Check PAN Aadhaar Link Status Online 2025: Link Now

00:00 / 00:00

Whether you set out to buy jewelry or a flat, furnishing your PAN number is mandatory for large financial transactions. What if you discover that your PAN is not accepted and it has turned inoperative due to your PAN number not being linked to your Aadhaar?

Many taxpayers scramble at year-end to file income tax and are puzzled to find out that their PAN is not linked to Aadhar. In this article, you will learn how to check your PAN Aadhaar link status and we will also take you through the step-by-step process to link your PAN and Aadhar.

Why is PAN and Aadhaar Linking Necessary?

In 2022, the Income Tax department made it compulsory for individuals to link their PAN numbers with their Aadhaar. After many extensions, 30th June 2023 was set as the final deadline to link your PAN and the Aadhaar. If the linking was not done by then, the PAN turned inoperative with effect from 1st July 2023.

This decision to link the PAN with the Aadhar was aimed at strengthening the digital economy, simplifying the verification process, checking tax evasion and streamlining data across digital records. The move helps the overall economy by widening the tax net, keeping fraudulent transactions in check and also in maintaining clear financial and tax records.

What Happens if PAN is Not Linked to Aadhaar?

PAN number is the most basic requirement for many financial and non-financial transactions in our country. If the PAN is not linked to Aadhaar, it becomes inoperative in government records. Therefore, it is pertinent to check the PAN Aadhar link status. Without an active PAN, you will face difficulty in various transactions, for example,

An active PAN is required for filing income tax returns and claiming refunds.

PAN is mandatory to open any bank account, demat account or make any investments, avail loans, credit cards, etc. Open a free demat account online within hours with Rupeezy.

You cannot file form 15G/H, create fixed deposits, make demand draft/pay orders above a certain amount, or make cash deposits or bank transactions above a threshold limit without an active PAN.

Any government-related service e.g. applying for a passport, renewals, availing subsidies, or applying to any government benefit scheme, all require an active PAN number.

In case you want to apply for a new PAN to replace a lost or damaged one, you can’t until it is linked to Aadhaar.

In short, for any transaction where a PAN number is required, you need to have an active PAN linked to Aadhaar. At such places, your PAN will not be accepted if it is in inoperative status.

Therefore, linking is mandatory and it is advisable to check the PAN Aadhaar link status and initiate the process.

Also Read: Know Your PAN Number

How to Check PAN Aadhaar Link Status

Here is the best way for PAN Aadhaar link status check online in a few easy steps.

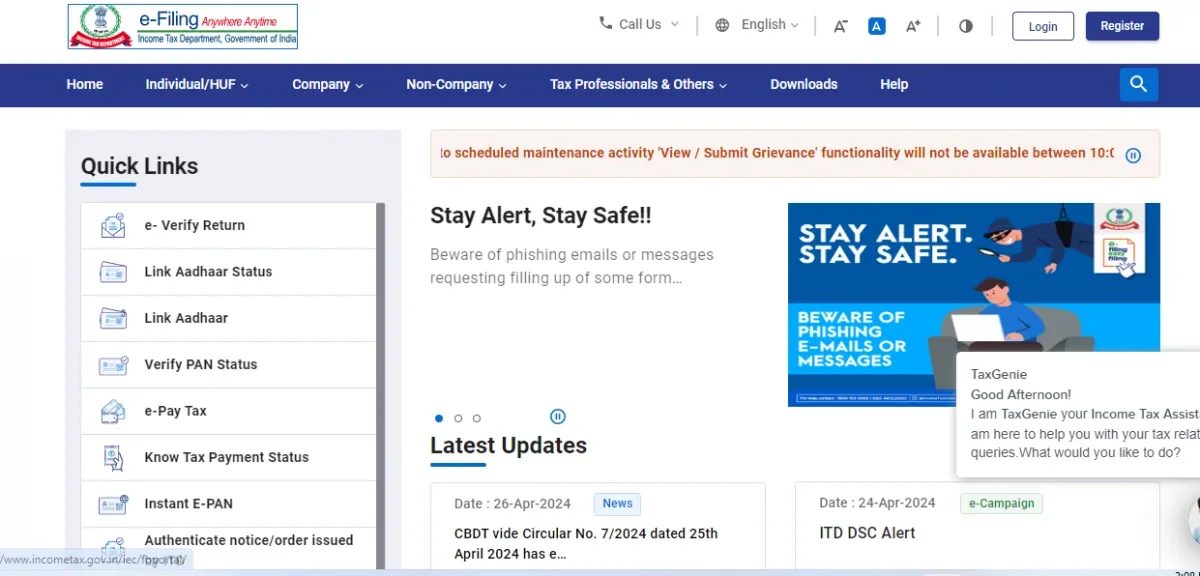

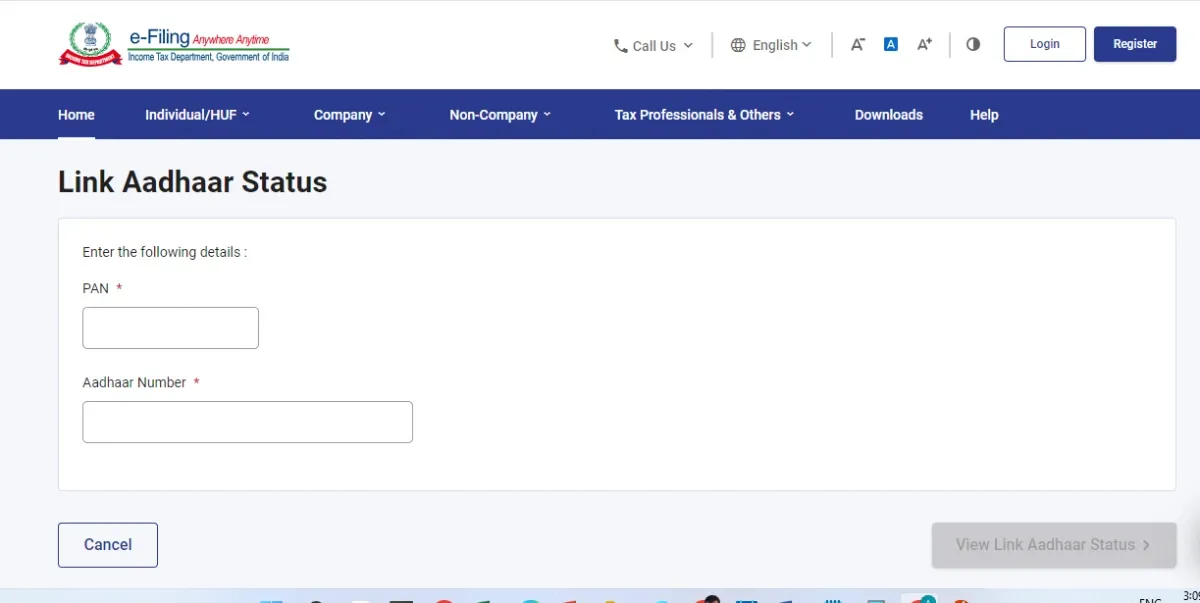

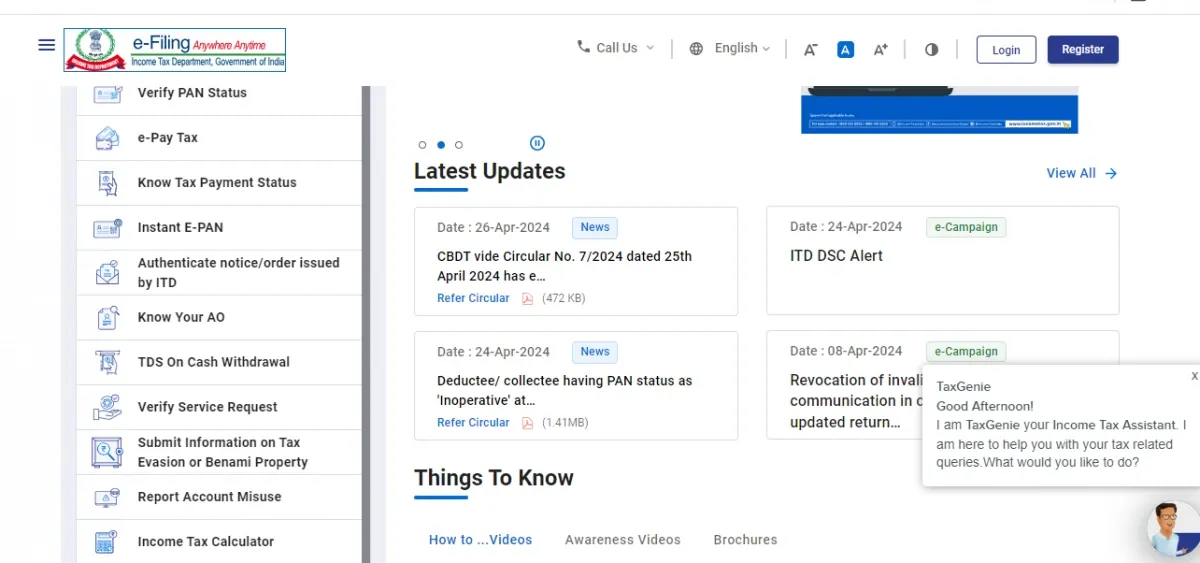

Visit the income tax portal eFiling Portal

On the income tax portal, click on ‘Home’ and you’ll view ‘Quick Links’ on the left side of the page.

5. You will get a notification confirming the status of Aadhaar PAN verification/linking.

Is There a Fee for Linking PAN and Aadhaar?

The deadline for linking PAN and Aadhaar was set for June 2023. Failing to do so, one needs to pay a late submission penalty fee of Rs 1000 before proceeding to link Aadhaar and PAN.

Visit the online Income Tax portal to pay the Aadhar PAN link penalty.

Go to Quick Links and click on the e-Pay Tax option.

4. After OTP verification you are redirected to the e-Pay Tax page.

5. Click ‘Continue’. On the e-Pay Tax page, click ‘Proceed’ in the Income Tax box.

6. Select Assessment Year, type of Payment as ‘Other Receipts 500’

7. Add SubType as ‘Fee for Delay in Linking Aadhaar’.

8. Click ‘Continue’ and pay the prefilled amount of Rs 1000 from the given payment options.

9. Once payment is done, you can now go ahead and link your PAN with Aadhar.

How to Link PAN with Aadhaar?

You can link PAN and Aadhaar by submitting online or offline link requests.

For online linking:

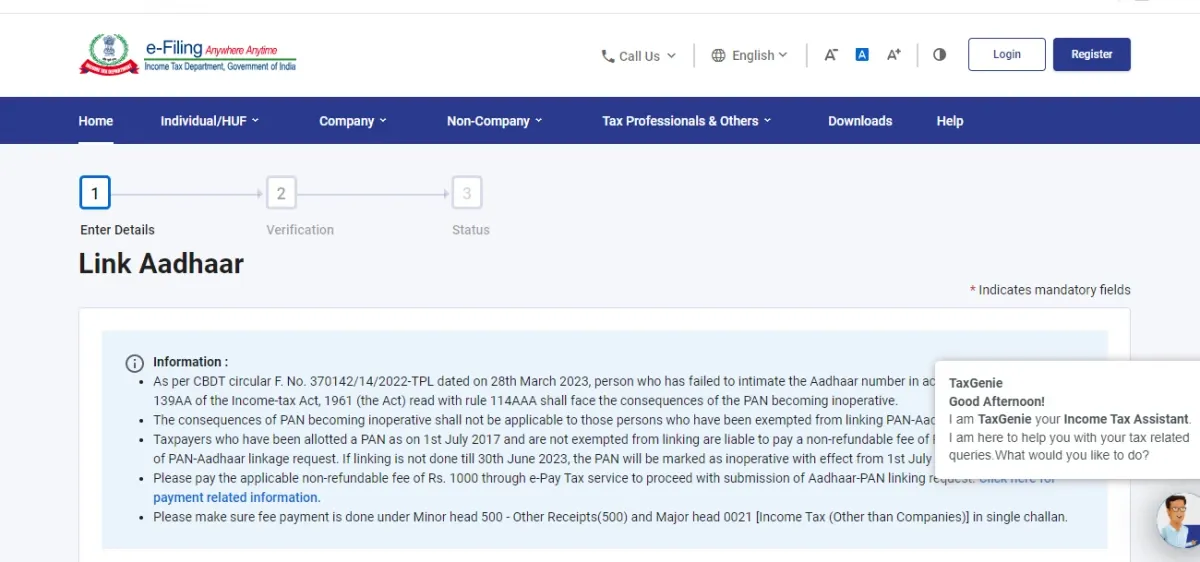

Go to the Income Tax e-Filing portal.

Go to ‘Quick Links’ and select the ‘Link Aadhaar’ option.

3. Enter your Aadhaar and PAN number and click ‘Validate’.

4. If your penalty payment has been verified, which takes 4-5 days, you will see a pop up notification.

5. Click ‘Continue’ to proceed with the linking process.

6. Enter the details and click the ‘Link Aadhaar’ button.

7. Enter the OTP received and a linking request is submitted.

If you are registered on the income tax portal, you can log in and click ‘Link Aadhaar’ button on the Homepage. Alternatively, you can go to ‘My Profile’ section and select ‘Link Aadhaar to PAN’.

For offline Aadhaar linking, taxpayers can also visit PAN card centres to submit offline requests along with copies of their Aadhaar and PAN for linking.

PAN Aadhaar Linking Through SMS

There is an option to link PAN and Aadhaar via SMS as per the Income Tax department. You can send an SMS from your registered mobile number to 567678 or 56161 as per the format below and follow further instructions/notifications for linking to be initiated.

UIDPAN<Space><12-digit Aadhaar><Space><10-digit PAN>

Aadhaar and PAN will be linked if the date of birth of the applicant is the same in both documents.

Conclusion

To conclude, PAN Aadhaar linking is an important step in keeping your essential documentation up to date. Open a demat account online with Rupeezy in a few clicks and enjoy seamless trading and investment in stocks, derivatives and commodities. But before that, do ensure your PAN number is linked to your Aadhar. Follow steps given in this blog to link the your PAN and Aadhar in a jiffy.

For more such interesting information and updates, explore our blog page and social handles.

FAQs on PAN Aadhaar Link Status Check

1. Is it mandatory to link PAN and Aadhaar?

Yes, as per Income Tax department’s directive, it is mandatory to have PAN linked with Aadhaar except for those who are under exempt category e.g. NRIs, foreign nationals and senior citizens above the age of 80 etc.

2. Can I link PAN and Aadhaar if there is any mismatch in name or date of birth?

In case there is a mismatch or incorrect details in your name, date of birth, gender or mobile, you need to submit the documentary proof of accurate personal details and submit request for correction. Once correction is done, you can apply for PAN Aadhaar linking.

3. Is PAN Aadhaar linking free?

PAN Aadhaar linking deadline was 30th June 2023. If you missed linking PAN and Aadhaar, you need to pay a penalty of Rs 1000. Once the payment is verified, you can proceed with the linking process.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category