Put Call Ratio - Meaning, Formula, and Analysis

00:00 / 00:00

The put call Ratio (PCR) is a popular tool used to understand market sentiment. It shows if traders are feeling bullish or bearish based on option trading activity.

In this article, we’ll explore the significance of the PCR, how it is calculated, and how traders use it to gauge the underlying mood of the market.

But, before diving into the put call ratio, one must be aware of the basic terminologies of Options trading, which are very crucial to this concept. So let us cover these concepts first.

What are Options Contracts?

Options contracts are derivative instruments that derive their value from a base asset/underlying asset. These are agreements made between the two parties, i.e., the options seller/writers and options buyers, which can be executed at a future date at a predetermined price. Here, the options sellers create these contracts, which are used to buy and sell an underlying asset, and these contracts are purchased by the buyers for a price, which is called a premium.

A Deeper Dive into the Parties Involved in Options Trading

Now, when buyers purchase an options contract, they have the right to execute this contract on or before the predetermined date. But if the price of the underlying asset does not move in their favor, they can choose not to execute the contract. And, this privilege is received by them for the premium they pay to the options sellers.

Therefore, the option buyers can execute the options contracts when the underlying asset moves in their favor and earn unlimited profits to the extent the asset moves in their direction. But if the underlying asset doesn't move in their direction, they can choose not to execute the contracts, and the only loss that they would have to bear is the premium that they paid while entering into the contracts.

On the other hand, the options writers are the ones to create the contracts and sell them to the options buyers, for which they receive an upfront premium. For this premium received, the options sellers would need to compulsorily execute the options contract if the buyer of the options wishes to do so.

Here, the profit potential for the options sellers is limited to the premiums they receive. However, if the underlying asset moves against the conviction of the seller and the buyer of the option wishes to execute the contract, the seller would have to bear the loss to the extent the underlying asset has moved against them.

Important Note: From the above explanation, it is quite clear that options sellers have more at stake than the options buyers. Furthermore, options sellers have a better chance at winning in options than the buyers, as they are more resourceful and have better infrastructure.

Due to this reason, in options trading, the conviction or the interpretation of options sellers is given greater importance than that of an options buyer. Keep this point in mind when we move on to the concept of put call ratio.

What Are the Types of Options That Are Involved?

Based on the direction of the move of underlying asset, the options contract that is created can be classified into two types. They are:

Call Option Contracts: These are contracts that are bought by the option buyers when they think that the underlying asset will move in an upward direction. On the contrary, these are sold by the options seller when they think the underlying asset will not move upward or remain stagnant.

Put Option Contracts: These are contracts that are bought by the option buyers when they think that the underlying asset will move in a downward direction. Option Sellers sell this contract with the conviction that the underlying asset will remain stagnant or will move in the upward direction.

Now, these options contracts are created at different prices in the underlying asset by the options sellers, and these prices are referred to as the ‘strike price’. Now, we are just one step away from understanding the concept of put call ratio, which is understanding open interest.

What are Open Interests?

Open interest refers to the total number of options contracts entered into by the options seller and the options buyer but have not been executed or expired. In simple terms, suppose an options writer creates 1 option contract that you buy from them and haven’t exercised yet, it creates an open interest of 1. If this contract is executed by you tomorrow, the open interest is reduced by 1.

Basically, an agreement that is open between 1 options seller and 1 options buyer creates 1 open interest.

This is the overall gist that is required by you to understand the put call ratio. So let's get into it.

What is Put Call Ratio or PCR Ratio?

The Put Call Ratio, which is also called the PCR ratio, is a mathematical fraction that is calculated to interpret the sentiment that is present in an underlying security. This ratio is derived by dividing the total volumes or open interest of the put contracts by that of the call contracts over a specific period.

While both total volumes and open interest can be used to calculate the put call ratio, we will be discussing this concept only in terms of open interest. Why? Because the open interest PCR ratio provides a clearer picture of the market sentiment, as it reflects the total number of outstanding contracts and the cumulative commitment of the market participants. On the other hand, the Volume PCR ratio only represents the total contract traded within a specific time period, which can be temporary and is influenced by short-term trading activity.

How to Calculate Put Call Ratio

You can calculate the Put Call Ratio in two ways. First, based on Open Interest, where you divide Put Open Interest by Call Open Interest. Second, based on Volume, where you divide Put Volume by Call Volume.

Put Call Ratio Formula

Here is the put call ratio formula, based on Open Interest and Volume:

Based on Open Interest:

PCR ratio (OI) = Put Open Interest/ Call Open Interest

Based on Volume:

PCR ratio (Volume) = Put Volume/ Call Volume

Put Call Ratio Example Calculation

Example 1:

Strike Price | Put Open Interest | Call Open Interest |

20000 | 1500 | 3000 |

20100 | 2000 | 2500 |

20200 | 2500 | 2000 |

20300 | 3000 | 1500 |

20400 | 3500 | 1000 |

Total OI | 12500 | 10000 |

PCR ratio (OI) = 12500/10000

PCR ratio (OI) = 1.25

Example 2:

Strike Price | Call Open Interest | Put Open Interest |

20000 | 1500 | 3000 |

20100 | 2000 | 2500 |

20200 | 2500 | 2000 |

20300 | 3000 | 1500 |

20400 | 3500 | 1000 |

Total OI | 12500 | 10000 |

PCR ratio (OI) = 10000/12500

PCR ratio (OI) = 0.8

As you can see from the above examples, we have arrived at the Put Call ratio of 1.25 and 0.8 in the above examples. But what do these PCR ratios tell you? Let us learn to interpret them through the following explanation.

Put Call Ratio Interpretation

PCR Ratio < 1 (less than 1): A put call ratio below 1 indicates a higher number of call options than put options, reflecting a bullish market sentiment. This suggests that traders and investors expect the asset's price to increase.

PCR Ratio > 1 (greater than 1): A put call ratio above 1 means there are more put options than call options, signaling a bearish outlook. This implies that market participants expect the asset’s price to decline.

PCR Ratio ? 1: When the ratio is near 1, it reflects a neutral market sentiment, with no strong preference for bullish or bearish positions among traders and investors.

As mentioned previously, this is the traditional way of interpreting OI. But do you remember we earlier stated that the conviction of Options sellers has greater weightage than that of the options buyer? This is where the earlier-explained concept comes in handy. So if you have missed out on that part, do check it out again.

Put Call Ratio Interpretation for Option Sellers

PCR Ratio > 1 (greater than 1): When a PCR is greater than 1, it means that more writers are selling put options than call options. And when do option writers sell put options? Exactly! When they expect the underlying asset's price to increase or remain above a certain level. Therefore, one can expect a bullish sentiment in the underlying security

PCR Ratio < 1 (less than 1): Similarly, when a greater number of call options are being sold than the put options, it suggests that a greater number of options sellers are expecting the underlying price to stay below a certain level or go down. Here, one can expect a bearish sentiment in the underlying security.

However, if the Put Call ratio is 1.6 or greater, it might suggest that the underlying security is excessively bullish, and there might be a temporary downward movement in the prices. Similarly, a PCR ratio of 0.6 or less indicates that the underlying security is excessively bearish, and there might be a temporary upward movement in the underlying asset price. Therefore, it can be used as a contrarian indicator when the values are too high.

Variations in PCR Ratio Across Different Platforms

Now, if you have come across PCR ratios, you might notice variations in the ratio across different websites. Why the variations? It is based on the considerations of expiries to compute the Put-Call ratio.

Some websites consider all the listed expiries to compute the PCR ratio. While this approach reflects the broad perspective of the market, it may not be suitable for interpreting the short-term sentiment. On the other hand, some websites use only the near-term or immediate expiry, which helps you gauge the immediate market sentiments.

Therefore, it is very crucial to be aware of the basics of how to calculate Put Call ratio, so you can get an accurate interpretation based on your trading strategy.

Should You Consider All Strike Prices for PCR?

Here comes the question of using the open interest of all strike prices to compute the put call ratio. Is considering the open interest of all the strike prices actually necessary? Let us understand this with an example:

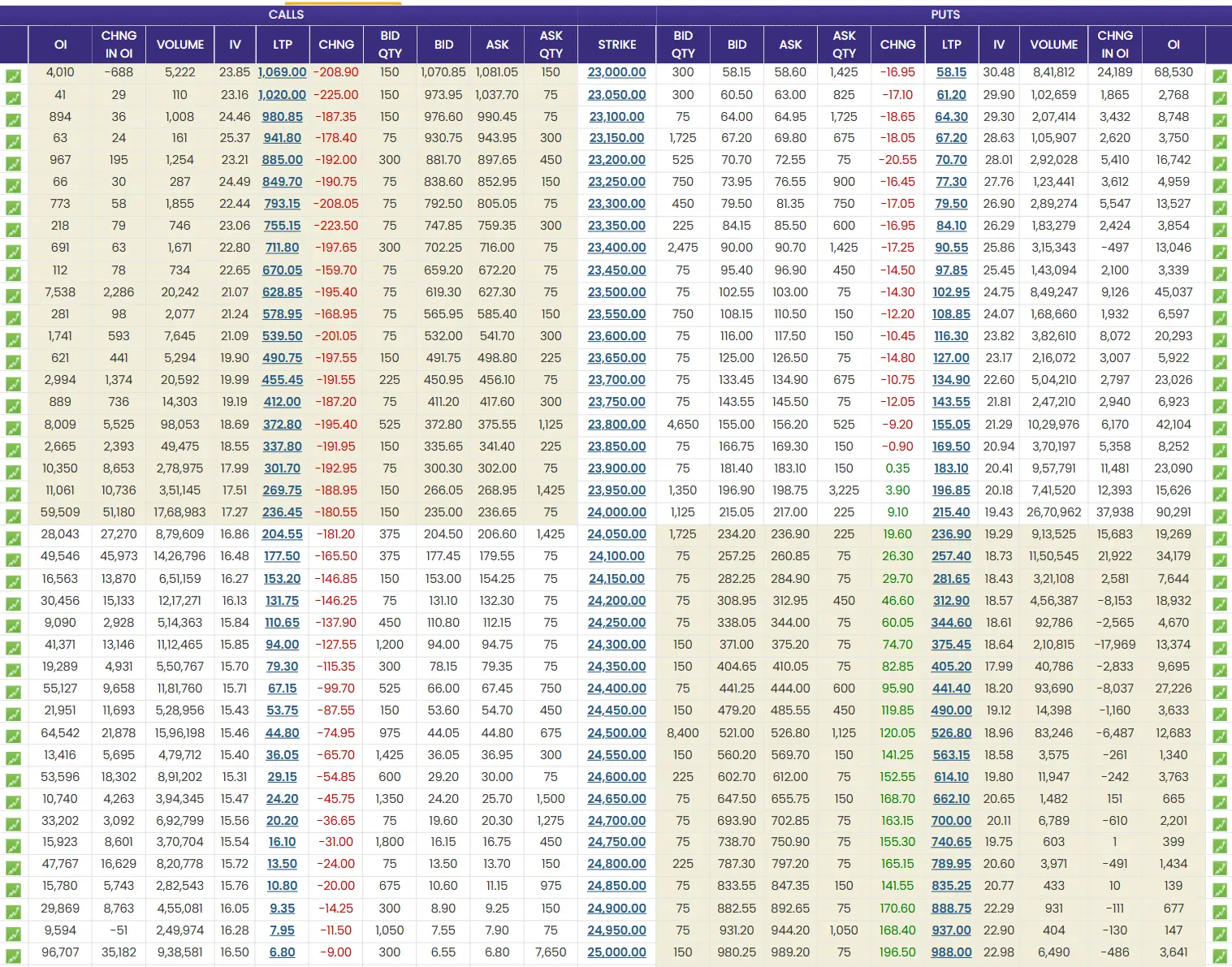

The above image shows the option chain of Nifty 50, which expires on May 15, 2025, with Nifty trading at 24000. This image was captured on the end of May 9, 2025, which was a Friday. This means the contract on this option chain has two trading days left before expiry.

Now, consider that there is no high volatility in the market. How much do you think Nifty will move, provided there are no external events occurring in the market, 2% to 3%? But if you check the image, you can see that there is open interest for every strike price where Nifty 50 may not reach in the two trading days it has left. Options sellers may be just sitting there to eat the premiums from the time decay, as all OTM contracts expire at zero.

So what should you be doing? Well, here you can analyze the IndiaVix and various other technical factors to determine how much the Nifty can move. Suppose the range is set between 23500 and 24500, you have to add all the open interest within this range for put and call options, and calculate the PCR ratio accordingly. This method might give you a better overview of the market mood. However, using this methodology is left to the preference of the traders.

Advantages of the Put Call Ratio

The following are the advantages of using the PCR ratio

The calculation and interpretation of the PCR ratio is simple, and its data is readily available on exchanges and broker terminals.

This ratio helps determine the overall mood of the underlying security.

It is a contrarian tool that helps traders assess whether a recent rise or fall in the market has been excessive and whether it may be an appropriate time to consider taking an opposite position.

Limitations of the Put Call Ratio

The following are the limitations of PCR:

Relying solely on the put call ratio indicator without incorporating other technical or fundamental indicators can sometimes lead to inaccurate market analysis.

Overlooking the broader market context, such as economic developments or geopolitical events, can distort the interpretation of PCR data.

Sudden market volatility or unexpected news can cause short-term fluctuations in the PCR, which may not reflect a genuine or lasting shift in market sentiment.

Conclusion

The put call Ratio (PCR) is a simple yet powerful indicator that offers useful insights into market sentiment. However, it is important to note that PCR indicates trader positioning, not necessarily their confidence or conviction, and relying on it in isolation can lead to misinterpretation. Therefore, it should be used alongside technical analysis for a more accurate view of the market.

Frequently Asked Questions

1. What if PCR is more than 1?

A PCR greater than 1 means more put options than call options are open, which traditionally signals bearish sentiment. However, from the perspective of option sellers (who are considered more informed), it may actually indicate bullish sentiment, as they are selling puts expecting the market to stay up or rise.

2. What does a low put call ratio mean?

A low PCR (less than 1) suggests more call options than puts, indicating bullish sentiment traditionally. But from the option sellers' perspective, it can imply bearish sentiment, as they are selling more calls expecting the market to fall or remain below a certain level.

3. Is the put call ratio reliable?

PCR is a useful sentiment indicator, especially when used with other tools. However, relying solely on it can be misleading, particularly during times of high volatility or unexpected news events.

4. Can the put call ratio predict market direction?

It helps gauge sentiment, not predict exact direction. Extreme PCR values (too high or too low) can serve as contrarian indicators, suggesting potential market reversals. But it should be combined with other analyses for better accuracy.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category