Share Market & Failure: A Comprehensive Analysis in 2023

00:00 / 00:00

A share market crash is when a stock or a index drops brutally in a day or for successive days and weeks of trading.

What we are seeing currently (Stockmarketcrash2020) is more sudden than a stock market correction, when the market falls 10% from its 52-week high over days, weeks, or even months.

Stock markets organically in the last 40 years has had a correction. Indian, share market also have seen correction from time and again.

However, what we are seeing is much more than a correction as about 248 stocks hit 52-week lows on NSE. This time market crash brings back 2008 haunted memories.

We all know what had happenned during that period, if you are not aware you can read old archived articles and newpapers cuttings.

In this blog we will try to find

- All possible reason of Why Share Market Is Falling?

- Various Causes triggering panic selling in the market?

- What Not to Do In Stock Market Crash?

- How Much more Share market will Fall?

and Lot more. Before we proceed to understand current share market scenario, one need to know one of the important point mentioned in Dow Theory .

The Averages Discount Everything

Every known or unkown component that may perhaps affect both demand and supply is already considered in the market price.

The next observation is that the market reflects all available information. Even the information which are not in public domain.

Everything there is to know is already reflected in the markets through the price. However natural calamities like drought, cyclone, flood or earthquake can’t be factored.

All major geo-political events, trade war, domestic policies, elections, GDP growth, changes in interest rates, earning projections or expectations are already priced in the market.

The unexpected events will definitely occur, but it usually affect the short-term trend. The primary trend will remain unaffected.

As said natural calamities which includes any medical or health releated emergency as well. Impact of Coronavirus on global economy is one of them.

So let us dig deeper to know is it only because of this pandemic or is there any other factors also playing in this bloobath on dalal streets.

Main Causes of Fall In Share Market

No, not just Cornovirus pandemic that has hit the indian market, our markets was already facing crisis since last year 2019 starting with big fall in Infrastructure Leasing & Financial Services Ltd(ILFS).

We saw Auto sectors tumble to new low companies like tata motors saw sharp decline in share price now trading at 52week low.

Whereas in global economy there was already trade wars going between many countries(USA-CHINA).

Saudi Arabia and Russia have locked horns to grab market share and price control of the oil market. Indian markets are no exception to this.

Companies such as Yes Bank, Jain Irrigation, DHFL and Vodafone-Idea amongst others which have been in the limelight for their persistent problems.

This year with the fall of YES bank this situation was bound to come. However, the market were expecting some correction, there was no major challenge as we are facing in the name of Corona globally.

Fear, Panic, fright, anxiety added the required ingredients which caused heavy selling in share market.

Let us see some of the major stocks, indexes which have fallen since Jan14,2020.

Crashes generally occur at the end of an extended bull market. An unexpected economic event, catastrophe, or crisis triggers the panic.

For example, the market crash of 2008 began on September 29, 2008, when the Dow fell 777.68 points. It was the largest point drop in the history of the New York Stock Exchange at that time.

But that crisis was majorly due to financials institutions, this time its different we are dealing not only with the financial crisis but with ongoing pandemic.

Yes the RBI and GOI is doing everything that can be done to restrict the impact, but the sentiments currently does not support.

Effects On Economy, Investors and traders

Crashes can lead to a bear market which can last for more than 12 to 18 months before full fledge recovery.

When the market falls 10% beyond a correction for a total decline of 20% or more. Bear markets occur with a recession.

You might be thinking how stock market crash can cause a recession?

If you can remember in the past, stock market crashes preceded the Depression, the 2001 recession, and the Great Recession of 2008.

Stocks are how corporations get cash to grow their businesses. If stock prices fall dramatically, corporations have less ability to grow.

Firms that don’t produce will eventually lay off workers to stay solvent. As workers are laid off, they spend less. A drop in demand means less revenue.

That means more layoffs. As the decline continues, the economy contracts, creating a recession.

Already many great credit rating agencies are pointing cut in overall GDP growth forecast made earlier.

Most leading brokerages domestic and foreign are already sounding cautious as regards the economic impact, and see the world economy heading into a recession perhaps the worst since 2001.

But What about Investors?

Foreign investors have dumped Indian shares worth Rs 43,273 crore in March till now dampening the mood on the Street.

Its very tough time for investors, but tougher time brings more opportunities. However, Buying a stock that has lost the most or one that has fallen the least isn’t a surefire strategy.

One need to understand market globally haven’t discounted all the available information yet.

To calculate the losses not only in terms of money, one need to see the post situation after this crisis ends.

Many successful investors know that a correction in the market is a favourable time to go for bottom hunting or picking stocks with attractive valuations.

Likewise, every long-term investor knows that a bad phase in the market is the best time to accumulate stocks to create long-term wealth.

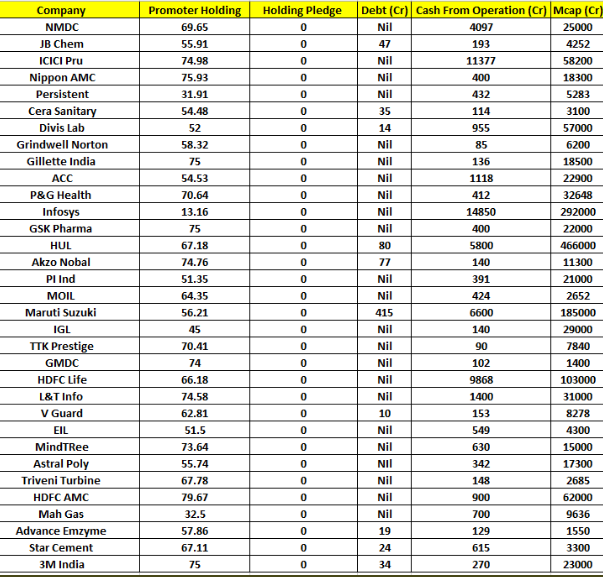

But how you will know stocks with better valuations in market ? Check this before making any decisions :

The P/E ratio, Earnings Per Share, Price-to-Book Ratio (P/B), Dividends Per Share, Operating Cash Flow, Capital Expenditures, Free Cash Flow.

Below image shows the same, but do not consider this as any recommendation from our end.

Do you Remember the financial crisis of late 2008 and early 2009 when stocks dropped nearly 50%?

A better investment strategy would be Selling at the top and buying at the bottom, unfortunately that kind of market timing is nearly impossible.

However the learning from that would still work.

You have to form a disciplined approach towards your trading or investing style. “Patience is the key”, don’t get overwhelmed & start agitating with situation.

If you have done proper research, you know what you own & why you own it, than there is no need to remain in fear all the time.

“Bear in mind you are potentially your own worst enemy”.

There is nothing called free lunch, meaning that if you want to increase potential returns, you have to accept more potential risk. A Successful Investor knows his risk apetite .The market is hard to predict, but one thing is certain it will be volatile for sure. You mood will swing with time and events, this is where discipline comes. At the end of the day hope for luck favour’s you.

What Not to Do In Stock Market Crash?

Markets are falling like there’s no tomorrow.

Now that panic selling has been causing havoc in the markets, it’s natural to get tensed and make some mistakes which otherwise you won’t.

Have these points in your mind before cherry picking any stocks during this time.

During a crash, don’t give in to the temptation to sell. It’s like trying to catch a falling knife.

A stock market crash will make the individual investor sell at rock-bottom prices. That’s precisely the wrong thing to do. Why?

The stock market usually makes up the losses in three months or so. When the market turns up, they are afraid to buy again.

As a result, they lock in their losses. Most crashes are over in a day or two. In most cases, sit tight. If you sell during the crash, you will probably not buy in time to make up your losses.

Your best bet is to sell before the crash. How can you tell when the market is about to crash?

There’s a feeling of “I’ve got to get in now, or I’ll miss the profits,” which leads to panicked buying. But most investors wind up buying right at the market peak. Emotion, not financials drive them.

Investing in stocks that have fallen to multi-year low thinking that they will recover,not always.

Below are the some of the companies that have hit multi-year low.

You might start selling off stocks that have fallen the least, thinking this an strategy is nothing but a thought that comes to every second investor or trader.

You will try to bottom hunt the stocks, but before doing so check what famous American investor, mutual fund manager, and philanthropist Peter Lynch has to say.

When stocks are attractive, you buy them. Sure, they can go lower. I’ve bought stocks at $12 that went to $2, but then they later went to $30. You just don’t know when you can find the bottom.

Post financial crisis of 2008-09, markets rose without giving any prior notice.

Those who kept waiting for the ultimate bottom couldn’t buy for a long time as Nifty rallied 25% within a month by April 2009.

Many investors repeated the same mistakes when markets fell close to 25% between February 2015 and February 2016.

Keep Calm & Invest in Nifty50 Index

This is for the people who are risk averge investors. If you do not have time and resources to do the adequate research instead picking up the stocks go with any Index.

The best thing about investing in Index can reduce non-systematic risk

In other words this type of risk include dramatic events such as a strike, plunging revenues, Higher financing cost, Declining profit margins.

A natural disaster such as a fire, or something as simple as Management misconduct or slumping sales. Two common sources of unsystematic risk are business risk and financial risk.

However non-systematic risk can be diversified.

First thing to remember, instead of investing all your money in one company, you can choose to diversify and invest in 3-4 different companies (ideally from different sectors).

When you do so, unsystematic risk is drastically reduced.

The NIFTY50 Index which constitutes of 50 major companies, can easily help in diversifying your portfolio .These are premium companies with high market capitalization.

For this reason just Invest in index and stay secure as we have already seen the returns annually given since inception

The NIFTY 50 total return index delivered returns of 15.98% per annum during the previous 10 year period (as on March 29, 2019).

How Much more Share market will Fall?

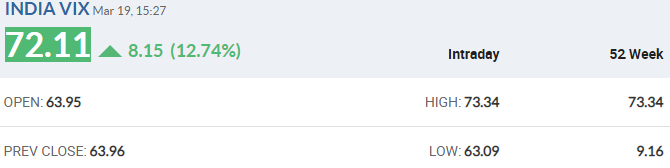

The Indian stock market is not only falling amid coronoavirus fears but the level of volatility you are seeing is same what had happenned in past 2008 crisis period.

Look at below the India VIX which is at 52week high.

India VIX is a volatility index based on the NIFTY Index Option prices.

From the best bid-ask prices of NIFTY Options contracts, a volatility figure (%) is calculated which indicates the expected market volatility over the next 30 calendar days.

You have also observed how market are getting negatively open, doing full recovery in afternoon and loosing all till end of the market.

Being a trader specially incase of FNO it becomes very hard to trade naked calls and puts.

Its highly recommended if you are trading please go with certain option stratgies instead of plain vanilla calls and puts.

Now coming to the point how much more the indian stock market will fall from here, already nifty has touched below 7800 mark (more than 25%).

In that case one need to be aware of pre and post effects of market crash.

May be you might see share market crashing more than 40% till this pandemic continues or may be this will bring more oppourtunity towards india.

As we are seeing this still undercontrol in our country compares to other european and asian countries.

China will surely going to pay lot more as this has created risky buisness enviorment within country.

Foreign investors will lure more towards india rather than other asian countries.

Moral of the story

International Monetary Fund (IMF) expects the global growth for 2020 to be lower than 2.9% recorded in 2019—which would make it the lowest in the last 10 years.

Cash is king

Amid the uncertainty in the market, investors are racing to preserve their capital and cashing out their investments.

The trend has affected all asset classes including gold which is considered a safe haven.

Stocks, bonds, gold and commodities have fallen in a secular selloff as the world struggles to contain coronavirus and investors and businesses scramble for hard cash.

So overall it’s an early stage to predict anything, better to have cash in your hands and wait for some more days or start picking quality stock in small quantities.

That’s it from my end, If you have any questions or feedback please let us know in the comment box below.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category