Is Canara Robeco Asset Management Company IPO Good or Bad – Detailed Review

00:00 / 00:00

Canara Robeco Asset Management Company Limited’s IPO is set to open its initial public offering from October 09, 2025, to October 13, 2025. When considering applying for this IPO, potential investors might have questions about whether the Canara Robeco Asset Management Company IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Canara Robeco Asset Management Company IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Canara Robeco Asset Management Company IPO Review

Canara Robeco Asset Management Company Limited's IPO is open for subscription from October 09, 2025, to October 13, 2025, with listing expected on October 16, 2025, on NSE and BSE. The company is India's second-oldest Asset Management Company (AMC), specializing in investment management services for the Canara Robeco Mutual Fund and advisory services on Indian equities. It is a Joint Venture between Canara Bank (51% stake) and ORIX Corporation Europe N.V. (49% stake), leveraging dual parentage for domestic reach and global expertise. The core business is highly concentrated in equity-oriented schemes, which constituted 91.17% of its Quarterly Average Assets Under Management (QAAUM) as of June 30, 2025, supported by a research-driven investment process. The company operates a well-established, pan-India multi-channel distribution network, leveraging over 52,343 empaneled partners and 25 physical branches. As of June 30, 2025, the company's QAAUM stood at Rs 1,11,052 crores.

The company operates within the Indian Mutual Fund Industry, a sector demonstrating robust and sustained expansion, driven by the financialization of household savings and rising investor awareness. The industry's QAAUM reached Rs 67.4 lakh crores by March 2025, reflecting a significant CAGR of 29% (FY23-FY25), and is projected to grow at a CAGR of approximately 16% to 18% between Fiscal 2025 and Fiscal 2030, potentially reaching up to Rs 155 lakh crores. Market growth is fueled by favorable demographics and low penetration (AUM-to-GDP ratio of 19.9% in FY25).

Canara Robeco Asset Management Company's financial performance from FY23 to FY25 shows strong top-line growth and consistently high profitability. Revenue from Operations grew from Rs 204.6 crore in FY23 to Rs 403.7 crore in FY25. Profit After Tax (PAT) similarly showed strong growth, rising from Rs 79.0 crore to Rs 190.7 crore in FY25 with a CAGR of around 55%. For the three months ended June 30, 2025, Revenue was Rs 121.07 crore and PAT was Rs 60.98 crore. The company maintains superior capital efficiency, with a strong Return on Net Worth (RoNW) of 31.78% in FY25.

Key strengths include Market Leadership (second-oldest AMC, highest equity-oriented QAAUM among top 10 AMCs, and second-highest retail AUM share among top 20 AMCs), Exceptional Operational Excellence (RoNW of 31.78%, Cost-to-Income of 36.23% in FY25), an Integrated Value Chain from its dual parentage, and an Extensive Distribution network leveraging Canara Bank. Risks involve a critical reliance on the "Canara" and "Robeco" trademarks, requiring a mandatory brand transition plan within two years of the IPO. Other risks include a significant contingent liability risk from a Rs 476.28 crores GST demand, high Asset Class Concentration in equity (91.17%), and Distribution Concentration (73.45% from third-party distributors).

The IPO is entirely an Offer for Sale (OFS) of 4,98,54,357 shares, worth Rs 1,326.13 crores. Consequently, the entire proceeds will go to the selling shareholders (Canara Bank and ORIX Corporation Europe N.V.). Shares are priced in the band of Rs 253 to Rs 266 per share, with a Lot Size of 56 Shares.

Company Overview of Canara Robeco Asset Management Company IPO

Canara Robeco Asset Management Company Limited, India's second-oldest Asset Management Company (AMC), specializes in providing investment management services to the Canara Robeco Mutual Fund and advisory services on Indian equities to Robeco Hong Kong Limited. The company has a significant focus on equity-oriented schemes, which constituted 91.17% of its Quarterly Average Assets Under Management (QAAUM) as of June 30, 2025. The core philosophy is built around a research-driven investment process focusing on robust, growth-oriented businesses run by competent management at reasonable valuations, leading to a QAAUM of Rs 1,11,052 crores as of June 30, 2025.

The company operates a well-established, pan-India multi-channel distribution network, successfully navigating market shifts to become a leader in the industry. The network leverages over 52,343 empaneled distribution partners and 25 physical branches across 23 cities as of June 30, 2025. It is a joint venture between Canara Bank (holding a 51% stake) and ORIX Corporation Europe N.V. (OCE) (holding a 49% stake). The company benefits from Canara Bank's widespread brand recognition and massive branch network for distribution and OCE's global expertise in risk and investment management. The company currently utilizes the "Canara" and "Robeco" trademarks under license agreements, which stipulate the formulation of a brand transition plan to a new, non-competing brand within two years of the IPO.

The asset management platform is supported by a disciplined investment process for both fixed income and equity portfolios, backed by a strong in-house research team. Key leadership includes Rajnish Narula (Managing Director and CEO) and Ashwin Harshadrai Purohit (CFO). For the three months ended June 30, 2025, the company reported total revenue from operations of Rs 121.06 crores and a profit after tax of Rs 60.97 crores. The substantial revenue concentration is driven predominantly by management fees collected from its high-proportion equity-oriented portfolio, resulting in a consistent PAT margin of over 50%.

Industry Overview of Canara Robeco Asset Management Company IPO

Canara Robeco Asset Management Company Limited operates within the Indian Mutual Fund Industry, a sector that has demonstrated robust and sustained expansion, primarily driven by the financialization of household savings, rising investor awareness, and technological advancements. The industry's Quarterly Average Assets Under Management (QAAUM) reached Rs 67.4 lakh crores by March 2025, reflecting a significant CAGR of 29% between Fiscal 2023 and Fiscal 2025. This strong trajectory is projected to continue, with the overall industry's AUM expected to grow at a CAGR of approximately 16% to 18% between Fiscal 2025 and Fiscal 2030, potentially reaching Rs 147 lakh crores to 155 lakh crores.

The market growth is structurally fueled by India's favorable demographics, including a large young working population, accelerating urbanization, and increasing per capita GDP. Crucially, penetration remains relatively low, with the Mutual Fund AUM-to-GDP ratio at 19.9% in Fiscal 2025, significantly below the global average of 64%. This signals substantial untapped potential as household savings increasingly shift from physical assets (like gold and real estate) towards financial instruments.

A primary driver of recent growth is the escalating participation of individual retail investors, with their AUM constituting 62.2% of the total mutual fund industry AUM as of June 2025. This momentum is channeled significantly through Systematic Investment Plans (SIPs), which saw monthly contributions hit Rs 27,269 crores by June 2025. Furthermore, expansion into "Beyond 30" (B30) cities highlights deepening penetration into non-metro regions, with B30 assets growing at a 21% CAGR from March 2019 to March 2025.

Within this intensely competitive environment, the industry is navigating increasing competition from Exchange Traded Funds (ETFs), technological shifts driven by AI and robo-advisors, and a complex regulatory landscape overseen by SEBI. Canara Robeco AMC benefits from its strategic focus on equity-oriented schemes and its second-highest share of retail AUM amongst the top 20 AMCs, positioning it well to capture future market expansion, particularly within the equity space, which is projected to grow at a CAGR of 20 to 21% between Fiscal 2025 and Fiscal 2030.

Financial Overview of Canara Robeco Asset Management Company IPO

Particulars | June 30, 2025 (Rs in Crores) | June 30, 2024 (Rs in Crores) | March 31, 2025 (Rs in Crores) | March 31, 2024 (Rs in Crores) | March 31, 2023 (Rs in Crores) |

Revenue from Operations | 121.07 | 101.8 | 403.7 | 318.09 | 204.6 |

Total Expense (%) | 0.04% | 0.03% | 0.14% | 0.16% | 0.17% |

Operating Margin (%) | 0.07% | 0.07% | 0.26% | 0.26% | 0.19% |

PAT | 60.98 | 51.07 | 190.7 | 151 | 79 |

PAT Yield (%) | 0.05% | 0.05% | 0.18% | 0.20% | 0.14% |

RoNW (%) | 9.23% | 10.11% | 31.78% | 33.22% | 24.05% |

Mutual Fund QAAUM | 1,110.52 | 946.85 | 1,033.44 | 870.7 | 624.85 |

Note: The above calculations for Total Expense, Operating Margin, and PAT Yield are based on the Average AUM for the respective fiscal period.

The financial performance of Canara Robeco Asset Management Company over the three fiscal years ending March 31, 2023, 2024, and 2025 reflects strong top-line growth and consistently high profitability, driven by an accelerating accumulation of managed assets and efficient cost control inherent to the asset-light AMC model. This consistent performance has carried through into the most recent reported quarter.

Revenue from Operations has shown a significant upward trend, directly correlating with the expansion of its core business. Revenue increased from Rs 204.6 crore in FY23 to Rs 318.09 crore in FY24, and surged to Rs 403.7 crore in FY25. This impressive growth has been fundamentally supported by the expansion of the Mutual Fund QAAUM, which rose from Rs 624.85 crore in FY23 to Rs 1,033.44 crore in FY25 (a 28.60% CAGR over the period). The strong operating period ended June 30, 2025, continued this momentum, reporting revenue of Rs 121.07 crore, up significantly from Rs 101.8 crore in the corresponding prior period ended June 30, 2024, supported by QAAUM growth from Rs 946.85 crore to Rs 1,110.52 crore in the respective June quarters.

In the Operating efficiency part, it is exceptionally high, which is typical for a scalable asset management business model. The Operating Margin (as a percentage of AUM) remained stable and competitive at 0.26% in both FY24 and FY25, a substantial improvement over the 0.19% margin recorded in FY23, demonstrating enhanced cost management relative to its growing asset base. For the quarterly periods, the Operating Margin was maintained at a robust 0.07% in both the June 30, 2025, and June 30, 2024, periods. Crucially, the Total Expense Ratio (as a percentage of AUM) remained minimized, improving from 0.17% in FY23 to 0.14% in FY25, reinforcing the profitability of its scale (and stood at 0.04% for the recent June quarter).

Profit After Tax (PAT) has consistently grown at an accelerating pace. PAT sharply increased from Rs 79.0 crore in FY23 to Rs 151.0 crore in FY24, and recorded further strong growth to Rs 190.7 crore in FY25. This represents a remarkable PAT CAGR of over 55% between FY23 and FY25. For the recent quarter, PAT rose from Rs 51.07 crore (June 30, 2024) to Rs 60.98 crore (June 30, 2025). The PAT Yield (as a percentage of AUM) reflected this improvement, rising from 0.14% in FY23 to a peak of 0.20% in FY24, and sustaining a high 0.18% in FY25. The PAT Yield for the quarter remained stable at 0.05% in both the June 30, 2025, and June 30, 2024, periods, indicating that profit generation is keeping pace with asset accumulation.

The Return on Net Worth (RoNW) highlights exceptionally efficient utilization of shareholders' capital. RoNW significantly improved from 24.05% in FY23 to a peak of 33.22% in FY24, and remained robust at 31.78% in FY25, showcasing superior capital productivity relative to industry norms. For the recent quarter, RoNW stood at 9.23% (June 30, 2025), compared to 10.11% (June 30, 2024), demonstrating continued, strong, and consistent capital efficiency. This high level of RoNW underscores the company's asset-light structure and strong overall financial health.

Strengths and Risks of Canara Robeco Asset Management Company IPO

Let's delve into the strengths and weaknesses to assess if the Canara Robeco Asset Management Company IPO is good or bad for investors.

Strengths

Market Leadership: Canara Robeco AMC is the second-oldest Asset Management Company in India, benefitting from a long legacy and the backing of two major institutional Sponsors. The company holds a highly competitive position with its equity-oriented schemes, possessing the highest share of equity-oriented Quarterly Average Assets Under Management (QAAUM) among the top 10 AMCs as of June 30, 2025. It also maintains a significant retail focus, ranking second in retail AUM share among the top 20 AMCs.

Operational Excellence and Capital Efficiency: The Company demonstrates robust performance metrics, supported by a cost-to-income ratio of 36.23% in Fiscal 2025 and a strong Return on Net Worth (RoNW) of 31.78% for the same period. This efficiency is underpinned by a stable and experienced professional management team, with the senior management boasting an average tenure of 8.67 years as of June 30, 2025.

Integrated Value Chain and Localization: The company operates as a joint venture between Canara Bank (51% stake) and ORIX Corporation Europe N.V. (49% stake), leveraging a dual parentage for both deep domestic reach and global investment expertise. Its investment process is strictly research-driven and time-tested, aimed at delivering consistent, risk-adjusted returns to maintain client confidence and scheme performance.

Extensive Distribution and Service Network: The Company maintains a broad reach across India, supported by 52,343 empaneled distribution partners and 25 physical branches across 23 cities as of June 30, 2025. This network includes leveraging Canara Bank’s extensive branch presence, particularly for deeper penetration into Beyond 30 (B30) cities, where it holds the second-highest share of AUM among the top 20 AMCs.

Technological Innovation and Brand Equity: The company benefits from a trusted brand image and a growing digital ecosystem, utilizing an integrated online platform and a mobile application with over 7,00,000 downloads to facilitate customer and distributor interaction.

Risks

Reliance on Promoter for Core Technology and Brand: The business is substantially dependent on trademark license agreements for the use of the "Canara" and "Robeco" brand names. These agreements necessitate the formulation of a brand transition plan post-IPO, with a maximum two-year window for transition, creating inherent business continuity and reputational risks should the new brand adoption face challenges.

Significant Contingent and Tax Liabilities: The Canara Robeco Mutual Fund (CRMF), managed by the company, has an outstanding show cause cum demand notice for non-payment of GST amounting to Rs 476.28 crores as of June 28, 2025, which, if materialized, could adversely affect the financial condition and indirectly impact the AMC.

Asset Class Concentration Risk: The business displays a high concentration in a single asset class, with equity-oriented schemes constituting 91.17% of its QAAUM as of June 30, 2025, making the company disproportionately vulnerable to volatility and adverse performance within the Indian equity markets.

Distribution Concentration: A significant portion of the business relies on third-party distributors, who contribute 73.45% of the Monthly Average AUM as of June 30, 2025. Any failure to maintain or grow these relationships, or adverse changes in distributor commissions, could materially impact AUM and revenue.

Personnel and Underperformance Risk: The company is highly dependent on its Key Managerial Personnel (KMPs) and investment team. Furthermore, one equity scheme and nine debt schemes underperformed their respective benchmarks over a one-calendar-year period ending June 30, 2025, posing a risk of AUM outflow.

Strategies of Canara Robeco Asset Management Company IPO

Expanding Footprint and Distribution Network: The core strategy involves continued expansion of its physical and digital distribution reach, focusing heavily on increasing presence and market penetration in high-growth B-30 cities while simultaneously leveraging the vast network of its Promoter, Canara Bank.

Driving Portfolio Diversification and New Products: The strategy is to actively diversify the AUM mix by increasing the contribution from debt-oriented schemes, contingent on prevailing market conditions. This includes the continuous evaluation and launch of new schemes and specialized products across asset classes to capture emerging investment themes and meet varied investor goals.

Enhancing Employee Value Proposition and Talent Retention: The company plans to strengthen its internal talent pool by enhancing its employee value proposition, attracting high-quality talent, and focusing on retaining its experienced investment and senior management teams, which are crucial for maintaining investment performance and operational continuity.

Strengthening Digital Ecosystem and Operational Efficiency: Plans include ongoing investment in enhancing the integrated digital platforms, such as mobile applications, distributor portal,s to streamline processes, improve operational efficiency, and deliver a seamless, end-to-end customer and distributor experience, thereby supporting scalable growth.

Canara Robeco Asset Management Company IPO vs. Peers

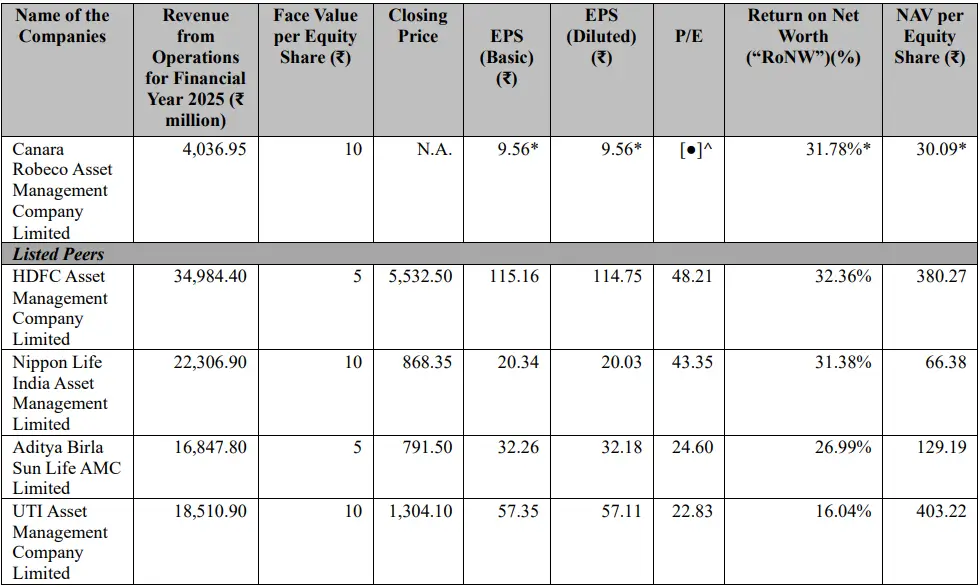

Canara AMC achieved competitive profitability and superior returns on equity in FY25. The Company delivered a Net Profit Margin of 47.24% in FY25, a figure that is generally higher than its peer group average due to the high proportion of equity-oriented assets (91.69% of QAAUM in FY25). This profitability also supports a strong Return on Net Worth (RoNW) of 31.78% in FY25, which ranks favorably against major listed peers such as HDFC AMC (32.36%) and Nippon Life India AMC (31.38%). Furthermore, the company maintains robust operational efficiency, supported by a competitive cost-to-income ratio of 36.23% in FY25.

Operationally, Canara AMC demonstrates strong retail penetration and a strategic focus on the equity segment. It maintains the highest share of equity-oriented QAAUM (91.17%) among the top 10 AMCs as of June 30, 2025. It also boasts a significant retail focus, ranking second in retail AUM share (49.96%) among the top 20 AMCs as of June 30, 2025. The high profitability of its equity-heavy portfolio allows it to efficiently manage assets. As of March 31, 2025, the company had a Quarterly Average Assets Under Management (QAAUM) of Rs 1,03,344 crores, demonstrating substantial scale within the industry.

Objectives of Canara Robeco Asset Management Company IPO

The offering consists solely of an Offer for Sale (OFS). Consequently, Canara Bank and ORIX Corporation Europe N.V. will receive the entire proceeds from the IPO issue.

Canara Robeco Asset Management Company IPO Details

IPO Dates

Canara Robeco Asset Management Company IPO will be open for subscription from October 09, 2025, to October 13, 2025. The allotment of shares to investors will take place on October 14, 2025, and the company is expected to be listed on the NSE and BSE on October 16, 2025.

IPO Issue Price

Canara Robeco Asset Management Company is offering its shares in the price band of Rs 253 to Rs 266 per share. This means you would require an investment of Rs. 14,896 per lot (56 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Canara Robeco Asset Management Company is issuing a total offer for sale of 4,98,54,357 shares, worth Rs 1,326.13 crores. The selling shareholders will receive the entire proceeds.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on October 14, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Canara Robeco Asset Management Company will be listed on the NSE and BSE on October 16, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Canara Robeco Asset Management Company IPO

Important IPO Details | |

Bidding Date | October 09, 2025 to October 13, 2025 |

Allotment Date | October 14, 2025 |

Listing Date | October 16, 2025 |

Issue Price | Rs 253 to Rs 266 per share |

Lot Size | 56 Shares |

FAQs:

Q1: What is the issue size of Canara Robeco Asset Management Company Limited's IPO?

The entire issue size is offer for sale worth Rs 1,326.13 crores. The whole proceeds will be received by Canara Bank and ORIX Corporation Europe N.V., which is the selling shareholder in this IPO.

Q2: What’s the minimum investment for the Canara Robeco Asset Management Company IPO?

56 shares per lot, requiring Rs 14,896 (at upper band).

Q3: How does Canara Robeco Asset Management Company compare to peers?

Canara Robeco Asset Management Company's peers in the asset management sector are HDFC AMC, Nippon Life India AMC, Aditya Birla Sun Life AMC, and UTI AMC. When compared to its peers, in terms of Revenue from Operations in Fiscal 2025, Canara AMC is smaller but a high-growth player relative to larger competitors like HDFC AMC and Nippon Life India AMC. Despite the difference in scale, the company exhibits strong profitability and efficiency.

Q4: Who is managing the Canara Robeco Asset Management Company IPO?

SBI Capital Markets Limited, Axis Capital Limited, and JM Financial Limited are the book-running lead managers for the IPO.

Q5: What are Canara Robeco Asset Management Company's latest financials?

Canara Robeco Asset Management Company's latest financials for Fiscal 2025 include a Revenue from Operations of Rs 403.70 crores and a Cost to Income ratio of 36.23%. The company’s Profit After Tax (PAT) for Fiscal 2025 was Rs 190.70 crores, with its PAT Margin being 47.24%.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category