Understanding Open Interest (OI): How to Calculate and Use It with Examples

00:00 / 00:00

Overview

Stock market consist of various terminology and one of the them is Open Interest (OI) .

Open interest is of utmost important for traders in derivative segment futures & options .

By knowing the OI one can somehow know the trend in the market . Besides this it also tells you about outstanding contracts of future (options) in the market .

Open Interest also indicates strength & weakness in a particular direction of market .

To know about OI first thing to remember that market exist because of buyers as well sellers .

In derivative contracts whether options or futures a buyer always known as long and seller as short .

If both parties to the trade are commencing a new position as one new buyer and one new seller, open interest will increase by one contract.

If both traders (buyer &seller) decides to close their positions than open interest will reduce by one contract .

Similarly if one old trader or buyer of contract passes of his position to a new buyer no changes happens in open interest .

Please note that open interest (OI) equals the total number of contracts, not the total of each transaction by every buyer and seller.

In other words, OI is the total of all the buys or all of the sells, not both. To know OI in any market ,we should know total of either buyer or seller not sum of both .

How to Calculate Open Interest?

Now to illustrate , we would be considering an example.

Suppose there are 3 different traders named A , B ,C . A buys 5 futures contracts and B buys 5 futures contracts, while C sells all of those 10 contracts.

After this transaction, there are 10 contracts in total with 10 on the long side (5 + 5) and another 10 on the short side;

hence the open interest is 10. As stated earlier, OI is not the total of both buy and sell trades.

Derivatives also called as “Zero Sum Game” because if you put +sign for long and -sign for short and add both contracts, the result would always be zero.

First thing to remember, We should know total of either buyer or seller not sum of both . Moreover OI just tells you about the open positions of contracts in market .

OI helps in understanding about liquidity in the market . Higher the open interest, more liquidity in market .

Open Interest example

On 22 May 2019, Open Interest on Nifty futures is around 1.79 Crores. It means that there are 1.79 crore Long Nifty positions and 1.79 crore Short Nifty positions.

Moreover about 12,71,250 roughly 14.11% over 1.79 Cr new contracts have been added today.

Increase in OI means more money is flowing in to the market . As a result whatever will be the trend (up ,down ,sideways) will continue.

check this table below for better explanation on a trader perspective about Open Interest .

Stock Price | Open Interest (OI) | Trader’s Insight |

|---|---|---|

Increases | Increases | If stock price increasing with high OI more trades will build on long side |

Decreases | Decreases | Longs build up started unwinding or covering their position from market . |

Decreases | Increases | Due to short build up stock price decreasing |

Increases | Decreases | As price increasing shorts covering their position from market |

However a common misconception of OI lies in its speculative ability. In no way it forecast price action.

High or low open interest shows investor or traders interest, but it does not mean that their perspective are correct or their positions will be profitable.

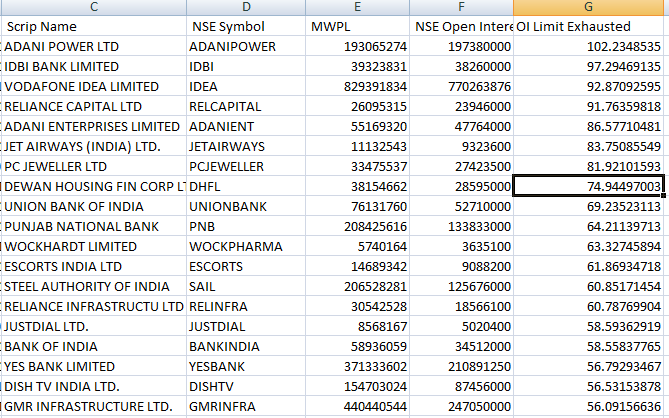

Here attaching another image to let you know how does it look like . It does help you in knowing the remaining limit of OI in any particular stock .

Conclusion

As you can see the image representing,

A symbol of stock MWPL (Market wide position limit is basically the maximum number of open positions allowed on futures and option contracts of a particular underlying stock) and Current OI .

we have calculated the limit exhausted or filled by them on excel .

This is the formula to calculate =F2/E2*100 than sort it from largest to smallest .

It can help you to determine and go for trades as per traders insight we discussed earlier, but not necessarily means price action in any particular direction in market .

We hope now you have better understanding about What is OI? & purpose of it .

Keep learning, Keep earning . Please let us know if you any questions in comments box below.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category