Trading Profit and Loss Account Format

00:00 / 00:00

A trading and profit and loss account helps determine how much your business has earned or lost during a set period. It’s split into two parts: the trading account, which shows your gross profit, and the profit and loss account, which reveals the net profit.

When you prepare this account, it will show where your business stands in terms of finance. It’s crucial because it shows if your company made money or faced losses. Without this, you can’t complete your balance sheet, which is why understanding the trading profit and loss account format in this article. So let’s get started!

What is a Profit and Loss Account?

A profit and loss account (P&L account) shows the total revenue and expenses of your business over a specific period, like a month or a year. With this report, you will see if your company made a profit by earning more than it spent on running costs. On the contrary, if your expenses are higher than your income, it shows a loss.

The profit and loss account format helps you measure your business’s success by clearly showing whether your business is profitable. However, it won’t tell you if you are low on cash or overstocking, so you also need a balance sheet for a complete picture of your finances.

Types of Profit and Loss Accounts

There are two main types of profit and loss accounts: the cash method and the accrual method. Each serves businesses of different sizes based on how they handle their finances.

The Cash Method

The cash method records transactions only when cash comes in or goes out. This method is straightforward—when you receive money, it’s recorded as income, and when you pay a bill, it’s recorded as a liability. Small businesses and individuals often use this method because it’s simple and gives a clear view of actual cash flow.

The Accrual Method

The accrual method tracks revenue and expenses as they happen, regardless of when the money changes hands. For example, if you sell a product but haven’t received payment yet, you still record the revenue in your profit and loss account format. Similarly, any expenses owed are recorded as liabilities, even if you haven’t paid them yet. This method gives a more accurate picture of your financial health over time, which is why larger companies prefer it.

Purpose of Profit and Loss Account

The purpose of a profit and loss account is to show you if your business made or lost money over a specific period, which is usually one year. Since it summarizes your revenue and expenses, this account shows how you have performed overall. It’s essential for tracking net profit, controlling costs, and making informed business decisions to improve growth.

How to Prepare Profit and Loss Account?

Here’s how to prepare your profit and loss account step by step:

Track revenue: Record all the money you receive from sales of products and services. This total is your operating revenue.

Determine the cost of sales: Identify the variable costs of producing your products. These include expenses like inventory and raw materials, but not fixed costs like rent or salaries.

Find out your gross profit: Subtract the cost of sales from your total revenue. This is what shows how much profit you made from your core operations.

Add up your overhead: Calculate your fixed expenses that don’t change much monthly. Include expenses like rent, salaries, and the cost of advertising. If you pay some yearly costs, divide them by twelve to have a monthly figure.

Calculate your operating income: Subtract the overhead costs from your gross profit to have your operating income.

Adjust for other income and expenses: Add any income not related to core business operations, like interest or dividends, and subtract unrelated expenses, such as finance charges. This gives you your pre-tax income.

Net profit: This final number shows if you made a profit or incurred a loss after all expenses.

Important Components of Profit and Loss Account

To understand a profit and loss account, you need to know its components: income, expenses, and net profit.

1. Revenue

Revenue is the first item on a P&L account. It includes all income from your business activities. You can call it sales, gross receipts, or fees. It’s essential to separate operating revenue from non-operating income, like interest. Depending on the method you use to account, you have to report revenue either when you earn it (accrual method) or when you receive payment (cash method).

2. Cost of Goods Sold (COGS)

The COGS is the direct cost of producing goods sold. This includes expenses like raw materials or inventory. Subtract COGS from revenue to find your gross profit. For instance, if you sell a product for ?10,000 but it costs you ?3,500 to make, your gross profit is ?6,500.

3. Gross Profit

Gross profit is what you earn after subtracting COGS from revenue. If you offer services without inventory, gross profit equals total revenue.

4. Expenses

Expenses are all costs needed to run your business. These can include:

Cost of advertising

Office supplies

Salaries and payroll taxes

Professional fees for services

You also need to consider depreciation, which spreads the cost of long-term assets over their useful lives.

5. Net Profit or Loss

Finally, net profit is your total earnings after subtracting expenses and taxes. This is what tells you if your business is making money or losing it.

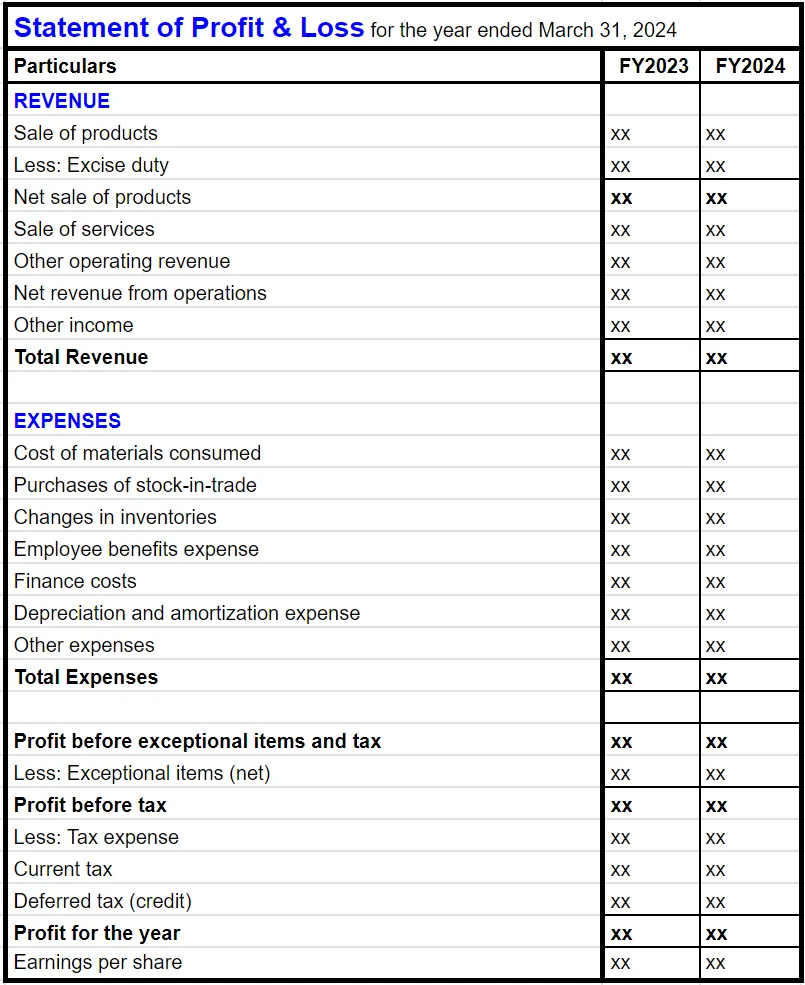

Trading and Profit and Loss Account Format

In a profit and loss account format, the revenue and expenses of a company are crucial elements. Revenue is the total income earned from the sale of goods or services, while expenses cover all costs involved in running the business, like salaries, rent, and materials. The difference between the two gives us the profit or loss for that accounting period. Accurate reporting of both revenue and expenses helps assess a company's profitability.

Here’s a breakdown of the typical format and key components of a P&L account, as shown in the tables:

Sale of products: This is the total income generated from selling goods.

Less: excise duty: This is the tax on goods sold, deducted to find the actual revenue.

Net sale of products: This is the revenue from product sales after deducting excise duty. It gives a clearer picture of income.

Sale of services: This shows income from services you provide.

Other operating revenue: This includes additional income from regular operations, such as fees or commissions.

Net revenue from operations: This is the total revenue after you add service sales and other operating income.

Other income: This entry captures income not from primary operations, like investment returns or asset sales.

Total revenue: This figure combines net revenue from operations and other income, representing total earnings.

Cost of material consumed: This includes expenses for materials used in production.

Purchases of stock in trade: This amount shows how much you spent buying goods intended for resale.

Changes in inventory: This reflects adjustments in stock levels, influencing the cost of goods sold.

Employee benefit expenses: These are costs related to employee salaries, benefits, and payroll taxes.

Financial cost: This includes interest paid on loans and other financing costs.

Depreciation and amortization Cost: This reflects the reduction in the value of assets over time, which affects profits.

Other expenses: These are additional costs incurred, such as marketing and office supplies.

Total expenses: This line sums all expenses. It shows the total cost of running the business.

Profit before exceptional item and tax: This figure represents earnings before accounting for one-time events and taxes.

Less: exceptional items (net): These are unique, non-recurring items that can impact profits, such as asset sales or large write-offs.

Profit before tax: This shows earnings just before tax expenses.

Less: tax expenses:

1) Current tax: This is the tax owed for the current year based on profits.

2) Deferred tax (credit) / expense: This reflects taxes due in the future or reductions from past overpayment.

3) Earlier year's (excess) / short provision: This adjusts for previous tax provisions that were overestimated or underestimated.

Profit for the year: This is the final profit after all expenses and taxes are deducted.

Basic and diluted earnings per equity share: This shows the profit allocated to each share. It helps investors gain insight into how the company performs.

Example for Profit and Loss Account

Here’s a practical example of a profit and loss account for a fictional company, ABC Pvt. Ltd.

ABC Pvt. Ltd. Profit and Loss Account for the Year Ended March 31, 2024

Revenue from operations | Amount (?) |

Sale of products | 38,000 |

Less: Excise duty | 4,000 |

Net sale of products | 34,000 |

Sale of services | 300 |

Other operating revenue | 20 |

Net revenue from operations | 34,320 |

Other income | 400 |

Total revenue | 34,720 |

Expenses | Amount (?) |

Cost of materials consumed | 20,000 |

Purchases of stock-in-trade | 2,000 |

Changes in inventories | 300 |

Employee benefit expenses | 1,500 |

Finance costs | 5 |

Depreciation and amortization expenses | 600 |

Other expenses | 4,300 |

Total expenses | 28,705 |

Profit/loss | Amount (?) |

Profit before tax | 6,015 |

Less: tax expenses | 1,500 |

Profit for the year | 4,515 |

Basic and Diluted Earnings per Equity Share | ?10.00 |

Summary

Total revenue: ?34,720

Total expenses: ?28,705

Profit for the year: ?4,515

This P&L account shows that ABC Pvt. Ltd. generated a profit of ?10,000 after accounting for all revenues and expenses.

What is a Trading Account?

A trading account is a financial statement used to determine the gross profit or loss from a business's trading activities, primarily on buying and selling activities. It is crucial for businesses engaged in trading as it helps you determine how well your company performs in these activities.

The trading account has two sides:

Debit side: This includes purchases, opening stock, and direct expenses related to buying.

Credit side: This consists of closing stock and sales.

To calculate gross profit, use the formula: Gross Profit = Net Sales – Cost of Goods Sold. Net sales equals gross sales minus returns, discounts, and allowances.

With a trading account, you will gain insights into how efficient your business is in buying and selling. It will become easier to assess financial health and operational success.

Debit Balance of Trading Account

The debit balance of a trading account shows that your costs exceed your sales revenue. This balance occurs when the total cost of goods sold and related expenses are higher than the income from selling those goods.

For example, if your total costs are Rs.50,000 and your sales revenue is only Rs.30,000, you face a debit balance of Rs.20,000. This situation indicates a loss during the accounting period. You have to understand this balance because you will be able to identify when your business is struggling to make profits and may need adjustments.

Credit Balance of Trading Account

The credit balance of a trading account shows that your sales revenue exceeds your direct costs. This balance occurs when the income generated from selling goods or services is higher than the cost of goods sold (COGS) and other direct expenses.

For example, if your total revenue is Rs.50,000 and your direct costs are Rs.30,000, you will have a credit balance of Rs.20,000, indicating a gross profit for the period.

What is a Profit and Loss Appropriation Account?

A profit and loss appropriation account shows how a company's net profits or losses are appropriated or distributed. This account is vital because it helps you understand how profits are distributed among shareholders, retained for future growth, and used for purposes like reserves.

It starts with retained earnings from previous years, adds the net profit for the current year, and then subtracts taxes and dividends paid or proposed. Additionally, it accounts for any transfers to or from reserves.

This account gives you clear insights into how profits are utilized. It helps ensure transparency in financial management and strategic planning for your business.

Difference Between a Trading Account and a Profit and Loss Account

Here’s a table that shows the main differences between a trading account and a profit and loss account:

Trading account | Profit and loss account |

Shows gross profit or loss from trading. | Shows net profit or loss after all expenses. |

Focuses on direct expenses and revenues related to the cost of goods sold. | Includes all income and expenses including those not related to trading activities. |

Used to evaluate a company's efficiency in buying and selling items. | Used to evaluate a company's overall financial performance. |

Required for businesses involved in trading activities. | Required for all businesses. |

Difference Between P&L Account and P&L Appropriation Account

Here’s a breakdown of the differences between a profit and loss account and a profit and loss appropriation account:

P&L Account | Profit and Loss Appropriation Account |

Shows net profit or loss after all expenses. | Shows how the net profit is distributed or appropriated. |

Focuses on revenues and expenses of a business. | Focuses on the distribution of net profit to reserves, dividends, etc. |

Includes income from operations and expenses like salaries, rent, and depreciation. | Includes retained earnings, taxes, dividends, and transfers to reserves. |

This account does not include an opening or closing balance. | This account may include both opening and closing balances. |

This account does not follow a partnership agreement, except for interest on loans from partners. | This account is prepared per a partnership agreement. |

Conclusion

Now you understand the trading profit and loss accounts format, you will manage your finances better because it helps you track your gross profit, operating expenses, and overall financial health. As you review these accounts regularly, you will make informed decisions to improve the efficiency and profitability of your business.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category