Is Canara HSBC Life Insurance Company IPO Good or Bad – Detailed Review

00:00 / 00:00

Canara HSBC Life Insurance Company Limited’s IPO is set to open its initial public offering from October 10, 2025, to October 14, 2025. When considering applying for this IPO, potential investors might have questions about whether the Canara HSBC Life Insurance Company IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Canara HSBC Life Insurance Company IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Canara HSBC Life Insurance Company IPO Review

Canara HSBC Life Insurance Company Limited's IPO opens on October 10, 2025, and ends on October 14, 2025. It operates under the globally recognized "Canara" brand, specializing in the generation and distribution of major life assurance and retirement solutions (excluding general insurance) such as protection plans, savings products, and annuity plans. The company is promoted by Canara Bank (a major public sector bank) and HSBC Insurance (Asia-Pacific) Holdings Limited. It ranks the 3rd highest in Individual Weighted Premium Income (WPI) growth among bank-led insurers, supported by its extensive bancassurance channel with access to over 15,700 geographically distributed branches as of March 31, 2025. Core operations are supported by advanced IT systems in Noida and Hyderabad, with a strong focus on AI and predictive analytics.

The company operates in the highly dynamic and expansive Indian Life Insurance sector, which is projected to expand at a Total Premium CAGR of approximately 8% to 10% over the next four years ending Fiscal 2028. The industry benefits from India's robust economic growth (projected 6.8% GDP growth in FY26), a vast demographic dividend (381.5 million individuals aged 15-29 in CY23), and low penetration rates (2.8% of GDP in FY24), indicating substantial opportunity.

Canara HSBC Life Insurance Company's financial performance from FY23 to FY25 reflects strong long-term value creation. Annualized Premium Equivalent (APE) accelerated substantially to Rs 2,339.39 crore in FY25 (24% YoY growth). The Value of New Business (VNB) rose significantly to Rs 446.08 crore in FY25 (18.12% YoY increase), maintaining a strong VNB Margin of 19.07%. Embedded Value (EV) grew consistently to Rs 6,110.74 crore in FY25, delivering a high Operating Return on EV (RoEV) of 19.53% in FY25. Profit After Tax (PAT) showed steady growth to Rs 116.98 crore in FY25.

Key strengths include a strong capital position (Solvency Ratio of 200.42% as of June 30, 2025), a highly efficient bancassurance distribution model (87.07% of NBP in FY25), a high Claims Settlement Ratio of 99.38% in FY25, and high technological integration (over 99.70% digital applications). Risks involve a high distribution concentration on promoter bank Canara Bank (70.58% of Total NBP in FY25), exposure to volatile investment returns and interest rate risk from guaranteed products, and significant contingent liabilities (Rs 319.88 crores as of June 30, 2025).

The IPO is an Offer for Sale (OFS) of 23,75,00,000 shares, worth Rs 2,517.50 crores, with the entire proceeds going to the selling shareholders (Canara Bank, HSBC Insurance, and Punjab National Bank). Shares are priced in the band of Rs 100 to Rs 106 per share, with listing expected on October 17, 2025, on the NSE and BSE.

Company Overview of Canara HSBC Life Insurance Company IPO

Canara HSBC Life Insurance Company Limited operates under the globally recognized "Canara" brand, a market leader in major life assurance and retirement solutions (excluding general insurance) in India. It specialises in the generation and distribution of insurance products such as protection plans, savings products, and annuity plans. The company offers products characterized by localized, consumer-centric innovations, often leading the market in persistency rates and solvency ratios, resulting in its third-highest growth in Individual Weighted Premium Income (WPI) growth among bank-led insurers.

The company has an extensive pan-India distribution network and bancassurance channel, with an IFSC Insurance Office for international business in GIFT City, Gandhinagar. Its domestic reach is supported by access to over 15,700 geographically distributed branches as of March 31, 2025, and it has established a robust digital sales and service network. Core operations rely on advanced IT systems for seamless transaction processing in Noida and disaster recovery in Hyderabad, with continuous future plans for a greater focus on AI and predictive analytics across all functions.

As a company promoted by Canara Bank (a major public sector bank) and HSBC Insurance (Asia-Pacific) Holdings Limited, the company benefits from licensed global brand equity, financial expertise, and strong governance oversight.

Canara HSBC Life Insurance Company Limited's comprehensive value chain includes highly automated, in-house underwriting processes and the utilization of key digital tools like e-KYC and video verification. The company's leadership includes Anuj Dayal Mathur (Managing Director and Chief Executive Officer) and Tarun Rustagi (Chief Financial Officer).

Industry Overview of Canara HSBC Life Insurance Company IPO

Canara HSBC Life Insurance Company Limited operates within the highly dynamic and expansive Indian Life Insurance sector, a market intrinsically linked to India’s robust economic environment, characterized by strong real GDP growth projected to be approximately 6.8% in Fiscal Year 2026 and rapidly rising household savings and financial literacy. The industry benefits structurally from an economy reaching a demographic inflection point, driven by 381.5 million individuals aged 15-29 for the Calendar Year 2023, historically associated with accelerated consumer adoption of financial security products.

The overall life insurance premium market in India has demonstrated sustained growth, with Total Premium projected to expand at a CAGR of approximately 8% to 10% over the next four years ending Fiscal 2028. Notably, bank-led insurers are projected to grow faster, clocking 10% to 12% CAGR over the same period, signalling potent underlying distribution efficiency.

Market expansion is driven by compelling structural tailwinds, including a vast demographic dividend characterized by a youthful, aspiring consumer base, accelerating urbanization projected at 40% urban population by 2030, and an increasing focus on personal financial security. Furthermore, penetration rates remain low compared to global benchmarks, with life insurance penetration, which is a premium as a % of GDP, at 2.8% in FY24, indicating a substantial opportunity. This momentum is further fuelled by a sustained consumer shift toward protection, non-par savings, and annuity products, alongside comprehensive regulatory support through initiatives like "Insurance for All by 2047" aimed at enhancing universal coverage.

Financial Overview of Canara HSBC Life Insurance Company IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Annualized Premium Equivalent (APE) | 2,339.39 | 1,887.79 | 1,883.72 |

Operating expenses to GWP ratio | 12.39% | 13.12% | 11.62% |

Value of New Business (VNB) | 446.08 | 377.6 | NA |

VNB Margin (%) | 19.07% | 20.00% | NA |

Embedded Value (EV) | 6,110.74 | 5,179.86 | 4,271.94 |

Operating Return on EV (%) | 19.53% | 18.48% | NA |

PAT | 116.98 | 113.32 | 91.19 |

Return on Net Worth (RoNW) | 7.97% | 8.18% | 6.90% |

Note: The NA (Not Available) for the Fiscal 2023 values of VNB and Operating RoEV exists because these are specialized Non-GAAP metrics whose disclosure relies on the actuarial/Embedded Value (EV) reports, which were prepared and provided only for the more recent comparative periods of Fiscal 2024 and Fiscal 2025.

The financial performance of Canara HSBC Life Insurance Company over the three fiscal years ending March 31, 2023, 2024, and 2025 reflects a focused strategy shift, resulting in strong long-term value creation and maintaining a sound financial position, despite moderate statutory profit growth.

Annualized Premium Equivalent (APE), the core metric for new sales volume, has demonstrated encouraging growth, increasing from Rs 1,883.72 crore in FY23 to Rs 1,887.79 crore in FY24, and accelerating substantially to Rs 2,339.39 crore in FY25. This robust growth of 24.03% year-over-year in FY25 highlights the successful shift in product mix and efficiency gains within the bancassurance channel, reversing the earlier impact of exiting certain low-margin group businesses.

The company's focus on profitability and capital strength is evident in its specialized insurance metrics:

Value of New Business (VNB), which represents the expected present value of future profits from new sales, rose significantly from Rs 377.60 crore in FY24 to Rs 446.08 crore in FY25. This 18.12% YoY increase shows that the company is writing higher-quality, more profitable policies.

The VNB Margin (%), an indicator of new business profitability, remained exceptionally strong, stabilizing near the industry's best-in-class levels at 20.00% in FY24 and 19.07% in FY25, reflecting tight control over product pricing and a favorable mix towards non-linked savings and protection products.

Embedded Value (EV), the estimate of the company's total economic worth from existing business, grew consistently, increasing from Rs 4,271.94 crore in FY23 to Rs 5,179.86 crore in FY24, and further to Rs 6,110.74 crore in FY25. This translates to a strong Operating Return on EV (%) of 18.48% in FY24 and 19.53% in FY25, confirming that the core business is generating sustainable economic value far exceeding the statutory returns.

Profit After Tax (PAT) has shown steady, conservative statutory growth, increasing from Rs 91.19 crore in FY23 to Rs 113.32 crore in FY24, and marginally to Rs 116.98 crore in FY25.

Capital Efficiency and Cost Management:

The Return on Net Worth (RoNW) remained stable and healthy at 6.90% in FY23, improving to 8.18% in FY24, and standing at 7.97% in FY25.

The operational expenses to GWP ratio has shown improving efficiency, reducing from 13.12% in FY24 to 12.39% in FY25, primarily due to leveraging the low-cost bancassurance distribution model and investing heavily in digital processes.

The company's strong solvency ratio, which hovered over 200% in all periods, further underpins its fundamental financial strength, ensuring robust capital adequacy to meet regulatory requirements and support future growth.

Strengths and Risks of Canara HSBC Life Insurance Company IPO

Let's delve into the strengths and weaknesses to assess if the Canara HSBC Life Insurance Company IPO is good or bad for investors.

Strengths

Market Position and Growth: Canara HSBC is a strategically positioned private sector insurer, ranking the 3rd highest in Individual WPI growth among bank-led insurers with is 16.58% CAGR and among the fastest to achieve profitability.

High Brand Trust and Customer Focus: Leveraging the credible parentage of Canara Bank and HSBC, the company reports a rapidly improving Net Promoter Score (NPS of 75 as of June 30, 2025, up from 50 in FY23) and consistently strong claims service, reflected in a Claims Settlement Ratio of 99.38% in Fiscal 2025.

Capital Strength and Financial Prudence: The company maintains a strong financial footing, with a Solvency Ratio of 200.42% as of June 30, 2025, significantly exceeding the regulatory mandate of 150%. This is backed by an Operating Return on Embedded Value (RoEV) of 19.53% in Fiscal 2025.

Efficient Multi-Channel Distribution Model: The distribution strategy is highly optimized, primarily leveraging its bancassurance channel, which contributed 87.07% of New Business Premium in Fiscal 2025, and gained access to over 15,700 branches nationwide as of March 31, 2025.

Technological Integration and Operational Efficiency: Core operations are highly digitized, with over 99.70% of applications handled digitally and approximately 67% utilizing straight-through processing as of Q1FY26. This focus delivers efficiency, with a Total Cost Ratio of 18.70% in Fiscal 2025.

Risks

High Distribution Concentration: The business relies heavily on its bancassurance model, specifically promoter bank Canara Bank, which accounted for 70.58% of the Total NBP in Fiscal 2025, exposing the Company to significant risk from potential competition or adverse changes in renewal or distribution agreements.

Volatile Investment Returns and Interest Rate Risk: Products with guaranteed returns (43.63% of total policies in force as of June 30, 2025) expose the Company to interest rate fluctuations and reinvestment risks, necessitating effective hedging strategies that may not fully mitigate potential losses.

Regulatory and Solvency Fluctuation Risk: The business operates in a heavily regulated sector, and failure to maintain the mandated solvency ratio, which is currently at 200.42% or adverse changes to IRDAI regulations relating to surrender value rules, tax changes could negatively impact profitability and necessitate raising additional capital.

Actuarial Assumption Deviations: The Company's profitability relies on assumptions regarding mortality, morbidity, and persistency. Any material deviation of experience from these assumptions in claims, policy lapsation, or renewal rates could significantly and adversely affect future earnings and valuation.

Contingent Liabilities and Pending Legal Actions: The Company is subject to contingent liabilities totaling Rs 319.88 crores as of June 30, 2025, representing around 20.77% of Net Worth, alongside numerous pending criminal and civil proceedings involving the Company and its management, the outcomes of which remain uncertain.

Strategies of Canara HSBC Life Insurance Company IPO

Enhance Penetration in Existing Network: The core focus is to deepen engagement within the current bancassurance ecosystem, particularly leveraging Canara Bank’s vast network to segment customers and offer tailored life insurance products while utilizing AI and digital solutions to improve ease of onboarding and cross-selling.

Strengthening and Diversifying Channels: Implement a strategy to rebalance the business mix by expanding emerging channels (brokers, direct sales, digital platforms) and evaluating new partnerships (RRBs, FinTech/InsureTech) to mitigate distribution concentration risk and reach underpenetrated markets, including launching a dedicated agency channel.

Continuous Technology and Analytics Leverage: Drive organizational efficiency and improved risk management by continuing investment in IT infrastructure, particularly using AI and advanced analytics for automated underwriting, predictive engagement models, early claim detection, and robust sales governance.

Focus on Customer Centricity and Retention: Improve customer satisfaction and retention by focusing on need-based sales, launching fintech solutions such as policy assignment or loans, extending CRM capabilities, and increasing the overall digital service penetration to bolster persistency rates over the long term.

Ensure Profitable Product Portfolio Growth: Maintain a strict focus on sustainable, profitable growth by actively managing the product mix across Non-PAR, ULIP, and Annuity plans, and strengthening the protection portfolio (term, credit life) to enhance VNB margins and capitalize on market demand for high-margin products.

Canara HSBC Life Insurance Company IPO vs. Peers

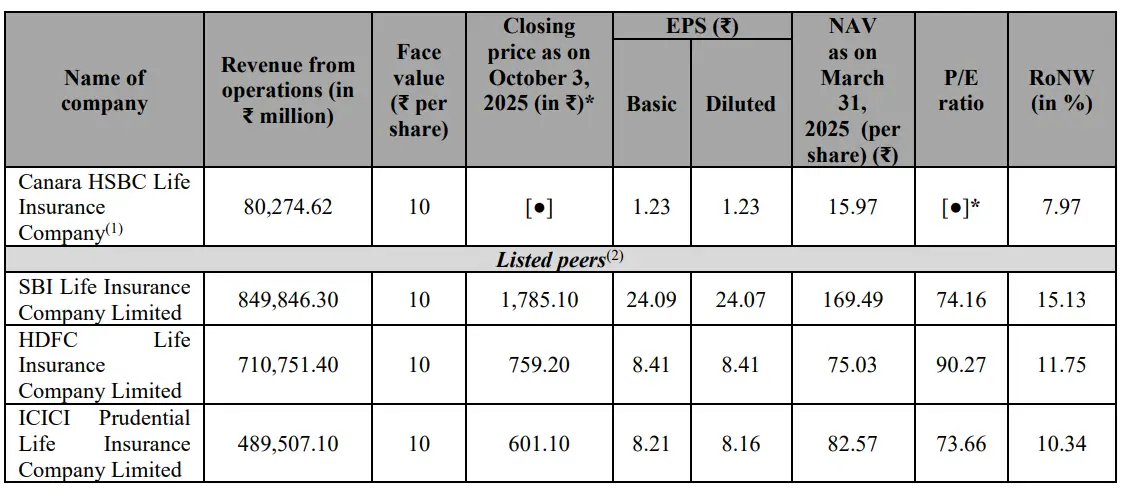

Canara HSBC maintains highly competitive costs and strong capital efficiency, even with its moderate scale. The Company achieved a Total Cost Ratio (as a percentage of GWP) of 18.70% in Fiscal 2025, demonstrating effective expense management that is competitive with larger players like ICICI Prudential Life (18.04%). While the Return on Net Worth (RoNW) for Canara HSBC stood at 7.97% (FY25), lower than SBI Life (15.13%) and HDFC Life (11.75%), its Operating Return on Embedded Value (RoEV) of 19.53% in Fiscal 2025 highlights strong underlying economic value creation. Furthermore, its Value of New Business (VNB) Margin of 19.07% in Fiscal 2025 provides a solid base for future profitability, though it trails the margins of top private players like SBI Life (27.80%) and HDFC Life (25.60%).

Operationally, Canara HSBC demonstrates strong financial prudence and service quality. Its Solvency Ratio of 205.82% as of March 31, 2025, is among the highest, surpassing both SBI Life (196.00%) and HDFC Life (194.00%), ensuring exceptional financial resilience. The Company maintains excellent customer trust with a Claim Settlement Ratio of 99.38% in Fiscal 2025, comparable to the industry's best-in-class service benchmarks. This performance is largely underpinned by its dominant bancassurance access to over 15,700 branches through promoter and partner banks, a key differentiation in the competitive landscape.

Objectives of Canara HSBC Life Insurance Company IPO

The offering consists solely of an Offer for Sale (OFS). Consequently, Canara Bank, HSBC Insurance (Asia-Pacific) Holdings Limited, and Punjab National Bank will receive the entire proceeds from the IPO issue.

Canara HSBC Life Insurance Company IPO Details

IPO Dates

Canara HSBC Life Insurance Company IPO will be open for subscription from October 10, 2025, to October 14, 2025. The allotment of shares to investors will take place on October 15, 2025, and the company is expected to be listed on the NSE and BSE on October 17, 2025.

IPO Issue Price

Canara HSBC Life Insurance Company is offering its shares in the price band of Rs 100 to Rs 106 per share. This means you would require an investment of Rs. 14,840 per lot (140 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Canara HSBC Life Insurance Company is issuing a total offer for sale of 23,75,00,000 shares, worth Rs 2,517.50 crores. The selling shareholders will receive the entire proceeds.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on October 15, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Canara HSBC Life Insurance Company will be listed on the NSE and BSE on October 17, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Canara HSBC Life Insurance Company IPO

Important IPO Details | |

Bidding Date | October 10, 2025 to October 14, 2025 |

Allotment Date | October 15, 2025 |

Listing Date | October 17, 2025 |

Issue Price | Rs 100 to Rs 106 per share |

Lot Size | 140 Shares |

FAQs:

Q1: What is the issue size of Canara HSBC Life Insurance Company Limited's IPO?

The entire issue size is offer for sale worth Rs 2,517.50 crores. The whole proceeds will be received by Canara Bank, HSBC Insurance (Asia-Pacific) Holdings Limited, and Punjab National Bank, which is the selling shareholder in this IPO.

Q2: What’s the minimum investment for the Canara HSBC Life Insurance Company IPO?

140 shares per lot, requiring Rs 14,840 (at upper band).

Q3: How does Canara HSBC Life Insurance Company compare to peers?

Canara HSBC Life Insurance Company's peers in the life insurance sector are SBI Life Insurance Company, HDFC Life Insurance Company, and ICICI Prudential Life Insurance Company. When compared to its peers, in terms of Individual Weighted Premium Income (WPI) growth, Canara HSBC outperformed its scale by achieving a 14.65% CAGR from Fiscal 2023 to Fiscal 2025, ranking it the 3rd fastest among bank-led insurers. With a Superior Solvency Ratio of 205.82% as of March 31, 2025, Canara HSBC has outperformed its peers.

Q4: Who is managing the Canara HSBC Life Insurance Company IPO?

SBI Capital Markets Limited, BNP Paribas, HSBC Securities and Capital Markets (India) Private Limited, JM Financial Limited, and Motilal Oswal Investment Advisors Limited are the book-running lead managers for the IPO.

Q5: What are Canara HSBC Life Insurance Company's latest financials?

Canara HSBC Life Insurance Company's latest financials for Fiscal 2025 include an Annualized Premium Equivalent (APE) of Rs 2,339.39 crores and a Profit After Tax (PAT) of Rs 116.98 crores. The company's Embedded Value (EV) for Fiscal 2025 was Rs 6,110.74 crores, and its Operating Return on EV (%) was 19.53%. Additionally, the company recorded a Value of New Business (VNB) of Rs 446.08 crores with a VNB Margin of 19.07% in Fiscal 2025.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category