Stamp Duty: A Comprehensive Guide to Old and New Rates

00:00 / 00:00

Overview

Coming Thursday, Jan 9th, 2020 Stamp duty will be charged equally regardless of the state of residence.

Prior to this, stamp duty was charged at different rates depending up on your resident state.

All brokerage firms used to collect it from thier clients and pay it monthly to the respective state government.

However, From January 9,2020 brokers will collect stamp duties and pay directly to the exchanges.

The exchange than give it back to the central government, which in turn will divide it among the states.

Earlier, every contract note requires to be stamped as per regulations of the respective state government.

Union Budget 2019-20, stamp duty was made uniform across all states. For reference Check Page 14 on the finance bill.

You can also check the links to the circulars from various exchanges: Equity, Futures & Options, Currency, Offer for Sale, Offer for Takeover/Delisting/Buy-back, and Commodity.

Stamp Duty Example

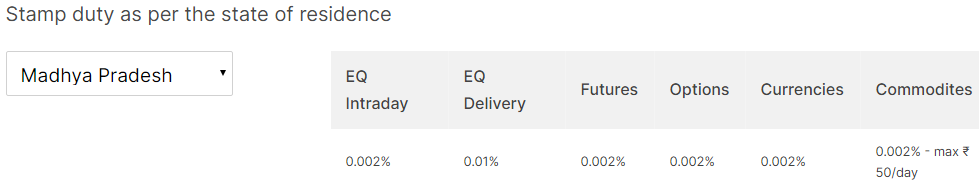

As you can see in the image above, the charges of stamp duty were different for most of the states. But going forward this will be equal for all states.

Few States like Telangana, Haryana, had a maximum cap per contract note on the stamp duty.

Which means the charges would be maximum per contract were capped in a range.

Investors from states such as Tamil Nadu and RajRupeezyn will see a fall in their stamp duty, while investors from Haryana, Telangana, Uttar Pradesh, Odisha and Assam will end up paying higher stamp duties.

For states such as Gujarat, West Bengal and Kerala it will remain unchange.

Those traders who were residing in these states which had a cap on maximum stamp duty per day per contract note, will be most hurt.

As they will not enjoy the benefit of the cap going forward.

Old Rates

You can check the charges you were charged untill now below.

Most states were charging in the range of Rs 200 to Rs 300 per crore for intraday/derivatives and Rs 1000 per crore for equity delivery trades.

Stamp Charges (Not charged in case of future settlement, charged on premium value in case of options settlement)

State | EQ Intraday | EQ Delivery | FUTURES | OPTIONS | Currencies | Commodites |

KARNATKA | 0.003 | 0.003 | 0.003 | 0.003 | 0.003 | 0.003 |

GOA,DAMAN & DIU | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 |

ANDHRA PRADESH | 0.005/Max 50 | 0.005/Max 50 | 0.005/Max 50 | 0.005/Max 50 | 0.005/Max 50 | 0.005/Max 50 |

ASSAM | 0.018/ Max 49.5 | 0.018/ Max 49.5 | 0.018/ Max 49.5 | 0.018/ Max 49.5 | 0.018/ Max 49.5 | 0.018/ Max 49.5 |

KERALA,GUJARAT, MAHARASHTRA,DELHI | 0.002 | 0.01 | 0.002 | 0.002 | 0.002 | 0.001 |

HARYANA | 0.002/ Max 200 | 0.01/ Max 500 | 0.002/ Max 200 | 0.002/ Max 200 | 0.002/ Max 200 | 0.001/ Max 500 |

HIMACHAL PRADESH | Flat 50 | Flat 50 | Flat 50 | Flat 50 | Flat 50 | Flat 50 |

MADHYA PRADESH | 0.002 | 0.01 | 0.002 | 0.002 | 0.002 | 0.002 |

ODISHA | 0.005/ Max 50 | 0.005/ Max 50 | 0.005/ Max 50 | 0.005/ Max 50 | 0.005/ Max 50 | 0.005/ Max 50 |

TELANGANA | 0.01/ Max 100 | 0.01/ Max 100 | 0.01/ Max 100 | 0.01/ Max 100 | 0.01/ Max 100 | 0.01/ Max 100 |

UTTAR PRADESH | 0.002/ Max 1000 | 0.002/ Max 1000 | 0.002/ Max 1000 | 0.002/ Max 1000 | 0.002/ Max 1000 | 0.002/ Max 1000 |

RAJASTHAN | 0.003 | 0.012 | 0.0012 | 0.0024 | 0.0012 | Non Argi – 0.0012 / Agri 0.0006 |

TAMIL NADU | 0.006 | 0.006 | 0.006 | 0.006 | 0.006 | |

WEST BENGAL | 0.002 | 0.01 | 0.002 | 0.002 | 0.0002 | 0.002 |

JAMMU & KASHMIR | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

State | Symbol | Absolute | ||||

TAMIL NADU | GOLD SILVERM | 0.5 | ||||

GOLDGUINEA | 0.004 | |||||

GOLDM | 0.05 | |||||

GOLDPETAL GOLDPTLDEL | 0.0005 | |||||

SILVER | 3 | |||||

SILVER1000 SILVERMIC | 0.1 | |||||

CARDAMOM CPO MENTHAOIL | 0.00004 | |||||

New Stamp Duty Rates

Type of trade | New stamp duty rate |

Delivery equity trades (offline transfers) | 0.015% or Rs 1500 per crore on buy-side |

Intraday equity trades | 0.003% or Rs 300 per crore on buy-side |

Futures (equity and commodity) | 0.002% or Rs 200 per crore on buy-side |

Options (equity and commodity) | 0.003% or Rs 300 per crore on buy-side |

Currency | 0.0001% or Rs 10 per crore on buy-side |

Old Rate Vs New Rate

One of the major difference in old versus new stamp duty rates are applicable only on the buy-side and not on both buy and sell-side.

Therefore stamp duty costs for most of the traders will get reduce by more than 50%.

Also, till now there was no stamp duty charged for offline transfer of shares using DIS (delivery instruction slip).

However from now the charges will be based on the amount entered on the DIS slip.

This will also end the tax advantage that brokerages and investors have been getting for routing their trade through some states with cheaper stamp duty. Visit Our Website For More Details.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.