Is LG Electronics India IPO Good or Bad – Detailed Review

00:00 / 00:00

LG Electronics India Limited’s IPO is set to open its initial public offering from October 07, 2025, to October 09, 2025. When considering applying for this IPO, potential investors might have questions about whether the LG Electronics India IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive LG Electronics India IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

LG Electronics India IPO Review

LG Electronics India Limited's IPO opens on October 07, 2025, and ends on October 09, 2025. It operates under the globally recognized "LG" brand, specializing in the manufacturing and sale of major home appliances and consumer electronics (excluding mobile phones) such as refrigerators, washing machines, air conditioners, and televisions. The company is a wholly-owned subsidiary of LG Electronics Inc. (the global parent). It is a market leader in the Indian market across key product categories based on value market share in the offline channel, supported by a vast distribution network (35,640 B2C touch points) and an extensive after-sales service network (1,006 centers). Core operations are supported by two advanced manufacturing units in Noida and Pune, with plans for a third in Andhra Pradesh.

The company operates in the rapidly expanding Indian Appliances and Electronics sector, projected to grow at a CAGR of approximately 11% to reach nearly USD 129 billion by CY2029. Market expansion is driven by structural tailwinds, including low penetration rates, a youthful consumer base, and a shift toward premium, energy-efficient products, supported by government schemes like "Make in India."

LG Electronics India's financial performance from FY23 to FY25 shows strong top-line growth (Revenue from Operations CAGR of 10.70%) and improving profitability. Revenue accelerated to Rs 24,366.64 crore in FY25. EBITDA surged to Rs 3,110.12 crore in FY25, with the EBITDA margin improving to 12.76% from 9.54% in FY23. Net Profit After Tax (PAT) grew to Rs 2,203.35 crore in FY25. The company maintained exceptionally high capital efficiency with an RoCE of 42.91% in FY25. The Home Appliances and Air Solution division contributes the majority of revenue (78.37%).

Key strengths include market leadership (No. 1 in key categories like washing machines and refrigerators), exceptional operational excellence and capital efficiency (RoCE of 45.31% in FY24), an integrated and localized value chain, an extensive pan-India distribution and service network, and strong brand equity leveraged from the global parent. Risks involve reliance on the Promoter for core technology and brand, significant outstanding contingent and tax liabilities (Rs 4,717.05 crore, 73.16% of Net Worth), supply chain risks from global sourcing, and high revenue concentration in the Home Appliances and Air Solution division.

The IPO is an Offer for Sale of 10,18,15,859 shares, worth Rs 11,607.01 crores, with the entire proceeds going to the parent company, LG Electronics Inc. Shares are priced in the band of Rs 1,080 to Rs 1,140 per share, with listing expected on October 14, 2025, on the NSE and BSE.

Company Overview of LG Electronics India IPO

LG Electronics India Limited operates under the globally recognized "LG" brand, a market leader in major home appliances and consumer electronics (excluding mobile phones) in India. It specialises in the manufacturing and sale of consumer durables such as refrigerators, washing machines, air conditioners, and televisions. The company offers products characterized by localized, consumer-centric innovations, often leading the market in technology and energy efficiency, resulting in its position as the top player in the Indian market across key product categories based on value market share in the offline channel.

The company has an extensive pan-India distribution and service network, with products exported to 47 countries across Asia, Africa, and Europe. Its domestic reach is supported by 35,640 B2C touch points and one of the largest after-sales service networks (1,006 centers as of June 30, 2025). Core operations rely on two advanced manufacturing units in Noida and Pune, with future plans for a third manufacturing unit in Andhra Pradesh. As a wholly-owned subsidiary of LG Electronics Inc. (the global parent), the company benefits from licensed global R&D, technology, and strong brand equity. The Indian subsidiary paid Rs 454.61 crores (1.87% of Operational Revenue) of Royalty for technology use and brand name to the parent company in Fiscal 2025.

LG Electronics India's comprehensive value chain includes highly automated, in-house manufacturing processes and the production of key components like compressors and motors. The company's leadership includes Hong Ju Jeon (Managing Director) and Dongmyung Seo (Whole-time Director and CFO). As of the three months ended June 30, 2025, revenue is heavily concentrated in the Home Appliances and Air Solution division (78.37%), with the Home Entertainment division contributing 21.63% of revenue from continuing operations.

Industry Overview of LG Electronics India IPO

LG Electronics India Limited operates within the highly dynamic and expansive Indian Appliances and Electronics sector, a market intrinsically linked to India’s robust economic environment, characterized by strong real GDP growth of approximately 6.5% in Calendar Year (CY) 2024 and rapidly rising consumption expenditures. The industry benefits structurally from an economy reaching a per capita GDP inflection point, projected to be approximately USD 2,878 in CY2025P (projected), historically associated with accelerated consumer adoption of home durables.

The overall appliances and electronics market in India has demonstrated sustained growth, expanding at a Compound Annual Growth Rate (CAGR) of approximately 7% from CY2019 to CY2024. This market, estimated at around USD 75 billion in CY2024, is projected to accelerate significantly, reaching nearly USD 129 billion by CY2029P, reflecting an anticipated CAGR of 11%. Notably, the Total Addressable Market (TAM) excluding mobile phones is projected to expand at an even higher CAGR of approximately 14% over the same period, signalling potent underlying demand for major home appliances and consumer electronics.

Market expansion is driven by compelling structural tailwinds, including a vast demographic dividend characterized by a youthful, aspiring consumer base, accelerating urbanization, and the nuclearization of families, which collectively increase the effective household count. Furthermore, penetration rates remain low compared to global benchmarks, such as refrigerators around 35% and washing machines around 22%, indicating substantial opportunity. This momentum is further fueled by a sustained consumer shift toward premium, feature-rich, and energy-efficient products, alongside comprehensive governmental support through "Make in India" and Production-Linked Incentive (PLI) schemes aimed at enhancing domestic manufacturing capabilities.

Within this intensely competitive environment, comprising a dominant domestic market, low cost manufacturing hubs like China, and technology-focused Global players, LGEIL has maintained a position of market leadership, ranking as the number one player in major home appliances and consumer electronics (excluding mobile phones) in India for the six months ended June 30, 2025, and the preceding three calendar years.

Financial Overview of LG Electronics India IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Revenue from Operations | 24,366.64 | 21,352.00 | 19,868.24 |

EBITDA | 3,110.12 | 2,224.87 | 1,895.12 |

EBITDA Margin (%) | 12.76% | 10.42% | 9.54% |

PAT | 2,203.35 | 1,511.07 | 1,344.93 |

PAT Margin (%) | 8.95% | 7.01% | 6.69% |

RoE (%) | 37.13% | 40.45% | 31.13% |

RoCE (%) | 42.91% | 45.31% | 34.38% |

The financial performance of LG Electronics India over the three fiscal years ending March 31, 2023, 2024, and 2025 reflects strong top-line growth and improving profitability, driven by increasing sales volume in core categories and enhanced operational efficiency.

Revenue from Operations has shown a significant upward trend, increasing from Rs 19,868.24 crore in FY23 to Rs 21,352.00 crore in FY24, and accelerating substantially to Rs 24,366.64 crore in FY25. This robust, double-digit growth in FY25 (14.12% YoY) was primarily driven by strong demand in the Home Appliances and Air Solution division, alongside strategic expansion and market leadership in key product segments like washing machines, refrigerators, and air conditioners.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) has seen a remarkable increase, reflecting improved operational leverage and cost control. It rose sharply from Rs 1,895.12 crore in FY23 to Rs 2,224.87 crore in FY24, and surged to Rs 3,110.12 crore in FY25. Crucially, the EBITDA margin improved consistently, rising from 9.54% in FY23 to 10.42% in FY24, and achieving an impressive 12.76% in FY25, indicating that the company is effectively translating top-line growth into operational profit.

Profit After Tax (PAT) has consistently grown, demonstrating the company's ability to translate strong operational performance into bottom-line profitability. PAT increased from Rs 1,344.93 crore in FY23 to Rs 1,511.07 crore in FY24, and jumped to Rs 2,203.35 crore in FY25 (a 45.81% jump year-over-year). The PAT margin reflects this strength, climbing steadily from 6.69% in FY23 and 7.01% in FY24 to reach 8.95% in FY25.

In terms of Return on Equity (RoE), the company maintained an exceptionally high return profile, demonstrating efficient utilization of shareholders' capital. RoE stood at 31.13% in FY23, accelerated sharply to 40.45% in FY24, and remained robust at 37.13% in FY25.

Return on Capital Employed (ROCE) highlights capital efficiency and minimal external debt. ROCE significantly improved from 34.38% in FY23 to a peak of 45.31% in FY24, and remained exceptionally high at 42.91% in FY25. This performance underscores the benefits of efficient domestic manufacturing capabilities and tightly managed working capital cycles.

Strengths and Risks of LG Electronics India IPO

Let's delve into the strengths and weaknesses to assess if the LG Electronics India IPO is good or bad for investors.

Strengths

Market Leadership: LGEIL is the clear number one player in the Indian major home appliances and consumer electronics market for the six months ended June 30, 2025, and the preceding three calendar years, based in terms of value in the offline channel. This includes market leadership across key categories such as washing machines (33.5% market share) and refrigerators (29.9% market share) as of June 30, 2025.

Operational Excellence and Capital Efficiency: The Company demonstrates high efficiency metrics, including a Return on Capital Employed (RoCE) of 45.31% in Fiscal 2024, which is significantly above the average of leading competitors around 17% and a net working capital cycle of 15.95 days in the same period.

Integrated Value Chain and Localization: LGEIL operates a robust, highly localized value chain with two advanced manufacturing units in Noida and Pune, contributing 85.51% of overall sales in the three months ended June 30, 2025. It maintains a strong localization focus, sourcing 54.12% of raw materials from Independent third parties in the three months ended June 30, 2025.

Extensive Distribution and Service Network: The Company manages one of the largest distribution networks in India, comprising 35,640 B2C touchpoints, supported by 1,006 service centers as of June 30, 2025. This scale ensures superior pan-India market coverage and after-sales service quality.

Technological Innovation and Brand Equity: Leveraging the global R&D leadership of its Promoter, LG Electronics, LGEIL has a track record of introducing industry-first technologies in India, such as being the first company to introduce OLED TVs in 2015, and benefitting from the strong, trusted "LG" brand image.

Risks

Reliance on Promoter for Core Technology and Brand: LGEIL's business operations, including product innovation, design, and manufacturing know-how, are fundamentally dependent on technologies licensed from its Promoter, LG Electronics. Any adverse change in this relationship or the License Agreement could impact the business.

Significant Contingent and Tax Liabilities: The Company faces outstanding contingent tax claims totaling Rs 4,717.05 crores, representing approximately 73.16% of its Net Worth as of June 30, 2025. This includes a contingent royalty-related liability of Rs 315.3 crores as of June 30, 2025.

Supply Chain and Raw Material Risk: Operations rely on global sourcing, with 45.88% of raw materials sourced outside India in the three months ended June 30, 2025, and the top 10 suppliers contributed 32.25% of raw material purchases during the same period, exposing the Company to risks related to geopolitics, commodity prices, and supply interruptions.

Product and Segment Concentration: The Company derives a majority of its revenue, which stands at 78.37% in the three months ended June 30, 2025, from its Home Appliances and Air Solution division, making the business sensitive to demand fluctuations within this segment, particularly for refrigerators, washing machines, and air conditioners.

Foreign Currency Exchange Rate Fluctuations: Given the significant value of raw material imports and exports to overseas markets, the Company's financial results are exposed to material foreign currency risk, despite mitigation through hedging strategies.

Strategies of LG Electronics India IPO

Expanding Footprint and Manufacturing Capacity: LGEIL plans a major investment of around Rs 5,001 crores to establish a third manufacturing unit in Andhra Pradesh (expected to be operational by Fiscal 2027), primarily focusing on air conditioners or compressors initially, to boost production capacity and capitalize on market growth significantly.

Driving Premiumization and Portfolio Diversification: The core strategy is to position the "LG" brand as the household choice across all segments, focusing heavily on premium products such as AI integration, LG ThinQ connectivity, and luxurious design to increase average selling prices, while expanding into emerging categories like built-in kitchens.

Deepening B2B and Service Offerings: The Company seeks to diversify its revenue streams by penetrating deeper into the B2B market (Commercial HVAC, specialized displays) and expanding the high-margin recurring Annual Maintenance Contract (AMC) service offerings, such as the "Careship" subscription program for both B2C and B2B consumers.

Strengthening Distribution and Omnichannel Presence: Plans include continuously expanding the physical B2C distribution network into smaller towns, increasing the number of exclusive LG BrandShops, and simultaneously enhancing the online presence through its D2C website and partnerships with new commerce platforms like quick commerce.

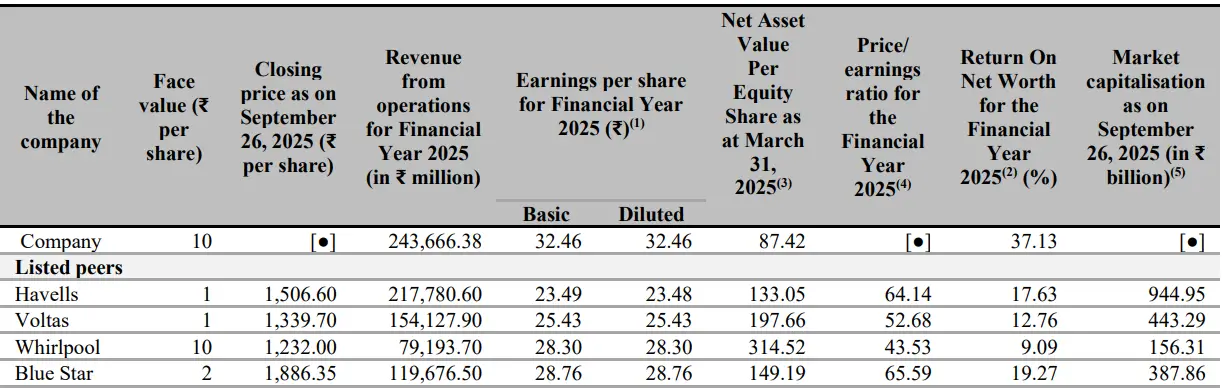

LG Electronics India IPO vs. Peers

LGEIL consistently achieved significantly superior profitability and returns in FY25. The Company delivered an EBITDA Margin of 12.76% and a Net Profit Margin of 8.95%. This profitability significantly outstrips several competitors, such as Voltas Ltd.'s 6.42% EBITDA Margin and Whirlpool of India Ltd.'s 7.04% EBITDA Margin. Furthermore, LGEIL showcased exceptional capital efficiency, recording a Return on Capital Employed (RoCE) of 42.91%. This metric is markedly higher than peers like Blue Star Ltd. (22.00% RoCE) and Havells India Ltd. (19.98% RoCE), highlighting LGEIL’s efficient deployment of capital.

Operationally, LGEIL demonstrates dominant market penetration and comprehensive product leadership. It held the largest market share in India across key categories in the first half of CY2025, including 33.5% in Washing Machines and 29.9% in Refrigerators (offline channel). Furthermore, the Company maintains a strong global presence, generating Rs 1,452.25 crores in export revenue in FY25, supported by one of the largest pan-India distribution and service networks in the industry.

Objectives of LG Electronics India IPO

The offering consists solely of an Offer for Sale (OFS). Consequently, LG Electronics Inc., the parent company based in South Korea, will receive the entire proceeds from the IPO issue.

LG Electronics India IPO Details

IPO Dates

LG Electronics India IPO will be open for subscription from October 07, 2025, to October 09, 2025. The allotment of shares to investors will take place on October 10, 2025, and the company is expected to be listed on the NSE and BSE on October 14, 2025.

IPO Issue Price

LG Electronics India is offering its shares in the price band of Rs 1,080 to Rs 1,140 per share. This means you would require an investment of Rs. 14,820 per lot (13 shares) if you are bidding for the IPO at the upper price band.

IPO Size

LG Electronics India is issuing a total offer for sale of 10,18,15,859 shares, worth Rs 11,607.01 crores. The selling shareholders will receive the entire proceeds.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on October 10, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of LG Electronics India will be listed on the NSE and BSE on October 14, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for LG Electronics India IPO

Important IPO Details | |

Bidding Date | October 07, 2025 to October 09, 2025 |

Allotment Date | October 10, 2025 |

Listing Date | October 14, 2025 |

Issue Price | Rs 1,080 to Rs 1,140 per share |

Lot Size | 13 Shares |

FAQs:

Q1: What is the issue size of LG Electronics India Limited's IPO?

The entire issue size is offer for sale worth Rs 11,607.01 crores. The whole proceeds will be received by LG Electronics Inc., which is the selling shareholder in this IPO.

Q2: What’s the minimum investment for the LG Electronics India IPO?

13 shares per lot, requiring Rs 14,820 (at upper band).

Q3: How does LG Electronics India compare to peers?

LG Electronics India's peers in the appliances and electronics sector are Havells India, Voltas, Blue Star, and Whirlpool of India. When compared to its peers, in terms of Revenue from Operations, LGEIL outperformed by achieving a scale of Rs 24,366.63 crores in Fiscal 2025, surpassing Havells India and Voltas in turnover. With a Superior RoCE of 42.91% in FY25, LGEIL significantly outperformed peers like Blue Star and Havells India, highlighting its exceptional capital efficiency.

Q4: Who is managing the LG Electronics India IPO?

Axis Capital Limited, Citigroup Global Markets India Private Limited, Morgan Stanley India Company Private Limited, J.P. Morgan India Private Limited, and BofA Securities India Limited are the book-running lead managers for the IPO.

Q5: What are LG Electronics India's latest financials?

LG Electronics India's latest financials for Fiscal 2025 include a Revenue from Operations of Rs 24,366.64 crores and a Profit After Tax (PAT) of Rs 2,203.35 crores. The company's EBITDA for Fiscal 2025 was Rs 3,110.12 crores, and its PAT Margin was 8.95%.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category