The Essential Guide to Investing in the Stock Market in 2023

00:00 / 00:00

Introduction

Stock investing is a very lucrative asset class but, unfortunately, it is very risky too.

Many people are fascinated by the returns they see initially from a few stocks but they completely ignore the risk element of those stocks.

I invest in the stock market for long term wealth generation, which means, holding the stocks for a longer term, i.e. 10-15 years.

Being a long term investor means you can park the funds into your stocks and you do not require this corpus in the immediate or short term.

i.e. you can afford to invest and forget without worrying about volatility or ups and downs in the investment value, that comes with stock investing.

In short, you do not depend on your investment for day to day living expense or any short term goal.

Hence, it is necessary to have enough liquid money for your short term needs and invest only that money which you won’t in near future.

The ultimate goal of any investment plan is to meet your financial goals and achieve mental peace and comfort in the future.

Therefore, you must have a few basics in place before you start investing in the markets.

You Should Invest In Stock Market Only When You Have

Emergency fund

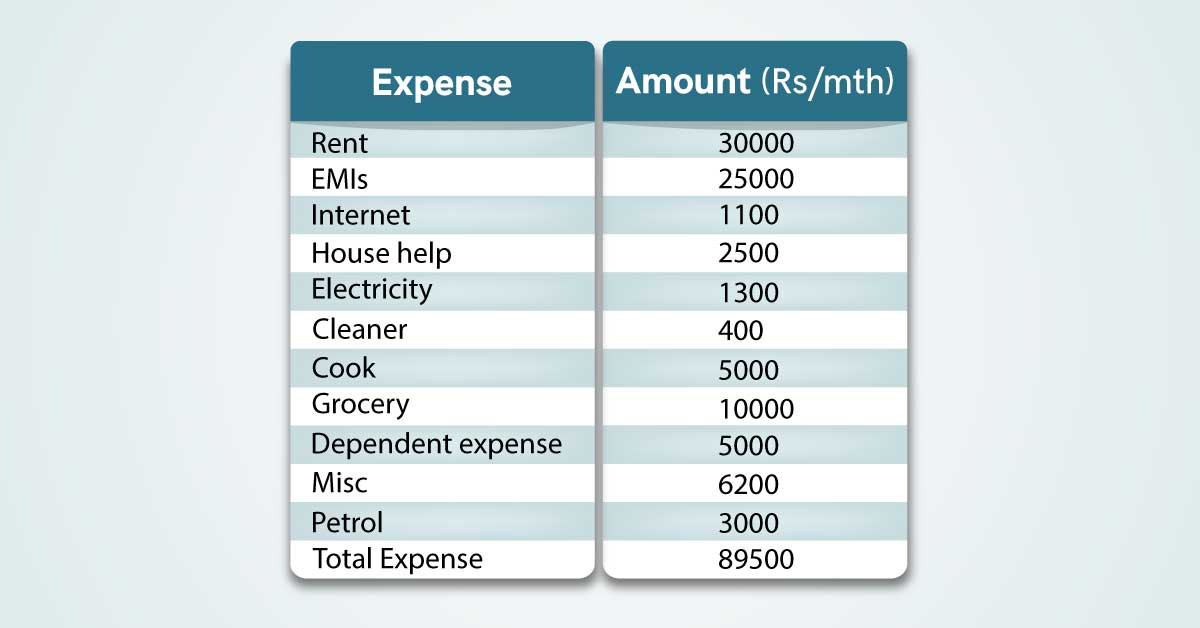

Keep aside an amount enough to cover at least 3 months expenses. Simple formula is add all your expenses (Rent, salaries, EMIs, bills etc.)

e.g. my total monthly expense adds up to 89500 (table below), so I should have at least 89500 x 3 = Rs.

2,68,500 in liquid form (savings account, FD, liquid fund) so that I can withdraw the money at a short notice.

Health Insurance and Other Coverages

Biggest reason for unexpected money outgo are unforeseen events like accidents, hospitalisation, theft etc. One must cover these risks before investing in the stock market.

Have enough cover for health, vehicle, house insurance etc for unforeseen events. If your parents are dependent on you, make sure you take health insurance for them as well.

Many of us feel we don’t require insurance but it is of great saviour in case of emergency. Remember Covid?

Before selecting an insurance provider, check claim settlement percentage and customer feedback about claims process, services etc.

Term insurance

Having a term insurance cover is advisable before allocating money for stock market investment and is must if you have any dependents (spouse, children, parents).

Term insurance should be at least 10-15 times of your annual salary i.e. if your annual income is 10L you should take term insurance of at least 1 Cr.

Insurances are like oxygen mask in an airplane, you hope you don’t need to use them but it’s good to have them.

Experience with Mutual Funds/ETFs

Before jumping directly into the stock market, one should first explore mutual funds. Mutual funds are managed by professionals,

Who dedicate all their time to maximise the return and managing the risks for you.

Another benefit is that you don’t need to invest your time managing the portfolio.

Once you track your mutual funds, you will automatically start learning about the economy, factors affecting the markets and its impact on any asset class.

With controlled risk and professional management, you can participate in stock markets and build your investing muscle gradually.

Knowledge of Financial Ratios

Before investing in stocks, one should be aware of the financial ratios such as P/E, P/B, ROCE etc. to have a basic understanding of balance sheet, income statement and cash flow statement.

These are not very difficult to understand and mostly you need to just see the trend in revenue, profit and cash flow etc.

With above safeguards and basic skill in place, you can begin to allocate a small percentage of your corpus into the market.

Follow me for more such insights and posts.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category