Is Ivalue Infosolutions IPO Good or Bad – Detailed Review

00:00 / 00:00

Ivalue Infosolutions Limited's IPO is set to open its initial public offering from September 18, 2025, to September 22, 2025. When considering applying for this IPO, potential investors might have questions about whether the Ivalue Infosolutions IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Ivalue Infosolutions IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Ivalue Infosolutions IPO Review

Ivalue Infosolutions Limited's IPO is a book-built issue worth Rs 560.29 crores, consisting entirely of an offer for sale of 1,87,38,958 shares. The IPO will be open for subscription from September 18, 2025, to September 22, 2025, with a price band of Rs 284 to Rs 299 per share and a lot size of 50 shares. The net proceeds from the offer will be received by the selling shareholders, including the promoters and other individuals.

Ivalue Infosolutions is an enterprise technology solutions specialist and a value-added distributor (VAD) in India, focusing on securing and managing digital applications and data for large enterprises. The company's offerings are primarily in cybersecurity, information lifecycle management, data center infrastructure, and application lifecycle management. It operates with a network of 109 OEM partners and 804 system integrators, serving 2,877 enterprise customers across India and six international markets. The business model is centered on providing high-margin, solutions-led services rather than being a traditional IT hardware distributor.

Financially, Ivalue Infosolutions has shown consistent growth in revenue and profit over the last three fiscal years. Revenue from operations increased from Rs 796.83 crore in Fiscal 2023 to Rs 922.68 crore in Fiscal 2025, with a slight dip in Fiscal 2024 due to a strategic change in revenue recognition policy. The company's Profit After Tax (PAT) has consistently increased from Rs 59.92 crore in Fiscal 2023 to Rs 85.30 crore in Fiscal 2025. It has maintained healthy profit margins, with an EBITDA margin of 13.99% and a PAT margin of 9.05% in Fiscal 2025, which are considerably higher than its peer comparison companies.

Key strengths of the company include its leading position in the fast-growing technology solutions market, a diverse and expanding network of OEM partners and SIs, a high-margin business model, and an experienced management team. Potential risks, however, include a high dependency on a small number of key OEMs and system integrators, non-exclusive and short-term agreements, a working capital-intensive business, and a history of negative cash flows from operations.

Company Overview of Ivalue Infosolutions IPO

Ivalue Infosolutions Limited is an enterprise technology solutions specialist based in India. The company provides comprehensive, purpose-built solutions for securing and managing digital applications and data, primarily serving large enterprises undergoing digital transformation. It acts as a value-added distributor (VAD), working with System Integrators (SIs) and Original Equipment Manufacturers (OEMs) to identify, recommend, and deploy solutions. According to Frost & Sullivan (F&S), Ivalue is one of India's fastest-growing technology services and solutions integrators.

The company's business model is centered on aggregating value for its customers, partners, and OEMs. It offers a diverse portfolio of products and services, including:

Cybersecurity: Integrated threat detection, response, and consulting services.

Information Lifecycle Management (ILM): Solutions for data protection, storage, and compliance.

Data Center Infrastructure (DCI): Services for on-premise, hybrid, and edge architectures.

Application Lifecycle Management (ALM) & Cloud: Solutions for development, deployment, and security in cloud environments.

Professional and Managed Services: This includes services like managed security, infrastructure management, and technical support.

As of March 31, 2025, the company had a network of 109 OEM partners, including leading names such as Check Point, Forcepoint, Hitachi, Tenable, Yubico, Imperva, Arista, Splunk, Nutanix, and Google Cloud. The company's network of System Integrators grew from 567 in Fiscal 2023 to 804 in Fiscal 2025, and the number of enterprise customers served increased from 1,804 in Fiscal 2023 to 2,877 in Fiscal 2025.

The company is headquartered in Bengaluru with offices across eight Indian locations and an international presence in six markets: Singapore, Bangladesh, Sri Lanka, the UAE, Cambodia, and Kenya. Its leadership team includes co-founders Sunil Kumar Pillai (Chairman and Managing Director), Krishna Raj Sharma (Executive Director), and Srinivasan Sriram (Chief Strategy Officer). The gross sales billed to the customers stood at Rs 2,439.37 crore as of Fiscal 2025, out of which 46.89% from Cybersecurity, 21.95% from Information Lifecycle Management, 17.03% from Data Center Infrastructure, and the remaining 14.13% from Others.

Industry Overview of Ivalue Infosolutions IPO

Ivalue Infosolutions operates within the global and Indian IT transformation market, which is experiencing significant growth. The company's focus areas, such as cybersecurity, information lifecycle management, data center infrastructure, ALM, and managed services, are key drivers of this expansion.

Several factors that drive the industry's growth:

Market Growth: According to F&S, the total addressable market (TAM) for these IT transformation segments in India is projected to grow at a CAGR of 23.1% from USD 22.7 billion in 2024 to USD 78.9 billion by 2030.

Technological Advancements: The accelerated digital transformation of enterprises is driving demand for solutions in cloud computing, data analytics, and cybersecurity. India is also becoming a data center hub, attracting significant investments from global tech giants.

Cybercrime and Compliance: The increasing frequency and sophistication of cyber threats, along with stringent regulatory requirements, are pushing businesses to invest heavily in robust cybersecurity solutions and services. The Indian cybersecurity market is expected to reach USD 16.4 billion by 2030, growing at a CAGR of 19.3% from 2024.

Competition: The market is highly competitive, and the company's prospectus notes that there are no directly listed peers in India with a comparable business model.

The company's position as a value-added distributor and technology enabler allows it to capitalize on this market growth by bridging the gap between OEMs and SIs, providing a wide range of solutions, and offering a deep bench of technical expertise.

Financial Overview of Ivalue Infosolutions IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crores) | March 31, 2023 (Rs crore) |

Revenue from operations | 922.68 | 780.23 | 796.83 |

EBITDA | 129.13 | 111.06 | 88.821 |

EBITDA Margin | 13.99% | 14.23% | 11.15% |

Profit after tax | 85.3 | 70.57 | 59.917 |

PAT Margin | 9.05% | 8.87% | 7.44% |

Return on Equity (RoE) | 20.49% | 21.13% | 29.15% |

Days Sales Outstanding | 125 | 116 | 141 |

The financial performance of Ivalue Infosolutions over the three fiscal years ending March 31, 2023, 2024, and 2025 highlights a significant shift in profitability and operational efficiency.

Revenue from operations shows growth from Rs 796.83 crore in Fiscal 2023 to Rs 780.23 crore in Fiscal 2024, and then increased to Rs 922.68 crore in Fiscal 2025. The company experienced a slight decline in revenue in Fiscal 2024 compared to Fiscal 2023, decreasing by 2.08%. This was primarily due to a change in the revenue recognition policy for software and allied support services.

EBITDA has shown an upward trend, increasing from Rs 88.82 crore in Fiscal 2023 to Rs 111.06 crore in Fiscal 2024, and further to Rs 129.13 crore in Fiscal 2025. The corresponding EBITDA Margin was 11.15% in Fiscal 2023, increasing to 14.23% in Fiscal 2024, and then slightly decreasing to 13.99% in Fiscal 2025. This shows improved operational efficiency over the period.

Profit After Tax (PAT) has consistently increased over the three years, from Rs 59.92 crore in Fiscal 2023 to Rs 70.57 crore in Fiscal 2024, and then significantly to Rs 85.30 crore in Fiscal 2025. The PAT margin also showed a consistent upward trend, from 7.44% in Fiscal 2023 to 8.87% in Fiscal 2024, and then to 9.05% in Fiscal 2025.

Return on Equity (RoE) was 29.15% in Fiscal 2023, decreasing to 21.13% in Fiscal 2024, and then to 20.49% in Fiscal 2025. Days Sales Outstanding (DSO) was 141 days in Fiscal 2023, improving to 116 days in Fiscal 2024, but increasing slightly to 125 days in Fiscal 2025.

In summary, Ivalue Infosolutions has demonstrated consistent growth in profit and improved profitability margins over the last three fiscal years, despite a minor dip in revenue in Fiscal 2024 due to a change in accounting policy. The company has maintained healthy operational efficiency and continues to generate positive returns for its equity holders.

Strengths and Risks of Ivalue Infosolutions IPO

Let's delve into the strengths and weaknesses to assess if the Ivalue Infosolutions IPO is good or bad for investors.

Strengths

Diverse and Expanding Partnerships: Ivalue Infosolutions has a growing network of OEM partners, increasing from 93 in Fiscal 2023 to 109 in Fiscal 2025. The company has long-standing relationships with key OEMs, with 19 partnerships lasting over 10 years, 38 lasting over six years, and 84 lasting more than three years as of March 31, 2025. This extensive network allows the company to offer a comprehensive portfolio of multi-OEM solutions and services.

Strong Growth and Financial Performance: The company has shown consistent financial growth, with a compound annual growth rate (CAGR) of 16.07% for gross sales from Fiscal 2023 to Fiscal 2025. Its high return on equity (RoE) and return on capital employed (RoCE) indicate efficient use of shareholder funds and capital.

Specialized and Value-Added Offerings: Ivalue is positioned as a technology enabler and strategic advisor, moving beyond traditional distribution to provide value-added services. The company leverages its deep domain expertise to design and deploy customized solutions, including over 30 pre-integrated multi-OEM stacks for various industries and applications. This approach provides higher margins compared to traditional IT hardware distributors.

Expanding Customer and Partner Ecosystem: The company's customer base has grown significantly, with the number of system integrators (SIs) increasing from 567 in Fiscal 2023 to 804 in Fiscal 2025, and enterprise customers growing from 1,804 to 2,877 over the same period. This diversification helps to mitigate dependency on a few large accounts.

Experienced Leadership and Skilled Workforce: The company's business is led by experienced promoters, including Sunil Kumar Pillai, Krishna Raj Sharma, and Srinivasan Sriram, who have extensive experience in the IT and software solutions sector. Over 50% of the company's employees are technically qualified, collectively holding over 1,011 OEM certifications as of March 31, 2025.

Risks

High Dependency on a Limited Number of OEMs and SIs: In Fiscal 2025, a significant portion of the company's gross sales (63.02%) was derived from its top 10 OEMs. The loss of or a material change in terms of these key partners could adversely affect the business. Similarly, the company's gross sales billed to customers heavily rely on a small number of System Integrators.

Non-exclusive and Short-term Agreements: Ivalue enters into non-exclusive agreements with OEMs and SIs that often lack long-term commitments and can be terminated without cause, typically with short notice periods. The non-renewal or early termination of such agreements could adversely affect the company's business and financial condition.

Working Capital Intensive Operations: The business is working capital intensive, particularly due to the need to finance the purchase of products from OEMs before receiving payment from SIs. This could be a challenge if payment terms with SIs become less favorable.

Negative Cash Flows: The company has experienced negative cash flows from operations in the past, and there is no assurance that it will have positive net cash flows in the future.

Competition and Pricing Pressure: Ivalue operates in a highly competitive market and faces pressure from other resellers and Value-Added Distributors (VADs). This competition can limit pricing flexibility and impact margins.

Strategies of Ivalue Infosolutions IPO

Capitalize on Market Growth: The company aims to leverage the rapid growth of the Indian enterprise technology solutions market, particularly in high-growth areas like cybersecurity, data center infrastructure, and ALM.

Expand Partner and Customer Portfolio: Ivalue's strategy involves continuing to expand its portfolio of OEMs, SIs, and end-customers. It plans to use its existing relationships to generate cross-selling and up-selling opportunities, with a focus on growing in newer product categories.

Focus on ALM and Hybrid Cloud: The company is strategically focused on expanding its offerings in application lifecycle management and hybrid cloud solutions to cater to the growing demand for cloud-native applications and flexible infrastructure solutions.

Enhance Value-Added Services: Ivalue plans to continue its evolution as a technology enabler by offering a comprehensive suite of value-added services, including pre-sales, post-sales, implementation, and 24x7 managed services. The company's "Ivalue Centre of Excellence" (Ivalue CoE) platform is a key part of this strategy, allowing for faster and risk-free evaluation of multi-OEM solutions.

Ivalue Infosolutions IPO vs. Peers

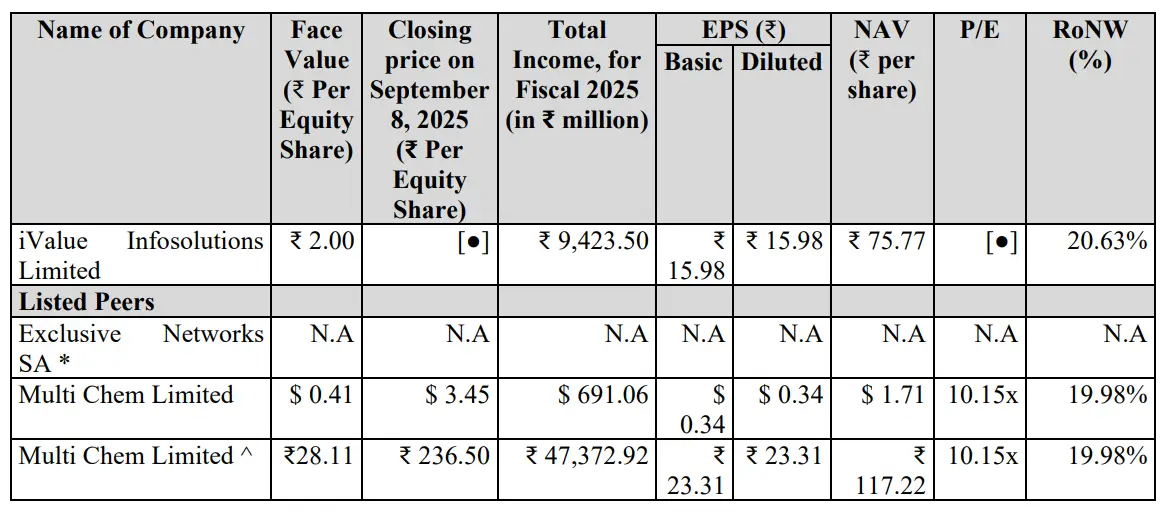

In Fiscal 2025, Ivalue Infosolutions' revenue from operations was Rs 922.68 crore, showing a growth of 18.26% year-on-year from Rs 780.23 crore in Fiscal 2024. The company's gross sales billed to customers increased to Rs 2,439.37 crore in Fiscal 2025 from Rs 2,110.48 crore in Fiscal 2024, a CAGR of 16.07% from Fiscal 2023. This is lower than its peer, Multi-Chem Limited, which reported revenue of Rs 4,302.63 crore for the year ended December 31, 2024, and significantly lower than Exclusive Networks S.A.'s revenue of Rs 14,288.07 crore for the year ended December 31, 2023.

Ivalue's profitability metrics are strong, reflecting efficient operations. For Fiscal 2025, its EBITDA margin was 13.99%, and its net profit after tax (PAT) margin stood at 9.05%. These margins are considerably higher than its peers. In comparison, Multi-Chem Limited reported an EBITDA margin of 6.18% and a PAT margin of 4.46% for the year ended December 31, 2024. Similarly, Exclusive Networks S.A. reported an EBITDA margin of 8.15% and a PAT margin of 2.89% for the year ended December 31, 2023.

The company's return metrics highlight its efficient use of capital. Ivalue's Return on Equity (RoE) was 20.49% for Fiscal 2025. This is comparable to Multi-Chem Limited's RoE of 20.66% for the year ended December 31, 2024, but significantly higher than Exclusive Networks S.A.'s RoE of 4.50% for the year ended December 31, 2023.

Objectives of Ivalue Infosolutions IPO

This offer comprises a complete offer for sale. The net proceeds from the offer for sale will be received by the selling shareholders, namely Sunil Kumar Pillai, Krishna Raj Sharma, Srinivasan Sriram, Sundara (Mauritius) Limited, Venkatesh R, Subodh Anchan, Roy Abraham Yohannan, Hilda Sunil Pillai, Brijesh Shrivastava, L Nagabushana Reddy, Ran Vijay Pratap Singh, Ravindra Kumar Sankhla, and Venkata Naga Swaroop Muvvala.

Ivalue Infosolutions IPO Details

IPO Dates

Ivalue Infosolutions IPO will be open for subscription from September 18, 2025, to September 22, 2025. The allotment of shares to investors will take place on September 23, 2025, and the company is expected to be listed on the NSE and BSE on September 25, 2025.

IPO Issue Price

Ivalue Infosolutions is offering its shares in the price band of Rs 284 to Rs 299 per share. This means you would require an investment of Rs. 14,950 per lot (50 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Ivalue Infosolutions is planning to sell shares through an offer for sale, totalling 1,87,38,958 shares, which are worth Rs 560.29 crores.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on September 19, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Ivalue Infosolutions will be listed on the NSE and BSE on September 25, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Ivalue Infosolutions IPO

Important IPO Details | |

Bidding Date | September 18, 2025 to September 22, 2025 |

Allotment Date | September 23, 2025 |

Listing Date | September 25, 2025 |

Issue Price | Rs 284 to Rs 299 per share |

Lot Size | 50 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category