Is GK Energy IPO Good or Bad

00:00 / 00:00

GK Energy Limited's IPO will be open for subscription from September 19, 2025, to September 23, 2025. The company plans to raise a total of Rs.464.26 crore through this IPO, which includes a fresh issue of Rs.400 crore and an offer for sale of Rs.64.26 crore. The price band per share has been set at Rs.145 to Rs.153. This raises the question: is the GK Energy IPO good or bad? Will investing in it be a wise decision? In this article, we'll cover the GK Energy IPO review in detail to help investors make informed decisions.

GK Energy Ltd. IPO Review

GK Energy Limited's IPO has a total issue price of Rs.464.26 crore (approximately $1.4 billion), consisting of a fresh issue of Rs.400 crore (approximately $1.4 billion) and an offer for sale (OFS) of Rs.64.26 crore (approximately $1.6 billion). The IPO will be open for subscription from September 19, 2025, to September 23, 2025. The company has fixed a price band of Rs.145 to Rs.153 per share, with a lot size of 98 shares.

The proceeds raised from the fresh issue will be used for expansion, working capital requirements, and general corporate purposes. GK Energy Limited operates in the energy sector and plans to use the capital to further expand its business.

The IPO has a maximum 50% share allocation for QIB investors, a minimum 35% for retail investors, and a minimum 15% for NII investors. The company's promoters are Gopal Rajaram Kabra and Mehul Ajit Shah. This IPO will be listed on both BSE and NSE, with the tentative listing date set as September 26, 2025.

Company Overview of GK Energy Ltd.

GK Energy Limited, an emerging energy company, aims to strengthen its operations and expansion through capital raised from the capital markets. The company is focused on power and energy solutions and is working to further strengthen its presence in the coming years.

The company's promoters are Gopal Rajaram Kabra and Mehul Ajit Shah, who are renowned for their experience and management skills in the sector. The promoters' strong stake reflects their long-term confidence and commitment to the company.

Regarding the shareholding pattern, the company's promoter holding was 93.29% pre-issue, while post-issue it will decrease to 78.64%. The total pre-issue shares were 176.6 million, which will increase to 202.8 million post-issue shares.

Overall, GK Energy Limited is poised to establish a strong foothold in the energy sector, supported by its expansion plans and strong management.

Industry Overview of GK Energy Ltd.

India's energy sector is poised to become a key pillar of the country's economic progress in the future. The country's growing population, rapid urbanization, industrialization, and increasing electricity consumption are the sector's biggest growth drivers. Currently, India is among the world's third-largest energy consumers, and electricity demand is projected to grow at an average CAGR of 5-6% by 2030.

The Indian government has also taken several major steps to promote this sector. Under the "National Electricity Plan," an emphasis is being placed on increasing the share of renewable energy in the coming years. The government has set a target of achieving 500 GW of renewable energy capacity by 2030. Schemes like the "Har Ghar Bijli Yojana (Saubhagya)" have rapidly expanded electricity access in both rural and urban areas.

Diversification in energy production is also a key feature of this sector. Demand for clean energy sources such as solar, wind, and hydropower, along with coal and thermal power, is rapidly increasing. Furthermore, the government's "Net Zero 2070" commitment has strengthened the power sector's direction and investment potential.

The role of private companies in power distribution and generation is also steadily increasing. Private sector investment and Foreign Direct Investment (FDI) are growing rapidly in this sector. By 2024–25, private players are projected to contribute nearly 50% to India's power generation.

The industry in which GK Energy Limited operates is driven not only by domestic demand but also by industrial and commercial consumption. Electricity consumption in sectors such as automobiles, real estate, IT parks, and manufacturing is steadily increasing. Furthermore, the shift towards green energy and sustainable solutions has opened up new opportunities in this industry.

Overall, India's energy industry is poised for further expansion in the future, driven by rapidly growing demand, government policy support, and private investment. This positive trend provides a strong foundation for long-term growth and profitability for companies like GK Energy Limited.

Financial Overview of GK Energy Ltd.

Particulars | Sep 30, 2024 | Sep 30, 2023 | Mar 31, 2024 | Mar 31, 2023 |

Total Assets | 4,473.09 | 1,230.65 | 2,140.78 | 1,428.22 |

Equity & Reserves | 1,070.31 | 259.68 | 559.58 | 198.68 |

Total Liabilities | 3,402.78 | 971.00 | 1,581.20 | 1,229.54 |

Revenue from Operations | 4,219.29 | 1,759.83 | 4,110.89 | 2,850.26 |

Total Income | 4,236.27 | 1,764.33 | 4,123.12 | 2,854.52 |

Profit After Tax (PAT) | 510.79 | 61.00 | 360.90 | 100.80 |

Earnings Per Share (EPS) | 3.02 | 0.36 | 2.14 | 0.66 |

Assets : The company's total assets as of September 30, 2024, stood at Rs. 4,473.09 million, a significant increase from Rs. 1,230.65 million as of September 30, 2023, compared to Rs. 2,140.78 million as of March 31, 2024. This indicates a rapid expansion of the company's balance sheet.

Property, Plant & Equipment constitutes the largest share of non-current assets, reaching Rs. 136.50 million as of September 2024.

The largest share of current assets is Trade Receivables and Inventories, with liabilities of Rs. 3,128.34 million and inventory of Rs. 482.50 million as of September 2024.

Equity & Liabilities : The company's Equity Share Capital stood at Rs. 13 million as of September 2024, while Other Equity reached Rs. 1,057.31 million. Total equity and liabilities stood at Rs. 4,473.09 million as of September 2024, a nearly 6-fold increase from Rs. 698.21 million as of 2022.

Non-current borrowings stood at Rs. 329.51 million as of September 2024, while current borrowings increased to Rs. 1,699.93 million. This indicates that the company is also using debt for expansion.

Revenue & Profitability : In the six months to September 2024, the company recorded revenue of Rs. 4,219.29 million, compared to Rs. 4,219.29 million in the same period last year. was Rs.1,759.83 million.

Total income in FY2023-24 was Rs.4,123.12 million, significantly higher than Rs.2,854.52 million in FY23.

Net profit has also increased sharply – in the six months to September 2024, the company earned a net profit of Rs.510.79 million, compared to Rs.360.90 million in FY24 and only Rs.100.80 million in FY23.

The company's EPS (Earnings Per Share) has also been steadily improving, rising from Rs.0.12 in FY22 to Rs.3.02 by September 2024.

Cash Flow : Operating cash flow remained negative (-Rs. 1,291.38 million) as of September 2024, compared to -Rs. 103.86 million in FY24. This indicates pressure on the company's working capital. However, the company received strong inflows from financing activities (Rs. 1,314.23 million as of September 2024), supporting expansion plans.

GK Energy Ltd. has shown rapid growth in both revenue and profitability. However, high borrowings and negative operating cash flow could pose a challenge in the future. However, the Rs. 400 crore being raised through the fresh issue could help pay down debt and strengthen its capital structure. Overall, the company's financial position indicates strong growth potential.

Strengths of GK Energy Ltd.

Strong Promoter Holding : Before the IPO, the promoters hold a significant 93.29% stake, which will remain robust at 78.64% even after the issue. This high promoter holding reflects strong confidence of the promoters in the company’s long-term growth potential.

Presence in a Growing Energy Sector : GK Energy operates in the power and energy space, a sector that is witnessing steady demand growth in India due to rising consumption, government push for energy expansion, and increasing industrial activities. This industry positioning provides the company with a long runway for future opportunities.

Healthy IPO Structure with Fresh Capital Infusion : Out of the total Rs. 464.26 crores, a large portion of Rs. 400 crores is being raised through fresh issue of shares. This ensures that the company will receive additional capital to fund expansion, reduce borrowings, or strengthen its balance sheet, making the IPO more attractive for investors.

Retail Investor-Friendly Allotment : The IPO has reserved 35% of the net offer for retail investors, making it retail-friendly. This increases the chances of allotment for small investors and makes the issue more inclusive compared to some other IPOs where retail participation is lower.

Risks of GK Energy Ltd.

Dependence on Government Policies and Approvals : The company's business model is linked to the energy sector, which is directly dependent on government policies and regulatory approvals. Any policy changes or delays in approvals could impact the company's operations and profitability.

Market Volatility After Listing : Market sentiment, global factors, and sector-specific fluctuations may impact the share price after the IPO listing. This could lead to volatility for short-term investors.

Risk of Equity Dilution : The majority of the IPO proceeds are coming in the form of a fresh issue (Rs. 400 crore). This will result in equity dilution, meaning the stake of existing shareholders will decrease. However, this will benefit the company in strengthening its capital.

Challenges from Strong Competitors : There are already several large and established players in the energy sector. Competition from these players could put pressure on GK Energy's growth strategy and margins.

Strategies of GK Energy Ltd.

Expansion of Capital from IPO : The company will use the funds raised from its IPO (Rs. 464.26 crore) for expansion plans. This capital will provide financial strength to new projects and accelerate growth.

Strengthening Operational Efficiency : GK Energy Ltd.'s focus is not limited to expansion, but also to increasing operational efficiency. Through improved technology, modern equipment, and efficient resource utilization, the company is strategizing to reduce production costs and improve profit margins.

Long-Term Growth Strategy in the Energy Sector : The company aims to establish a strong presence in the energy sector in the coming years. Long-term strategies include renewable energy projects, a stable supply chain, and a sustainable business model, enabling the company to meet future growing energy demand.

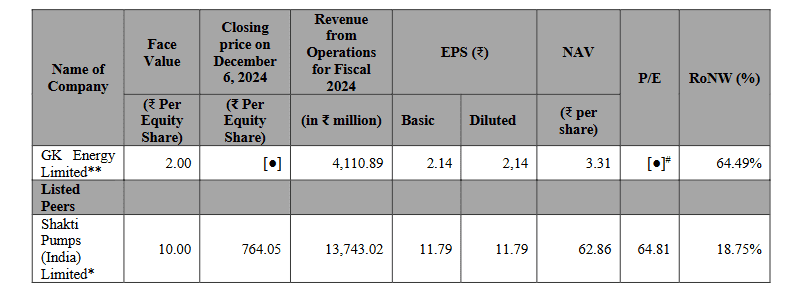

GK Energy Ltd. IPO Peer Comparison

GK Energy Limited's financial performance appears stronger than its listed peers. In FY2024, the company's revenue was Rs.4,110.89 million, with an EPS (Earnings Per Share) of Rs.2.14 and a NAV (Net Asset Value) of Rs.3.31 per share. Most notably, the company's RoNW (Return on Net Worth) is 64.49%, which distinguishes it in the industry.

Compared with its listed competitor, Shakti Pumps (India) Limited, it has revenue of Rs.13,743.02 million, EPS of Rs.11.79, and NAV of Rs.62.86 per share. However, Shakti Pumps has a P/E ratio of 64.81 and a RoNW of 18.75%, indicating weaker return potential compared to GK Energy.

This comparison clearly shows that while Shakti Pumps has larger size and revenue, GK Energy Limited is in a much stronger position in terms of profitability and RoNW. This is a key positive for investors.

Objectives of GK Energy Ltd. IPO

For Working Capital Requirements : The Company will utilize Rs.4,224.57 million from Net Proceeds to meet its working capital needs in Fiscal Year 2026.

Considering current working capital requirements and anticipating future growth, the Board of Directors approved this use by a resolution passed on December 13, 2024.

The working capital requirement is estimated at Rs.8,125.97 million, of which Rs.3,901.40 million will be met from internal accruals and working capital borrowings, and the remaining Rs.4,224.57 million will be met from the net proceeds from the IPO.

The Company's working capital has been estimated taking into account the order book, supply-demand gap, and bank guarantees and loan limits.

2. General Corporate Purposes : The Company will use a portion of the net proceeds (up to a maximum of 25% of total proceeds) for the following purposes:

Strategic initiatives

Business expansion and new growth opportunities

Brand building and promotion

Incidental and operational expenses

Other general corporate purposes may be approved by the Board of Directors or management from time to time.

3. Interim Use of Funds : Until the net proceeds are used for the above purposes, the Company will safely deposit them in a commercial bank listed in Schedule II of the RBI Act, 1934.

4. Monitoring and Compliance : In accordance with the SEBI ICDR Regulations, the Company will appoint a monitoring agency to monitor the use of the net proceeds.

The Audit Committee will regularly review this, and this will be disclosed in the financial statements and shareholders' report.

If funds are used for purposes other than those envisaged, shareholder approval will be required.

5. Offer Expenses

Offer-related expenses will include:

Bookrunning Lead Managers' fees and commissions

SEBI, BSE, and NSE fees

Legal, accounting, and registration expenses

Advertising and marketing costs

Printing and other administrative expenses

GK Energy Ltd. IPO Details

IPO Dates : GK Energy Limited's IPO will be open for subscription from September 19, 2025, to September 23, 2025. Allotment for this IPO is expected to take place on September 24, 2025, and the company's shares will be listed on the BSE and NSE on September 26, 2025.

IPO Issue Price : GK Energy Limited is offering its shares in a price band of Rs. 145 to Rs. 153 per share. Consequently, retail investors will need to invest a minimum of Rs. 14,994 for one lot, i.e., 98 shares.

IPO Size : The company will issue a total of 30.3 million shares through this IPO, amounting to a total size of Rs. 464.26 crore. This includes a fresh issue of Rs. 400 crore and an offer for sale (OFS) of Rs. 64.26 crore.

IPO Allotment Status : Investors who have applied for this IPO can check their allotment status on September 24, 2025, through the registrar's website, BSE, NSE, or their stockbroker platform.

IPO Listing Date : GK Energy Limited shares will be listed on the BSE and NSE on September 26, 2025.

IPO Application Link : Open a demat account with Rupeezy today and make the IPO application process easy and fast. With a user-friendly platform, Rupeezy makes IPO applications a completely hassle-free experience.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category