Understanding CPI Inflation: How To Calculate and Its Impact On Indian Economy

00:00 / 00:00

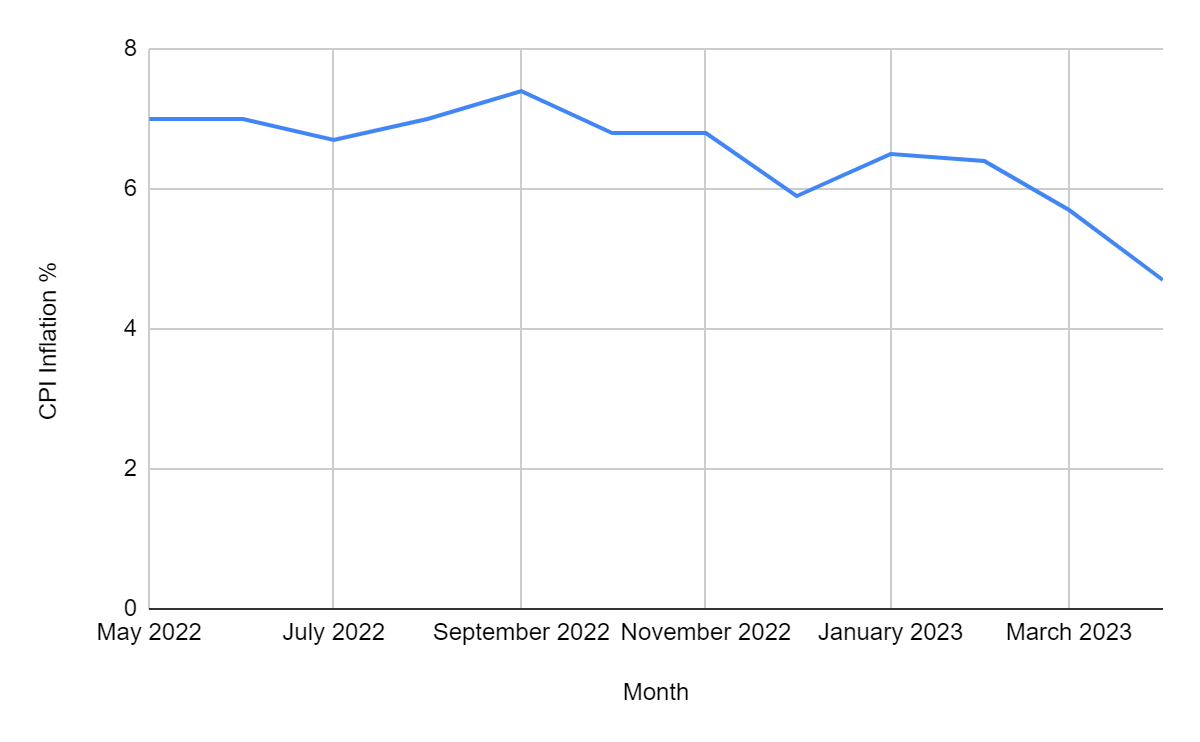

India’s retail inflation was reported at 4.7% in April on an annual basis, a level reached after 18 months, since Nov 2021.

In March the CPI (Consumer Price Index) inflation was at 5.66%. For a second consecutive month the retail inflation is contained within RBI’s target range of 2 to 6 percent.

The easing of inflation is attributed to a slower pace of price increase in food items e.g. cereal, fats and oil; and energy (fuel) cost.

Apart from this, the high base effect comes into picture given that the rate of price increase was much higher in the same period last year.

Retail Inflation in India graph (Change % yoy)

What is CPI Inflation?

CPI or Consumer Price Index measures the increase in prices of goods and services which common households buy and consume in everyday life.

Image credit: Unsplash

To track inflation, the price increase is measured on a year on year basis i.e. how much price of respective item has gone up after one year from a certain level.

RBI tracks India’s retail inflation /CPI closely to keep a check on prices of daily consumption essential commodities.

CPI is measured for different areas due to price variability e.g. in rural, urban and pan-India level.

CPI is a crucial macroeconomic indicator that regulators focus on to assess the value of currency.

Day to day cost of living for the general public, overall health of the economy, calculated on the basis of average weighted cost of commodities.

CPI is calculated as below

(Cost of Fixed Basket of Goods and Services in Current Year) * 100

(Cost of Fixed Basket of Goods & Services in Base Year)

For example, suppose price of butter in base year is Rs 100 and price of bread is Rs 40

The price goes up to Rs 120 and Rs 60 in the current year. Both items account equally in the basket.

CPI = {(120*50) + (50*50) / (100*50) + (40*50)} *100

= (8500 /7000) *100 = 121

Earlier this month, Finance Minister Nirmala Sitharaman had commented, “India’s inflation has been above the Reserve Bank of India’s (RBI) tolerance band of 2-6 per cent, however, the government is taking steps to control it.

Because we took a very calibrated approach, today we have an inflation which is slightly above the tolerance limit, but which is constantly being worked at so it can be brought down.”

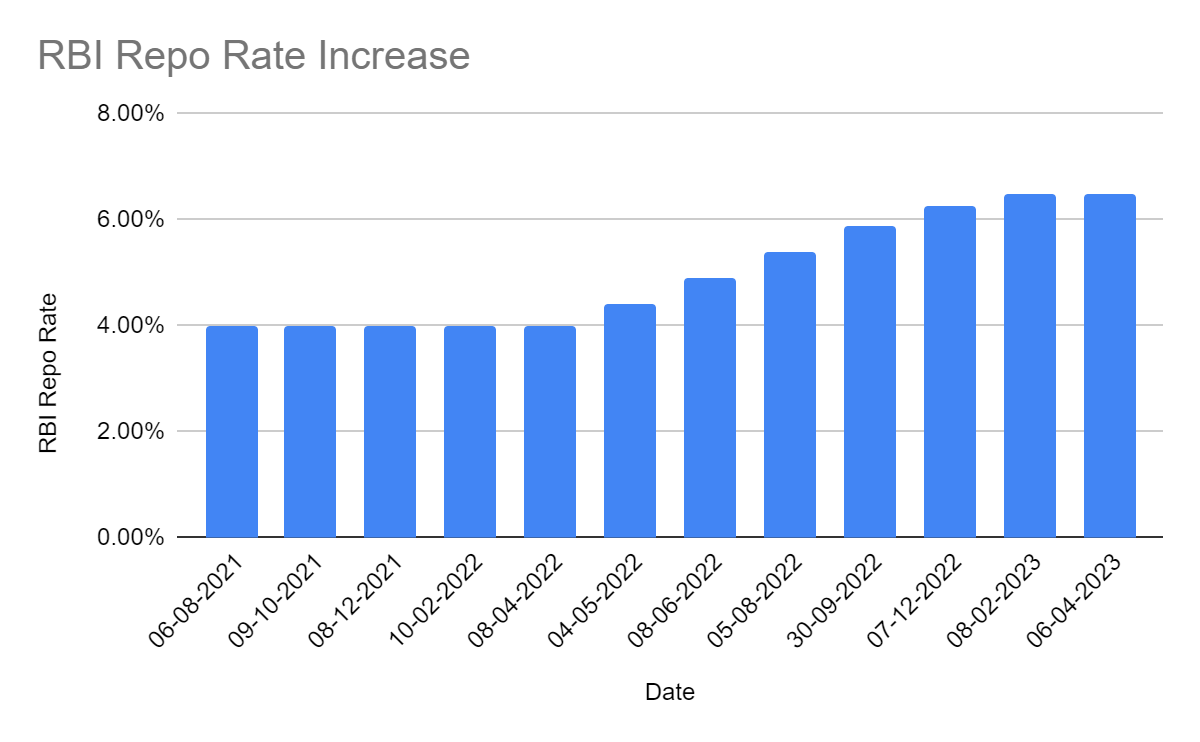

To control inflation, RBI has increased the repo rate by 250 basis points cumulatively since May 2022.

In the MPC (Monetary Policy Committee) meeting in April, RBI decided to keep the repo rate constant at 6.5% and termed it as a ‘pause not pivot’ to assess how rate hike of 250 bps has worked to control inflation in the last one year.

RBI had also cautioned adverse weather condition and volatile global financial markets as key risks that could impact inflation going ahead.

Experts predict that CPI target within expected range in Q1 FY24 may pause further rate hikes.

How does inflation impact the economy?

In simple terms, when inflation is high, the cost of goods & services, cost of living goes up. It further pushes up the cost of producing goods and services.

Cost of loans and borrowings for retail consumers, businesses go up thus impacting overall business and economy.

Low purchasing power, higher interest rates, low incentive to save due to money losing value, all these factors can lead to a slowdown of the economy.

With controlled and lower level of inflation, cost of living is in control, goods and services are within reach of all consumers, demand and consumption grows, businesses and employment prospers and economic activity grows and continues at a healthy rate.

For more such articles, visit our blog

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.