Is VMS TMT IPO Good or Bad

00:00 / 00:00

VMS TMT Limited is bringing its IPO, which will be open for subscription from 17 September 2025 to 19 September 2025. During this time, the question that will definitely arise in the minds of investors is whether VMS TMT IPO is good or bad. Can this IPO prove to be a better option in terms of investment or would it be wise to postpone it for now? In this article, we will do a detailed review of VMS TMT IPO, which will include the company's business model, financial performance and fundamental analysis so that investors can make the right and informed decision.

VMS TMT IPO Review

VMS TMT Limited's IPO is worth Rs 148.50 crore consisting entirely of a fresh issue of 1.50 crore shares. The IPO will be open for subscription from September 17 to September 19, 2025, with a price band of Rs 94 to Rs 99 per share and a lot size of 150 shares. The company will use the funds raised through the fresh issue primarily to repay borrowings up to Rs 115 crore and for general corporate purposes. VMS TMT Limited was founded in 2013 and manufactures TMT Bars, Scrap and Binding Wire.

Its manufacturing unit is located at Bhayla village in Ahmedabad district, which helps in easy distribution. As of July 31, 2025, the company's network extends to 3 distributors and 227 dealers. Also, the company has entered into a retail license agreement with Kamdhenu Limited in November 2022, under which it can sell its products in the state of Gujarat under the brand name ‘Kamdhenu NXT’. The bulk of the company's sales come from Gujarat, where 98.78% of revenue was earned in FY 2024. Financially, the company's revenue declined by 12% to Rs 771.41 crore in FY 2025, but its net profit (PAT) grew by 14% to Rs 15.42 crore. The company has a ROCE of 12.79%, RoNW of 20.14% and debt-equity ratio of 6.06. Its market capitalization is estimated at Rs 491.35 crore. The company's strength lies in its strong distribution network, association with the Kamdhenu brand and experienced management team. At the same time, high debt levels, excessive dependence on Gujarat and low margins remain its major risks. This IPO can help the company reduce debt and support future growth.

Company Overview of VMS TMT Ltd.

VMS TMT Limited was founded in 2013 and is primarily engaged in the manufacturing of Thermo Mechanically Treated Bars (TMT Bars). Apart from this, the company also deals in scrap and binding wires, which are sold in Gujarat and other states. The company's manufacturing plant is located at Bhayla village in Ahmedabad district, which gives it the strategic advantage of smooth distribution of products.

VMS TMT Limited has a strong distribution network. As of July 31, 2025, the company had 3 distributors and 227 dealers, which helps it reach customers effectively. In November 2022, the company entered into a retail license agreement with Kamdhenu Limited, under which it can sell its TMT Bars in Gujarat under the brand name 'Kamdhenu NXT'.

The company has 230 permanent employees and focuses mainly on Tier II and Tier III cities. During the financial year 2022 to 2024, most of the company's revenue has come from Gujarat.

Industry Overview of VMS TMT Ltd.

India's steel and TMT bar industry is expected to register strong growth in the coming years as the country is witnessing rapid urbanization, population growth, and large-scale investments in infrastructure development. Increasing government spending on housing, road network, railways, and smart city projects has further boosted the demand for construction materials.

The Indian steel sector is the second largest producer globally and TMT Bars are an important segment in it, which are widely used in residential and commercial construction projects. The growing number of real estate and infrastructure projects, especially in Tier II and Tier III cities, is driving the consumption of TMT bars.

The demand for TMT bars comes mainly from the construction and real estate industries, where both quality and strength are important factors. Due to this, the share of branded and organized players is constantly increasing. However, many regional and unorganized players are also active in this market, which creates tough competition in terms of pricing and supply.

Overall, the outlook for the Indian TMT bar industry is positive. Increasing urbanisation rate, government spending on infrastructure and housing demand in smaller cities are the key factors driving the sector.

Financial Overview of VMS TMT Ltd.

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 449.35 | 412.06 | 284.23 | 227.28 |

Total Income | 213.39 | 771.41 | 873.17 | 882.06 |

Profit After Tax | 8.58 | 15.42 | 13.47 | 4.20 |

EBITDA | 19.48 | 45.53 | 41.20 | 21.91 |

NET Worth | 81.77 | 73.19 | 46.51 | 30.84 |

Reserves and Surplus | 47.14 | 38.56 | 33.18 | 18.23 |

Total Borrowing | 309.18 | 275.72 | 197.86 | 162.70 |

If we look at the financial results of VMS TMT Ltd., there has been a slight decline in the company's income. The company's revenue decreased by about 12% between FY 2024 and 2025, but despite this, the company's Profit After Tax (PAT) increased by 14% from Rs. 15.42 crores to Rs. 17.58 crores. This shows that the company has focused on better cost management and margin improvement.

The company's EBITDA has increased from Rs. 41.20 crores in FY24 to Rs. 45.53 crores in FY25, while the Net Worth has also increased from Rs. 46.51 crores to Rs. 73.19 crores. At the same time, the total borrowing has also increased and it has increased from Rs. 275.72 crores to Rs. 309.18 crores in FY25.

If we talk about key ratios, the company's ROCE is 12.79%, RoNW 20.14%, Debt-to-Equity Ratio 6.06, PAT Margin 1.91% and EBITDA Margin 5.91%. It is clear from these figures that the company's return on equity is strong, but high debt remains a major risk.

The estimated market cap of the company at the time of IPO is fixed at Rs. 491.35 crore. These financial indicators provide investors a clear view of both the profitability and risk of the company.

Strengths of VMS TMT Ltd.

Strong Regional Presence in Gujarat : VMS TMT Ltd. has built a strong foothold in Gujarat since the beginning of its operations. Most of the company's revenue comes from this state, allowing it to leverage its local network and deep understanding of the market.

Association with Kamdhenu NXT Brand : The company entered into a retail license agreement with Kamdhenu Limited in November 2022. Under this agreement, VMS TMT can sell its TMT Bars in Gujarat under the brand name 'Kamdhenu NXT'. This brand association gives the company better market acceptance and brand value.

Distribution Network & Tier II/III Focus : The company's distribution network is based on 3 distributors and 227 dealers. VMS TMT is benefiting from a stable and growing customer base by focusing especially on Tier II and Tier III cities.

Growing Profitability Despite Revenue Dip : Even though the company's revenue declined in FY25, its profitability has increased due to cost control and operational efficiency. Both the company's PAT and EBITDA are performing better than previous years.

Experienced Promoters and Management Team : VMS TMT is led by experienced promoters and management team. The experience of promoters like Varun Manojkumar Jain, Rishabh Sunil Singhi, Manojkumar Jain and Sangeeta Jain can prove to be helpful in the future expansion and growth of the company.

Risks of VMS TMT Ltd.

High Debt Levels : The company's debt-to-equity ratio is 6.06, which is considered quite high. Due to this, the pressure of interest payment and debt repayment can affect the company's profitability and cash flow.

Overdependence on Gujarat Market : More than 98% of VMS TMT Ltd.'s revenue comes from Gujarat only. Due to this excessive dependence, the company's business can be affected by any local economic or policy changes.

Fluctuating Revenues : The company's revenue declined by 12% between FY24 and FY25. Such volatility can become a matter of concern for investors in the long term.

Commodity Price Volatility : TMT Bars and steel industries are highly dependent on raw material prices. Fluctuations in iron ore and scrap prices directly affect the company's margins.

Intense Competition : There are already many established and big players in the steel and TMT segment. Due to tough competition, it may be challenging for VMS TMT to maintain its margins and market share.

Strategies of VMS TMT Ltd.

Expansion of distribution network outside Gujarat : VMS TMT Ltd. currently earns most of its revenue from Gujarat. The company aims to strengthen its distribution network in other states outside Gujarat in the coming years. For this, the company is increasing partnerships with new dealers and distributors. This strategy will not only create a wider customer base but will also reduce excessive dependence on any one region.

Strengthening the presence of Kamdhenu NXT brand : The company has entered into a retail license agreement with Kamdhenu Limited, under which it can sell its TMT Bars under the brand name Kamdhenu NXT. VMS TMT Ltd. is paying special attention to increasing the market presence and identity of this brand. The company aims to further strengthen customer trust and brand value through branded TMT Bars.

Strategic use of funds raised from IPO : VMS TMT Ltd. A major part of the funds raised from the IPO will be used to repay its existing debt. In addition, the company will also use the funds for general corporate purposes and potential expansion projects. This strategy will strengthen the financial position, reduce the interest burden and provide greater flexibility in the future.

Increasing production and supply chain efficiency : The company is constantly focusing on improving its manufacturing processes and supply chain. This includes improving production capacity, ensuring timely delivery and increasing cost control. Improved efficiency will not only increase profitability but also ensure timely delivery of high-quality products to customers.

Sales expansion in Tier II and Tier III cities : VMS TMT Ltd. focuses on Tier II and Tier III cities, where manufacturing activities are growing rapidly. A strong presence in these regions will enable the company to benefit from a stable and ever-growing customer base and help increase market share.

Technology and quality improvement : The company is constantly working on improving its production technology and quality control. This strategy will help in providing reliable and durable TMT Bars to the customers as well as strengthen the company's position in the competitive market.

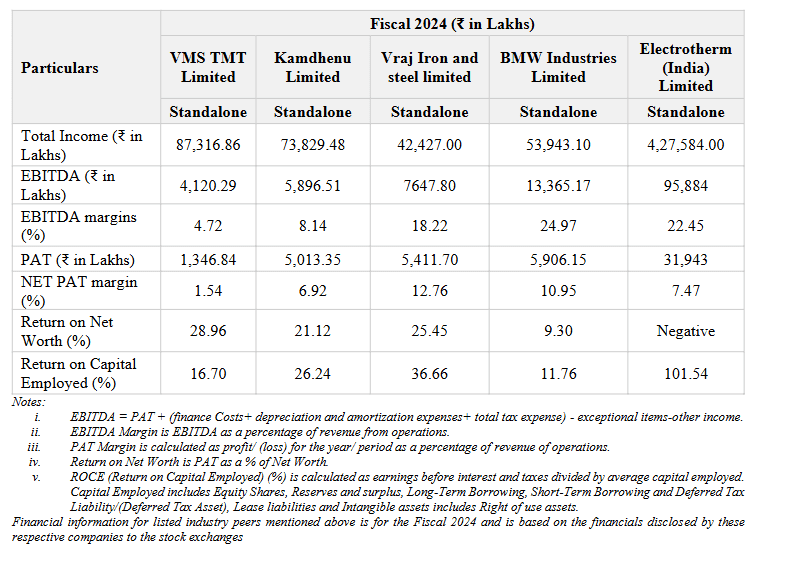

VMS TMT IPO Peer Comparison

VMS TMT Limited reported a total income of ?87,316.86 lakh in FY24, which is at a moderate level compared to many of its peers. EBITDA stood at ?4,120.29 lakh and EBITDA margin stood at 4.72%, indicating that the company's operating marginal efficiency has room for improvement. In comparison, Kamdhenu Limited had an EBITDA margin of 8.14% and Vraj Iron and Steel at 18.22%, while Electrotherm (India) Limited led the way with 22.45%.

The company's PAT stood at ?1,346.84 lakh and Net PAT margin was recorded at 1.54%, which is significantly lower than other players in the sector. In comparison, Kamdhenu Limited had a Net PAT margin of 6.92%, Vraj Iron and Steel at 12.76% and BMW Industries at 10.95%. Electrotherm (India) also reported a net margin of 7.47%, which is much better than VMS TMT.

However, VMS TMT has performed positively on return metrics. The company's Return on Net Worth (RoNW) was 28.96%, which is better than its peers like Kamdhenu (21.12%) and Vraj Iron and Steel (25.45%). On the other hand, BMW Industries stood at just 9.30% and Electrotherm (India) had a negative RoNW. On the Return on Capital Employed (ROCE) level, VMS TMT's figure was 16.70%, which is ahead of BMW Industries (11.76%) but far behind Vraj Iron and Steel (36.66%) and Electrotherm (101.54%).

Talking about valuation, the pre-IPO EPS of VMS TMT IPO is ?4.45 and post-IPO EPS is ?6.91. The company's pre-IPO P/E is at 22.24x and post-IPO P/E is at 14.32x. Price-to-Book Value stood at 7.43. It is clear from these metrics that the company's return profile is good, but there is a need for improvement at the marginal level.

Objectives of VMS TMT Ltd. IPO

1. Setting up of Solar Power Plant : The company is planning to set up a 15 MW solar power plant at Zenta village, Tharad taluka, Banaskantha district, Gujarat to reduce its production costs and ensure a sustainable supply of energy. The company will use approximately ?4,640 lakh from net proceeds for this. The project is expected to be commissioned in April 2025 and completed in about 11 months. This move will not only enable the company to reduce power costs but also reduce its carbon footprint.

2. Long-term working capital requirements : The company will use approximately ?3,000 lakh from net proceeds to meet working capital requirements to further strengthen its operations and expand the business. This will help in timely procurement of raw materials and maintaining the production cycle better.

3. Partial/Full Repayment of Debts : About ?1,100 lakh will be used to reduce or repay certain borrowings of the Company. This will reduce interest cost and help strengthen the balance sheet.

4. General Corporate Purposes : A portion of the net proceeds will be used for general corporate purposes, including enhancing brand value, investing in new opportunities and supporting future growth plans. This portion will be up to a maximum of 25% of the total issue proceeds, as prescribed in SEBI guidelines.

Additional Benefits : The Company will not only raise capital through the IPO but will also enhance its brand image and market visibility by listing on the stock exchange. This will further strengthen the Company's credibility among existing and potential customers and create a public market for equity shares.

VMS TMT IPO Details

IPO Dates

The VMS TMT IPO will be open for subscription from September 17, 2025 to September 19, 2025. Allotment of shares to investors is expected to take place on September 20, 2025 and the company's shares will be listed on NSE and BSE on September 24, 2025.

IPO Issue Price

VMS TMT is offering its shares in a price band of Rs. 94 to Rs. 99 per share. This means that investors bidding at the upper price band will have to invest Rs. 14,850 for one lot (150 shares).

IPO Size

The company is issuing a total of 1.50 crore shares through the VMS TMT IPO, raising around Rs. 148.50 crore.

IPO Allotment Status

Investors who have applied for this IPO can check the allotment status on September 20, 2025. This information will be available on the registrar's website, NSE, BSE or through your stockbroker platform.

IPO Listing Date

VMS TMT shares will be listed on NSE and BSE on September 24, 2025.

IPO Application Link

Open a demat account on Rupeezy today and make the IPO application process fast and easy. Applying for an IPO with Rupeezy will be extremely simple and hassle-free.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category