Best ESG Funds in India and How to Invest in Them

00:00 / 00:00

Have you ever considered how your investments can not only increase your wealth but also have a positive impact on the world? In recent years, many investors have begun to look beyond profits, preferring to invest in companies that care about the environment, people, and ethical practices. This growing shift in investment mindset has resulted in the emergence of a distinct category of funds known as ESG Funds.

These funds are gaining traction among both individual and institutional investors due to their balanced approach to financial returns and social responsibility. While the concept may appear to be modern, its core principles are based on long-term sustainability and accountability, both of which are becoming increasingly important in the modern world.

In this article, we will look at what ESG mutual funds are, what they stand for, and why they are becoming an important part of many portfolios. Whether you're a first-time investor or want to invest more responsibly, this article will help you know more about ESG funds.

What are ESG Mutual Funds?

ESG stands for Environmental, Social, and Governance. These are mutual funds that invest in companies that meet specific criteria based on ESG parameters, known as environmental, social, and governance, to promote sustainability. The ESG focuses on three key factors: it is possible to analyse a company's ethical impact and sustainability practices while promoting positive impact on society, while delivering returns for its investors.

Environmental Factor focuses on how a company has an impact on the environment, which includes carbon emissions, energy efficiency, reduced waste management, water conservation, recycling practices, and pollution control.

Social Factor focuses on how the company interacts with its employees and communities, such as paying fair wages, promoting equality, ensuring safe working conditions, protecting customer privacy, etc.

Governance Factor will look into how the company is managed and controlled while focusing on its leadership structure, behavioural ethics, and shareholder rights.

Why are They Becoming Popular in India?

ESG (Environmental, Social, and Governance) funds are becoming increasingly popular in India as investors shift toward sustainable and socially responsible investing. Unlike regular mutual funds that consider business and financial performance, ESG funds choose companies based on their ethical practices, environmental sustainability, and governance standards.

This shift is being driven by a growing understanding among modern investors of the long-term impact of their investments on society and the environment. Global influences, such as the United Nations Principles for Responsible Investment, are also encouraging investors to consider ESG factors when making investment decisions.

As a result, companies had to improve their governance, ethical behaviour, and environmentally friendly operations to remain appealing to investors. With the increasing regulatory compliance and shifting investor expectations, ESG compliance is no longer a trend but a strategy for companies seeking funding and long-term growth.

How does ESG Investing Work?

ESG investing considers companies that not only make profits but also care about the environment, treat employees fairly, and use good management practices. In India, ESG scores given by rating agencies like CRISIL Ratings, CareEdge Ratings, and ICRA help investors to know how well a company follows these values. India’s market regulator, the Securities and Exchange Board of India (SEBI), said that the top 150 listed companies are to report their ESG progress and efforts in the annual report, which promotes transparency. Companies that perform well in the ESG parameters attract more investors, reduce risks, and increase competitiveness.

How ESG Scores are Given to Companies

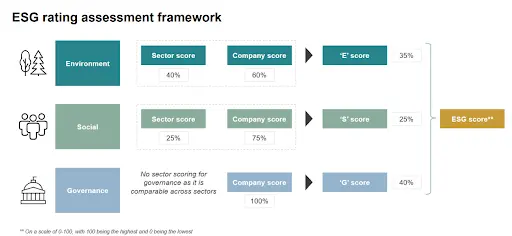

An ESG score indicates how responsible and sustainable a company is in terms of ESG parameters (Environmental, Social, and Governance), which promote sustainability. In India, this score is calculated by analysing many data points. If we look at a rating agency, let’s say Crisil ESG Ratings, they use a proprietary methodology that assesses more than 500 Key Performance Indicators (KPIs) spread across around 65 sectors.

Each indicator is given a performance-based score, with more important issues receiving more weight. The company's risk management practices are also being evaluated. All of these scores are combined to get an overall ESG score. Taking Crisil ESG Ratings as an example, they assess the parameters based on the following criteria:

The ESG score is divided into three major categories: environmental, social, and governance, which are further subdivided into themes and key issues. These criteria help investors understand a company's sustainability and ethics.

Difference between ESG Fund and Regular Mutual Fund

As we understood how rating agencies assess ESG, we will look at the key differences between ESG Funds and Regular Mutual Funds:

Aspect | ESG Fund | Mutual Fund |

Meaning | A type of mutual fund that invests in companies that meet ESG standards and prioritise long-term growth. | An investment fund that pools money from various investors to purchase securities, such as stocks, bonds, or other assets. |

Objective | These funds aim to provide decent financial returns while also positively impacting the environment and society. | The primary goals of a mutual fund are capital appreciation, income generation, and risk diversification. |

Investment Criteria | Invest in companies that have received good ratings on the ESG factors with sustained growth. | Invest in the company's profitability, historical performance, growth, and other parameters. |

Ideal for investors | It is ideal for investors who are impact-focused and cautious investors seeking sustainability and long-term value. | It is ideal for investors who are seeking a long-term investment and benefit from diversification. |

Top 10 ESG Funds in India

As we looked into the differences, here we will look at some of the top 10 ESG funds in India:

Name of ESG Fund | NAV | AUM (in crores) | 3 years' returns |

Rs. 258.93 | Rs. 5,555.82 | 16.50% | |

Rs. 23.53 | Rs. 1,487.89 | 22.53% | |

Rs. 22.51 | Rs. 1,232.30 | 14.72% | |

Rs. 18.00 | Rs. 863.66 | 17.02% | |

Rs. 18.67 | Rs. 621.79 | 16.92% | |

Rs. 18.86 | Rs. 466.25 | 16.92% | |

Rs. 35.53 | Rs. 284.41 | 21.97% | |

Rs. 18.62 | Rs. 99.14 | 14.61% | |

Rs. 25.03 | Rs. 94.69 | 16.33% | |

Rs. 10.42 | Rs. 62.21 | - |

(Note: The above data is as of June 4, 2025, and is subject to market fluctuations.)

Who can Invest in ESG Funds?

With the growing importance of sustainable investing, it is critical to identify the types of investors for whom ESG funds are best suited. ESG funds can be invested in by the following investors:

Investors with extensive knowledge of ESG funds and an understanding of the benefits and possible risks of investing in mutual funds.

Investors with a high risk tolerance.

Investors who seek long-term investment growth.

How to Start Investing in ESG Funds

We will look into some of the steps on how to invest in ESG funds, and here are as follows:

1. Open a Brokerage Account

To start your investment journey, opening an online broking account is essential. Choose a platform that supports ESG investing. Then fill out the application by providing your personal and financial information. Once your account is set up, connect it to your bank and transfer the money you want to invest. Platforms such as Rupeezy support investing in ESG mutual funds, and one can invest after necessary KYC compliance.

2. Define Your ESG Goals

Before investing, think about what matters most to you. ESG is an investment framework that evaluates a company’s impact on the environment, society, and its internal governance. Some investors care about climate change, focusing on diversity, ethical governance and other parameters. You as an investor need to decide whether you want to invest in broad ESG funds or target specific causes. You can also use ESG scores to set a minimum standard for companies or funds you’re willing to invest in.

3. Research Your ESG Investments

Now it’s time to explore your options. You can either do your research or use a financial advisor. If you’re investing on your own, you need to filter the companies by ESG score, industry, and other factors. Review the results and pick the ones that match your goals. If you prefer a hands-off approach, consult a financial advisor and seek guidance from them to build your portfolio based on your goals, risk level, and ESG preferences.

4. Make Your Investment

Once you’ve picked your ESG investments, you can invest. If you are new to investing, then you can open an account through the Rupeezy App, and you can start investing by following these steps:

Step 1: Download the Rupeezy App from Google Play or the Apple Store, then complete the KYC process to create an account.

Step 2: Open the application and search for ESG Funds. You will see a list of ESG funds, such as SBI or Kotak ESG Exclusionary Strategy Fund.

Step 3: Research accordingly and assess the ESG funds in which you wish to invest, based on your risk appetite and your objectives.

Step 4: Compare different ESG Funds based on their past performance, risk, fund size, sectors, ESG scores, and ratings, and then select the ESG Funds that align with your goal.

Step 5: Now you can invest in the ESG fund of your choice and constantly monitor and adjust your investments accordingly.

What SEBI says about ESG Funds in India

SEBI plays an important role in shaping ESG disclosures in India to ensure greater transparency and accountability. In May 2021, SEBI mandated the introduction of a regulation requiring the top 1,000 publicly listed companies in India to disclose their ESG performance through the Business Responsibility and Sustainability Reporting (BRSR) format in FY2022–23.

In July 2023, they instructed starting with the top 250 firms to provide sustainability data for 75% of their supply chain partners, with third-party verification. They planned to further extend to the top 1,000 companies by FY2026-27. However, due to industry worries regarding the practicality of such disclosures, SEBI modified several requirements in May 2024 and extended the deadline by one year in December 2024.

SEBI’s Chairman Tuhin Kanta Pandey highlighted that ESG disclosures must be honest, and there has to be a capacity to measure it accurately and not just formalities. The regulator will work with industry to build the capacity needed for reliable sustainability reporting.

How ESG Funds Help Build a Safer Future

ESG funds aim to build a safer future by investing in companies that demonstrate strong environmental, social, and governance practices. These funds help align investments with personal values and support companies prioritising sustainability and social responsibility.

For instance, environmental factors in ESG criteria include energy consumption, carbon footprint, and waste management, which can lead to reduced negative environmental impacts. Social factors address how companies treat employees, suppliers, and customers, promoting fair labour practices and better employee satisfaction. Governance factors ensure high standards for running a company, which can lead to better management and corporate governance.

Conclusion

In conclusion, we know that investing is no longer just about chasing profits; it’s also about making a meaningful impact. ESG funds allow investors to support companies that care about the planet, people, and ethical business practices. As awareness grows and regulations strengthen in India with SEBI’s active role, ESG investing is gaining momentum. For anyone looking to build wealth while contributing to a better future, ESG funds offer a smart and responsible choice. Consult a financial advisor before investing.

FAQs

Q. What does ESG stand for

ESG stands for Environmental, Social, and Governance.

Q. Can ESG give good returns?

ESG considerations can help investors identify companies with strong risk management and long-term growth potential, potentially leading to positive financial returns.

Q. How to know if a fund is truly ESG

By evaluating factors such as carbon footprint, energy efficiency, labour practices, and corporate governance, ESG scores provide insights into a company’s long-term sustainability and resilience.

Q. How to know if your SIP is ESG-friendly

To determine if your SIP is ESG-friendly, you need to look at the fund's investment strategy and how it aligns with environmental, social, and governance (ESG) principles.

Q. Which sectors are leading in ESG in India

In India, the Information Technology (IT), Banking, Financial Services, and Insurance (BFSI), and Fast-Moving Consumer Goods sectors are the leading in ESG.

Q. Do ESG funds have tax benefits?

No, ESG funds do not provide any additional tax benefits or rebates beyond those available to equity mutual funds in India.

Q. What to expect from ESG funds in the coming years?

In the future, ESG disclosures from the top 1,000 listed companies can increase it to mid and small-cap firms. The mutual funds can benefit from the diversification across a broader range of sectors.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category