List of Best Gold ETFs in India 2026

00:00 / 00:00

Are you looking for the best gold ETF in India? Gold has been one of the most trusted investments in India for centuries and it still plays an important role in the Indian culture. If we look at the long-term performance of gold, it has delivered an average annual return of 7.98% between January 1971 and March 2024 according to Statista. Investors today still turn to gold for diversification and also during economic downturns due to its stability. There are several alternatives to investing in physical gold, these include digital gold, SGB (Sovereign Gold Bonds), Gold Mutual Funds and Gold ETFs.

In this article, we will take a look at what Gold ETFs are, find the best Gold ETF in India and also the means through which we can invest in them. Keep reading to find out which gold ETF is best.

What is a Gold ETF?

A Gold ETF (Exchange Traded Fund) just like other ETFs is traded on the stock exchange just like stocks. Here a single unit of the Gold ETF is equal to one gram of gold. Investments made in Gold ETFs are backed by physical gold of very high purity and the Gold ETF units track the price of gold.

Gold ETFs function similarly to mutual funds. Multiple investors invest in these Gold ETFs and this investment is pooled together to invest in physical gold which is then held by a custodian. As each unit of the Gold ETF represents one gram of physical gold, its price as well is directly linked to gold. When the price of gold increases, your investment value also increases, and vice versa.

Investing in gold ETFs allows you to capitalize on the price fluctuations in gold without worrying about its storage and security. In India, the Securities and Exchange Board of India (SEBI) regulates these funds, and are offered by various mutual fund companies.

Best Gold ETFs in India 2026

Following are the best gold ETFs to buy in India after carefully taking into account the AUM, ETF performance, and expense ratios as of 20th January 2026. We have not considered the performance of any Gold ETF Fund of Funds while compiling this list.

ETF Name | 1Y Returns | 3 Y Returns | 5 Y Returns | Expense Ratio | AUM (Rs. Crores) |

26.68% | 17.67% | 14.06% | 0.41 | 172 | |

26.6% | 17.3% | 13.6% | 0.5 | 1473 | |

26.03% | 16.96% | 13.56% | 0.5 | 5693 | |

25.9% | 16.9% | 13.5% | 0.54 | 937 | |

Nippon India ETF Gold Bees | 25.8% | 16.8% | 13.4% | 0.81 | 15190 |

26% | 16.9% | 13.6% | 0.55 | 5221 | |

25.4% | 17% | 13.6% | 0.56 | 1184 | |

19.73% | 15.60% | 13.33% | 0.55 | 201 | |

19.55% | 15.42% | 13.19% | 0.59 | 6529 | |

19.3% | 15.33% | 13.14% | 0.73 | 5969 |

Overview of Best Gold ETF to Invest in 2026

Here is an overview of the best gold ETFs to invest in 2026:

1. LIC MF Gold ETF

Incepted in 2011, LIC Gold ETF, one of the best gold ETF funds in India, offers a solid investment option backed by strong institutional expertise, with the highest-ever returns of 26.15% in one year and 17.69% in three years among its competitors making it an ideal choice for investors.

2. UTI Gold ETF

Incepted in 2007, UTI Gold ETF is an open-ended exchange-traded fund scheme that tracks the domestic price of Gold by investing in physical gold bullions, LBMA certified 1 kg gold bars making it a reliable ETF to invest.

3. ICICI Prudential Gold ETF

Incepted in 2010, ICICI Prudential Gold ETF offers cost effective gold exposure with high liquidity. Its unique strength is in the trusted management and low expense ratio with stable returns over the years.

4. Aditya Birla Sun Life Gold ETF

Incepted in 2011, Aditya Birla Sun Life Gold ETF with its 13.68% CAGR returns over the past 5 years coupled with its competitive expense ratio makes it an attractive option for investors.

5. Nippon India ETF Gold Bees

Launched in 2007, Nippon India Gold ETF while having the highest AUM (in ETF) in India and a return of 24.9% over the past year stands out as one of the top gold ETFs in india. However, its higher expense ratio may slightly affect the returns.

6. Kotak Gold ETF

Incepted in 2007, Kotak Gold ETF offers balanced growth with a moderate expense ratio of 0.55%, making it an attractive choice for cost-conscious investors looking for reasonable gains.

7. Axis Gold ETF

Launched in 2010, Axis Gold ETF offers efficient gold exposure with a competitive expense ratio and a 23% returns over the past year, combined with Axis Mutual Fund’s trusted management making it an ideal choice.

8. Invesco India Gold ETF

Launched in 2010, Invesco India Gold ETF offers investors a cost-effective route to gain exposure to gold with a low expense ratio. Its unique advantage is the global investment expertise of Invesco, ensuring a well-managed and transparent gold investment option.

9. HDFC Gold ETF

Incepted in 2010, HDFC Gold ETF provides investors with a reliable way of investing in gold. With an expense ratio of 0.59%, it efficiently tracks the prices of gold while ensuring high liquidity to make transactions easy.

10. SBI Gold ETF

Launched in 2009, SBI Gold ETF is yet another institutional-backed ETF offering stable returns over the years. However, its slightly higher expense ratio compared to its peers makes it a bit expensive.

How to Invest in Gold ETF in India?

Indian investors have several options when it comes to investing in Gold ETFs. This investment option is also made available to investors on the Rupeezy app. The following steps will guide you to invest in Gold ETFs on the Rupeezy app if you already have created a Demat account with Rupeezy.

Step 1: Open the Rupeezy app and head to the Watchlist section.

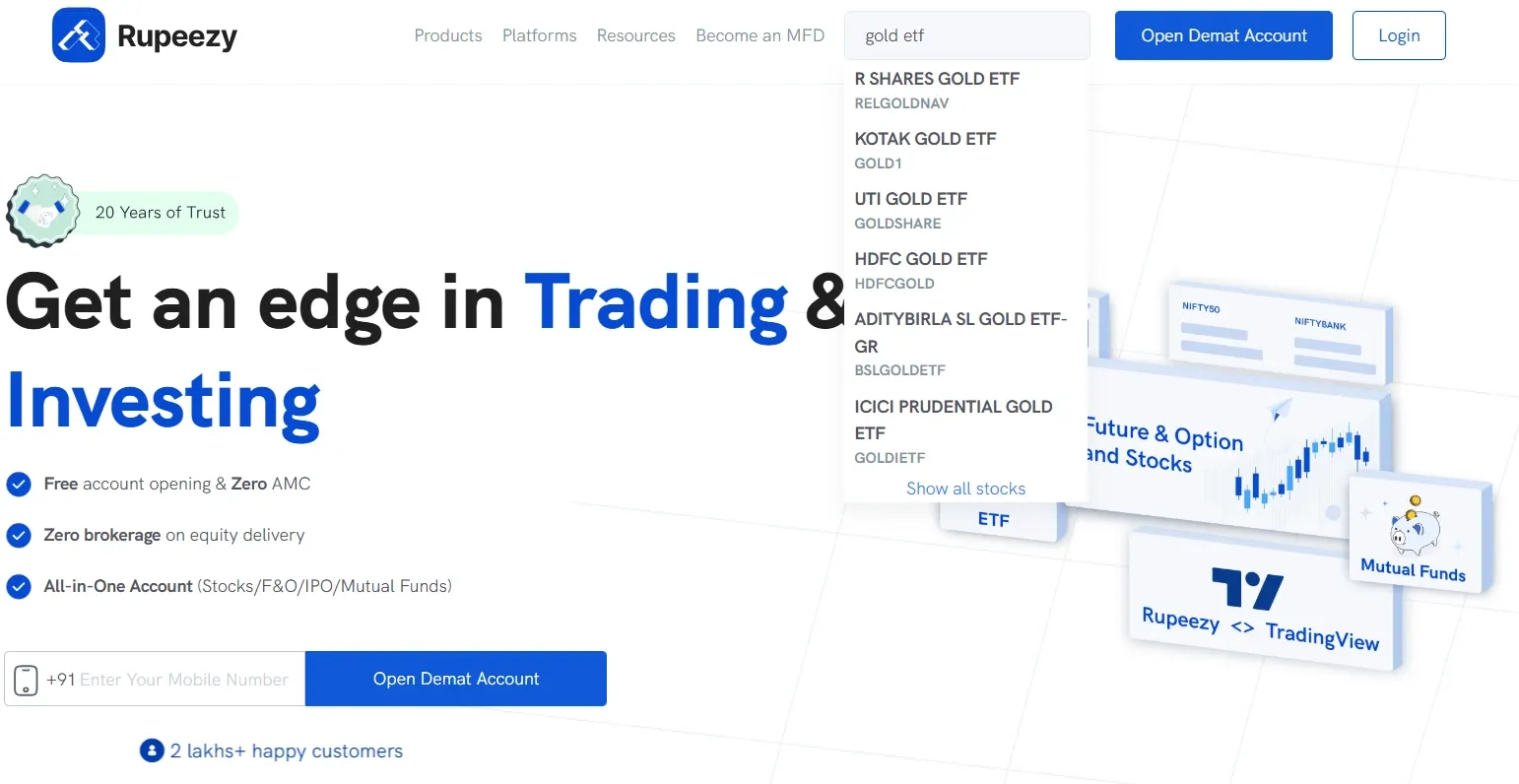

Step 2: Search for the desired Gold ETF or simply search for ‘Gold ETF’ and you will be provided with the available options.

Step 3: Analyse the Gold ETF based on the various metrics provided. Some of the metrics that you can consider are AMC performance, AUM of the ETF, expense ratio, NAV and past returns.

Step 4: Place the buy order by clicking on the ‘Buy’ option highlighted in green.

Screenshot of searching Gold ETF on Rupeezy web

The process followed to invest in a Gold ETF is similar to that of investing in stocks. Once you have placed the order and completed the transaction, you will receive an SMS notification confirming the same.

The steps mentioned above require you to have a DEMAT account opened with Rupeezy. If you have to still have not opened a Demat account with Rupeezy click here to find out how.

Benefits of Investing in Best Gold ETFs in India

Cost-effective: Investing in gold ETFs removes the expenses associated with its security or storing physical gold. Also, they have a low expense ratio, which makes it cost-effective.

Liquidity: Gold ETFs are traded on stock exchanges like NSE and BSE, which means you can buy and sell anytime during the market hour. Hence, you get the opportunity to capitalize on the gold price movement more frequently.

Flexibility: Gold ETFs can be purchased online at your convenience. Furthermore, ETFs allow you to buy and sell units just like stocks which makes the purchase and selling process flexible to your needs.

Transparent: You can track your investment in gold ETFs in real-time, which makes it transparent.

Storage: Physical gold often becomes a liability when held in large quantities due to storage issues. Gold ETFs address this as all your investments are held in the Demat account.

Things to Consider Before Investing in Top Gold ETFs

Although investing in Gold ETFs is really convenient and comes with several other benefits, here are some other factors that you should consider before investing in Gold ETFs.

Gold offers comparatively lower returns in comparison to equity, which averages around 10-12% annually.

Tracking market conditions, macroeconomic factors and other major global affairs is important as these factors can lead to changes in the value of gold.

If you want to trade in gold actively then Gold ETFs are a great option as they offer better financial viability compared to other gold-based investments.

It is advisable to invest 5–10% of your investment in Gold ETFs. This helps your portfolio to remain stable and offer consistent returns which enjoying the benefits of diversification.

Monitor gold price trends before initiating transactions. Consider purchasing Gold ETFs at lower prices and holding them for the long term as the prices increase.

Conclusion

Gold has been a great investment for the long term and serves as a great hedge in times of economic uncertainties. Gold has performed exceptionally well in the first half of 2024 delivering returns as high as 15% by May. This has led to several investors considering gold as an attractive investment. Gold ETFs serve as a great alternative to physical gold which come with several complexities associated with their ownership.

FAQs

Q. Which Gold ETF is best in India?

Due to its lower expense ratio and higher returns among its peers, LIC MF Gold ETF is considered the best ETF in India.

Q. Is Gold ETF a good investment?

Yes, Gold ETFs can be a good investment for portfolio diversification, especially as a hedge against inflation and market volatility. However, like all investments, gold prices can be volatile, and gold may not generate income like stocks or bonds.

Q. Which ETF gives the highest returns in India?

As per the latest data available LIC MF Gold ETF, UTI Gold ETF, ICICI Pru Gold ETF have given the highest returns.

Q. Is HDFC Gold ETF safe?

HDFC Gold ETF is generally considered a safe investment as it is backed by HDFC Asset Management, a reputable institution and gold being a reliable asset. However, like all investments, gold prices can be volatile and carry certain risks.

Q. What is the most popular gold ETF?

There are a number of Gold ETFs available for investment. LIC MF Gold ETF, HDFC Gold ETF, ICICI Gold ETF, and Nippon Gold ETF are among the popular Gold ETFs.

Q. Is SBI Gold ETF safe?

SBI Gold ETF is considered a relatively safe investment for those looking to gain exposure to gold because of its strong institutional backing and gold being a reliable asset. However, like all Gold ETFs, it is subject to fluctuations in the price of gold.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category