Is Saatvik Green Energy IPO Good or Bad – Detailed Review

00:00 / 00:00

Saatvik Green Energy Limited's IPO is set to open its initial public offering from September 19, 2025, to September 23, 2025. When considering applying for this IPO, potential investors might have questions about whether the Saatvik Green Energy IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Saatvik Green Energy IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Saatvik Green Energy IPO Review

Saatvik Green Energy Limited's IPO is a book-built issue of Rs 900 crores, consisting of a fresh issue of 1,50,53,763 shares worth Rs 700 crores and an offer for sale of 43,01,075 shares worth Rs 200 crores. The IPO will be open for subscription from September 19, 2025, to September 23, 2025, with a price band of Rs 442 to Rs 465 per share and a lot size of 32 shares. The company plans to use the net proceeds primarily for prepayment of certain borrowings, investment in its wholly-owned subsidiary for clearing outstanding borrowings, and setting up a new plant in Odisha.

Saatvik Green Energy is a solar photovoltaic (PV) module manufacturer and a key player in India's solar energy market. The company manufactures high-efficiency solar modules and provides end-to-end engineering, procurement, and construction (EPC), along with operations and maintenance (O&M) services for solar projects. Its product portfolio includes Mono PERC and N-TopCon solar modules, suitable for residential, commercial, and utility-scale projects. The company operates three manufacturing facilities in Ambala, Haryana, which are noted as one of the largest single-location module manufacturing setups in India. As of June 30, 2025, the company had an operational capacity of about 3.80 GW.

Financially, the company has demonstrated a consistent and strong upward trend. Its revenue from operations grew from Rs 608.59 crore in Fiscal 2023 to Rs 2,158.39 crore in Fiscal 2025. The company's profitability has also improved significantly, with its net profit after tax increasing from Rs 4.75 crore in Fiscal 2023 to Rs 213.93 crore in Fiscal 2025. Saatvik Green Energy also has strong return metrics, with a Return on Equity (RoE) of 63.41% and a Return on Capital Employed (RoCE) of 60.45% for Fiscal 2025. The company has also reduced its debt-to-equity ratio from 7.13 in Fiscal 2023 to 1.36 in Fiscal 2025, indicating a stronger balance sheet.

Key strengths of the company include its leading market position with high operational efficiency, a robust customer base with a strong order book of 4.05 GW as of June 30, 2025, and a commitment to technological innovation with an advanced product portfolio. The company's integrated business model with diversified revenue streams and consistent financial growth further contributes to its strengths.

However, potential investors should be aware of the risks, such as the company's dependence on a small number of key customers, reliance on imported raw materials (particularly from China), project implementation risks for its new Odisha facility, and potential impacts from regulatory and policy changes. The company also operates in a highly competitive market, facing competition from both domestic and international manufacturers.

Company Overview of Saatvik Green Energy IPO

Saatvik Green Energy Limited is a solar photovoltaic (PV) module manufacturer and a key player in India's solar energy market. Incorporated in 2015, the company's business includes manufacturing high-efficiency solar modules and providing end-to-end engineering, procurement, and construction (EPC) and operations and maintenance (O&M) services for solar projects.

The company's product portfolio includes Mono PERC and N-TopCon solar modules, available in both mono-facial and bifacial options, which are suitable for a range of applications, including residential, commercial, and utility-scale projects. As of June 30, 2025, the company had an operational capacity of about 3.80 GW, with three manufacturing facilities located in Ambala, Haryana. These facilities are noted as one of the largest single-location module manufacturing setups in India. The company's installed EPC base was 69.12 MW as of March 31, 2025.

It had a total order book of approximately 4.05 GW as of June 30, 2025. Saatvik’s order book stood at Rs 5,076.85 crore as of March 31, 2025. The company's sales are primarily domestic, accounting for 98.61% of revenue from operations in Fiscal 2025, with the remaining 1.39% from international markets such as North America, Africa, and South Asia. Across the business verticals, the product sales account for 70.50%, followed by 26.08% from Trading goods, 3.30% from the EPC segment, and 0.12% from Solar Photovoltaic pumping systems. The promoters of the company are Neelesh Garg, Manik Garg, Manavika Garg, and SPG Trust.

The company is undertaking a backward integration strategy, planning to establish an integrated cell and module manufacturing facility in Odisha. The new facility will have a 4.80 GW cell line and a 4.00 GW module line, with the module line expected to be operational in Fiscal 2026 and the cell line in Fiscal 2027. An additional 1.00 GW capacity is also being added to its Ambala facilities, expected to be operational in the second quarter of Fiscal 2026.

Industry Overview of Saatvik Green Energy IPO

Saatvik Green Energy operates within the Indian solar power market, a sector characterized by significant growth and government support. The overall installed renewable energy capacity in India, including large hydro, has grown to approximately 233 GW as of June 2025, up from about 123 GW in March 2019. Solar power has been a primary driver of this expansion, increasing to approximately 116 GW in June 2025, with an estimated 24 GW of new solar capacity added in Fiscal 2025.

India has a potential for 750 GW of solar energy installations, with only about 15.4% of this potential currently tapped as of June 2025. The growth of this industry is significantly supported by government initiatives and policies, such as the Production Linked Incentive (PLI) scheme for high-efficiency solar PV modules, preferential tariffs, and the Approved List of Models and Manufacturers (ALMM) mandate. The government's goal is to have 500 GW of non-fossil fuel-based capacity installed by 2030, with 280 GW coming from solar energy.

The industry faces competition from numerous domestic and international players, particularly from China and Southeast Asia. India has historically relied on imports for a significant portion of its solar components, but policy measures like the ALMM order and Basic Customs Duty (BCD) on imported solar cells and modules are aimed at boosting domestic manufacturing. The industry is also evolving technologically, with a shift from polycrystalline to monocrystalline silicon technology, and a growing preference for bifacial and advanced N-type technologies like TOPCon.

The solar sector is also benefiting from new business models and tenders, such as those for wind-solar hybrid projects and Firm and Dispatchable Renewable Energy (FDRE) projects, which provide more reliable power and higher capacity utilization. These new models, along with declining module prices and increasing demand from commercial and industrial (C&I) users, are expected to continue driving growth in the market.

Financial Overview of Saatvik Green Energy IPO

Particulars | March 31, 2025 (Rs in crores) | March 31, 2024 (Rs in crores) | March 31, 2023 (Rs in crores) |

Revenue from Operations | 2,158.39 | 1,087.97 | 608.59 |

EBITDA | 353.93 | 156.84 | 23.87 |

EBITDA Margin (%) | 16.40% | 14.42% | 3.92% |

Profit after tax | 213.93 | 100.47 | 4.75 |

PAT Margin (%) | 9.76% | 9.16% | 0.77% |

Return on Equity (RoE) | 63.41% | 83.21% | 23.40% |

Return on Capital Employed (RoCE) | 60.45% | 64.07% | 24.80% |

Debt-Equity Ratio | 1.36 | 2.18 | 7.13 |

The financial performance of Saatvik Green Energy over the three fiscal years ending March 31, 2023, 2024, and 2025 demonstrates a consistent and strong upward trend in both revenue and profitability.

Revenue from operations shows robust growth, increasing from 608.59 crore in Fiscal 2023 to 1,087.97 crore in Fiscal 2024, and further to 2,158.39 crore in Fiscal 2025. This sustained top-line growth, with a notable jump between Fiscal 2024 and Fiscal 2025, reflects the company's ability to scale its business and capture opportunities from market demand.

EBITDA and its corresponding margin have shown significant improvement, highlighting improved operational efficiency. EBITDA grew from 23.87 crore in Fiscal 2023 to 156.84 crore in Fiscal 2024, and then surged to 353.93 crore in Fiscal 2025. The EBITDA margin has also expanded consistently from 3.92% in Fiscal 2023 to 16.40% in Fiscal 2025.

Profit After Tax (PAT) has followed a similar impressive trajectory. The company's net profit increased from 4.75 crore in Fiscal 2023 to 100.47 crore in Fiscal 2024, and then increased to 213.93 crore in Fiscal 2025. The net profit margin also improved from 0.77% to 9.76% from Fiscal 2023 to Fiscal 2025, indicating better cost management.

The company's return metrics demonstrate strong capital management. Return on Equity (RoE) and Return on Capital Employed (RoCE) have both improved year-on-year, with RoE rising from 23.40% in Fiscal 2023 to 63.41% in Fiscal 2025, and RoCE increasing from 24.80% to 60.45% during the same period. This indicates the company is generating increasingly high returns from its equity and the capital it utilises.

Financially, the company's Debt-Equity Ratio has been on a downward trend, decreasing from 7.13 in Fiscal 2023 to 1.36 in Fiscal 2025. This suggests the company is becoming less reliant on debt and is strengthening its balance sheet. Overall, the financial performance of Saatvik Green Energy reflects a strong and well-managed company.

Strengths and Risks of Saatvik Green Energy IPO

Let's delve into the strengths and weaknesses to assess if the Saatvik Green Energy IPO is good or bad for investors.

Strengths

Leading market position and high operational efficiency: Saatvik Green Energy is among the top solar module manufacturers in India, with an operational capacity of 3.80 GW as of March 31, 2025. The company's facilities operate with high efficiency, achieving a capacity utilization of 83.70% in Fiscal 2025. It also operates one of India's largest single-location module manufacturing facilities in Ambala, Haryana.

Robust customer base and strong order book: The company has a diversified customer base that includes utility-scale developers, C&I clients, and government entities, both domestically and internationally. Its strong reputation and client relationships have resulted in a significant order book, with confirmed orders of 4.05 GW as of June 30, 2025, providing strong revenue visibility.

Technological innovation and advanced product portfolio: Saatvik Green Energy is committed to technological advancements and has pioneered the introduction of N-type TOPCon modules in India, which offer higher efficiency and lower degradation. The company's product line includes Mono PERC and N-TopCon modules, with efficiencies reaching up to 22.84%. Its bifacial modules are designed for dual-sided energy capture, reaching up to 26.27% efficiency.

Integrated business model with diversified revenue streams: The company's business model is not limited to manufacturing but also includes comprehensive EPC and O&M services. This integrated approach allows for end-to-end solutions, with EPC services contributing to a significant portion of its revenue.

Consistent financial growth: The company has a track record of strong financial performance, with revenue from operations growing at a CAGR of 88.32% from Fiscal 2023 to Fiscal 2025. Net profit after tax increased from Rs 4.74 crore in Fiscal 2023 to Rs 213.93 crore in Fiscal 2025.

Risks

Dependence on key customers: The company generates a significant portion of its revenue from a small number of key customers. In Fiscal 2025, its top 10 customers accounted for 57.77% of its revenue from operations. The loss of any of these customers could have a material adverse effect on the business and financial results.

Reliance on imported raw materials: The company is dependent on third-party suppliers, particularly from China, for raw materials such as solar PV cells. Any disruptions in the supply chain or changes in the price of these materials could adversely affect its manufacturing process and profitability. For instance, the company sourced 42.24% of its materials from China in Fiscal 2025.

Project implementation risks: A significant portion of the IPO proceeds will be used to fund a new 4.00 GW solar PV module manufacturing facility in Odisha. This project is subject to risks of unanticipated delays, cost overruns, and the timely procurement of necessary approvals and machinery.

Potential impact of regulatory and policy changes: The solar industry is highly dependent on government policies, subsidies, and tariffs such as Anti-Dumping Duties on Chinese companies and ALMM. Any unfavorable changes in these regulations could reduce demand for solar products and negatively impact the company's financial condition.

Competition: The company operates in a highly competitive market, facing competition from both domestic and international manufacturers, especially from China and Southeast Asia. Increased competition could lead to pricing pressure, reduced margins, and a loss of market share.

Strategies of Saatvik Green Energy IPO

Backward integration into cell manufacturing: The company aims to reduce its dependence on external suppliers, particularly from China and Taiwan, by establishing an integrated cell and module manufacturing facility in Odisha. This strategy is expected to improve profitability and give the company greater control over its supply chain and product quality.

Capacity expansion and technology reinforcement: The company is in the process of expanding its manufacturing capacity in both its Ambala and new Odisha facilities, with the goal of increasing its total capacity to 8.80 GW for modules and 4.80 GW for cells by Fiscal 2027. This expansion is aimed at meeting the growing demand in both domestic and international markets.

Diversify market presence: Saatvik Green Energy plans to strengthen its domestic distribution network across India and establish a retail brand for solar panels. The company also intends to expand its international footprint, particularly in the United States, Canada, Sri Lanka, and GCC (Gulf Cooperation Council) states, by offering both solar modules and EPC services.

Leverage government incentives: The company is strategically positioned to benefit from government initiatives like the PM Surya Ghar Muft Bijli Yojana and the PM KUSUM scheme, which are expected to drive demand for solar pumps and residential rooftop installations. It has already secured orders for solar pump installations under these schemes.

Focus on innovation and quality: The company is dedicated to continuous innovation, with a focus on developing new products like tandem or perovskite solar cells. It adheres to rigorous quality control measures and holds various certifications, such as those from UL India and TUV Rheinland.

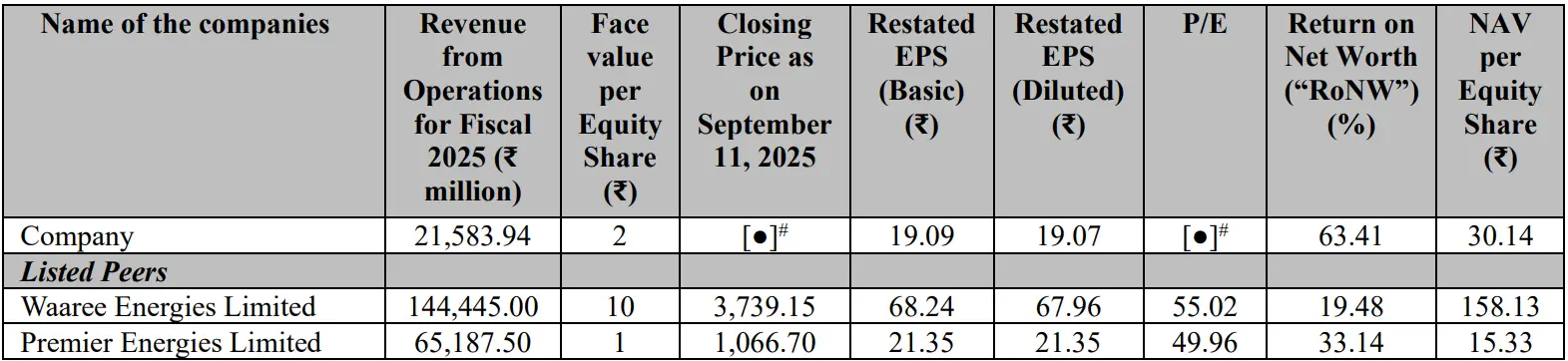

Saatvik Green Energy IPO vs. Peers

The company's profitability metrics are strong, indicating efficient operations. For Fiscal 2025, its EBITDA margin was 16.40%. This is higher than Premier Energies Limited's EBITDA margin of 16.07% in Fiscal 2024 and is competitive with Waaree Energies Limited's 21.63%. The company's net profit margin of 9.76% is also competitive within its peer group, although Saatvik’s margins are lower.

Saatvik Green Energy's return metrics highlight its efficient use of capital. The company's Return on Equity (RoE) was 63.41% for Fiscal 2025, which is notably higher than Premier Energies Limited's 33.21% and Waaree Energies Limited's 19.70% in the same fiscal year. Similarly, its Return on Capital Employed (RoCE) was 60.45% for Fiscal 2025, also outperforming its peers.

The company's debt-to-equity ratio of 1.36 for Fiscal 2025 is higher than Waaree Energies Limited's 0.10 and Premier Energies Limited's 0.67. The IPO proceeds can lower the leverage, and it can be moderate compared to its peers.

Installed Capacity of Saatvik for the Fiscal 2025 stood at 3.74 GW, compared to its peers, it is lower than Premier’s 5.1 GW and Waaree’s 13.3 GW. In order book, Saatvik had orders worth Rs 5,076.85 crores, which is relatively lower than Premier’s 8,445.6 crores and Waaree’s 47,000 crores as of Fiscal 2025.

Overall, Saatvik Green Energy shows a strong financial position, marked by superior returns on capital, healthy profitability, and rapid growth in revenue.

Objectives of Saatvik Green Energy IPO

Saatvik Green Energy is planning to issue a mix of fresh issues and offer for sale totalling Rs 900 crores. The shares sold by selling shareholders through the offer for sale are worth Rs 200 crore, and the remaining Rs 700 crore raised through fresh issue, which will be utilised for the proceedings, such as:

Prepayment of part or full outstanding borrowings availed by the company worth Rs 10.81 crore.

Investment in wholly owned subsidiary (WOS) company (Saatvik Solar Industries Private Limited) in the form of debt or equity for clearing certain outstanding borrowings availed by the subsidiary worth Rs 166.43 crore.

Investment into setting up a new plant of 4GW solar PV module manufacturing facility at Ganjam, Odisha, through its WOS company, worth Rs 477.22 crore.

General Corporate Purposes.

Saatvik Green Energy IPO Details

IPO Dates

Saatvik Green Energy IPO will be open for subscription from September 19, 2025, to September 23, 2025. The allotment of shares to investors will take place on September 24, 2025, and the company is expected to be listed on the NSE and BSE on September 26, 2025.

IPO Issue Price

Saatvik Green Energy is offering its shares in the price band of Rs 442 to Rs 465 per share. This means you would require an investment of Rs. 14,880 per lot (32 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Saatvik Green Energy is planning to issue fresh issue and offer for sale totalling 1,93,54,838 shares, which are worth Rs 900 crores. Out of which fresh issue shares are 1,50,53,763 worth Rs 700 crores, and 43,01,075 shares of offer for sale worth Rs 200 crore sold by Promoter Group’s Parmod Kumar (Rs 112 crores) and Sunila Garg (Rs 88 crores).

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on September 24, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Saatvik Green Energy will be listed on the NSE and BSE on September 26, 2025.

Saatvik IPO Grey Market Premium (GMP)

As per Investor Gain, the shares of Saatvik Green Energy GMP stood at 16.77% higher from the upper band price of Rs 465 dated 18th September 2025 at 11:31 A.M. The estimated profits on the upper price band and total number of shares in a lot translate to Rs 2,496. The Shringar share is expected to list at Rs 543 per share, translating to a premium of Rs 78 per share on the upper band issue price.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Saatvik Green Energy IPO

Important IPO Details | |

Bidding Date | September 19, 2025 to September 23, 2025 |

Allotment Date | September 24, 2025 |

Listing Date | September 26, 2025 |

Issue Price | Rs 442 to Rs 465 per share |

Lot Size | 32 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category