Best Silver ETF to Invest in India for 2026

00:00 / 00:00

An ETF (Exchange Traded Fund) is a financial instrument that tracks an underlying asset and is traded on a stock exchange like a stock. Gold and Silver ETFs have gained popularity in recent times with prices of these commodities touching all-time highs. While Indians prefer buying physical jewellery and metals, it involves the hassle of holding physical security, additional cost of making charges, and nil return, ETFs provide a liquid alternative that can be traded easily anytime and involves nominal cost.

This article will discuss Silver ETFs as an investment avenue and the best Silver ETFs in India.

What are Silver ETFs?

A silver ETF is an instrument that has silver as an underlying commodity. Silver ETFs invest in physical silver and related instruments and track the price of silver as per the prevailing rate of silver commodity.

SEBI mandates the purity of silver to be 99.9% purity and as per international norms for commodities. ETFs can also invest up to 10% of their assets in Exchange Traded Commodity Derivatives.

You can invest in Silver ETFs in the following ways:

Silver ETFs: These ETFs invest in physical silver and track the commodity prices directly. You can buy these ETFs listed and raided daily at prevailing NAV.

Derivative-based Silver ETFs: Instead of investing in physical silver, these ETFs are backed by future contracts in silver with a defined expiry date. These contracts are rolled over after expiry to maintain exposure to commodity.

Silver ETF Mutual Funds: There are specific mutual funds that invest in Silver ETFs as the underlying security. You can buy Silver ETF funds through online platforms or fund houses as per prevailing NAV.

List of the Best Silver ETFs in India 2026

Investors can invest in Silver ETFs directly through stock exchanges and also through mutual funds that invest in Silver ETFs. Here is a list of best Silver ETFs in India and top Silver ETF Funds.

Name | Assets (Rs. Cr) | Return (1Y) | Expense Ratio |

HDFC Silver ETF | 321 | 28.95% | 0.40 |

UTI Silver ETF | 120 | 28.46% | 0.40 |

Kotak Silver ETF | 713 | 27.82% | 0.45 |

ABSL Silver ETF | 450 | 27.81% | 0.35 |

ICICI Pru Silver ETF | 3714 | 27.79% | 0.40 |

Nippon India Silver ETF | 4477 | 27.51% | 0.56 |

Top Silver ETF Funds

Fund Name | Fund Size (Rs. Cr) | Return (1Y) | Expense Ratio |

Nippon Silver ETF FOF | 418 | 25.32% | 0.25 |

ICICI Prudential Silver ETF FOF | 819 | 25.62% | 0.12 |

UTI Silver ETF FOF | 33 | 25.44% | 0.13 |

Aditya Birla Sunlife Silver ETF FOF | 165 | 25.90% | 0.21 |

HDFC Silver ETF FOF | 139 | 25.17% | 0.6 |

Kotak Silver ETF FOF | 37 | 25.04% | 0.14 |

SBI Silver ETF FOF | 288 | - | 0.25 |

Tata Silver ETF FOF | 58 | 6.49% (6-Mth Absolute) | 0.07 |

Why Invest in Silver ETF?

Intrinsic Value: Silver and gold are precious metals with intrinsic value based on quality, longevity, and scarce availability of these rare commodities. Silver has traditionally been used as currency to save and store wealth for many years and passed on from one generation to the next.

Inflation Hedge: While paper currency and other investments erode in value over time driven by economic conditions, hard metals retain their monetary value and often act as a hedge against loss in the value of money. While governments can print more currency, hard metals remain an attractive investment option

Convenience: Investing in the top Silver ETFs is easy and convenient compared to buying physical metal. ETFs are traded on exchanges and can be bought or sold easily any time. ETFs are more liquid compared to physical metal and without any hassle of storage.

Highest Quality: Silver ETFs invest in physical metal of the highest purity as per SEBi guidelines and conform to international standards for commodity investments. There is risk of poor quality or fraud in silver investment.

SEBI Purview: SEBI mandates 95% of assets of a Silver ETF to be invested in silver or silver-related instruments to ensure fund corpus is aligned with the intended objective only.

Expense Ratio: Since ETFs are not actively managed and invest in a single commodity, the administrative and management costs are much lower compared to other actively managed funds. Therefore Silver ETFs are more cost effective compared to other asset classes.

Return Potential: Silver prices have gone up in recent months due to various geopolitical and economic factors. Silver touched a high of Rs. 92000+ per kg recently, Fed rate cut expectation and demand for industrial applications. Government’s drive to promote solar energy has driven demand for silver in India, for its use in solar panels. With gold prices going out of reach, many investors are buying silver for its affordable price and availability.

Key Factors Driving Recent Demand for Silver

In recent times, the following factors have played a role in driving demand for silver:

Geopolitical Factors

Recent geopolitical events like the Russia-Ukraine war, conflict in the Middle East, and election year in America have given rise to an uncertain political climate where investors looking for safer havens such as silver and gold.

Market Demand

Silver is useful not just as a precious metal and silverware but also in many industrial and electronic applications such as solar panels, EVs, smartphone devices, photography, medical instruments, etc.

The industrial demand for silver is expected to grow by 8% while supply is not expected to match the demand due to challenges in silver mining and supply chain.

Portfolio Diversification

Precious metal silver as an asset class provides diversification to any portfolio to balance risk from other asset classes such as equities and traditional investments with usually inverse movements in value.

Investors seek allocation to precious metals especially when markets are either highly volatile or overvalued. It can help manage overall portfolio risk over different market cycles.

How to Choose the Best Silver ETF

If you are wondering how to select the best silver ETF out of the choices available, here are a few factors to consider:

Return: Compare the asset’s or fund’s performance and track record with other assets available in its category. In mutual funds. select direct funds over regular funds as there is no commission charged and your overall cost is lower.

Expense Ratio: The expense ratio is the overall administration and operation cost of the fund/asset calculated as a percentage of its AUM/Total Assets. The lower the expenses ratio of a fund, the lower the cost to the investor and the higher the overall return.

Tracking Error: Tracking error measures an ETF’s returns compared to the benchmark index’s returns. The tracking error is calculated on past year's data and it must be within 2% as an indicator of the fund’s performance compared to actual commodity return.

Risk Metrics: For ETF funds, the risk is measured through various parameters such as Alpha (Excess returns relative to the benchmark), Beta (Volatility of scheme relative to the benchmark), Sharpe Ratio (Risk-adjusted returns), and overall Risk (Standard deviation of daily returns).

With Rupeezy you can track a fund’s risk parameters and overall risk compared to benchmark on a risk-return graph.

Risks of Investing in Silver ETFs

While Silver ETFs may be an attractive investment opportunity for diversifying your portfolio, you must be well aware of the risks involved as well:

Volatility Risk: Silver is a commodity vulnerable to inherent risks of market demand and price fluctuations due to global factors, commodity cycles, economic conditions and overall demand and supply. Analyse past data and allocate to Silver with moderate risk appetite and long time horizon.

Counterparty Risk: Some ETFs invest in derivative instruments to track the price of silver. These instruments are known as Exchange Traded Commodity Derivatives. There is a counterparty risk involved as the value of investment depends on the obligation to be fulfilled by a counterparty. Even ETFs investing in physical silver carry the risk of physical commodity held by a custodian.

Liquidity Risk: Some ETFs may not have large volumes traded on the exchange thus posing liquidity risk in volatile times.

Taxation: Silver ETFs are subject to capital gains tax as per income tax rules. The revised tax structure, applicable for investments from July 23, 2024, subjects capital gains ETFs to a 12.5% capital gains tax if held for over 12 months, and as per slab rate for shorter holding periods.

Tax Implications of Silver ETFs

Silver ETFs received a favourable tax announcement in the recent Union Budget along with an announcement of lower Customs Duty on gold and silver.

Previously, capital gains from Gold and Silver ETFs were taxed at income slab rates irrespective of the period of holding (for units bought after 1st April 2023).

For fresh units acquired today, if these units are redeemed after 31st March 2026, LTCG of 12.5% is applicable (For holding period > 12 months ETFs and for holding period > 24 months for ETF FoFs).

The table below explains taxation on Silver ETFs:

Units acquired before 1st April 2023 | Units acquired on or after 1st April 2023 | ||||

Instrument/Holding Period | STCG | LTCG | STCG | LTCG | |

Redeemed between 23rd July ‘24 to 31st March ‘25 | Silver ETF (12 months) | Income tax slab rate | 12.5% | Income tax slab rate | Income tax slab rate |

Silver ETF FOF (24 months) | |||||

Redeemed after 31st March ‘25 | Silver ETF (12 months) | Income tax slab rate | 12.5% | Income tax slab rate | 12.5% |

Silver ETF FOF (24 months) | |||||

How to Invest in the Best Silver ETFs in India

You can invest in Silver ETFs through Rupeezy in a few easy steps:

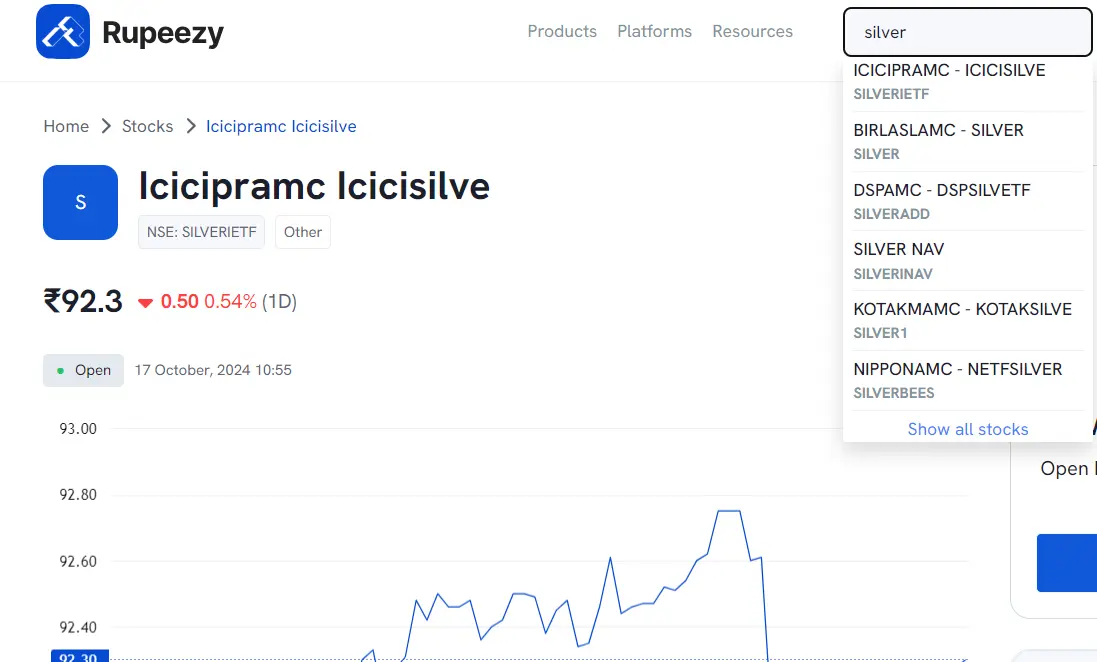

Visit Rupeezy, go to ‘Watchlist’ and search for Silver ETFs or your choice of particular ETF

View and analyse the ETFs for metrics e.g. performance, total assets, expense ratio, trading volume, etc.

Simply buy listed ETFs as per prevailing market price by placing a Buy Order. The process is the same as buying any listed stock.

You can also invest in Silver ETFs through the mutual fund route

Visit the Rupeezy app and go to ‘Explore’ tab.

Search for Silver ETF or a particular fund.

Check the fund’s performance against category average and other metrics such as AUM, expense ratio, risk, past record, holdings, etc.

Select the OneTime option, enter the amount, and make payment.

Conclusion

Silver is a useful commodity as a precious metal as well as commercially in demand for industrial consumption in the new age EV industry, solar panel, smartphone manufacturing, etc.

Silver ETFs and ETF FOFs make it convenient and simpler for investors to buy silver digitally without holding physical metal or checking the purity of silver. ETFs bear lower costs compared to other asset classes and provide a hedge against inflation in currencies. Silver ETFs and ETF funds are tax-efficient and attractive option to diversify and manage risks in a portfolio.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category