Invest Wisely: Key Takeaways from Union Budget 2019

00:00 / 00:00

Overview

In her Maiden Union Budget 2019, Nirmala Sitharaman started with few quotes “We have shown by our deeds that the principles ‘perform, reform, transform’ can indeed succeed.

Have set the ball rolling for a ‘New India’: FM. Finance Minister Nirmala Sitharaman in her first Budget speech today said the Indian economy had reached from $1.85 trillion to $2.7 trillion.

And that the Centre had the target of taking it to $5 trillion by FY25.

Our objective was and continues to be ‘Mazboot desh ke liye Mazboot nagrik’. With determined human efforts the task will surely be completed: FM

Under Housing For all By 2022:

She also presented roadmap for $5 trillion economy:

Let’s Check Important Takeaways from her Speech

- Union Budget 2019 brings new hope for Micro, Small & Medium Enterprises, 350 crores allocated for GST-registered MSMEs.

- A Public-Private partnership will usher the new dawn of Indian railway. FM says a PPP will make services better and faster.

- Roof for all, PMAY-Gramin to ensure 1.95 cr houses to eligible beneficiaries.

- Pradhan Mantri Karam Yogi Mandhan Scheme secures the future for retailers with less than 1.5 cr turnover.

- House construction under PMAY time reduces from 314 to 114 days.

- Pension benefits for 3 crore shop-owners with annual turnover of less than Rs 1.5 crore under Pradhan Mantri Karamyogi Mandhan Scheme .

- Proposal to increase minimum public shareholding in companies to 35 percent from 25 percent to deepen the corporate bond market .

- 6 percent higher than last year, India’s FDI flows in 2018-19 remained strong compared to global at $54.2 billion .

- 1.95 crore houses are proposed to be provided to eligible beneficiaries under the Pradhan Mantri Awas Yojana – Gramin .

- Every single rural family, except those unwilling to get access, will have electricity by 2022

- 1.25 lakh km of roads will be upgraded under Pradhan Mantri Gram Sadak Yojana at an estimated cost of nearly Rs 80,200 crore .

- To harness India’s space ability commercially, a public sector enterprise, New Space India Limited (NSIL) has been incorporated to tap benefits of ISRO .

- National Education Policy to transform and take India’s higher education system to global standards .

- National Research Foundation to be set up to strengthen overall research ecosystem in the country .

- Every panchayat in the country now will receive internet connectivity under Bharat Net .

- Allocation of Rs 400 crore for world-class higher education institutions in the country .

- Aadhar Card for NRIs to with Indian passports to be issued after their arrival in India, without having to wait for the mandatory 180 days .

- Loan of 1 lakh rupees under MUDRA for women entrepreneur in every SHG (Self Help Group ) .

- 100 lakh crore for the infrastructure sector, an expert committee will ensure ease of flow of funds .

- Rs 70,000 crore to be provided to public sector banks to boost capital and improve credit.

- Rs 100 lakh crore to be invested in infrastructure sector over next five years .

- Government’s ownership stake in the non-financial public sector may go below 51% .

- A new series of coins of denominations, Rs.1, 2, 5,10 and 20 in the pipeline .

- 25 percent corporate tax rate has been extended to companies with an annual turnover of up to Rs 400 crore .

- Additional income tax deduction of Rs 1.5 lakh on interest paid on loans taken to buy electric vehicles .

- Customs duty on gold and precious metals hiked, gold to become costlier .

- No longer dealing in Cash! 2% tax deduction at source on annual cash withdrawal of 1 crore. This will discourage business payments in cash.

- To resolve the angel tax issue, the startup’s and their investors who file requisite declaration & provide information in their return will not be subjected to any kind of scrutiny in respect of valuation of share premiums.

- A special additional excise duty of Re 1/litre on petrol and diesel.

- Taxpayers with an annual turnover of less than Rs 5 crore will have to file only quarterly returns.

- A surcharge will be levied on individuals with taxable income of Rs 2 to 5 crore, and Rs 5 crore and above.

- Aadhaar for the rescue! Taxpayers now can use their Aadhar Card number to file an income tax return .

- Union Budget 2019 also bought PAN and Aadhaar interchangeable now so that Aadhaar can be used for verification with no requirement for PAN.

- Additional deduction of Rs 1.5 lakh on interest on loans borrowed under affordable housing unitl 2020.

- Every verified woman SHG member with a Jan Dhan Account to get an overdraft of Rs. 5,000 .

- Govt to build 17 iconic sites to encourage arrival of tourists in India .

- Bank NPAs have reduced by Rs.1 lakh crore.

- Don’t have a PAN card? No worries, you can now file your Income Tax returns using your Aadhaar number .

- Under the Doordarshan bouquet, a new channel to be started to provide a platform for startups to disseminate information about their issues and growth in the industry .

- India attracted $64.4 bn worth of FDI in 2018-19 .

List of items that will become Costlier

- Imported books

- Gold

- Petrol and Diesel

- CCTV

- Imported Auto Parts

- Synthetic, PVC Tiles

- Plastic Material ,Gold, silver other precious metals ,Soap etc.

List of items that will become Cheaper

• Electric vehicles

• Leather itmes

• Defence equipments

• Purchasing of Home upto Rs. 45 Lakh

• Mobile Phone Set-top box, Electric vehicle components, Camera module ,Mobile phone chargers etc.

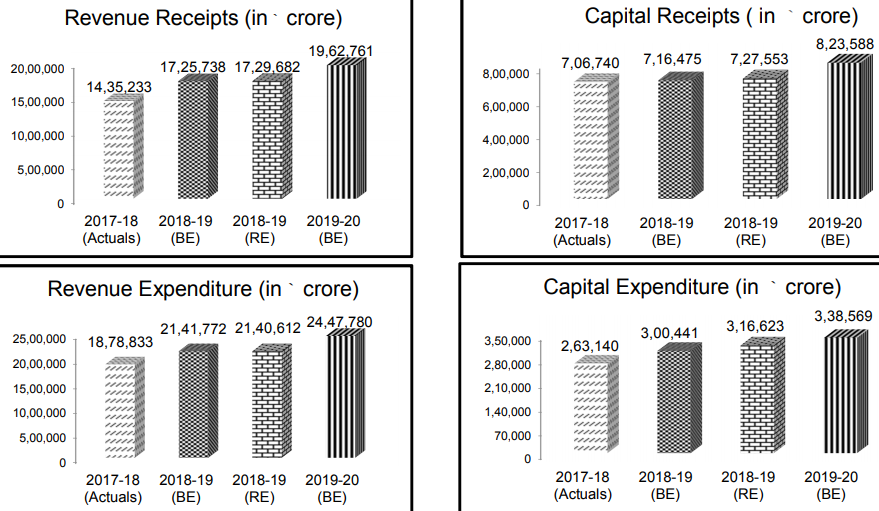

BUDGET AT A GLANCE

Vision for the next Decade By goverment

- Physical and social infrastructure

- Digital India

- Pollution free India

- Make in India

- Water management and clean rivers

- Blue economy

- Space programmes

- Self-sufficiency and export of food grains

- Healthy society

- Team India with Jan Bhagidari

Talking about Stock market ,Dalal Street reacted negatively towards Union Budget 2019.

NSE (national stock exchange ) were trading down by 150 points @ 11795 at 3:26 where as BSE (Bombay Stock Exchange) trading at 39,484.46 down by 422 points .

We might need to wait for proper analyses of the budget ,let us hope for the bright fututre of India .

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category