Aluminium Price Predictions Till 2030 in India

00:00 / 00:00

When it comes to trading and investing, most people opt for traditional investment options in metals like gold or silver. While these have a high potential for growth and value as well, there are certain other metals available that can offer you even better returns.

Now, you might be thinking which metals you should be looking forward to? Well, this is where you need to know about aluminium. One of the most used metals, it is known for its durability, strength, and versatile nature.

But do you know that before investing, you must look for the aluminium future price prediction as well? This will ensure that you are investing in an option with growth potential. So, read this guide. Understand everything needed about the aluminium. Also, explore the details of the future of aluminium that can help you make an investment well.

Rise in Aluminium Price - Historical Trend

To understand aluminium future price trends, it is important to look at how the metal has performed in the past. Studying the last five years is not just useful; it is a practical way to make informed decisions and avoid viewing aluminium through a short-term lens.

If you look at this period closely, you will see that aluminium’s position in the global economy has changed significantly. It is no longer just an industrial input. Aluminium has become a strategic material. It is now used in energy, infrastructure, and manufacturing growth.

It is now supported by long-term themes such as renewable energy, electric vehicles, power transmission, and data infrastructure. Policy recognition, including Europe adding aluminium to its critical raw materials list which has further strengthened this shift.

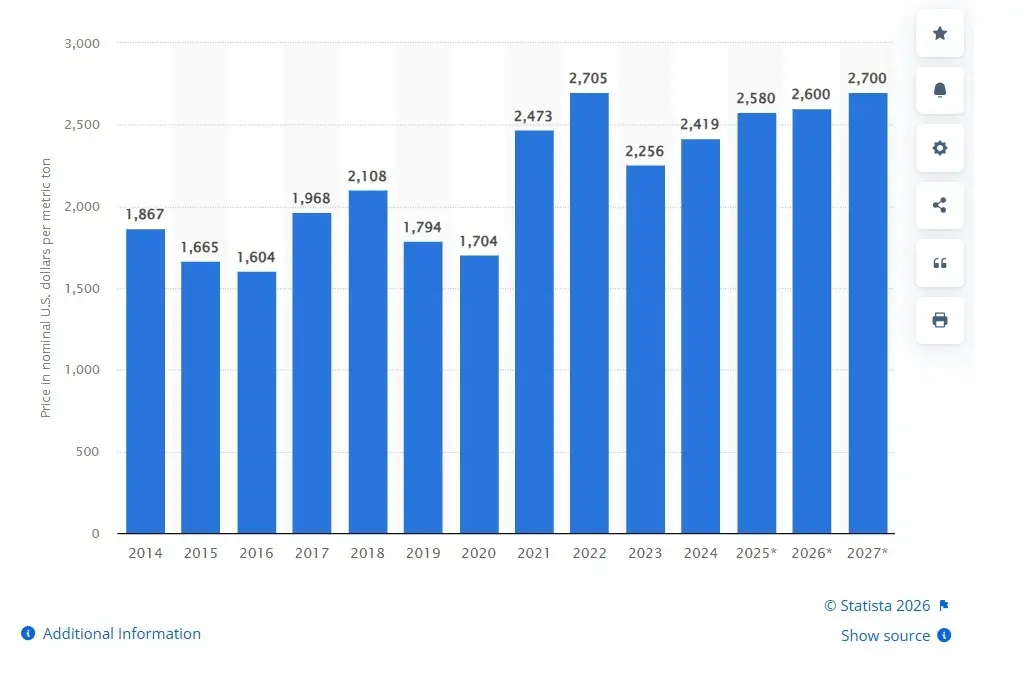

The price trend shown in the chart reflects this change clearly. Aluminium prices remained relatively weak between 2014 and 2016 and dipped again during the pandemic. However, from 2021 onwards, prices moved sharply as demand was more than supply. The overall peak level was moderate. This shows that aluminium has entered a higher price range supported by structural demand and supply constraints rather than short-term cycles.

The chart highlights aluminium’s price journey over the years.

How Aluminium Becomes a Usable Product

Aluminium does not reach factories in a ready-to-use form. It begins its journey from the earth and then goes to factories. This is how it happens.

Stage | What Happens | Why It Matters for Prices |

Bauxite Mining | Aluminium production begins with mining bauxite. It is through open-cast methods. The ore contains aluminium along with impurities like iron and silica. | Lower-quality bauxite raises processing costs and can tighten raw material supply. |

Refining to Alumina | Bauxite is refined into alumina using the Bayer process. About 4–5 tonnes of bauxite are needed for 1 tonne of alumina. | High input requirement increases cost sensitivity during supply disruptions. |

Smelting to Aluminium | Alumina is converted into aluminium metal using electricity-intensive smelting processes. | Power costs play a major role. It affects the aluminium pricing and supply decisions. |

Semi-Fabrication | Aluminium is shaped into sheets, foils, extrusions, rods, and slabs. This is for end-use industries. | Strong demand from construction, EVs, and power sectors. This supports steady consumption. |

Recycling | Used aluminium is melted. This is then reused with minimal loss in quality. | Recycling uses about 95% less energy. But it cannot fully meet rising demand. |

Global Primary Aluminium Production

Understanding where aluminium is produced helps explain supply concentration and price sensitivity. Global production is highly skewed toward a few countries, with China playing a dominant role. The data below shows how primary aluminium output.

Country | 2022 ('000 tons) | 2023 ('000 tons) | 2024 ('000 tons) | Total ('000 tons) |

China | 30,600 | 32,200.00 | 42,000.00 | 104,800 |

India | 3,900.00 | 4,000 | 4,200 | 12,100 |

Russia | 3,700 | 3,800.00 | 3,800.00 | 11,300 |

Canada | 3,200 | 3,200.00 | 3,300 | 9,700 |

UAE | 2,500 | 2,600.00 | 2,700 | 7,800 |

Australia | 1,600 | 1,500.00 | 1,500 | 4,600 |

Bahrain | 1,500.00 | 1,500.00 | 1,600.00 | 4,600 |

Norway | 1,300.00 | 1,300.00 | 1,300 | 3,900 |

Brazil | 1,100.00 | 1,100.00 | 1,100 | 3,300 |

Others | 7,200.00 | 7,300 | 7,400 | 21,900 |

World Total | 56,600.00 | 58,500.00 | 69,000 | 184,100 |

Aluminium Usage by End-User Sector

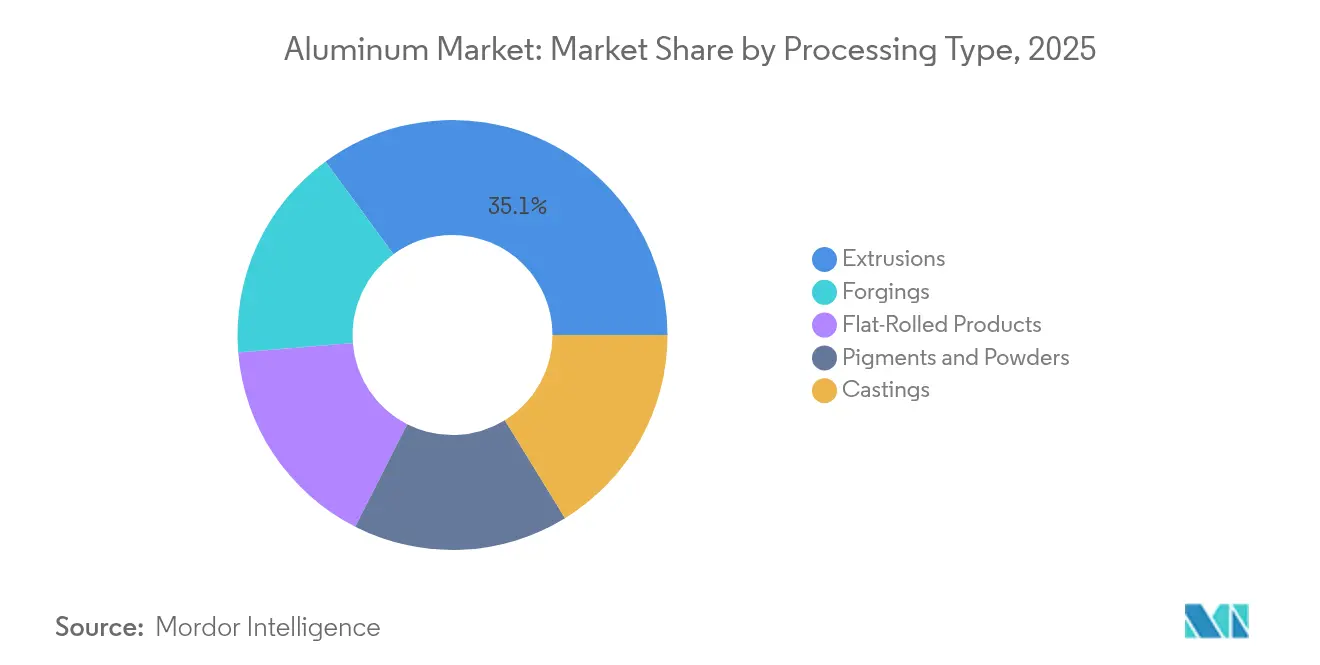

The aluminium market is projected to grow from 76.47 million tons in 2025 to 78.99 million tons in 2026. It will further reach 92.87 million tons by 2031. This is predicted at a 3.29% CAGR by Mordor Intelligence. This growth is supported by aluminium’s position as the second most used metal globally. This is mainly due to its high strength-to-weight ratio and its ability to stay in circulation through recycling.

Rising electrification, renewable energy expansion, electric mobility, and sustainability-led packaging shifts continue to push aluminium demand across industries, even as producers adapt to energy costs, decarbonization goals, and evolving trade policies.

Transportation and construction together form the core consumption base, supported by steady usage in packaging, power systems, and consumer goods. This diversified demand profile helps aluminium maintain stable consumption trends.

The details of consumption are shared below in the chart.

Aluminium Market Shifts

As per Future Market Insights, the aluminium market over the next decade will move toward low-carbon production, advanced manufacturing, and wider adoption across new-age industries. Regulation, technology, and sustainability goals shape this industry greatly.

Area | Expected Shift |

Regulation | Low-carbon aluminium mandates, hydrogen-based smelting |

Technology | AI-driven production, automation, and additive manufacturing |

Applications | EVs, renewable energy, hydrogen storage, aerospace |

Sustainability | Carbon-free output, closed-loop recycling |

Growth Focus | High-performance alloys, energy efficiency |

Supply Chains | Localised production, AI-optimised logistics |

End-User Demand | Smart structures, self-healing materials |

R&D | Hydrogen smelting, advanced aerospace alloys |

Infrastructure | Climate-resilient, green aluminium projects |

Global Standards | Net-zero compliance, recycling benchmarks |

India’s Position in the Global Aluminium Story

India is not just a growing aluminium consumer now. It is also becoming a more important manufacturing and value-added hub as well.

It is targeting 50% of its electricity generation from renewable sources by 2030, with aluminium leading the change. The metal is widely used across solar panels, wind systems, power grids, and electric vehicles.

With power demand expected to grow at 8% in the near term and up to 10% annually in the coming years, aluminium is increasingly central to infrastructure expansion, grid modernisation, and sustainable manufacturing.

Hindalco Industries: Announced a Rs. 210 billion aluminium smelter expansion in Odisha to reduce import dependence. The company also commissioned a Rs. 45 billion flat-rolled products and battery-grade aluminium foil facility.

Vedanta Aluminium: It focuses on clean energy-linked aluminium applications. These are used in various areas, starting from energy production to batteries.

NALCO: It plans to build 200–300 MW of renewable power capacity. This is to support greener aluminium production. The move is aimed at reducing dependence on non-renewable sources and focusing on ESG.

At the same time, RUSAL is positioning India as a key market for low-carbon aluminium. It is promoting products made with over 99% renewable energy and a certified carbon footprint of below 2.2 tonnes of CO? per tonne.

Aluminium Price Predictions till 2030

The outlook for aluminium prices through 2030 shows structural support. This is mainly due to green energy demand. Leading research firms note the metal entering higher price segments because of its wide applications and use.

Goldman Sachs: After recent highs above $3,000 per tonne, Goldman Sachs sees prices falling. It can reach to $2,650 per tonne by Q4 2026. This is due to global surpluses from China's restarts (source). Long-term, they project $2,900+. It is mainly from stabilisation as electrification demand offsets supply gains.

Fitch Ratings: Fitch revised metals assumptions (Sep 2025) forecast $2,700-2,850 per tonne through 2028, rising toward $2,900 by 2030 as 2.5% annual demand growth exceeds primary production limited by power costs (source).

Taken together, aluminium enters a higher price band where China volatility creates dips, but long-term levels hold firm amid decarbonisation and infrastructure demand. Current trends suggest elevated prices through five years ahead, with $2,900+ equilibrium if deficits persist.

Note: Educational content is only based on public reports. Commodity prices are volatile. Consult advisors before investing.

What Investors Need to Understand

Aluminium demand in India is growing. This is even more than the global average that is there. It is mainly due to the rise in construction and power needs. As an investor who is looking to invest in aluminium, here are some of the points that you should understand:

A rise in domestic production is a good sign for long-term growth.

Investing in aluminium with the view of holding can be a great option.

Keeping an eye on the global markets associated with the demand can give you signs.

Short-term price swings are normal, but the long-term trend remains stable to mildly positive.

Conclusion

Aluminium is moving into a phase where demand growth matters more than short-term cycles. In India, rising usage across power, infrastructure, transport, and renewables keeps the long-term outlook steady. While prices can fluctuate with global trends, the chances of staying stable are high.

And if you are looking for insights, register on Rupeezy. Gain all the details and information you need to invest better.

FAQs

What is the expected aluminium price outlook till 2030?

Aluminium prices are expected to stay supported through 2030. This is due to steady demand from clean energy, electric vehicles, and infrastructure. It is also backed by energy costs and supply constraints.

What factors will influence aluminium prices in the coming years?

Key factors include power costs, renewable energy adoption, and EV growth. Some other factors are low-carbon production policies and the pace of new smelter capacity additions.

How do energy costs affect aluminium prices?

Aluminium production requires large amounts of electricity. Higher power costs or supply disruptions can push prices up quickly. But access to energy supports long-term stability.

Why is aluminium demand rising with energy?

Aluminium is used in the production of batteries, solar turbines, and others. This is why their demand for the renewable energy sector is high.

Is aluminium considered a long-term strategic metal?

Yes, aluminium is a strategic metal. This is because of its role in energy transition, infrastructure, and industry. It is recyclable, which adds to the benefits.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category