Platinum Price Predictions Till 2030 in India

00:00 / 00:00

The moment you think about investing, luxury metals often come to your mind. Many people go for gold and silver, but there is an increasing trend for platinum investment. Known as the “little silver” or even as the “white gold,” this is not just one of the many metals, but also a profitable one.

But have you ever wondered, among all the hard and soft commodities, why platinum is the one that is gaining traction? Also, have you analyzed the platinum future price prediction, as this is one of the key factors that will impact the investment strategy?

So, if you are a new investor looking to make an investment in platinum, read this guide. Know the answers to all the basic questions and get the detailed analysis that will guide you on the platinum price in the future.

Rise in Platinum Price – Historical Trend

Looking at platinum prices from the past, it can be confirmed that it is a relatively stable industrial metal. This is because of concentrated supply, steady industrial demand, and rising interest from investors. This period clearly explains why many investors now ask whether the platinum price will increase in the future.

Platinum demand is heavily industrial. Around 40% comes from autocatalysts used in vehicles. On the supply side, nearly 70% to 75% of global production comes from South Africa. Power shortages, labor issues, and aging mines have steadily reduced output. These pressures created repeated supply deficits. All this started reflecting strongly in prices after 2024.

Between 2021 and 2024, platinum mostly traded in a narrow range of USD 900 to USD 1,100 per troy ounce. This phase followed the post-COVID slowdown in auto demand and concerns around electric vehicle adoption. However, from 2025 onward, the situation changed sharply. Supply disruptions lead to the search for new technologies. Prices surged and briefly touched record levels in early 2026.

Platinum Price Trend Overview

Year | Start Price (USD per t.oz) | End or Current Price (USD per t.oz) | YoY Change | Key Market Drivers |

2021 | 1,175 | 1,050 | -11% | Global auto demand recovery |

2022 | 1,067 | 1,000 | -5% | Labor strikes in South Africa |

2023 | 1,169 | 925 | -7% | Palladium substitution concerns |

2024 | 1,027 | 997 | -3% | Supply deficit crosses 1 million oz |

2025 | 997 | 1,400+ | +40% | South Africa's output drops 10% |

2026 YTD | 2,200 | 2,178 | +55% | Hydrogen demand and trade hedging |

How Platinum Becomes a Usable Product

Platinum is one of the most difficult metals to produce at scale. It is mined in very small quantities, processed through energy-heavy stages, and refined over long timelines. This slow and complex supply chain is a reason behind volatility.

Stage | What Happens in Simple Terms | Price Impact |

Underground Mining | Platinum is extracted from deep mines, mostly in South Africa. Large volumes of rock are removed to recover a very small amount of metal. | Heavy dependence on one region makes supply an issue. Any mining halt quickly affects prices. |

Ore Processing | The mined rock is crushed. It is treated to separate platinum-rich material from waste. | High energy use and low recovery rates are there. It keeps production costs elevated. |

High-Heat Smelting | The concentrated material is heated at extreme temperatures to remove unwanted elements. | Power shortages and rising electricity costs directly limit output. |

Metal Cleaning | Base metals are removed using chemical and electrical methods. This leaves platinum-rich material. | Losses at this stage reducethe final supply. It then tightens the market further. |

Platinum Separation | It is separated from other similar metals. This is using advanced chemical processes that take weeks. | Limited global capacity creates delays and supply bottlenecks. |

Final Shaping and Recycling | Pure platinum is shaped into bars, wires, or industrial forms. Recycled platinum adds some supply. | Recycling helps, but it cannot fully balance mining shortfalls. |

Global Platinum Production

Platinum production is highly concentrated and limited. This is why supply is limited, and prices are high. The production based on the top contributors in the world is as follows:

Country | Platinum Production (kg) |

South Africa | 124,870 |

Russia | 21,000.00 |

Zimbabwe | 19,180 |

Canada | 5,174 |

China | 4,000 |

United States | 3,040 |

Finland | 933.00 |

Colombia | 637.00 |

Australia | 110.00 |

Serbia | 20.00 |

Ethiopia | 8.00 |

Platinum Usage by End-User Sector

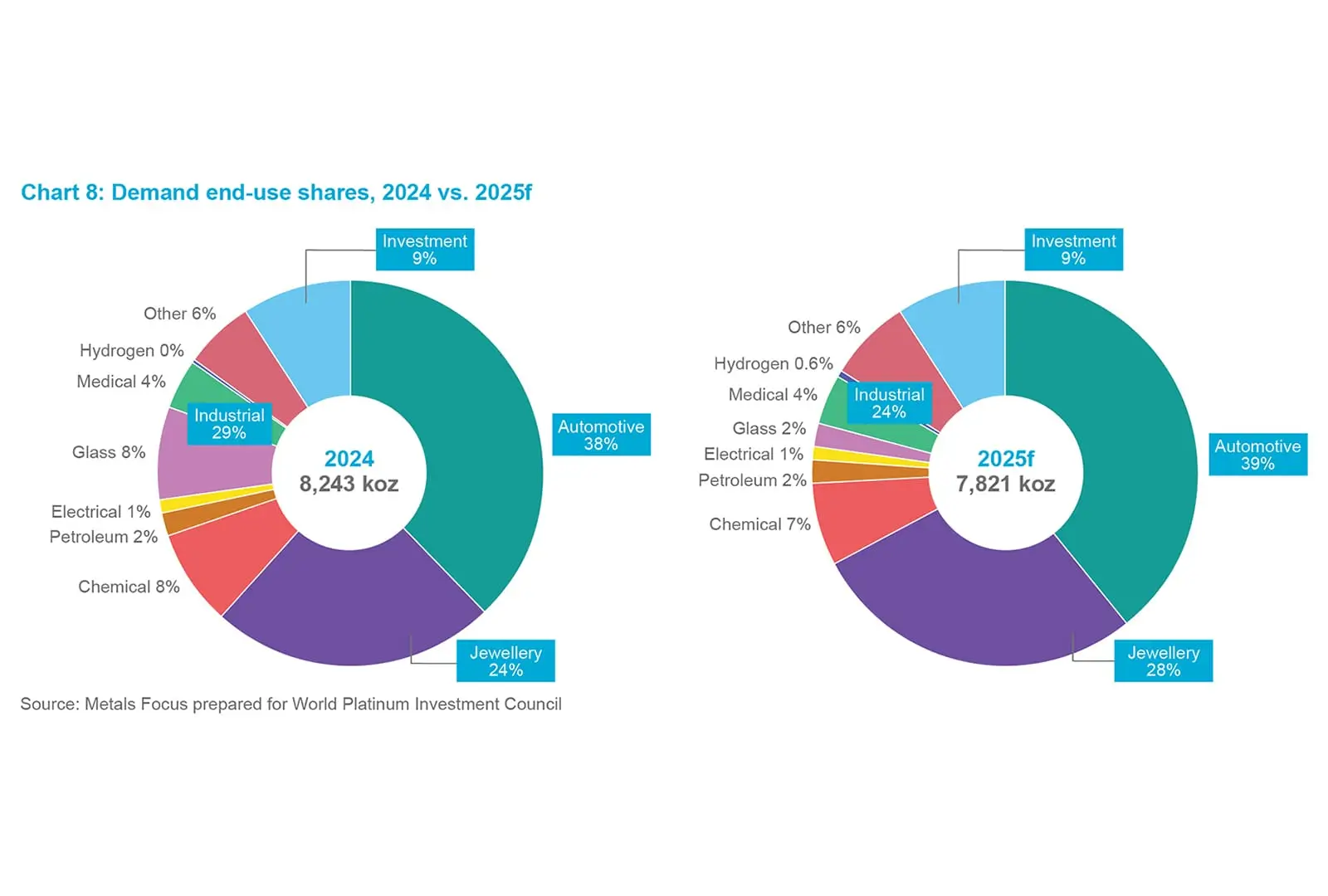

Platinum demand is not driven by a single industry. It comes from a mix of essential industrial uses and discretionary segments. This together creates a tight and resilient demand profile.

In 2024, the market recorded a deficit of around 692 koz. There was a demand of about 8.34 Moz against a supply of nearly 7.65 Moz. This imbalance explains why platinum prices stayed firm and why demand trends matter in any platinum price prediction.

The primary demand comes from the following sectors:

Sector | Share of Demand | Why It Matters |

Automotive | 40% | Emission control catalysts make this demand regulation-driven and hard to replace. |

Jewelry | 25% | Driven mainly by China and India; varies with price and consumer sentiment. |

Industrial | 25% | Essential for chemicals, glass, and petroleum refining processes. |

Investment | 9% | Physical bars and ETFs increase during tight supply phases. |

Hydrogen | <1% | Small today but offers long-term growth with the help of fuel cells and electrolyzers. |

Medical and Other | 6% | Stable niche demand with limited substitutes. |

Platinum in India: Why the Market Is Gaining Importance

India is becoming an increasingly important market for platinum, especially at times when gold prices remain high. Indian consumers are price-aware and often look for value alternatives without compromising on status or durability. This behavior makes India a key demand center in the broader platinum future price prediction narrative.

Recent reports show that platinum is no longer a niche metal in India. There is a rise in its use across sectors, but the supply is still limited. This is helping platinum outperform other precious metals during certain cycles.

As per the reports, the platinum prices surged by nearly 57% in 2025. This was more than both gold and silver. The report also cited data from the World Platinum Investment Council. This suggests that there is a supply deficit of around 968,000 ounces in 2024. This was followed by another 850,000-ounce shortfall in 2025. But jewelry demand was expected to grow by around 11%, supported mainly by India and China. (Source)

At the manufacturing level, India is seeing strong traction. There is platinum jewelry production, which saw a growth of 14% year-on-year in 2024-25. Men’s jewelry is emerging as a fast-growing segment. Platinum’s durability and modern appeal are the reasons for this. It is helping it gain ground among younger buyers and urban consumers. (Source)

From a broader market perspective, Straits Research notes that platinum demand remains well balanced. This is across automotive catalysts, industrial applications, and jewelry. This diversified demand is what makes this metal one of the most sought-after in 2026 and beyond. (Source)

India Market Driver | Current Trend | Impact on Prices |

Jewelry Preference | A valuable option when gold prices are rising. | Helps with steady demand when there is fluctuations in gold prices. |

Manufacturing Growth | 14% growth in platinum jewelry production. | Indicates long-term domestic demand strength. |

Global Supply Deficits | Large shortages in 2024 and 2025. | Even moderate Indian demand adds upward pressure. |

Demand Diversity | Jewelry backed by industrial and auto demand. | Improves price stability over time. |

Platinum Outlook Through 2026

Streetwise Reports suggests that platinum’s recent rise is not just a short-term move. The price strength is backed by real supply and demand factors, which keep platinum future price prediction models positive in the near term.

Some key points from the analysis are clear.

Supply remains tight. Platinum mining has seen years of underinvestment. Production issues in major regions continue to limit fresh supply.

Auto demand is holding up. Petrol, diesel, and hybrid vehicles still dominate global sales, keeping platinum essential for emission control systems.

Shift away from palladium. Automakers are moving back to platinum as it is more cost-effective, which is making demand steady.

Investor interest is improving. As platinum moved out of its old trading range, investment demand started picking up again.

Hydrogen adds future support. Usage in fuel cells and electrolyzers is small but supports long-term plans.

Platinum Price Expectation Till 2030

Looking at the current market structure, analyst commentary, and supply trends, platinum’s long-term outlook remains constructive. You can expect consolidation at higher levels. This is important when framing a realistic platinum future price prediction for 2030.

Supply remains constrained while the demand from autocatalysts is expected to remain relevant. This is because of hybrids and combustion engines for EV adoption. Hydrogen-related usage adds gradual upside, not an overnight demand shock.

This is what the platinum future price prediction 2030 can be all about.

Scenario | Expected Price Range (USD per t.oz) | Key Assumptions |

Conservative | 1,500 to 1,700 | Less deficit, which supports consistent demand and supply. |

Base Case | 1,700 to 2,000 | Long-term demand from the auto and upcoming sectors. |

Bullish | 2,000 to 2,400 | Persistent deficits make it a high-value investment. |

Insights for Investors

Platinum offers a different investment case compared to gold and silver. Its value is closely linked to industrial demand and limited supply, which makes it suitable for investors looking at long-term positioning rather than short-term price moves.

Focus on long-term investing.

Consider staggered investments instead of lump-sum buying.

Use platinum mainly for portfolio diversification.

Track supply and demand status.

Manage the volatility using this.

Conclusion

Platinum has moved beyond being a niche precious metal. Supply is still limited while demand is rising. But this is still an investment with a long-term view. If you are planning to explore commodities, register with Rupeezy. Explore all the details and insights you need to invest well.

FAQs

Will the platinum price increase in the future?

Maybe. Platinum prices will be impacted by supply and steady industrial demand. But there can be short-term fluctuations.

Is platinum a good investment till 2030?

Platinum can be a good long-term diversification asset if held with a multi-year horizon and controlled allocation.

What mainly drives platinum prices?

Supply constraints, automotive demand, industrial usage, and emerging hydrogen applications influence prices the most.

Is platinum riskier than gold?

Yes, platinum is more volatile than gold because it depends heavily on industrial demand and limited production regions.

How should retail investors invest in platinum?

Retail investors should prefer gradual investment and keep platinum exposure limited within a diversified portfolio.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category