What is US Debt Ceiling Crisis and Its Impact on the Economy

00:00 / 00:00

As we write, U.S. President Joe Biden is in talks with Congress leaders to arrive at a deal to raise the government debt ceiling and avert a debt default looming by June 1st and its domino impact not just on the U.S. economy, but a snowballing effect on the global economy.

Let us take a look at what the US debt ceiling is and what it can culminate into.

What is U.S. Debt Ceiling?

Debt limit in U.S. is a legislative limit on the debt that the U.S. Treasury can incur. Ceiling is a limit placed by govt on taking more debt to honour the existing debt obligations.

When the gross debt reaches the debt ceiling, Treasury takes measures so as not to allow a default to happen i.e. raising the debt ceiling as an immediate measure to avert default or fund debt obligations and expenses till a decision is taken.

After World War II, the debt ceiling concept came into effect as per ‘Second Liberty Bond Act, 1917’. Prior to this amendment, every new government debt required Congress approval.

To simplify the borrowing process, Congress now approves a blanket aggregate limit on debt and new bonds that the Treasury can issue.

In 2011, there was a near default situation in U.S. where the limit enhancement was delayed and it resulted in a first ever U.S.federal govt credit rating downgrade, markets going south and borrowing costs shooting up.

All governments receive funds from taxes and duties, and spend this money for various public, economic and welfare activities.

When expenses are higher than receipts,there is a deficit and the government issues bonds and securities to borrow money.

When the debt obligations from existing debt reach the debt ceiling limit, the government cannot issue new bonds any further, which can lead to non payment and govt debt default with severe repercussions.

What is the Current US Debt Ceiling Crisis?

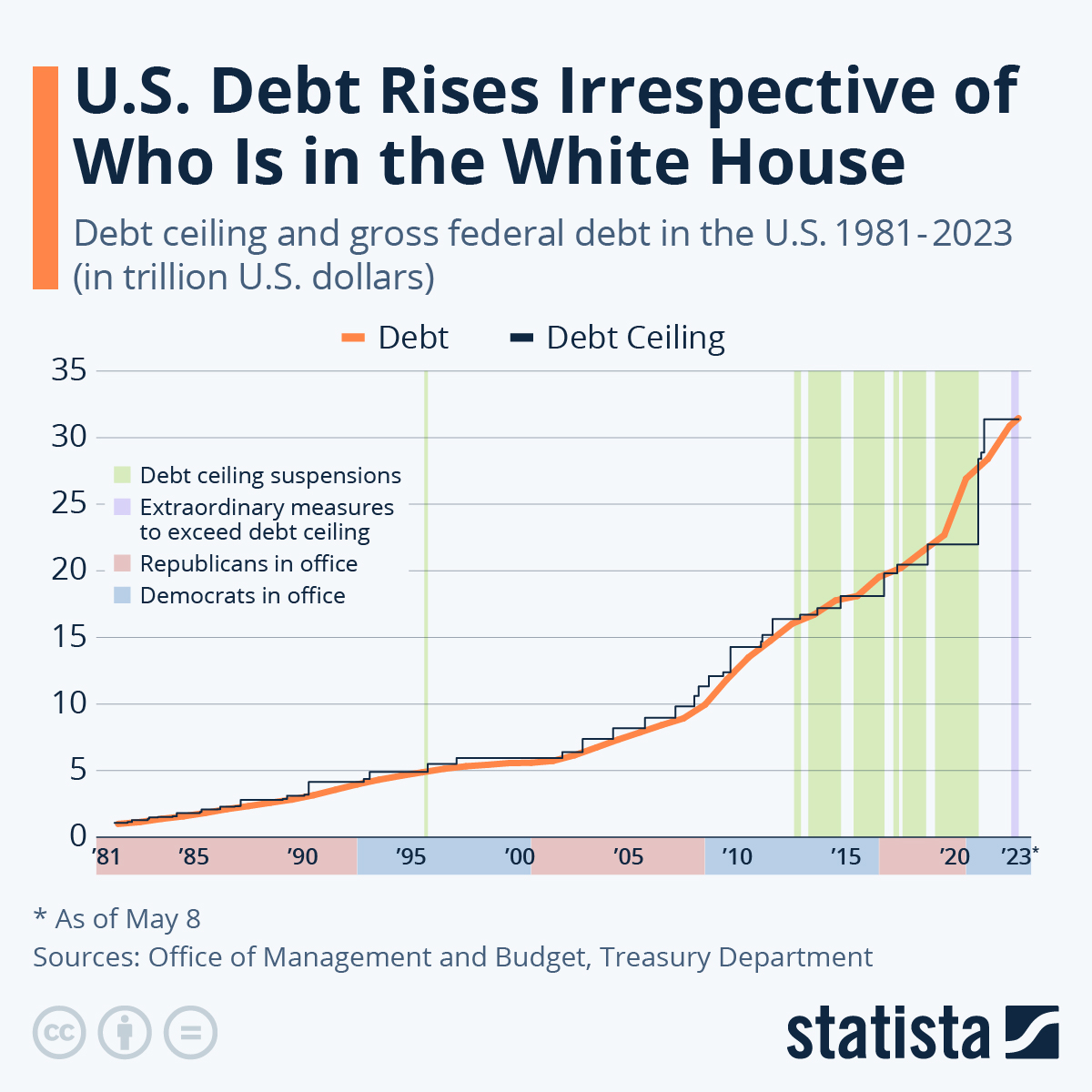

The current debt ceiling is USD 31.4 trillion and historically Congress has approved raising the limit 78 times since 1960. Last time the limit was raised in Dec 2021 by USD 2.5 trillion.

US Treasury Secretary Janet Yellen has warned, if Congress doesn’t take a quick decision, the Treasury may not have sufficient funds to meet debt obligations by June 1st.

Source: https://www.statista.com/chart/1505/americas-debt-ceiling-dilemma/

What will happen if there is a debt default?

Experts note that a potential default will have serious consequences for the economy, general public, businesses and global financial markets.

Debt default will cause a govt crest rating downgrade, thus increasing borrowing costs for the government, households and businesses, job cuts.

Slowdown in services and domestic consumption, reduced govt spending on public welfare, infrastructure development and job creation activities.

Higher interest rates will further balloon govt’s debt, setting off a negative spiral for coming years and shock financial markets and the economy that is yet to fully recover from the impact of Covid crisis.

Yellen has warned, “If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.”

She further commented that a US default would result in an “unprecedented economic and financial storm” that could trigger an income shock and lead to recession.

How will it impact the global economy?

Though the current debt ceiling situation is not new, there can be implications for the global economy if Congress does not approve a ceiling raise or other measures.

The US Dollar is the global benchmark currency. Governments and investors globally buy U.S. Treasury bonds.

A default will set off a shake-up in financial markets worldwide.

U.S. Treasury Bonds work as a benchmark to price bonds and financial instruments worldwide, an increase in interest rates will impact global borrowing costs.

A loss of confidence in the U.S. economy and currency can lead to a global slowdown and recession.

Read About US Inflation

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category