What is CAMS KRA? Types, Roles and KYC Process

00:00 / 00:00

KYC or Know Your Customer is a mandatory process you must have come across while making any investments. Before 2011, every intermediary such as banks, mutual funds, and broking houses had their own individual KYC process and application form required to be completed. This was time-consuming and cumbersome for investors as well as service providers. In 2011, SEBI introduced centralised KYC system known as KYC KRA accessible to investors and intermediaries. CAMS KRA is one of the entities offering KYC KRA services.

CAMS KRA validation eliminates the duplication of KYC processes at different touch points and simplifies the overall investment process and experience. In this article, we will learn about CAMS KRA, its function, and benefits to investors, and how you can check and update your KYC KRA status.

What is CAMS KRA?

KRA (KYC Registration Agency) is the central agency designated by SEBI to maintain centralised records of investor KYCs to be accessed by all capital market intermediaries e.g. mutual funds, banks, portfolio managers, stock brokerages, etc. The agency was formed and registered under SEBI KRA Regulations 2011.

CAMS (Computer Age Management Services) is a SEBI-registered RTA (Registrar & Transfer Agency) that offers tech infrastructure and services to mutual fund companies and other financial services institutions for maintaining records of transactions and customer records.

CAMS Investor Services Pvt Ltd is an agency designated by SEBI as a KYC Registration Agency (KRA) for intermediaries such as mutual funds, banks, stock brokerages, depository participants, investment managers, etc.

CAMS KRA is a single point pan-India service provider for all mutual fund KYC services and also offers these services to stock brokerages and commodity brokers.

Types of KRAs

There are different types of KRA forms to cater to different investor requirements:

1. Individual KYC Form:

The individual KYC form is meant to update individual investors’ KYC. The form records an individual's personal details like name, address, date of birth, and identity document. All information is verified through supporting documents submitted with the KYC form.

After verification, the individual’s KYC is approved and verified. Now investor can begin investing in mutual funds and capital market securities through designated market intermediaries.

2. Non-Individual Form:

This form is meant for KYC updation of non-individual entities such as companies, partnerships, trusts, institutions, etc. The KYC form includes details such as incorporation details, directors, signatories, company structure, registered address, taxation, etc to ensure regulatory compliance.

3. Modification Form:

This form is meant to update or modify any KYC information already furnished in an investor’s profile, for example, any incorrect information provided can be amended with relevant proof. The modification in the profile ensures KYC details are updated and there is no obstruction in the investment process.

4. KRA KYC Change Form:

This form is used when there’s any change in an investor’s KYC e.g. change of name or identity, phone numbers, address, etc. and these details are to be updated in KYC information.

Role of CAMS KRA

The SEBI KRA Regulations 2011 defines the roles and obligations of KRA. The key roles & processes CAMS KRA is responsible for are:

Centralised Data: It is KRA’s responsibility to store and safe keep various KYC documents submitted by designated SEBI registered intermediaries and investors. The data must be maintained in a way that it is easily accessible at anytime.

Original Document Repository: KRA retains the original KYC documents of the client, in both physical and electronic form. KRAs ensure that KYC information can be retrieved easily as and when required within a reasonable time.

Online KYC: CAMS KRA facilitates an easy online KYC process without any physical documentation or offline submission. The platform also allows investors to check their KYC application status anytime.

Data Updation: Investors can update their KYC online hassle-free through the CAMS KRA platform.

The revised data is automatically updated and communicated to intermediaries connected with KRA, therefore easing the process and time taken.

Interconnected to other KRAs: CAMS KRA system is interconnected to other KRAs for easy interoperability.

Data Protection: CAMS KRA is required to ensure fool proof high security measures for protecting customer data and privacy.

Communication: KRA sends communication to investors for KYC registration and updation.

CAMS KRA KYC Process

KYC process and KRA verification is mandatory for every investor willing to participate in capital market investments. For investors who are not KYC compliant, the process for CAMS KRA registration/updation is simple.

Step 1: Download the applicable KYC application form from CAMS KRA website. Alternatively, mutual funds, intermediaries also provide the KRA form.

Step 2: Form Submission: The form with complete information such as personal details, address, contact information, financial information of the individual investor/institution needs to be submitted online or in person to the intermediary/fund house/RTA service centre.

Step 3: Supporting Document Submission: Personal information furnished in KYC form needs to be supported with KYC documents such as identity proof, address proof, PAN and income details etc. Self attested copies of required documents are submitted along with KYC form.

Step 4: Verification: Once the KYC form and documents are submitted, CAMS KRA verifies all the details with the documents provided. The verification process and in-person verification are conducted by the approved intermediary, fund house, or RTA.

Step 5: KYC Acknowledgement: Once KYC details are verified by CAMS KRA, the investor receives an acknowledgment. Now investor can start investing in mutual funds or related securities being KYC compliant in CAMS KRA records.

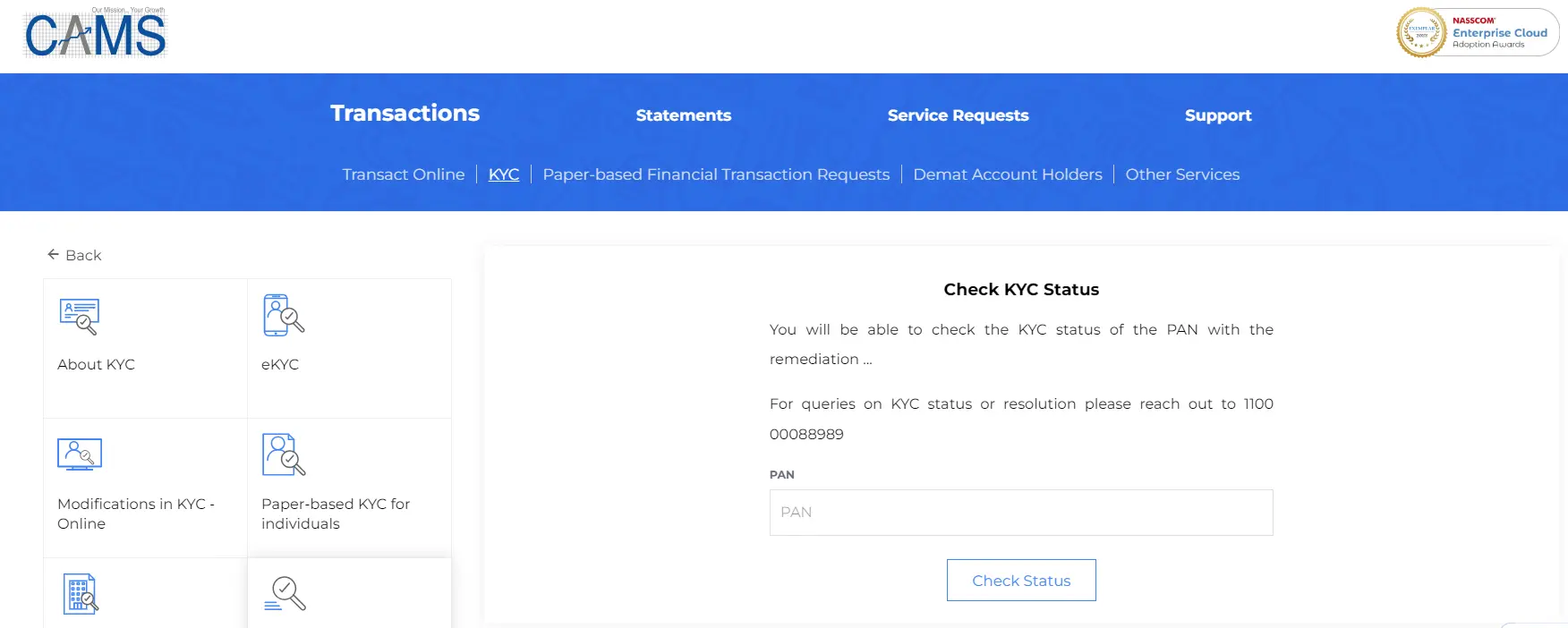

How to Check KYC Status on CAMS KRA

Investors can check their KYC status on CAMS KRA online within minutes. VIsit CAMS KRA website Check KYC Status section.

Here, enter your PAN number. You can see the status of your KYC if it is validated, under process, or requires action. Investors can stay informed about their KYC records and take necessary action to keep their personal details and KYC status updated.

Why is KYC Important for Investors

SEBI has streamlined the KYC KRA process for the ultimate benefit and safety of investors.

Single Point Access: KYC record maintained by a KRA ensures investors need not undergo KYC process every time they invest in a new instrument or via a different platform. Unified data ensures KRA records are accessible to various intermediaries for verification.

Data Security: KRAs follow stringent data security norms to keep investor data safe, secure and private. Investor need not worry about the safety of personal data submitted to different entities.

Digitised Process: KYC records are maintained and accessible online, thereby, saving time and hassle for investors.

Advantages of Using CAMS KRA

CAMS KRA offers many advantages to investors such as:

One-Stop KYC Services: CAMS KRA has a network of service centres across the county that serve as one one-point shop for mutual fund KYC registration updation, in-person verification, etc.

Fraud Prevention: CAMS KRAs stringent KYC process ensures the investor details are genuine. This prevents fraudulent activities in investment business and benefits all investing community and parties involved.

Regulatory Compliance: By ensuring that investor KYC details are updated as per SEBI requirements, CAMS KRA makes certain that investors are compliant and on the right side of the law.

Data Security: CAMS KRA maintains data security protocols to precent any breach and safe keeping of personal documents.

Tech Enabled: CAMS KRA platforms offers easy and swift connectivity for records to be quickly added and reflected across pan India service centres.

CAMS KRA vs Other KRAs

Currently, there are 5 SEBI-registered KRAs in India - CAMS KRA, CVL KRA, Karvy KRA, NSDL KRA and NSE KRA.

All SEBI registered KRAs play a similar role in maintaining KYC records of investors and facilitating KYC KRA process under the stipulated guidelines. All KRAs are interconnected and interoperable i.e. the records can be shared among them for investor benefit as per defined rules.

Each KRA is a separate entity with its own systems, processes and data management methods and security standards.

KRAs may have different intermediaries registered with them for KYC KRA services, but all KRAs adhere to the same compliance norms under SEBI’s regulatory purview.

Conclusion

KYC KRA is an important regulatory requirement for every investor before they begin investing. If you are a first time investor, you can visit the CAMS KRA website or visit the CAMS KRA service centre and get yourself KYC verified. The process is simple and hassle free, you can check KYC approval status online and take the required action.

Being KYC compliant makes investing easy and hassle-free. Invest in mutual funds, stocks, commodities, and derivatives with Rupeezy, one-stop shop for all your capital market investment needs. Ruppezy is a user-friendly platform that makes technology and data analytics work in your favour with advanced trading features at no cost.

FAQs

Q1. What is KRA in mutual funds?

KRA (KYC Registration Agency) is a SEBI-registered agency that carries out KYC verification of investors before they can invest in mutual funds. KRA is a simple, hassle-free process that can be completed online.

Q2. How can I check my KRA details?

You can check your KRA details online from the CAMS KRA website. You need to enter your PAN number and check if your KYC is validated or if there is some requirement to be fulfilled.

Q3. Can I get my details changed through CAMS KRA?

Yes, you can change your KYC details through CAMS KRA by filling in a simple form and updating details online as well.

Q4. What is the fee charged for CAMS KRA for online KYC?

There is no fee charged for CAMS KRA online KYC.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category