Investing in India’s Future: A Look at the IRCTC IPO

00:00 / 00:00

Overview

IRCTC IPO is about to get launched on 30 september 2019(Monday) and close on October 3.

Indian Railway Catering and Tourism Corporation (IRCTC), who provide catering services to the Indian Railways, is planning to raise money via an initial public offer (IPO).

The IRCTC IPO will be the fourth public offering from a Railway company after RITES, Rail Vikas Nigam Limited(RVNL) and Ircon International Limited.

IRCTC is planning to sell 2.01 crore equity shares of face value of Rs. 10 each in the price band of Rs. 315-320 to raise up to Rs. 645 crore.

IRCTC website www.irctc.co.in, is one of the most transacted websites in the Asia-Pacific region, with transaction volumes averaging 2.5-2.8 crore per month.

About 5,50,000 to 6,00,000 bookings every day is the world’s second busiest and highest of 15 to 16 lakh tickets every day.

Its tagline is “Lifeline of the nation”. After the public offer, Government of India’s holding in IRCTC will come down to 87.40 per cent.

IRCTC Business Segments

- Internet ticketing

- Catering Service

- Packaged drinking water

- Travel and tourism

They have also diversified into other businesses, including non-railway catering and services such as e-catering, executive lounges and budget hotels.

IRCTC wiil be opearting the Lucknow – New Delhi Tejas Express which have its inaugural service on 5 October 2019 and is the first privately operated long-distance train in India.

It has a unique business model where there are no competitors.

IRCTC History

It was incorporated on September 27, 1999 and is a central public sector enterprise wholly owned by the Government of India under the administrative control of the Ministry of Railway.

The objects of the Offer are

1. To carry out the disinvestment of Equity Shares by the Selling Shareholder constituting Company’s paid up Equity Share capital.

2. To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Check Red Herring Prospectus, Draft Red Herring Prospectus

IRCTC Company Financials

As per reports, the company posted revenue of Rs 1,535.38 crore(FY17), 1,470.46 crore(FY18) & Rs 1,867.88 crore, (FY19)respectively.

Operating profit during this period stood at Rs 312.54 crore, Rs 273.1 crore, and 372.17 crore respectively.

Moreover operating profit margin is at 20 percent, 19 percent and 20 percent.

Net profit during FY17 stood at Rs 229.08 crores,Rs 220.61 crore(FY18) and Rs 272.59 crore,(FY19) respectively.

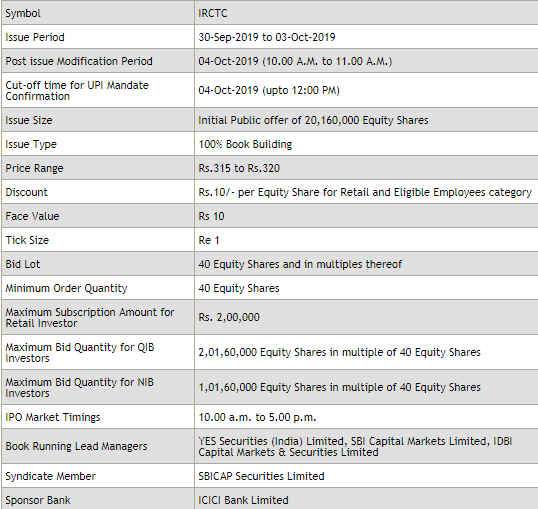

IRCTC IPO Offer

- The lot size of IRCTC IPO is 40. Or, in other words, bids can be made for a minimum of 40 equity shares and in multiples thereof. Maximun subscription amount for retail investor is Rs. 2,00,000.

- the price band of the IRCTC IPO has been fixed at Rs.315 to Rs.320 per equity share.

- The retail investors and employees of IRCTC are being offered a discount of Rs. 10 per share.

- Face value of Rs. 10 each

- IRCTC’s market capitalisation after the conclusion of the IPO will be Rs. 5,040 crore – Rs. 5,120 crore.

- The 50% of the IRCTC IPO is reserved for qualified institutional buyers(QIB), 15% is reserved for non-institutional buyers(NII) and 35% for retail investors.

- The company has set aside 1.6 lakh shares in the IPO for its Employee Reservation Portion.

- IDBI Capital, SBI Capital Markets and Yes Securities are the book running lead managers of the IPO and Alankit Assignments is the registrar.

IRCTC IPO Major Risk Factors

These risk factors can impact company revenue and margins which would affect its share price. Investors should go through and understand these risk factors before investing.

1) Its business and revenues are substantially dependent on Indian Railways.

Any adverse change in the policy of the Ministry of Railways may adversely affect its business and results of operations.

2) They are the sole provider of online railway ticketing, catering services, and packaged drinking water for trains and stations, and certain other services they provide;

if the Government were to allow open competition in all or any of these areas, it may impact its financial results.

3) Indian food service industry and package water industry have both historically been fragmented and unorganized, lacking sufficient reliable industry data.

As such, any attempt to analyze the relevant data on catering and packaged drinking water market competition and industry trend may be incomplete or unreliable.

IRCTC IPO Registrar

Alankit Assignments Ltd

Alankit House 2E/21,

Jhandewalan Extension,

New Delhi – 110055, Phone: (011) 4254 1234

Email: kamalarora@alankit.com

Visit The Website

IRCTC IPO Lead Manager(s)

IDBI Capital Market Services Limited

SBI Capital Markets Limited

Yes Securities (India) Limited

Company Contact Information

IRCTC Limited

11th Floor, B – 148, Statesman House,

Barakhamba Road,

New Delhi – 110 001, India, Phone: +91 11 2331 1263 / 64

Email: ipo@irctc.com

Website: http://www.irctc.com/

If you do not know what is IPO? How to Apply for IPO? Read here. You can apply for IPO from your Rupeezy trading and demat account online.

You can also contact out support team if you do not know the process at 0755-4268599.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category