Capital Gain Index/Cost Inflation Index (CII)

00:00 / 00:00

When you sell an asset like stocks, mutual funds, or property that you've held for years, there's a fundamental question that keeps investors awake at night: How do I calculate the true profit when the value of money itself has changed?

Let me walk you through one of the most overlooked yet critical aspects of investing in India—the Cost Inflation Index (CII), commonly known as the Capital Gains Index.

What is the Capital Gains Index?

The Capital Gains Index, officially called the Cost Inflation Index (CII), is a measure published annually by the Income Tax Department of India.

Think of it as a financial time machine that adjusts the purchase price of your long-term assets to reflect inflation over the years.

Here's why this matters: If you bought shares or mutual fund units for Rs.1,00,000 ten years ago, that money had far greater purchasing power than Rs.1,00,000 today.

The CII acknowledges this reality by allowing you to "inflate" your original purchase cost to present-day values before calculating your taxable capital gains.

In technical terms, this adjusted purchase price is called the Indexed Cost of Acquisition, and it directly reduces your taxable long-term capital gains, which means you pay less tax.

Why Do We Need a Capital Gains Index?

Without indexation, taxation would be fundamentally unfair. Let me illustrate this with a real scenario:

Imagine you purchased equity mutual fund units in 2010 for Rs.5,00,000.

In 2024, you sell them for Rs.12,00,000.

At first glance, your profit appears to be Rs.7,00,000. But here's the uncomfortable truth: inflation has eroded the value of that original Rs.5,00,000 over fourteen years.

Without indexation, you'd pay tax on the full Rs.7,00,000 gain.

With indexation, your purchase cost gets adjusted upward to reflect inflation.

If the indexed cost becomes Rs.9,00,000, your taxable gain drops to just Rs.3,00,000—a massive difference that keeps more money in your pocket where it belongs.

The Capital Gains Index serves three vital purposes:

Fairness: It prevents you from paying tax on phantom gains that are merely keeping pace with inflation

Encouragement: It incentivizes long-term investing by rewarding patience

Economic reality: It acknowledges that Rs.100 today doesn't equal Rs.100 from a decade ago

How Does the Capital Gains Index Work?

The mechanics are straightforward, though the math requires attention to detail. Here's the formula that determines your indexed cost:

Indexed Cost of Acquisition = Original Purchase Cost × (CII of Sale Year / CII of Purchase Year)

Let me break down the process step by step:

Step 1: Determine Your Asset Category

The indexation benefit applies primarily to:

Equity shares and equity mutual funds held for more than 12 months (though indexation benefit was removed for these from FY 2024-25)

Debt mutual funds held for more than 36 months (for purchases before April 1, 2023)

Real estate and physical gold held for more than 24-36 months

Other capital assets qualifying as long-term

Step 2: Identify the Relevant CII Values

You need two numbers:

The CII for the financial year in which you purchased the asset

The CII for the financial year in which you sold the asset

Step 3: Calculate Indexed Cost

Apply the formula above to inflate your original purchase price.

Step 4: Compute Taxable Gain

Long-Term Capital Gain = Sale Price - Indexed Cost of Acquisition - Sale Expenses

A Practical Example

Let's work through a real calculation:

You bought debt mutual fund units in April 2015 for Rs.3,00,000. You sold them in August 2023 for Rs.5,50,000 with brokerage costs of Rs.5,000.

Original Cost: Rs.3,00,000

CII for FY 2015-16: 254

CII for FY 2023-24: 348

Indexed Cost = 3,00,000 × (348/254) = Rs.4,11,024

Without indexation: Capital Gain = 5,50,000 - 3,00,000 - 5,000 = Rs.2,45,000

With indexation: Capital Gain = 5,50,000 - 4,11,024 - 5,000 = Rs.1,33,976

You just saved tax on Rs.1,11,024 by applying indexation—that's real money staying in your investment portfolio.

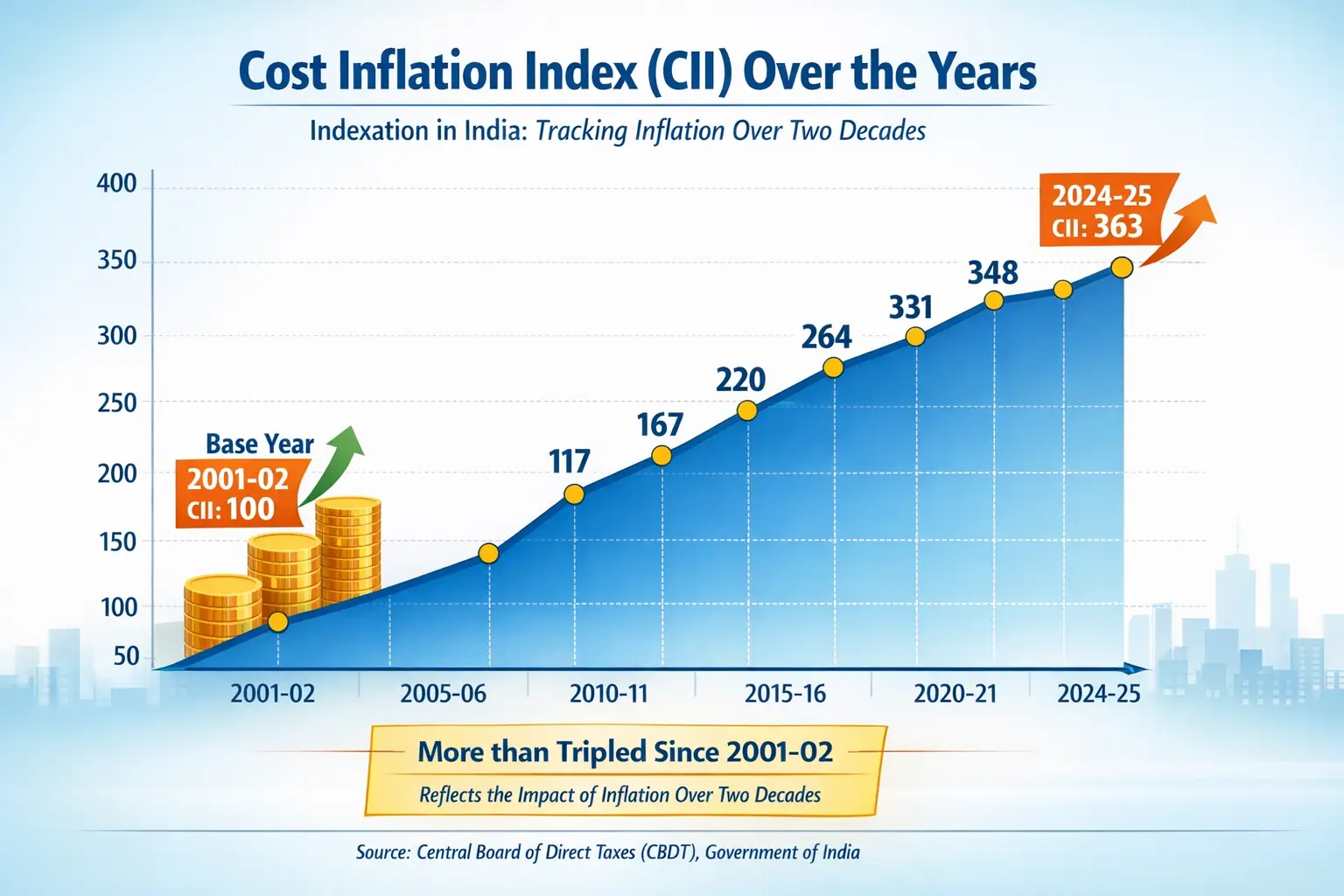

Year-Wise Capital Gains Index (Cost Inflation Index)

The Central Board of Direct Taxes notifies the CII every year, typically around mid-year for the current financial year. Here's the historical data:

Financial Year | Cost Inflation Index (CII) |

2001-02 | 100 (Base Year) |

2002-03 | 105 |

2003-04 | 109 |

2004-05 | 113 |

2005-06 | 117 |

2006-07 | 122 |

2007-08 | 129 |

2008-09 | 137 |

2009-10 | 148 |

2010-11 | 167 |

2011-12 | 184 |

2012-13 | 200 |

2013-14 | 220 |

2014-15 | 240 |

2015-16 | 254 |

2016-17 | 264 |

2017-18 | 272 |

2018-19 | 280 |

2019-20 | 289 |

2020-21 | 301 |

2021-22 | 317 |

2022-23 | 331 |

2023-24 | 348 |

2024-25 | 363 |

Source: Central Board of Direct Taxes (CBDT), Income Tax Department, Government of India

Important observation: Notice how the index has more than tripled since the base year of 2001-02. This reflects the cumulative impact of inflation over two decades and underscores why indexation is so crucial for long-term investors.

Critical Questions About Capital Gains Indexation

Does indexation apply to all investments?

No, and this is where many investors stumble. Recent tax reforms have significantly altered the landscape:

Equity shares and equity mutual funds: The indexation benefit was removed from April 1, 2023, for these assets. Long-term capital gains are now taxed at a flat rate without indexation benefit.

Debt mutual funds: For purchases made after April 1, 2023, gains are taxed as per your income slab, regardless of holding period. Indexation benefit was removed.

Real estate and gold: Indexation continues to apply for these long-term assets.

Can I use indexation for short-term gains?

No. Indexation is exclusively available for long-term capital assets.

The holding period thresholds vary, typically 12 months for equity, 24 months for real estate, and 36 months for debt instruments (though these rules have evolved with recent tax changes).

What if I inherited an asset or received it as a gift?

For inherited assets, you use the previous owner's original purchase date and cost for indexation purposes.

For gifts, the holding period of the previous owner is generally carried forward, allowing you to claim indexation from their original purchase date.

How does the government calculate CII?

The Income Tax Department calculates CII based on the Consumer Price Index for urban non-manual employees (75% weight) and the CPI for agricultural laborers and rural laborers (25% weight combined), as published by the Labour Bureau.

This methodology ensures the index reflects broad-based inflation across the economy.

Should I always opt for indexation when available?

In most cases, yes—but not always.

For assets held for very short qualifying long-term periods in low-inflation years, the indexed gain might actually be close to the nominal gain.

Always calculate both scenarios before filing your returns, especially when you have the option.

Conclusion

The Capital Gains Index isn't just a tax provision—it's a philosophical statement about how we should think about long-term wealth creation.

It tells us that governments recognize the corrosive effect of inflation on investment returns, and they're willing to adjust the tax system to account for it.

For you as an investor, understanding and utilizing the CII effectively can mean the difference between mediocre after-tax returns and truly wealth-building outcomes.

Every rupee saved in taxes through proper indexation is a rupee that continues compounding for your future.

However, I must emphasize something crucial: tax laws are complex and change frequently.

The recent removal of indexation benefits for equity and debt mutual funds is proof that what works today may not work tomorrow.

What I've shared here is educational guidance based on current understanding, but it should never replace personalized advice from a qualified chartered accountant or tax advisor who understands your specific situation.

As you build your investment portfolio, whether in stocks, mutual funds, real estate, or other assets. Factor in not just pre-tax returns but after-tax returns.

Study the CII table. Understand your holding periods. Calculate your indexed costs.

Because in the end, it's not what you earn that matters. It's what you keep.

The information presented in this guide is based on provisions of the Income Tax Act, 1961, and notifications from the Central Board of Direct Taxes (CBDT). Tax laws are subject to change, and individual circumstances vary. Always consult with a qualified tax professional before making investment or tax-related decisions.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category