Conquer Your Emotions: A 2023 Guide to Trading and Investing with Discipline

00:00 / 00:00

There is a popular theory that defines different emotions an investor or trader experiences while investing. It goes from Optimism > Excitement > Thrill > Euphoria > Denial > Anxiety > Fear > Panic > Despondency

Do you identify with these emotions? Did you encounter these in different situations and stages of your investing journey?

Markets being markets, one cannot predict how markets will turn at any time and feeling overwhelmed with emotions is bound to happen.

But, it need not impact your investing decisions and ultimate financial goals. In this blog, I am sharing a simple system I follow to control my emotions in investing and meet my investment objectives.

My Approach to Managing Emotions in Investing

Are you an investor with 2-3 months of experience who has faced the emotional roller coaster of selling stocks too early or holding onto tumbling ones?

If so, I can relate, as I’ve been through those ups and downs myself. However, I discovered a simple yet effective rule that has helped me maintain emotional stability and reduce regrets in my investment journey.

Allow me to share the three fundamental rules I follow when it comes to investing:

Protect Your Initial Investment

I ensure to take out my initial investment and invest only with the profits earned. By doing so, even if the stock’s value declines significantly, I can rest assured that I won’t incur any losses on my initial capital.

Let Your Winners Run

Holding onto good company stocks for the long term has been a game-changer for me. I make it a point to keep such winners in my portfolio indefinitely, which helps me realise substantial returns over time.

Stories of massive returns on investments often involve holding onto winning stocks for the long haul, and I find this strategy to be highly rewarding.

Limit Losses on Declining Stocks

Not all stocks in my portfolio rise; some inevitably go down. To manage this, I have set specific rules to limit emotional distress caused by declining stocks.

When a stock’s price falls by a certain percentage, I sell a predetermined percentage of that stock from my holdings.

Here’s a breakdown of the guidelines I follow for managing gains and losses:

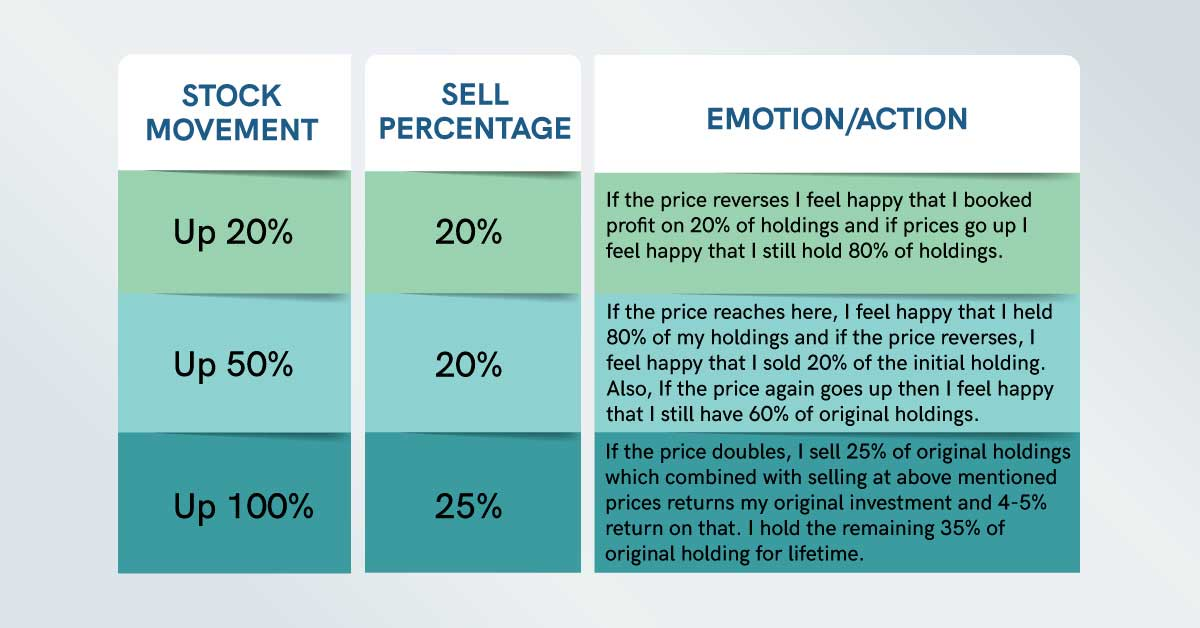

Profit Management

- When a stock’s price goes up by 20%, I sell 20% of my holdings. If the price keeps rising, I’m happy to have retained the majority of my initial investment.

- When a stock’s price goes up by 50%, I sell 20% of my original holdings. If the price keeps rising, I’m happy to have retained the majority of my initial investment. If the price declines I feel happy that I sold some.

- If the stock price doubles (up 100%), I sell 25% of my original holdings, recovering my initial investment and earning a 4-5% return. I hold the remaining 35% of my original holding for the long term.

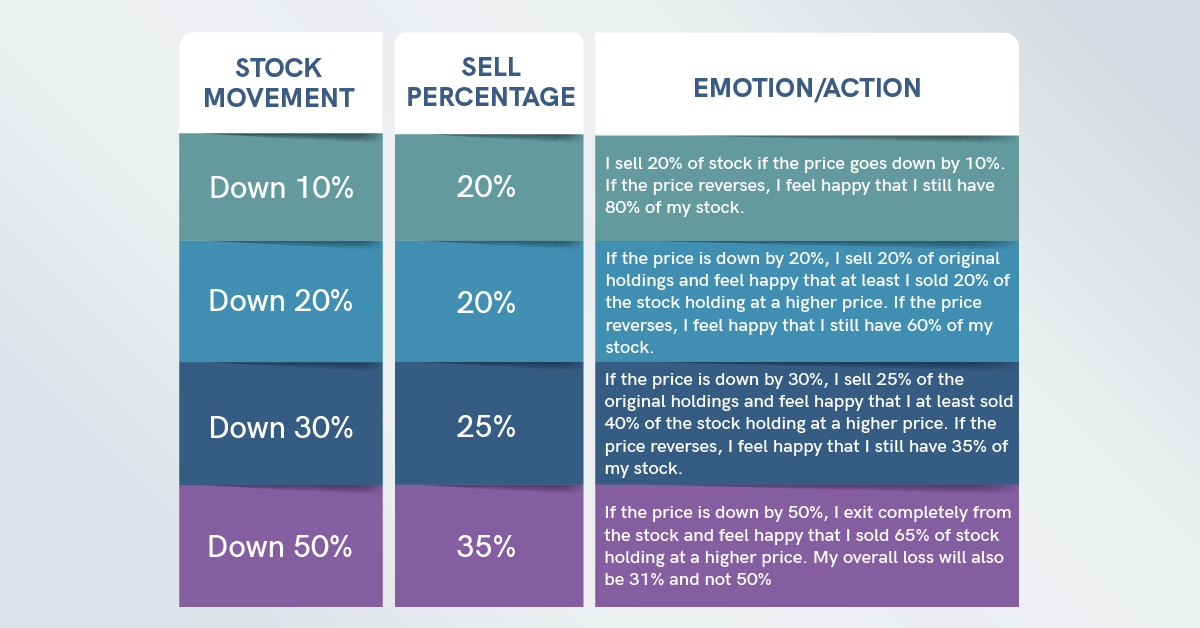

Losses Management

- If a stock’s price goes down by 10%, I sell 20% of my holdings. This strategy helps me reduce potential losses and retain 80% of my stock if the price bounces back.

- When the stock price is down by 20%, I sell 20% of my original holdings. This provides some comfort knowing that I have minimised losses on that particular stock.

- At a 30% decline, I sell 25% of my original holdings, further limiting potential losses.

- When a stock’s price is down by 50%, I exit completely from the stock, content that I sold 65% of my holdings at higher prices. By doing so, I limit my overall loss to 31% instead of the full 50%.

For added clarity, I follow these rules for stocks priced between Rs 50 to Rs 3500. However, you can customise these rules to suit your preferences and risk tolerance.

The key is to manage emotions and avoid impulsive decisions that could affect your financial well-being.

Please note that the rules I’ve shared are my personal approach, and I encourage you to develop your own strategies for emotional management in investing.

Remember, the journey of investing involves learning and adapting, so feel free to tweak and adjust as needed.

Lastly, when implementing these guidelines, consider buying at least 20 quantities of stocks so that you can sell in increments, avoiding sudden liquidation.

I hope these insights prove valuable to your investing journey. Let’s strive for financial success together,

Managing emotions and making informed decisions. Feel free to share your experiences or discuss further strategies in the comments below.

(Note: The rules mentioned do not account for corporate actions like stock splits or bonuses, but these can be adjusted accordingly to maintain accuracy in pricing.)

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category