Unlock the Power of Trading with These 5 Essential Indicators

00:00 / 00:00

Top 5 Indicators

Technical analysis can make your trading strategy even better, whether it’s about trading in stocks, commodities, or forex.

Technical analysis includes the study of various trading indicators. Trading indicators are mathematical calculations plotted on the price chart.

These calculations help traders discover trends and signals in the market. There are various types of trading indicators.

In this article, we will talk about the top five. Learning about these indicators will help you over the long run. Here’s how the list of indicators looks!

Moving Average Convergence Divergence (MACD)

The relationship between two moving averages of a security’s price is shown by moving average convergence divergence (MACD), a trend-following momentum indicator.

Two moving averages are considered to be convergent when they diverge, and divergent when they converge.

This means that as moving averages converge, momentum decreases, but when they diverge, momentum increases.

When MACD crosses above its signal line, a trader can take a buy/put position, and when MACD crosses below its signal line, a trader can take a sell/short position.

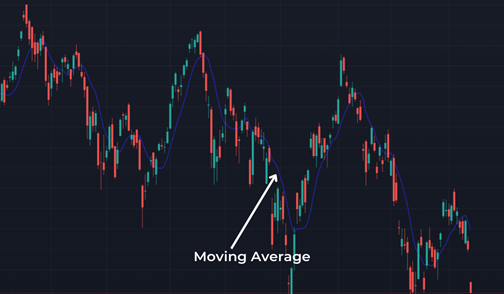

Moving Average

The Moving Average is in second place on our list. Moving average is a broad concept because it is diversified into multiple different types.

The most used types are “The Simple Moving Average” and the “Exponential Moving Average”.

The period over which the average price is calculated is also an important consideration.

The most used periods are the moving average of 50 and 200 days. Moreover, the Candlestick used here is created daily.

Bollinger Bands

Bollinger bands are among the most used technical indicators. This indicator is an excellent tool to determine the right time to take a position or confirm the one you already have in mind.

Bollinger bands show how volatile the market is. A middle band, which is a 20-day simple moving average.

A +2 standard deviation higher band, and a -2 lower deviation lower band are the three varieties of Bollinger bands.

A stock’s price fluctuates between the upper and lower bands. When the market is moving and there is more volatility, the band widens, and when there is less volatility, the gap narrows.

Bollinger bands are used by traders to determine a stock’s price range.

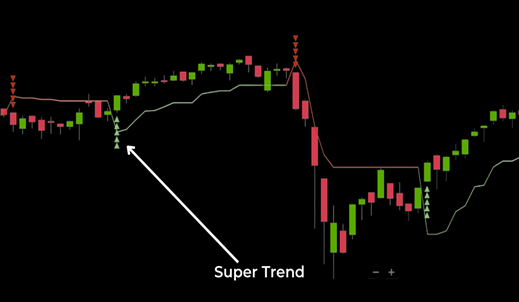

Super Trend

In a trending market, a super trend indicator gives a precise buy or sell signal. It’s a simple indicator that works similarly to moving averages.

It is plotted on price, and the current trend may be identified simply by its position in relation to price. Only two parameters are used to create it: period and multiplier.

The default parameters for the Supertrend indicator approach are 10 for the Average True Range (ATR) and 3 for the multiplier.

The average true range (ATR) is important in ‘Supertrend’ since it is used to calculate the indicator’s value and it signals the degree of price volatility.

Relative Strength Index (RSI)

Traders generally use the RSI to identify market conditions, momentum, and warning signals of high-risk price movements from a candlestick pattern.

The relative strength index is expressed between 0 and 100. RSI above 50 shows an up-trend and below 50 shows a down-trend.

Any assets around 70 level are mostly considered overbought. On the other hand, assets near or at the 30 level are considered oversold.

Final Words

These are the top five indicators that every trader must know. Remember, never use too many indicators simultaneously or in isolation.

Focus on a handful of those that align best with your goals. Also, make sure you use these indicators along with your analysis of price movements.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category