Bharti Airtel shares gain 3% on robust Q2FY26 earnings performance

00:00 / 00:00

On Tuesday, the Bharti Airtel share price rose around 2.84% touching a day’s high price of Rs 2133 on NSE after it delivered a robust performance in Q2FY26 and announced fresh strategic developments, including plans to consolidate its holding in Indus Towers further. These developments underscore the company’s ongoing growth initiatives and focus on infrastructure expansion.

Q2FY26 Financial Performance and KPI

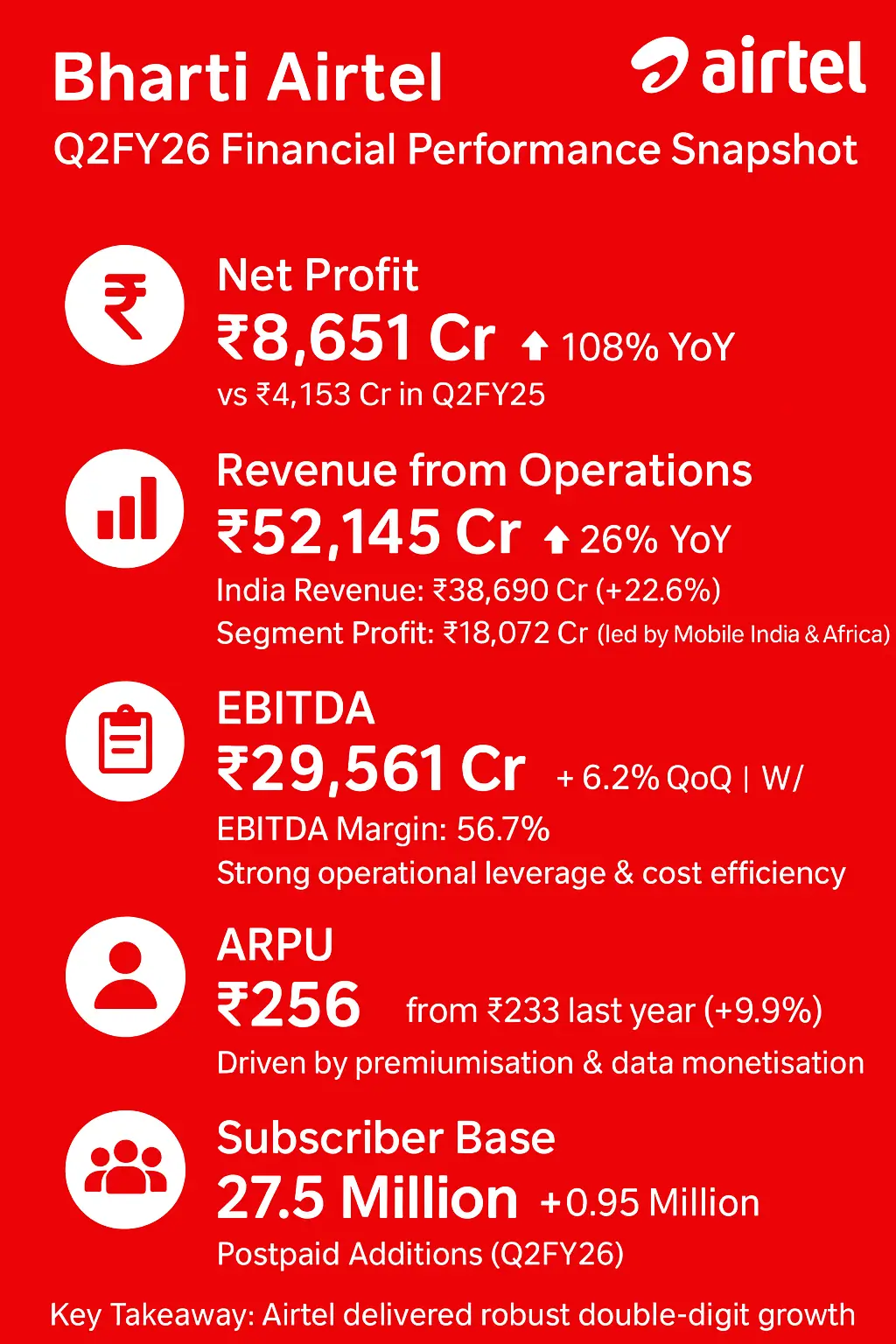

Bharti Airtel posted a consolidated net profit of Rs 8,651 crore for Q2FY26, more than doubling compared to Rs 4,153 crore in Q2FY25. Revenue from operations surged 26% YoY to Rs 52,145 crore, with the India revenue component growing 22.6% to Rs 38,690 crore. Revenue drove segmental profits higher, with total segment profit at Rs 18,072 crore, primarily led by Mobile Services India and Africa.

The company's EBITDA reached Rs 29,561 crore, up 6.2% quarter on quarter and 35.9% year on year, reflecting strong operational leverage and cost efficiency. The EBITDA margin improved to 56.7%, supported by stable operating costs and a steady increase in premium subscribers.

Airtel’s average revenue per user (ARPU) climbed to Rs 256 for Q2FY26 from Rs 233 a year earlier, indicating healthy traction in premiumisation and data monetisation. The growth in ARPU contributed significantly to revenue and profitability, showcasing the company’s resilience and ability to attract high-value customers. The subscriber base reached 27.5 million. The postpaid segment saw a quarterly net addition of 0.95 million customers.

Strategic Plans and Corporate Action

Bharti Airtel’s board approved a proposal to acquire up to an additional 5% stake in Indus Towers, thus planning to increase its stake from the existing 51.03% as of September 2025. This move positions Airtel to consolidate its ownership further and strengthen its long-term infrastructure strategy amid sector-wide efforts to expand 5G networks. The stake acquisition may be carried out in multiple tranches, based on market conditions, liquidity, price, and regulatory compliance. The company’s filings highlight that this consolidation aims to balance investments between business operations and dividend payments while capturing cost and network expansion efficiencies. To put Airtel’s performance and strategic moves in perspective, investors can also compare Vodafone Idea vs Bharti Airtel, examining differences in network scale, subscriber growth, and operational strategies within India’s telecom sector.

The market has responded positively, with Indus Towers shares touching around 3.7%, making a day’s high in response to Airtel’s announcement and related Supreme Court clarifications on Vodafone Idea’s AGR dues, thus improving prospects for dividend resumption by Indus Towers as per the recent transcript. The increased holding in Indus Towers is expected to support Airtel’s control over its network expansion and potentially benefit from the cost efficiencies, underscoring the strategic importance of infrastructure in telecom sector growth.

Conclusion

Bharti Airtel’s Q2FY26 filing shows a clear trajectory of revenue and profit growth, margin expansion, and ongoing premiumisation of its subscriber base. The company’s fresh stake move in Indus Towers aligns with industry-wide priority shifts towards infrastructure readiness for technologies such as 5G.

These combined developments mark Bharti Airtel as an aggressive and forward-looking player in the Indian telecom sector, leveraging infrastructure control and customer monetisation to drive sustainable growth.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category