Is Atlanta Electricals IPO Good or Bad – Detailed Review

00:00 / 00:00

Atlanta Electricals Limited is holding its initial public offering (IPO) between September 22, 2025, and September 24, 2025. The issue is valued at Rs.687.34 crore, consisting of a fresh issue of Rs.400 crore and an offer for sale of Rs.287.34 crore. The company has set a price band of Rs.718 to Rs.754 per share, with an expected listing date of September 29, 2025. Consequently, investors naturally wonder whether the Atlanta Electricals IPO is a good or bad investment opportunity. In this article, we will thoroughly review the Atlanta Electricals IPO details, business model, and financial analysis to help guide you in making your investment decision.

Atlanta Electricals IPO Review

Atlanta Electricals Limited is launching its initial public offering (IPO) with a total issue size of Rs.687.34 crore (approximately $1.8 billion). This includes a fresh issue of Rs.400.00 crore (approximately $1.8 billion), while an offer for sale (OFS) of Rs.287.34 crore (approximately $1.8 billion) is being offered by the promoters and promoter group. The IPO will be open for subscription from September 22, 2025, to September 24, 2025. The company has fixed a price band of Rs.718 to Rs.754 per share, with a lot size of 19 shares.

The proceeds raised from the fresh issue will be primarily used to partially or fully repay certain outstanding debt (Rs.79.12 crore) and for working capital requirements (Rs.210 crore). Additionally, a portion will be used for general corporate purposes.

Atlanta Electricals Limited, founded in December 1988, specializes in the manufacture of power, auto, and inverter-duty transformers. As of March 31, 2025, its product portfolio consists of six major products: power transformers, inverter-duty transformers, furnace transformers, generator transformers, and special-duty transformers. The company serves 19 states and three union territories and also exports to countries such as the United States, Kuwait, and Oman.

Financially, the company has demonstrated strong performance. In FY2025, its revenue grew 43% to Rs.1,250.49 crore, and net profit (PAT) increased 87% to Rs.118.65 crore. Its ROE is 33.91% and ROCE is 39.43%, which are better than industry standards

The company's strengths lie in its broad product portfolio, diverse customer base, strong order book, and experienced management team. However, potential investors should also consider risks such as high valuation (P/E 46.33x), fluctuations in raw material costs, and dependence on a few large clients.

Overall, the Atlanta Electricals IPO presents an opportunity for investors that could support the company's growth momentum, but it's important to evaluate both its strengths and risks before making a decision.

Company Overview of Atlanta Electricals Ltd.

Atlanta Electricals Limited was established in December 1988. The company specializes in the manufacture of power, auto, and inverter-duty transformers. As of March 31, 2025, its product portfolio includes six major categories: power transformers, inverter-duty transformers, furnace transformers, generator transformers, and special-duty transformers.

The company has five manufacturing units, four of which are currently operational. These include two units in Anand (Gujarat), one in Bengaluru (Karnataka), and one in Vadodara, which began commercial production in July 2025. This strong manufacturing network allows the company to supply a wide range of customers.

As of March 31, 2025, Atlanta Electricals has a presence in 19 states and three union territories. The company has supplied a total of 4,400 transformers, with a capacity of 94,000 MVA, to state and national grids, the private sector, and major renewable energy projects.

The company has a diverse and strong customer base. Its major customers include major names such as Gujarat Energy Transmission Corporation (GETCO), Adani Green Energy, Tata Power, and SMS India. Furthermore, the company has exported its products to international markets such as the United States, Kuwait, and Oman.

With its long presence, diverse product portfolio, and strong customer base, Atlanta Electricals Limited has established itself as a major player in the Indian transformer industry.

Industry Overview of Atlanta Electricals

The transformer industry in India is poised to grow rapidly in the coming years. Rising electricity consumption, industrial development, and the expansion of renewable energy projects have given this sector a new impetus. Large-scale modernization and expansion of the power grid is underway across the country, driving a steadily increasing demand for transformers.

The government is also focusing on strengthening the transmission and distribution (T&D) network. Investments in green energy corridors and smart grid projects are increasing nationally, which will directly benefit transformer manufacturing companies.

The demand for transformers is increasing not only in the domestic market but also globally. Renewable energy and industrial projects in the US, the Middle East, and Asian countries are creating growing export opportunities. Companies like Atlanta Electricals, which already have an international presence, can benefit from this growing demand.

Market Size & Growth :

India's transformer market was valued at approximately USD 2.44 billion in 2024 and is projected to reach USD 5.18 billion by 2033, at a CAGR of approximately 8.08%.

According to other sources, the power transformer market is expected to grow from approximately USD 2,143.9 million to USD 4,443.9 million between 2025-2033, at a CAGR of 8.5%.

The distribution transformer market is also growing. The distribution transformer market is expected to grow between USD 1.21 billion and USD 1.77 billion, at a CAGR of 4.92% for FY2025-FY2032.

Financial Overview of Atlanta Electricals

Particulars | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 |

Revenue from Operations | 5,701.41 | 8,675.53 | 8,738.83 |

Other Income | 37.54 | 44.96 | 27.73 |

Total Income | 5,738.95 | 8,720.49 | 8,766.56 |

Total Expenses | 5,024.97 | 7,847.83 | 7,662.09 |

Profit Before Tax (PBT) | 713.98 | 872.66 | 1,104.47 |

Profit After Tax (PAT) | 517.28 | 635.21 | 874.73 |

Total Comprehensive Income | 518.07 | 635.78 | 871.98 |

Revenue Growth: The company's revenue from operations grew steadily from FY22 to FY24. However, there was a slight decline from Rs.8,738.83 million in FY24 to Rs.5,701.41 million in FY25 H1 (30 Sep 2024), likely due to seasonal or project-based order bookings.

Profitability: PAT increased from Rs.553.03 million in FY22 to Rs.874.73 million in FY23 and Rs.635.21 million in FY24. The company has already reported a profit of Rs.517.28 million in FY25 H1, indicating strong results by the end of the year.

EPS: EPS of Rs.12.22 in FY23 was the company's highest level. Although it declined to Rs.8.87 in FY24, the Rs.7.23 in FY25 H1 indicates a strong performance.

Total comprehensive income: This figure has also been consistently positive, indicating financial stability.

Strengths of Atlanta Electricals

Broad & Diversified Product Portfolio : Atlanta Electricals has a strong and diverse product portfolio that meets the needs of the power sector. The company primarily specializes in transformer manufacturing and also provides a range of power distribution and transmission solutions. This diversity helps the company meet the demands of various customer segments and maintain business stability.

Strong Order Book & Customer Base : The company has a strong order book that includes projects for government institutions, large industrial customers, and export markets. Its customer base includes power distribution companies, EPC contractors, and international clients. This extensive customer network supports the company's long-term stability and growth.

Experienced Management with Industry Expertise : Atlanta Electricals' management team has decades of experience in the power and transformer industry. Experienced leadership has enabled the company to not only achieve operational efficiency but also capitalize on new projects and business opportunities in a timely manner.

Consistent Profitability in a High-Barrier Industry : The transformer industry faces barriers to entry, including technical expertise, high capital investment, and stringent regulatory norms. In such an environment, the company has maintained consistent profitability. This is a testament to its strong business model and cost management strategies.

Strong Manufacturing Capabilities with Compliance Focus : The company has modern manufacturing facilities focused on quality standards and regulatory compliance. The production units are equipped with advanced technology and operate in accordance with international quality standards. Furthermore, the company is ensuring long-term sustainable growth by adhering to sustainability and environmental regulations.

Risks of Atlanta Electricals

1. High Competition in the Power Equipment Industry : The power equipment and transformer industry already has several established players, such as ABB, Siemens, Crompton Greaves, and others. In such an environment, Atlanta Electricals may face pricing pressure and continued challenges maintaining its order book.

2. Dependency on Limited Large Clients : A significant portion of the company's revenue is dependent on a select few large clients, such as Adani, Tata, and other large EPC companies. A decrease in order flow from these clients or delays in contracts could directly impact the company's revenue.

3. Rising Raw Material Costs : Copper, steel, and other metals are required to manufacture transformers and power equipment. The prices of these commodities have fluctuated significantly in recent years. Rising raw material prices could put pressure on the company's operating margins.

4. Increasing Debt Levels : The company's total debt in FY24 was Rs. 48 crore in FY25, which increased to Rs. 141 crore. This rising debt could put pressure on the company's balance sheet and impact profitability by increasing interest expenses.

5. Valuation Concerns : The Atlanta Electricals IPO price band is offered at a high P/E multiple. Its valuation appears high compared to other players in the sector, which may raise concerns for investors about return on investment (ROI).

Strategies of Atlanta Electricals

Expansion of Vadodara Manufacturing Unit : The company is focusing on increasing the capacity of its Vadodara-based manufacturing unit. This expansion will enable the company to fulfill larger orders and increase production capacity, thereby strengthening both market share and revenue growth.

Focus on the Renewable Energy Sector : Renewable energy projects are growing rapidly in India and globally. Atlanta Electricals is paying special attention to transformer and power equipment orders from this sector. This will provide the company with an opportunity to make a significant contribution to the green energy transition and grow business with new clients.

Expansion into Export Markets : The company already supplies its products to several countries and is now focused on increasing exports to the Middle East, the U.S., and other international markets. Increasing its presence in export markets will not only strengthen the company's brand value but also increase foreign exchange revenue.

Focus on Research and Development (R&D) : Atlanta Electricals is strengthening its R&D capabilities to develop custom-built transformers and advanced power equipment. This strategy will help the company deliver technology-driven and innovation-oriented solutions, keeping it ahead of its competitors.

Atlanta Electricals IPO Peer Comparison

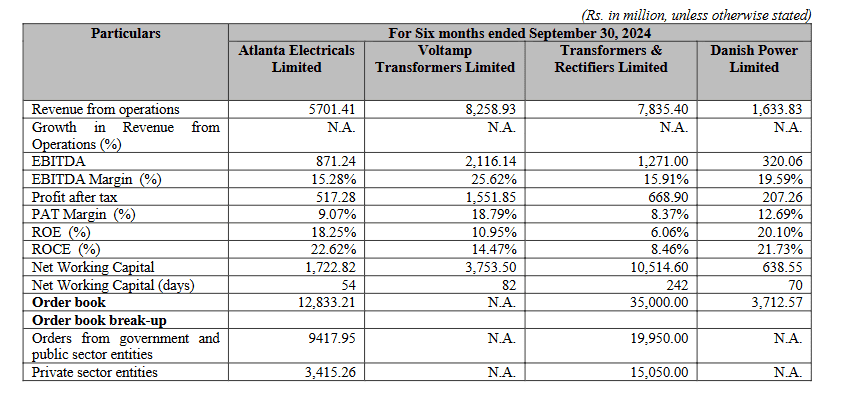

Atlanta Electricals Limited has reported strong performance in the financial year. The company's Revenue from Operations was Rs. 5701.41 million, establishing it as a stable player in the transformer and power equipment industry. In comparison, Voltamp Transformers Limited had revenues of Rs. 8258.93 million and Transformers & Rectifiers Limited had revenues of Rs. 7835.40 million. Danish Power Limited had revenues of Rs. 1633.83 million.

The company's EBITDA is Rs. 871.24 million and EBITDA Margin is 15.28%, which is considered balanced compared to the industry average. This margin is slightly lower than Voltamp Transformers (25.62%) and Danish Power (19.59%), but maintains stability. Profit After Tax (PAT) is Rs. 517.28 million and PAT Margin stood at 9.07%, which is better than Transformers & Rectifiers (8.37%).

The company's Return on Equity (ROE) is 18.25% and Return on Capital Employed (ROCE) is 22.62%, which is much stronger than competitors like Voltamp Transformers (ROE 10.95%, ROCE 14.47%) and Transformers & Rectifiers (ROE 6.06%, ROCE 8.46%). This clearly indicates that the company is creating better value for its shareholders.

Net Working Capital is Rs. 1,722.82 million and Net Working Capital Days is 54 days, making it an efficient player in the industry.

Most importantly, the company's Order Book is Rs. 12,833.21 million, of which Rs. Orders worth Rs.9417.95 million came from the government and public sectors, while orders worth Rs.3415.26 million came from the private sector. These figures reflect the company's strong and diverse customer base.

Overall, Atlanta Electricals Limited's financial position and order book indicate that the company has the potential to deliver better returns than its competitors and maintain stable growth.

Objectives of Atlanta Electricals IPO

Repayment/Prepayment of Borrowings : The Company will use a portion of its Net Proceeds (Net Proceeds) of approximately Rs.791.20 million (Rs.79.12 crore) to partially or fully repay/prepay certain existing loans. This will reduce the Company's interest burden, strengthen its debt servicing capacity, and improve its position to raise new funding in the future.

Meeting Working Capital Requirements : The Company plans to invest Rs.2,100.00 million (Rs.210 crore) of its net proceeds in working capital. This is primarily aimed at expanding production capacity, purchasing raw materials, fulfilling large orders, and providing better credit terms to customers. The Company's new Vadodara facility will play a key role in this direction, significantly increasing the Company's total installed capacity.

For General Corporate Purposes : Additionally, a portion of the net proceeds will be used for general corporate purposes. This includes marketing and brand building, exploring growth opportunities, corporate contingencies, and general business expenses. This portion will be limited to a maximum of 25% of the total gross proceeds.

Overall, Atlanta Electricals will use the funds raised through this IPO to reduce its debt, increase production and operational efficiencies, and fund strategic spending for long-term growth.

Atlanta Electricals IPO Details

IPO Dates

The Atlanta Electricals IPO will be open for subscription from September 22, 2025, to September 24, 2025. Investors are expected to receive allotment of shares on September 25, 2025, and the company's shares will be listed on the NSE and BSE on September 29, 2025.

IPO Issue Price

The company has fixed the price band per share at Rs. 718 to Rs. 754. This means that if an investor bids at the upper price band, the total investment for one lot (20 shares) will be Rs. 15,080.

IPO Size

The company is aiming to raise a total of Rs. 687.34 crore from the Atlanta Electricals IPO. This includes a fresh issue of Rs. 400 crore and an offer for sale (OFS) of Rs. 287.34 crore.

IPO Allotment Status

Investors who applied for this IPO will be able to check their allotment status on September 25, 2025. This information will be available on the websites of Registrar Kfin Technologies Limited, BSE, NSE, or through their stockbroker platform.

IPO Listing Date

Atlanta Electricals shares will be listed on both the NSE and BSE exchanges on September 29, 2025.

IPO Application Link

Open a demat account on Rupeezy today and experience a seamless IPO application experience. Rupeezy's user-friendly platform makes the IPO application process fast and hassle-free.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category