Future of Hedge Funds in India by 2030

00:00 / 00:00

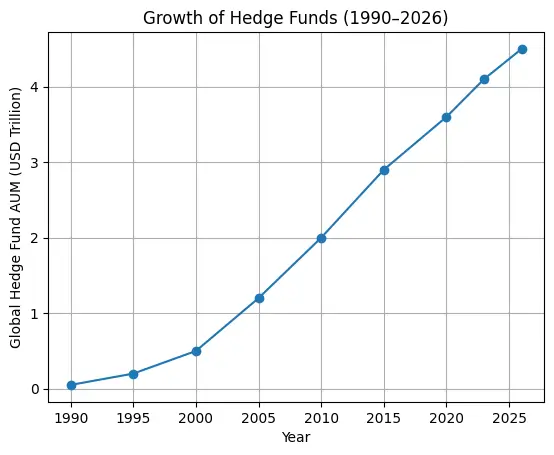

The world of hedge funds is rapidly evolving, and by 2030, the Indian hedge fund landscape is expected to become more sophisticated, accessible, and influential within the broader financial ecosystem.

Hedge funds are typically used by high-net-worth individuals (HNIs), ultra-HNIs, family offices, institutional investors, and occasionally large corporations. Due to regulatory requirements, investors must qualify under specific criteria, usually involving a high minimum investment threshold.

For eligible investors, hedge funds provide access to advanced strategies, flexible portfolio construction, and customised risk-return profiles that are not always available in traditional investment products.

Top 10 Hedge Funds in India

Below is a structured table presenting some of the prominent hedge funds operating in India along with their key characteristics:

Sl. No. | Hedge Fund Name | Key Features |

|---|---|---|

1 | Avendus Absolute Return Fund | Known for alternative strategies and relatively consistent returns |

2 | Motilal Oswal Alternative Investment Trust | Focuses on equity-oriented long/short strategies |

3 | Edelweiss Multi Strategy Fund | Diversified approach with strong risk management focus |

4 | IIFL Multi Strategy Fund | Innovative investment products backed by robust research |

5 | ASK India Select Fund | Concentrated equity bets on high-conviction investment ideas |

6 | Reliance Alternative Investment Fund | Combines exposure to public and private markets |

7 | Alchemy Leaders of Tomorrow Fund | Emphasises growth-oriented emerging companies |

8 | ICICI Prudential Alternative Investment Fund | Multi-asset strategies with institutional-grade risk controls |

9 | Helios India Rising Fund | Opportunistic and agile portfolio management style |

10 | Tata Capital Growth Fund | Focus on scalable, high-growth Indian businesses |

Which Are the Biggest Hedge Funds in India?

The biggest hedge funds in India are generally identified by their Assets Under Management (AUM). Funds managed by groups such as Avendus, Edelweiss, and Motilal Oswal typically rank among the largest.

These fund houses have built credibility through:

Long operating histories

Strong institutional participation

Disciplined investment frameworks

A focus on innovation and alternative strategies

For investors seeking scale, stability, and institutional processes, these hedge funds are often considered benchmarks in the Indian market.

Average Returns from Hedge Funds in India

Hedge fund returns in India can vary significantly depending on:

Market cycles

Strategy employed (long/short, event-driven, multi-strategy, etc.)

Risk management practices

On average, Indian hedge funds have delivered annualised returns in the range of 12% to 20%, with certain funds outperforming during favourable market conditions.

Important Note: Past performance does not guarantee future results. Investors should carefully assess risk tolerance, investment horizon, and portfolio suitability before investing.

Conclusion

Looking ahead to 2030, hedge funds are expected to play a more prominent role in wealth creation, portfolio diversification, and risk-adjusted returns in India.

If you are considering investing in hedge funds:

Ensure you meet the qualification criteria

Understand the underlying strategies and risks

Seek advice from credible financial professionals

Prefer funds with transparent processes and a proven track record

With the right approach, hedge funds can become a powerful component of a sophisticated investment portfolio.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category