Is Sai Life Sciences IPO Worth Buying? Detailed Review

00:00 / 00:00

Sai Life Sciences, a leading player in the Contract Research, Development, and Manufacturing Organization (CRDMO) sector, is gearing up to launch its Initial Public Offering (IPO) from December 11, 2024, to December 13, 2024. If you’re wondering whether the Sai Life Sciences IPO is worth buying, you’re in the right place.

In this article, we provide a Sai Life Sciences IPO review by covering the company’s business operations, financial performance, and the objectives of the IPO to help you make an informed investment decision.

Company Overview of Sai Life Sciences IPO

Incorporated in 1999, Sai Life Sciences is one of the leading Contract Research, Development, and Manufacturing Organizations (CRDMO) that provides complete services across the drug discovery development and manufacturing value chain. It specializes in small molecule NCEs and works collaboratively with global pharmaceutical innovators and biotechnology firms based on its dual expertise as a CRO and CMCO.

Sai Life Sciences operates primarily as a B2B company, having large-scale facilities located in Hyderabad and Bidar in India along with research laboratories near innovation hubs in Boston, USA, and Manchester, UK, the company has positioned itself to serve over 280 pharmaceutical companies worldwide. Of these, 18 are part of the global top 25 leaders in the industry.

With over 170 pharmaceutical products in its development portfolio that cover all phases of drug discovery to commercialization, Sai Life Sciences is exceptionally well-positioned to meet growing demands in the pharmaceutical industries, with regulatory accreditations by the USFDA and Japan's PMDA, a team of over 2,300 highly qualified scientific professionals stand behind quality standards at Sai Life Sciences.

Additionally company offers customized services according to the customer's needs, whether it's a small client, a large biotech company, or a global pharmaceutical company making them unique in the field.

As of FY24, the Contract Development and Manufacturing Organization (CDMO) segment is the largest contributor to Sai Life Sciences accounting for 66% of total revenue in FY2024, up from 61% in FY2023, and Contract Research (CRO) contributed 34% of total revenue in FY2024.

Financial Overview Sai Life Sciences IPO

The company demonstrated strong growth over the past three fiscal years, with revenue increasing to Rs.1465.17 crores in FY24 from Rs.1217.13 crores in FY23 and Rs.869.59 crores in FY22.

The company also posted excellent growth in net profit at Rs 82.81 crore in FY24 against Rs 9.99 crore posted in FY23 and Rs.6.26 crore in FY22, because of increased margins, indicating the increased operational efficiency of the company.

This robust rise in revenue and profits reflects the company’s ability to enhance efficiency and strengthen margins despite scaling operations.

The company reported a Return on Equity (ROE) of 8.49% and a Return on Capital Employed (ROCE) of 10.26% for the fiscal year 2024, which indicates low returns to shareholders and also an inefficient use of financial resources. Furthermore, the company maintains a healthy leverage balance, as reflected by a debt-to-equity ratio of 0.75 during the same period.

Strengths of Sai Life Sciences IPO

The company provides the full value chain of CRDMO development and manufacturing services, including intermediates and APIs, and is an ideal partner for pharmaceutical innovators.

The company’s scientific talent specializes in diverse therapeutic areas, including oncology, CNS, autoimmune diseases, metabolic disorders, and rare diseases, ensuring its relevance in addressing complex medical challenges.

The Company is one of the few CRDMOs to have research laboratories for discovery and development in major talent hubs outside India, with large-scale research laboratories and manufacturing facilities in cost-efficient locations in India.

The company has a long-standing relationship with a diverse base of existing and new customers. As of September 30, 2024, no single customer accounted for more than 8.00% of their revenue from operations.

Risk Factors of Sai Life Sciences IPO

The CRDMO market is highly fragmented, with more than 1000 global CROs and CDMOs competing for market share.

Stringent regulations and current geopolitical dynamics, such as the Biosecure Act and IRA, among others, could challenge Sai Life Sciences' pricing power and raise compliance costs.

Dependent on biotechnology and pharmaceutical customers, facing industry-specific risks.

Company’s business may be adversely affected if its customers fail to develop or manufacture commercially viable drugs, due to industry-specific challenges they may face.

Strategies of Sai Life Sciences IPO

The company seeks to increase average spending from existing customers through deeper engagement and cross-selling of their services.

Implementing robotic automation, automated liquid handling, real-time data acquisition, and parallel experimentation in their Discovery and CMC R&D laboratories.

The company plans to expand the commercial development and manufacturing capabilities of Bidar and Hyderabad units to meet growing demand.

The Company intends to pursue more integrated Discovery projects to drive customer stickiness and larger integrated discovery programs.

Sai Life Sciences Vs Peers

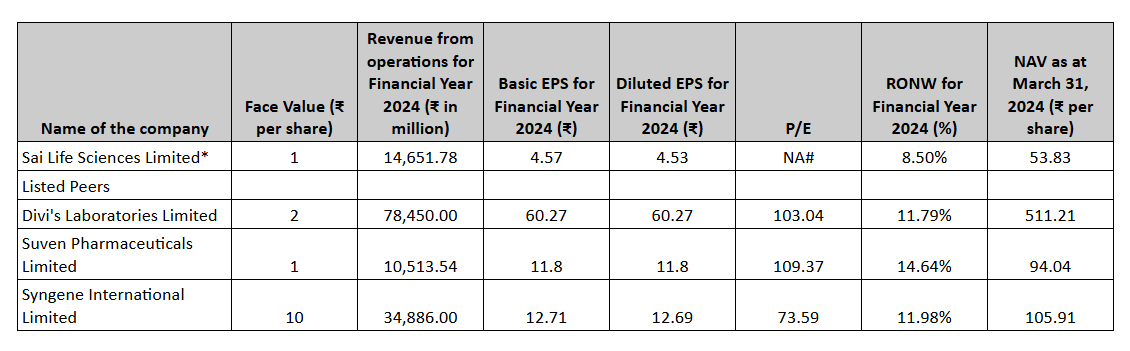

Below is the image showing a comparison of Sai Life Sciences with its listed industry peers as of FY24:

Sai Life Sciences operates in a very competitive market where it competes with some of the large established companies in the emerging space of CRDMO within India, which is among the largest growing markets within Asia Pacific, and also witnesses growth at a rate of 14% from 2023 to 2028.

Sai Life Sciences, with FY2024 revenues of Rs 1,465.17 crores, shows promising growth but lags behind peers like Divi’s Laboratories, Syngene International, and Suven Limited. Furthermore, the company’s EPS of Rs 4.53 lags behind Suven’s (Rs 11.80), Syngen’s (Rs 12.69), and Devi’s (Rs 60.27) even though reporting more revenue than Syngene.

Its RONW of 8.50% trails behind Suven Pharmaceuticals (14.64%), Divi’s (11.79%), and Syngene’s (11.98%), indicating room for improvement in return generation. These metrics suggest Sai Life Sciences faces stiff competition from well-established peers.

Objectives of Sai Life Sciences IPO

Sai Life Sciences ipo includes a fresh issue of Rs.950 crores and an offer for sale of Rs.2092.62 crores by existing investors and promoters. The funds will primarily be used to repay debt, expand R&D and Manufacturing capabilities, and for general corporate purposes.

Sai Life Sciences IPO Details

IPO Date

Sai Life Sciences IPO is open to subscription from December 11, 2024, to December 13, 2024. The shares will be allocated to investors on December 16, 2024, and the company will be listed in the NSE and BSE on December 18, 2024

IPO Issue Price

Sai Life Sciences is offering its shares in the price band of Rs.522 to Rs.549 apiece. This means you would require an investment of Rs.14823 per lot (27 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Sai Life Sciences is offering a total of 5,54,21,123 shares, amounting to Rs.3042.62 Crores, which includes a fresh issue of Rs.950 crores and an offer for sale of Rs.2092.62 crores by existing investors and promoters.

IPO GMP

Many investors look at the Grey Market Premium (GMP) before applying for Sai Life Sciences, as it indicates market sentiment and potential listing prices. However, it does not reflect Sai Life Sciences' financial strength, so conducting a financial analysis before investing is essential.

IPO Allotment Status

The shares from Sai Life Science will be allotted to its investors on December 16, 2024. One can check the allotment status for the IPO from its registrar Kfin Technologies Limited Private Limited, the BSE website, or your broking platform where you have applied for the IPO.

IPO Application Link

Open a demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free. Click on the apply link below to get started.

Apply for Sai Life Sciences IPO

Sai Life Sciences IPO Good or Bad?

Sai Life Sciences IPO presents a compelling investment opportunity, supported by strong financial growth, comprehensive CRDMO service offerings, and advanced R&D and manufacturing facilities. Additionally, the company’s focus on automation, customer engagement, and capacity expansion positions it strategically in a rapidly growing sector.

However, the company operates in a highly fragmented market and lags behind its peers in terms of operational metrics. Furthermore. The company faces regulatory pressures and geopolitical risks such as the Biosecure Act and IRA which can act as a hindrance to the growth of the company.

While the company shows a potential for promising growth in the pharmaceutical sector. Investors should carefully assess the risks associated with the company before considering investing in the IPO.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category