Is Euro Pratik Sales IPO Good or Bad – Detailed Review

00:00 / 00:00

Euro Pratik Sales Limited's IPO is set to open its initial public offering from September 16, 2025, to September 18, 2025. When considering applying for this IPO, potential investors might have questions about whether the Euro Pratik Sales IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Euro Pratik Sales IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Euro Pratik Sales IPO Review

Euro Pratik Sales Limited's IPO is a book-built issue worth Rs 451.31 crores, consisting entirely of an offer for sale of 1,82,71,862 shares. The IPO will be open for subscription from September 16, 2025, to September 18, 2025, with a price band of Rs 235 to Rs 247 per share and a lot size of 60 shares. The net proceeds from the offer will be received by the selling shareholders, including the promoters and their family members.

Euro Pratik Sales is a leading seller and marketer of decorative wall panels and laminates. The company operates on an asset-light business model, focusing on design, branding, and distribution while outsourcing manufacturing. It holds a 15.87% market share by revenue in India's organized Decorative Wall Panels industry. The company has a wide product portfolio of over 30 varieties and 3,000 designs, sold under the brands "Euro Pratik" and "Gloirio." It has an extensive distribution network of 180 distributors across 25 states and five union territories in India, and also exports to six countries.

Financially, Euro Pratik Sales has shown growth in revenue and profit over the last three fiscal years. Revenue from operations increased from Rs 221.70 crore in Fiscal 2024 to Rs 284.23 crore in Fiscal 2025, after a decline from Rs 263.58 crore in Fiscal 2023 due to a strategic shift to high-margin products. The company's Profit After Tax (PAT) has consistently increased, from Rs 59.56 crore in Fiscal 2023 to Rs 76.44 crore in Fiscal 2025. It has maintained healthy profit margins, with an EBITDA margin of 38.74% and a PAT margin of 26.22% in Fiscal 2025.

Key strengths of the company include its leading market position, comprehensive product portfolio, an asset-light business model, a well-established distribution network, and an experienced management team. However, potential risks include a high dependence on a small number of contract manufacturers and distributors, negative cash flows from operations in Fiscal 2025, a lack of intellectual property protection for its designs, and outstanding legal proceedings.

Company Overview of Euro Pratik Sales IPO

Euro Pratik Sales Limited is a seller and marketer of decorative wall panels and decorative laminates. The company operates on an asset-light business model, focusing on product design, branding, and distribution, while outsourcing manufacturing to contract partners in India and internationally. As one of India's leading and largest organized decorative wall panel brands, it has a market share of 15.87% by revenue in the organized Decorative Wall Panels industry.

The company's product portfolio is comprehensive, offering over 30 product varieties and more than 3,000 designs for both residential and commercial applications. It has pioneered the introduction of products like Louvers, Chisel, and Auris in India. The company's products are sold under its brands "Euro Pratik" and "Gloirio" and are marketed as durable, eco-friendly, and resistant to water, termites, and borers. As of March 31, 2025, Euro Pratik has an extensive distribution network of 180 distributors across 25 states and five union territories in India.

Pratik Gunvantraj Singhvi serves as the Chairman and Managing Director, and Jai Gunvantraj Singhvi is the Executive Director and Chief Financial Officer, holding over 19 and 13 years of experience in the Decorative Wall and Laminates industries. They started exporting products to six countries, namely Singapore, the UAE, Australia, Bangladesh, Burkina Faso, and Nepal. The company earns 66.13% of its operational revenue from Decorative Wall Panels, 25.64% from Decorative Laminates, and the remaining 8.23% from Others for the Fiscal 2025.

Industry Overview of Euro Pratik Sales IPO

Euro Pratik Sales operates within the broader Indian wall decorative industry, which includes products like decorative paints, wallpapers, wall decorative laminates, and non-wood wall panels. The wall decorative industry in India was valued at Rs 36,622 crore in Fiscal 2025. This industry is projected to grow at a CAGR of 14.5% over the next four years, reaching Rs 62,890 crore by Fiscal 2029.

The growth of this industry is driven by several macroeconomic and demographic factors in India, including:

Growing Economy and Disposable Income: India's nominal GDP is projected to grow at a CAGR of approximately 11.2% from Fiscal 2025 to Fiscal 2030, as per the Technopak Report, which is expected to increase consumer purchasing power. As the middle class expands, there is a growing demand for both residential and commercial properties, contributing to real estate growth.

Urbanization and Nuclearization: Rapid urbanization and the trend towards smaller, nuclear families are increasing the number of households, leading to higher demand for housing units and interior decoration products.

Technological Integration: The adoption of new composites and synthetic materials, as well as digital printing technology, is broadening the scope of wall cladding materials and offering greater design flexibility.

Changing Consumer Preferences: Consumers are increasingly influenced by social media and are seeking personalized, stylish, and durable home decor options. There is a rising preference for eco-friendly and low-maintenance products, which benefits non-wood wall panels.

The decorative wall panel and decorative laminates market is highly competitive and requires constant innovation. Competition is based on factors such as product quality, price, technology, and brand reputation. Euro Pratik also faces competition from alternative interior solutions like decorative paints and wallpapers.

Financial Overview of Euro Pratik Sales IPO

Particulars | Consolidated | Standalone | |

March 31, 2025 (Rs crores) | March 31, 2024 (Rs crores) | March 31, 2023 (Rs crores) | |

Revenue from operations | 284.22 | 221.69 | 263.58 |

EBITDA | 110.10 | 89.00 | 83.63 |

EBITDA Margin | 38.74% | 40.15% | 31.73% |

Profit after tax | 76.44 | 62.90 | 59.56 |

PAT Margin | 26.22% | 27.33% | 22.18% |

Return on Equity (RoE) | 39.18% | 44.03% | 47.7% |

Return on Capital Employed (RoCE) | 44.58% | 55.17% | 61.42% |

Debt to Equity Ratio | 0.01 | 0 | 0.02 |

The financial performance of Euro Pratik Sales over the three fiscal years ending March 31, 2023, 2024, and 2025 highlights a significant shift in profitability and operational efficiency. The company's financial reporting changed from a standalone basis in Fiscal 2023 to a consolidated basis for Fiscal 2024 and 2025. This change was due to recent acquisitions made in Fiscal 2025, which included acquiring controlling interests in several businesses such as Vougue Decor, Millenium Decor, Lamage Decor, and others. Therefore, the financial information for Fiscal 2023 is not fully comparable to that of Fiscal 2024 and Fiscal 2025.

Revenue from operations shows growth from Rs 221.70 crore in Fiscal 2024 to Rs 284.23 crore in Fiscal 2025. The company experienced a decline in revenue in Fiscal 2024 compared to Fiscal 2023, decreasing from Rs 263.58 crore to Rs 221.70 crore. This was primarily due to a strategic shift to focus on high-margin products.

EBITDA has shown an upward trend, increasing from Rs 83.63 crore in Fiscal 2023 to Rs 89.00 crore in Fiscal 2024, and further to Rs 110.10 crore in Fiscal 2025. The corresponding EBITDA Margin was 31.73% in Fiscal 2023, 40.15% in Fiscal 2024, and 38.74% in Fiscal 2025.

Profit After Tax (PAT) has consistently increased over the three years, from Rs 59.56 crore in Fiscal 2023 to Rs 62.90 crore in Fiscal 2024, and then significantly to Rs 76.44 crore in Fiscal 2025.

Return on Equity (RoE) was 47.70% in Fiscal 2023, decreasing to 44.03% in Fiscal 2024, and then to 39.18% in Fiscal 2025. Return on Capital Employed (RoCE) followed a similar pattern, decreasing from 61.42% in Fiscal 2023 to 55.17% in Fiscal 2024 and to 44.58% in Fiscal 2025.

In summary, Euro Pratik Sales has demonstrated decent growth in revenue and profit over the last three fiscal years, despite a dip in revenue in Fiscal 2024 due to a change in business strategy. The company has maintained healthy profit margins and returns on equity and capital.

Strengths and Risks of Euro Pratik Sales IPO

Let's delve into the strengths and weaknesses to assess if the Euro Pratik Sales IPO is good or bad for investors.

Strengths

India's Leading and Largest Organized Wall Panel Brands: Euro Pratik Sales is one of India's leading Decorative Wall Panel brands and is considered one of the largest in the organized sector. According to the Technopak Report, the company has a market share of 15.87% by revenue in the organized Decorative Wall Panels industry.

Comprehensive Product Portfolio: The company offers a wide range of products across various categories, including over 30 product varieties and more than 3,000 designs as of March 31, 2025. The portfolio includes products like decorative wall panels, decorative laminates, interior films, and adhesives.

Asset-Light Business Model: The company operates on a contract manufacturing model, outsourcing the manufacturing of its products and not owning any manufacturing facilities. This model allows the company to partner with contract manufacturers in countries like South Korea, China, and Vietnam to manufacture its products.

Pan-India Presence with a Well-Established Distribution Network: As of March 31, 2025, Euro Pratik Sales has a distribution network of 180 distributors across 25 states and 5 union territories in India. The company has relationships with its key distributors, with the average duration of a relationship being more than five years.

Experienced Promoters and Management Team: The company's promoters and key management personnel have extensive experience in the wall decor industry. They are responsible for setting the strategic business direction and managing the company's operations. The company's Chairman and Managing Director, Pratik Gunvantraj Singhvi, has over 19 years of experience, and its Executive Director and Chief Financial Officer, Jai Gunvantraj Singhvi, has over 13 years of experience in the industry.

Risks

Dependence on a Small Number of Contract Manufacturers: The company is materially dependent on its contract manufacturers for its products. For Fiscals 2025, 2024, and 2023, the top 10 contract manufacturers accounted for 52.79%, 91.66%, and 87.88% of the total value of products purchased, respectively. The loss of a key manufacturer could have a material and adverse effect on the company's business. However, they have reduced exposure to a significant extent.

Dependence on a Concentrated Distributor Network: The company relies on its top 30 distributors, who collectively contributed to 57.44% of its revenue from operations in Fiscal 2025. The company does not have definite-term agreements with its distributors, and the loss of any of these key distributors could negatively impact its business.

Negative Cash Flows from Operations: The company experienced negative cash flows from operating activities during Fiscal 2025, primarily due to an increase in trade receivables and inventory. Sustained negative cash flows could affect the company's ability to meet its working capital requirements and implement its growth plans.

Lack of Intellectual Property Protection for Designs: A majority of the designs used in the company's products are not protected by intellectual property rights. This makes the company's designs susceptible to being copied by competitors, which could harm its competitive position and brand reputation.

Outstanding Legal Proceedings: There are outstanding legal proceedings involving the company, its subsidiaries, directors, and promoters. An adverse outcome in these proceedings could harm the company's reputation and financial condition.

Strategies of Euro Pratik Sales IPO

Expand Product Portfolio: The company aims to stay ahead of market trends by focusing on product novelty and new designs. This includes continuously developing new products to cater to evolving consumer preferences.

Strengthen Distribution and Geographical Presence: A key strategy is to increase the penetration of its products by appointing new distributors and expanding its distribution network across different regions. This includes expanding its presence in new domestic and international markets such as the United States, the UAE, and Europe.

Strategic Inorganic Growth: The company has a history of making strategic acquisitions to grow its business and may continue to do so in the future. The recent acquisitions in Fiscal 2025 were aimed at diversifying the product range, accessing new distribution channels, and expanding into new markets.

Operational Efficiency and Brand Development: The company plans to leverage its asset-light model and focus on strengthening its brand image and reputation. This involves using brand ambassadors and marketing activities to increase market recognition and enhance the perceived value of the "Euro Pratik" and "Gloirio" brands.

Leverage Macroeconomic Trends: The company is positioned to benefit from India's economic growth, urbanization, and increasing disposable income, which are key drivers for the decorative wall panel and laminates industries. By catering to consumer preferences for premium and durable products, the company aims to capitalize on these trends to increase its market share.

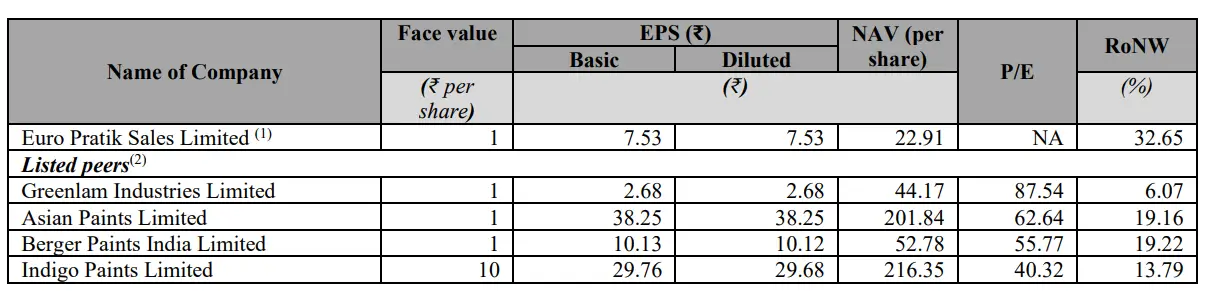

Euro Pratik Sales IPO vs. Peers

In Fiscal 2025, Euro Pratik Sales Limited's revenue from operations was Rs 284.23 crore. The company's revenue increased by 28.20% from the previous fiscal year, when it was Rs 221.70 crore. This is significantly lower than the listed peer companies. For instance, in the same period, Asian Paints Limited reported revenue of Rs 33,905.62 crore, Berger Paints India Limited had Rs 11,544.71 crore, Greenlam Industries Limited's revenue was Rs 2,569.34 crore, and Indigo Paints had Rs 1,340.67 crore.

Euro Pratik's profitability metrics reflect a strong performance relative to its revenue size. In Fiscal 2025, the company's EBITDA margin was 38.74%, which is higher than all its listed peers, including Asian Paints (19.82%), Berger Paints India (17.20%), Greenlam Industries (11.12%), and Indigo Paints (18.80%). Its Return on Equity (RoE) of 39.18% is also higher than its peers, with Greenlam Industries at 6.21%, Asian Paints at 18.79%, Berger Paints India at 20.47%, and Indigo Paints at 14.71%. Similarly, its Return on Capital Employed (RoCE) of 44.58% in Fiscal 2025 surpasses its peers.

The company's debt profile is very low, with a debt-to-equity ratio of 0.01 in Fiscal 2025. This is lower than Greenlam Industries' 0.96 and Berger Paints India's 0.02, indicating a very low-leverage model. The company's working capital days of 168.00 in Fiscal 2025 are higher than most of its peers, such as Greenlam Industries (1.61 days) and Berger Paints India (26.90 days).

Overall, Euro Pratik Sales demonstrates robust profitability and return metrics, despite its significantly smaller scale compared to its listed peer group. The company's asset-light business model and low debt appear to be key factors contributing to its high efficiency. The company does not have a direct comparable peer company in the decorative wall panel and decorative laminate industry in India.

Objectives of Euro Pratik Sales IPO

This offer comprises a complete offer for sale. The net proceeds from the offer for sale will be received by the selling shareholders, namely Pratik Gunvantraj Singhvi (Rs 28.25 crore) and HUF under his name (Rs 27.88 crore), Jai Gunvantraj Singhvi (Rs 156.67 crore) and HUF under his name (Rs 156.67 crore), Dipty Pratik Singhvi (Rs 40.92 crore) and Nisha Jai Singhvi (Rs 40.92 crore).

Euro Pratik Sales IPO Details

IPO Dates

Euro Pratik Sales IPO will be open for subscription from September 16, 2025, to September 18, 2025. The allotment of shares to investors will take place on September 19, 2025, and the company is expected to be listed on the NSE and BSE on September 23, 2025.

IPO Issue Price

Euro Pratik Sales is offering its shares in the price band of Rs 235 to Rs 247 per share. This means you would require an investment of Rs. 14,820 per lot (60 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Euro Pratik Sales is planning to sell shares through an offer for sale, totalling 1,82,71,862 shares, which are worth Rs 451.31 crores.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on September 19, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Euro Pratik Sales will be listed on the NSE and BSE on September 23, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Euro Pratik Sales IPO

Important IPO Details | |

Bidding Date | September 16, 2025 to September 18, 2025 |

Allotment Date | September 19, 2025 |

Listing Date | September 23, 2025 |

Issue Price | Rs 235 to Rs 247 per share |

Lot Size | 60 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category