Is Mamata Machinery IPO Good or Bad - Detailed Review

00:00 / 00:00

Mamata Machinery IPO is kicking off its initial public offering which will be open from December 19, 2024, to December 23, 2024. While considering applying for this IPO, certain questions may arise in your mind, including whether the Mamata Machinery IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive Mamata Machinery IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice

Mamata Machinery IPO Review

Mamata Machinery Limited is well-positioned for growth in the packaging machinery sector, bolstered by strong financial performance and strategic initiatives focusing on technological advancement and operational efficiency.

Its strategic focus on technological advancement, international expansion, and operational efficiency enhances its market position and resilience against industry risks.

While it faces challenges such as dependency on key customers and potential disruptions in manufacturing, its comprehensive strategies aimed at diversifying its customer base and enhancing production capabilities are likely to sustain its momentum. The review is supported by the overview we have provided below; please go through it to learn more.

Mamata Machinery IPO - Company Overview

Mamata Machinery Limited manufactures and exports plastic bags, pouch-making machines, packaging machines, and extrusion equipment. It provides end-to-end manufacturing solutions for the packaging industry.

Products manufactured using its machines are used across several industries as packaging applications, such as the packing of food and FMCG products.

They primarily supply packaging machinery to direct consumer brands in the FMCG, food, and beverage industries. Additionally, they sell bag and pouch-making machines to converters and service providers, who predominantly serve the FMCG and broader consumer markets.

Mamata Machinery equipment is also utilized in non-packaging applications, such as e-commerce bags and garment packaging bags. The company consistently endeavors to expand product offerings and solutions to customers.

Mamata Machinery Limited has a wide range of customers some of which include Balaji Wafers Private Limited, Dass Polymers Private Limited, Jflexy Packaging Private Limited, and more.

Mamata Machinery also provides after-sales service to customers. As part of its focus on innovation, it has launched new and advanced machines from time to time.

The company provides end-to-end solutions for the entire ecosystem of plastic film-based flexible packaging, offering services from concept to commissioning throughout the complete lifecycle of their machinery.

They operate two machine manufacturing facilities, one in India and one in the USA. As of September 30, 2024, it has two international offices located in Bradenton, Florida, USA, and Montgomery, Illinois, USA, as well as sales agents in over 5 countries.

As of September 30, 2024, they have been granted four patents, one for the design and method to stack bags at very high speeds for India with the name “Machine and Method to Produce PlasticBags” and the second for machine design and manufacturing process for “Flat Bottom Pouches” in various jurisdiction including USA, European Union, Japan, and India with the name “Machine and Method to ProducePlastic Pouches”, the third for “Multi-Purpose Sealing Module for Plastic Film-based Bags and Pouches making machine” and the fourth for “A Cross Sealing Device”.

As of September 30, 2024, Mamata Machinery Limited has 197 employees, including 87 engineers and application experts. These professionals specialize in electronics, mechanics, software, and design applications, and come from regions such as Europe, South Africa, and Asia.

Mamata Machinery sells its machines under the brand names “Vega” and “Win”. As of September 30, 2024, it has installed over 4,500 machines in 75 countries around the world.

This range of product offerings by the company in the packaging segment, combined with end-to-end solutions and a good geographical presence, made the Mamata Machinery IPO worth considering for investors.

Mamata Machinery IPO - Industry Overview

According to the Economic Survey 2022-23, the packaging industry is one of the largest economic sectors in the country, and it is estimated that the Indian packaging industry accounts for approximately 10 to 15% of the global packaging industry.

The Indian Packaging Market, valued at USD 50.5 billion in 2019, is estimated to have reached USD 130.14 billion by 2023, experiencing a compounded annual growth rate of 26.7% from 2019 to 2023.

This reflects the robust growth of the packaging sector in India, expanding at a rate of 23-28% annually and establishing itself as a preferred hub for the packaging industry.

The Indian flexible packaging market is valued at USD 12.92 billion and is estimated to have reached USD 49 billion in 2023. Further, the industry is estimated to grow at a CAGR of 12.6% between 2022 and 2027.

In contrast, the global packaging machinery market's size was estimated to be USD 46.8 billion in 2022, slated to grow to USD 60.8 billion by 2028, witnessing a 4.5% CAGR increase between 2022-28.

The export of packaging machinery has displayed a remarkable trajectory over the given years. In FY 2020, the export value stood at INR 15.5 billion, and by FY 2024, it reached an impressive INR 28.2 billion.

The CAGR over this period stands at a remarkable 16.1%, indicative of sustained and substantial growth. India is a net importer of packaging machinery. Annual imports reached INR 73.5 Bn in FY 2024, up by 9%, from INR 67.7 billion in FY 2023.

Indian e-commerce is projected to reach USD 12 billion in gross merchandise value (GMV) during the festival season from October to December 2024, reflecting a 23% increase from the previous year.

This caused the steady demand push for packaging materials, and thereby packaging machinery, in the Indian market. This positive growth rate of the packaging industry locally and globally makes the Mamata Machinery IPO an attractive offer for investors.

Source: Mamata Machinery IPO RHP

Mamata Machinery IPO - Financial Overview

As per the RHP of the company, in the financial year ended March 31, 2024, the revenue from operations was INR 236.61 crore, compared to INR 200.86 crore in 2023 and INR 192.24 crore in 2022. This represents a consistent year-over-year growth, with an increase of 17.8% from 2023 to 2024, likely due to expanded business operations or improved market conditions, enhancing the company's revenue streams.

EBITDA for 2024 stood at INR 47.17 crore, showing a significant improvement from INR 23.74 crore in 2023 and INR 29.93 crore in 2022. The EBITDA margin increased to 19.94% in 2024 from a lower margin of 11.88% in 2023. This improvement in EBITDA is indicative of better operational efficiency and cost management, contributing to a higher margin despite the broader scale of operations.

The company's profit after tax in 2024 was INR 36.12 crore with a PAT margin of 15.27%, an improvement from INR 22.50 crore and a margin of 11.20% in 2023 and INR 21.69 crore with a margin of 11.29% in 2022. This growth in profit and margin could be attributed to higher operational revenue and efficiency, alongside effective tax management strategies, enhancing net profitability.

The ROE for 2024 was reported at 27.76%, which shows a significant improvement compared to 19.41% in 2023 and 23.12% in 2022. This increase suggests that the company has become more effective at generating profits from shareholders' equity, possibly due to better asset management or improved earnings.

The ROCE has seen a slight improvement, recording 31.29% in 2024, up from 15.71% in 2023 and 25.73% in 2022. This substantial increase indicates a more efficient use of capital in generating earnings, which is critical for assessing the company's investment efficiency and could reflect strategic investments or operational improvements yielding higher returns.

Strengths of Mamata Machinery IPO

Mamata Machinery is among the leading exporters of machinery and equipment for bag and pouch making, with over three decades of presence, strong customer connections, and more than 4,500 machinery installations globally.

They have high-tech manufacturing facilities and know a lot about materials, which allows them to tailor their systems and products to meet specific customer needs.

The company leverages advanced technology and prioritizes high-quality, innovative development to produce market-responsive products. Their facility is equipped with the latest testing tools and software to bolster their development efforts.

The company has developed unique technology that allows its machines to utilize recyclable plastic films, enhancing their commitment to environmental sustainability.

Mamata Machinery operates with a strong customer focus and boasts an extensive global sales and distribution network. As of May 31, 2024, they serve a diverse customer base in over 75 countries, including both end-user brands and conversion players.

Risk Factors of Mamata Machinery IPO

Significant increases or fluctuations in the prices of primary materials, as well as shortages or supply disruptions, could significantly impact their estimated costs, expenditures, and timelines. Such changes could have a material adverse effect on their business.

Their business heavily relies on the FMCG, food and beverage, and consumer industries. If these sectors slow down or if there are negative changes in the market for plastic processing and packaging machines, it could seriously hurt their business, finances, operations, and future prospects.

Their business depends heavily on their manufacturing facilities running smoothly. Any slowdown, shutdown, or disruption caused by natural or other disasters could lead to significant disruptions in their operations. This could negatively impact their business performance, operational results, financial health, and cash flows.

A significant portion of their revenue comes from their top ten customers. Losing any of these customers, or a reduction in their purchases could negatively impact their business, operational results, and financial health.

They depend on third parties for various services for their manufacturing, assembly, and office premises, including waste and facility management. This lack of long-term supply agreements and reliance on third-party services could pose risks to their operational stability.

Strategies of Mamata Machinery IPO

Mamata Machinery is set to expand its international presence by diversifying its customer base and increasing exports. They plan to enhance manufacturing efficiency and reduce costs through backward integration, including setting up a new unit to fabricate machine frames. This unit will feature advanced equipment like CNC laser cutters and welding machines, ultimately speeding up production and delivery times.

Mamata Machinery is committed to innovation across all product categories to accommodate a broader range of end applications. As part of their growth strategy, They aim to capitalize on emerging opportunities within their existing product lines. While their current portfolio primarily serves the food packaging industry, they are planning to expand their offerings to include other fast-moving consumer goods (FMCG) sectors. This diversification will allow them to meet the varied needs of their industries and enhance their market reach.

Mamata Machinery is committed to reducing operating costs and enhancing operational efficiencies by investing in its manufacturing facilities, infrastructure, and technology. These improvements enable them to expand their product suite and increase productivity without significant future costs.

They are upgrading their ERP system to support their growth strategies and focusing on increasing production volumes to improve capacity utilization at their production facilities. This comprehensive approach will optimize operations and facilitate sustainable growth.

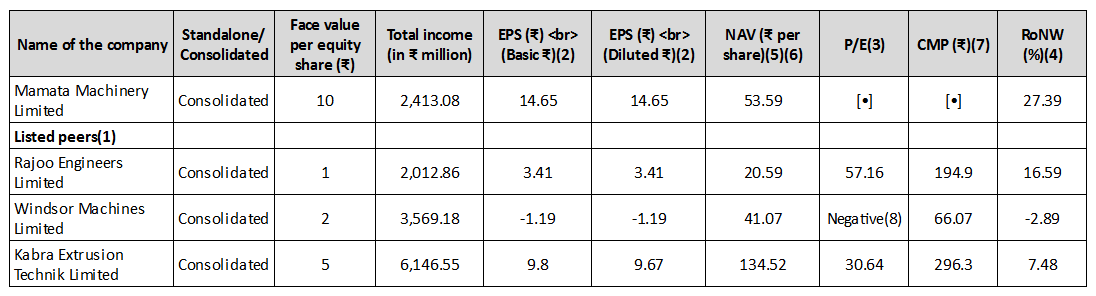

Mamata Machinery Limited Vs Peers

Mamata Machinery's total income stands at INR 241.30 crore, compared to its peers Rajoo Engineers who reported a total income of INR 201.28 crore while Windsor Machines reported INR 356.91 crore and Kabra Extrusion INR 614.65 crore, indicating that while Mamata Machinery is competitive, it doesn't lead in revenue.

Mamata Machinery shows a RoNW of 27.39%, significantly higher than that of its peers, with Rajoo Engineers at 16.59%, Windsor Machines negative at -2.89%, and Kabra Extrusion at 7.48%. It shows that Mamata Machinery is using its equity much more effectively to generate profits.

Mamata's EPS of INR 14.65 significantly outperforms Rajoo Engineers' INR 3.41 and is better than Windsor Machines which has a negative EPS of -INR 1.19, indicating losses. Although Kabra Extrusion's EPS is close at INR 9.80, Mamata still leads, indicating higher profitability per share.

Mamata Machinery Limited has demonstrated strong financial health and profitability compared to its peers. It leads in EPS and RoNW, suggesting efficient profit generation and asset utilization. Compared to its peers, it's positioned as more efficient and profitable, though not the leader in total income, where Kabra Extrusion leads.

Objectives of Mamata Machinery IPO

The company will not keep any of the money raised from this offer. Instead, all the money made from selling these shares will go to the current shareholders who are selling their shares, after subtracting any costs related to organizing and completing the sale. These costs will also be paid by the shareholders who are selling, not by the company itself.

Mamata Machinery IPO Details

IPO Date

Mamata Machinery IPO is open to subscription from December 19, 2024, to December 23, 2024. The shares will be allocated to investors on December 24, 2024, and the company will be listed in the NSE and BSE on December 27, 2024.

IPO Issue Price

Mamata Machinery IPO is offering its shares in the price band of Rs.230 to Rs.243 per share. This means you would require an investment of Rs.14,823 per lot (61 shares) if you are bidding for the IPO at the upper price band.

IPO Size

The Mamata Machinery IPO is offering a total of 73,82,340 shares, amounting to Rs. 179.39 Crores which is completely through an offer for sale

IPO Allotment Status

The shares from the Mamata Machinery IPO will be allotted to its investors on December 24, 2024. One can check the allotment status for the IPO from its registrar Link Intime India Private Ltd, the BSE website, or your broking platform where you have applied for the IPO.

IPO Application Link

Open a demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free. Click on the apply link below to get started.

Apply for Mamata Machinery IPO

Conclusion

Mamata Machinery is a good company in the packaging machinery sector with strong financials and a diversified geographical presence. However, it is recommended that investors conduct thorough research before making an investment decision.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category