Is Orkla India IPO Good or Bad – Detailed Review

00:00 / 00:00

Orkla India Limited’s IPO is set to open its initial public offering from October 29, 2025, to October 31, 2025. When considering applying for this IPO, potential investors might have questions about whether the Orkla India IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Orkla India IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Watch Orkla India IPO Video Analysis

Orkla India IPO Review

Orkla India Limited's IPO is open for subscription from October 29, 2025, to October 31, 2025, with listing expected on November 6, 2025, on NSE and BSE. The company is a multi-category Indian food company with a legacy spanning decades, specialising in the manufacture, distribution, and sale of authentic South Indian packaged foods across Spices and Convenience Foods under the MTR and Eastern brands. It is a subsidiary of Orkla Asia Pacific Pte. Ltd., which held around a 90.0% stake pre-offer. The core business is highly concentrated in the Spices category, which constituted 66.3% of its revenue as of June 30, 2025, supported by its Cuisine Centres of Excellence (CoEs). The company operates a well-established, highly penetrated regional distribution network, utilising 834 distributors and 1,888 sub-distributors. It holds around 400 products in its portfolio and sells approximately 2.3 million units on average every day as of June 30, 2025.

The company operates within the Indian Packaged Food Market, a sector demonstrating robust and sustained expansion, driven by accelerating urbanisation and the growing demand for convenience. The packaged food market in India was estimated at Rs 10.18 lakh crores in Fiscal 2024, reflecting a significant CAGR of 10.8% (FY19-FY24), and is projected to continue growing at an estimated 11% CAGR to Rs 17.12 lakh crores by Fiscal 2029. Market growth is fuelled by India's favourable demographics, including a median age of 29.8 years and projected urbanisation reaching 40.9% by FY30. Crucially, the Domestic Packaged Spices Market constitutes only 40% of the total spices market, signalling substantial untapped potential. The Convenience Food market, valued at Rs 7,900 crores in Fiscal 2024, is expected to grow at a CAGR of 16% to Fiscal 2029.

Orkla India's financial performance from FY23 to FY25 reflects strong top-line growth and consistently high profitability. Revenue from Operations grew from Rs 2,172.48 crore in FY23 to Rs 2,394.71 crore in FY25, a 5.0% CAGR over the period. Profit After Tax (PAT) rebounded strongly to Rs 255.69 crore in FY25, achieving a 10.7% PAT Margin. Operating efficiency is superior, with the Adjusted EBITDA Margin improving consistently to 16.6% in FY25. The company maintains superior capital efficiency, evidenced by an exceptional Return on Capital Employed (RoCE) of 32.7% in FY25, reinforcing its strong financial health relative to peers.

Key strengths include Market Leadership in packaged spices in core Southern markets (31.2% in Karnataka, 41.8% in Kerala), Capital Efficiency (RoCE of 32.7% and Cash Conversion of 124.8% in FY25), an Extensive Distribution Network, and a Dual Brand Strategy (MTR and Eastern) catering to distinct consumer segments. Risks involve Raw Material Price and Supply Volatility (53% of total expenses in Q1FY26), Regional Sales Concentration (79.4% of domestic sales in South India in FY25), Regulatory Compliance Risk (124 pending proceedings under the FSS Act), and Trademark Dependency on a revocable Letter of Authorisation for the "Orkla" brand.

The IPO is entirely an Offer for Sale (OFS) of 2,28,43,004 shares, aggregating Rs 1,667.54 crores. Consequently, the entire proceeds will go to the selling shareholders (Orkla Asia Pacific Pte Ltd and others). Shares are priced in the band of Rs 695 to Rs 730 per share, with a Lot Size of 20 Shares.

Watch Orkla India IPO Video Analysis

Company Overview of Orkla India IPO

Orkla India Limited, a multi-category Indian food company with a legacy spanning decades, specialises in the manufacture, distribution, and sale of authentic South Indian packaged foods across Spices and Convenience Foods. They sell products under the MTR and Eastern brands. The company has a significant focus on the Spices category, which constituted 66.3% of its revenue from the sale of products as of June 30, 2025. The key product categories under Convenience include ready-to-cook (RTC), ready-to-eat (RTE) foods and Vermicelli, and others. They hold around 400 products in their portfolio and sell approximately. 2.3 million units on average every day as of June 30, 2025. The core philosophy is built around mastering regional consumer tastes through its Cuisine Centres of Excellence (CoEs), focusing on authentic recipes and quality control.

The company operates a well-established, highly penetrated regional distribution network, successfully leveraging the brands' household loyalty in core Southern markets. The network utilises 834 distributors and 1,888 sub-distributors across 28 states and six union territories as of June 30, 2025. It is a subsidiary of Orkla Asia Pacific Pte. Ltd., which holds around 90.0% stake pre offer. The company benefits from its holding company, Orkla ASA's global expertise in corporate governance, operational standards, and Centres of Excellence. The company currently utilises the "Orkla" trademark under a Letter of Authorisation from Orkla ASA, which grants a non-exclusive, non-transferable, and revocable authorisation.

The food platform is supported by automated manufacturing and stringent quality control measures verified by BRCGS (Brand Reputation Compliance Global Standards) and ISO certifications. Key leadership includes Sanjay Sharma (Managing Director and CEO) and Suniana Calapa (CFO).

Industry Overview of Orkla India IPO

Orkla India Limited operates within the Indian Packaged Food Market, a sector demonstrating robust and sustained expansion, primarily driven by the shift toward branded and hygienic products, accelerating urbanisation, and the growing demand for convenience. The packaged food market in India was estimated at Rs 10.18 lakh crores in Fiscal 2024, reflecting a significant CAGR of 10.8% between Fiscal 2019 and Fiscal 2024. This strong trajectory is projected to continue, with the overall market expected to grow at a CAGR of approximately 11%, potentially reaching Rs 17.12 lakh crores by Fiscal 2029.

The market growth is structurally fuelled by India's favourable demographics, including a large young working population with a median age of 29.8 years, accelerating urbanisation (projected to reach 40.9% by Fiscal 2030), and an expanding middle class driving consumption. Crucially, the category penetration remains low, with the Domestic Packaged Spices Market constituting only 40% of the total spices market in Fiscal 2024, signalling substantial untapped potential as consumption shifts from loose to packaged formats.

A primary driver of recent growth is the escalating demand for convenience foods and blended spices. The Convenience Food market, valued at Rs 7,900 crores in Fiscal 2024, is expected to grow at a CAGR of 16% to Fiscal 2029. This momentum is channelled through the rapid expansion of modern retail and e-commerce or quick-commerce, catering to time-constrained, urban consumers. Furthermore, the strong preference for regional and authentic flavours remains critical across India.

Within this intensely competitive environment, the industry is navigating risks such as commodity price volatility impacting key ingredients like chilli and turmeric, stringent FSSAI regulations, and supply chain disruptions. Orkla India benefits from its structural market leadership in South India, with 31.2% market share in packaged spices in Karnataka and 41.8% in Kerala, positioning it well to leverage both the core domestic market growth and the surging export demand fuelled by the Indian diaspora globally.

Financial Overview of Orkla India IPO

Particulars | March 31, 2025 (Rs crores) | March 31, 2024 (Rs crores) | March 31, 2023 (Rs crores) |

Revenue from operations | 2,394.71 | 2,356.01 | 2,172.48 |

Adjusted EBITDA | 396.44 | 343.61 | 312.44 |

Adjusted EBITDA Margin | 16.6% | 14.6% | 14.4% |

Profit after tax | 255.69 | 226.33 | 339.13 |

PAT Margin | 10.7% | 9.6% | 15.6% |

Return on Equity (RoE) | 13.8% | 10.3% | 15.2% |

Return on Capital Employed (RoCE) | 32.7% | 20.7% | 32.1% |

The financial performance of Orkla India over the three fiscal years ending March 31, 2023, 2024, and 2025 reflects strong top-line growth and consistently high profitability, driven by efficient cost control and volume growth in its core Spices and Convenience Foods segments.

Revenue from Operations has shown a significant upward trend, driven by continuous market penetration and sales channel optimisation. Revenue increased from Rs 2,172.48 crores in FY23 to Rs 2,356.01 crores in FY24, and reached Rs 2,394.71 crores in FY25, a 5.0% CAGR over the period.

In the Operating Efficiency part, it is driven by strategic cost management and shifting product mix towards high-margin categories. The Adjusted EBITDA Margin demonstrated an upward trajectory, improving consistently from 14.4% in FY23 to 14.6% in FY24, and achieving a robust 16.6% in FY25. The efficiency gains are primarily linked to the optimisation of raw material sourcing and the strategic outsourcing of low-value production.

Profit After Tax (PAT) has demonstrated strong underlying growth and recovery. While PAT saw a temporary dip in FY24’s Rs 226.33 crores due to merger-related and exceptional items compared to FY23’s Rs 339.13 crores, it rebounded strongly in FY25 to Rs 255.69 crores, reflecting a significant 13% YoY growth over FY24. The PAT Margin reflected this underlying stability, rising from 9.6% in FY24 to 10.7% in FY25.

The Return on Equity (RoE) highlights efficient utilisation of shareholders' capital. RoE, while fluctuating due to a large dividend payout of Rs 600 crores in FY25. The ratio stood at 13.8% in FY25, improving from 10.3% in FY24 and compared to 15.2% in FY23.

Crucially, the Return on Capital Employed (RoCE) highlights superior operational asset utilisation, significantly improving from 20.7% in FY24 to 32.7% in FY25, showcasing superior capital productivity relative to peers and reinforcing the company's strong overall financial health and disciplined use of capital.

Strengths and Risks of Orkla India IPO

Let's delve into the strengths and weaknesses to assess if the Orkla India IPO is good or bad for investors.

Strengths

Market Leadership and Regional Command: Orkla India is a recognised market leader in the packaged spices segment within its core markets, holding strong dominance with its dual-brand strategy. The company commands a significant market share, including approximately 31.2% in Karnataka and 41.8% in Kerala for packaged spices (Fiscal 2024).

Capital Efficiency and Financial Robustness: The Company operates a highly efficient model, evidenced by robust financial metrics, including an exceptional Return on Capital Employed (RoCE of 32.7%) and a high Cash Conversion ratio (124.8%) in Fiscal 2025, demonstrating effective capital allocation and disciplined operational performance.

Extensive and Diversified Distribution Network: The Company maintains a broad national and international reach, supported by a network of 834 distributors and 1,888 sub-distributors. This is complemented by strong penetration in modern trade, e-commerce, and quick-commerce channels, ensuring product availability across traditional and emerging retail environments.

Dual Brand Strategy and Portfolio Breadth: The MTR and Eastern brands allow the company to effectively segment the market, catering to distinct consumer needs, primarily vegetarian and non-vegetarian food, respectively, and offering a comprehensive portfolio of nearly 400 products across all meal occasions.

Certified and Integrated Value Chain: The company operates nine owned manufacturing facilities with world-class quality certifications, including BRCGS and ISO. It employs a hybrid approach, combining in-house, high-value production with efficient contract manufacturing for scale and flexibility.

Risks

Raw Material Price and Supply Volatility: Operations are heavily dependent on raw materials like chilli, coriander, skimmed milk powder, and packaging materials. Fluctuations in the price and availability of these key commodities, which constituted 53% of total expenses in the three months ended June 30, 2025 which pose a risk to its margins.

Regional Sales Concentration Risk: A major portion of the company’s domestic revenue is focused in South India (79.4% of domestic sales in Fiscal 2025), making the business highly vulnerable to adverse shifts in local consumer preferences, regional competition, or economic disturbances in Karnataka, Kerala, Andhra Pradesh, and Telangana.

Statutory and Regulatory Compliance Risk: The company faces multiple statutory and regulatory actions, including 124 pending proceedings under the Food Safety and Standards Act, 2006 (FSS Act), largely concerning pesticide residues and labelling non-conformities, risking reputational damage and operational penalties.

Trademark Dependency and Historical Gaps: The company's corporate identity relies on a revocable Letter of Authorisation from the Promoter, Orkla ASA, for the "Orkla" trademark. Additionally, the RHP notes the inability to trace some historical corporate records and regulatory filings, exposing the company to unquantifiable risks of future penalties.

Key Supplier Concentration: The business relies substantially on a concentrated supplier base for raw and packaging materials, with the top ten suppliers contributing 37.9% of total purchases during the three months ended June 30, 2025. Loss or disruption involving these key suppliers could severely impact manufacturing and operations.

Strategies of Orkla India IPO

Drive Penetration and Usage in Core Markets: The core strategy is to deepen market penetration and increase consumer purchase frequency in key Southern markets (Karnataka, Kerala, AP, Telangana) by improving distribution reach, digitalising sales, like using the Suggestive Order Module - SOM app, and increasing retail shelf presence.

Expand Presence in Key International Markets: The company intends to scale up its export business, focusing on geographies with a high density of Indian diaspora, such as GCC (Gulf Cooperation Council), the US, and Canada, using a structured, phased market entry and expansion model to capitalise on the rising global demand for authentic Indian cuisine.

Strategic Product Portfolio Development: Focus on innovation to meet evolving consumer demands for convenience, including introducing a higher mix of value-added, high-margin products like Ready-to-Eat (RTE) meals, Ready-to-Cook (RTC) mixes, and specialised regional and fusion spice blends such as the “Wok N Roll” Asian range.

Improve Operational Efficiency and Cost Optimisation: Continuous efforts to improve margins through operational efficiencies, including recipe and packaging optimisation, utilising advanced technology like IoT-enabled manufacturing at its key facilities, and streamlining the supply chain process to minimise process losses and inventory days.

Leverage Mergers and Acquisitions for Growth: The company aims to pursue strategic acquisitions of complementary brands and businesses to accelerate expansion into new geographies beyond the South and diversify the product portfolio, utilising its robust capital base and integration expertise demonstrated by the Eastern acquisition.

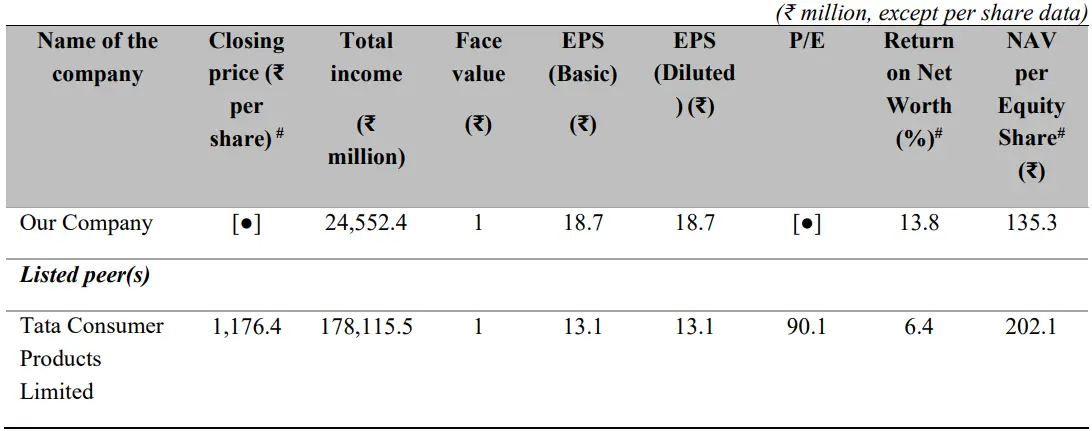

Orkla India IPO vs. Peers

Orkla India achieved notably superior profitability and returns on capital in FY25. The Company delivered a PAT Margin of 10.7% and an Adjusted EBITDA Margin of 16.6% in Fiscal 2025, figures that are structurally superior to TCPL's PAT Margin of 7.3% and Adjusted EBITDA Margin of 13.5%. This profitability supports a highly robust Return on Capital Employed (RoCE) of 32.7% in Fiscal 2025, which ranks favourably against TCPL's RoCE of 24.6%, indicating better efficiency in utilising capital resources.

Operationally, Orkla India demonstrates a sharp focus and disciplined execution across its dual-brand portfolio. The company maintained competitive operational efficiency, recording Trade Working Capital Days of 21.4 days in Fiscal 2025, nearly identical to TCPL's 21.1 days. Orkla’s superior margins (PAT and EBITDA) are driven by its focus on high-margin categories like blended spices and convenience foods and rigorous cost optimisation measures, allowing it to generate higher returns relative to its scale.

Objectives of Orkla India IPO

The offering consists solely of an Offer for Sale (OFS). Consequently, Orkla Asia Pacific Pte. Ltd., Navas Meeran and Feroz Meeran will receive the entire proceeds from the IPO issue.

Orkla India IPO Details

IPO Dates

Orkla India IPO will be open for subscription from October 29, 2025, to October 31, 2025. The allotment of shares to investors will take place on November 03, 2025, and the company is expected to be listed on the NSE and BSE on November 06, 2025.

IPO Issue Price

Orkla India is offering its shares in the price band of Rs 695 to Rs 730 per share. This means you would require an investment of Rs. 14,600 per lot (20 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Orkla India is issuing a total offer for sale of 2,28,43,004 shares, worth Rs 1,667.54 crores. The selling shareholders will receive the entire proceeds.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on November 03, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Orkla India will be listed on the NSE and BSE on November 06, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | October 29, 2025 to October 31, 2025 |

Allotment Date | November 03, 2025 |

Listing Date | November 06, 2025 |

Issue Price | Rs 695 to Rs 730 per share |

Lot Size | 20 Shares |

FAQs:

Q1: What is the issue size of Orkla India Limited's IPO?

The entire issue size is offer for sale worth Rs 1,667.54 crores. The whole proceeds will be received by Orkla Asia Pacific Pte. Ltd, Navas Meeran and Feroz Meeran, which is the selling shareholder in this IPO.

Q2: What’s the minimum investment for the Orkla India IPO?

20 shares per lot, requiring Rs 14,600 (at upper band).

Q3: How does Orkla India compare to peers?

Orkla India's peer in the packaged food sector is Tata Consumer Products Limited (TCPL). When compared to its peer, in terms of Revenue from Operations in Fiscal 2025, Orkla India is smaller (Rs 2,394.71 crores) relative to the larger competitor, TCPL (Rs 17,618.30 crores). Orkla India reported an Adjusted EBITDA Margin of 16.6% (vs. 13.5% for TCPL) and a PAT Margin of 10.7% (vs. 7.3% for TCPL). Crucially, Orkla India achieved a significantly better Return on Capital Employed (RoCE) of 32.7% compared to TCPL's RoCE of 24.6% in FY25, indicating high efficiency in utilising capital resources.

Q4: Who is managing the Orkla India IPO?

ICICI Securities Limited, Citigroup Global Markets India Private Limited, J.P. Morgan India Private Limited and Kotak Mahindra Capital Company Limited are the book-running lead managers for the IPO.

Q5: What are Orkla India's latest financials?

Orkla India's latest financials for Fiscal 2025 include a Revenue from Operations of Rs 2,394.71 crores and an Adjusted EBITDA Margin of 16.6%. The company’s Profit After Tax (PAT) for Fiscal 2025 was Rs 255.69 crores, with its PAT Margin being 10.7%.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category