among India’s largest single-site pump manufacturing plants and is strategically located near major agricultural states. Oswal is also ALMM-listed, reflecting its compliance with national quality standards and reinforcing its strong industry reputation.

Quick Steps to Invest in IPOs with Rupeezy

Step 1: Download Rupeezy Trading App

Step 2: Register and Complete Verification

Step 3: Open the app and Navigate to the IPO Section

Step 4: Select “Oswal Pumps”

Step 5: Click on Apply

Disclaimer: The GMP (Grey Market Premium) numbers mentioned above are unverified and based on media reports, not the official price. It is provided for informational purposes only. Investors should conduct their own research and consider all relevant factors before making any investment decisions. Rupeezy is not associated with this price and has not participated in any GMP-related trades or deals. We do not recommend trading based on this information.

All Category