Tata Motors Q4 and FY19 Results: An In-Depth Analysis

00:00 / 00:00

Overview

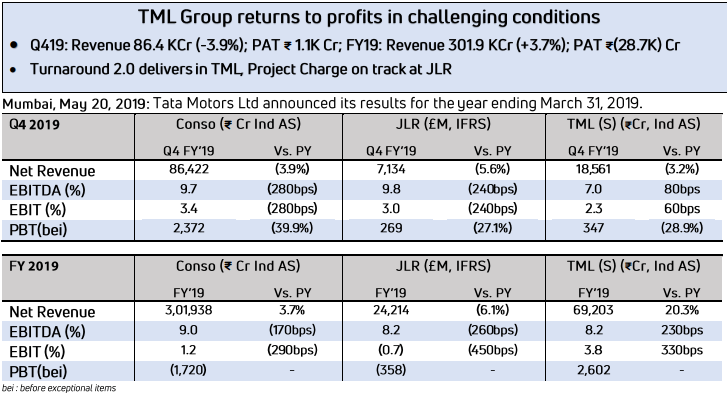

NSE 180.55(-5.05%) Tata Motors on Monday reported a 47.41 per cent (YoY) fall in profit at Rs 1,117.48 crore for March quarter compared with Rs 2,125.24 crore in the same quarter last year.

Tata Motors Q4 & FY19 Result Key Highlights

Ebitda for Jaguar Land Rover fell 40 bps to 9.8 %, while that of domestic business expanded 80 bps to 7 %.

TM Revenue for the quarter fell to Rs 85,676.33 crore from Rs 88,966.34 crore in the same quarter last year .

Tata Motors’ standalone profit after tax came in at Rs 106.19 crore over loss of Rs 499.94 crore in the same period last year.

Total revenue from operations came at Rs 18561.41 crore in March quarter against Rs 19173.46 cr .

Chairman N Chandrasekaran commented that the company’s domestic business delivered a resilient performance in the face of challenging market conditions.

“The ‘Turnaround 2.0’ strategy is delivering well, and I am confident that the business is getting the building blocks in place for long term success.

In JLR, we continue to face challenges in China which we are addressing on priority,’ .

Tata Motors said “To improve the volatile external scenario, we are taking decisive steps to step up .

The company incurred losses in JLR on full year basis. “Cash flow turned negative due to operating environment of JLR,” .

Below are the Tata Motors Q4 & FY19 Result Key Highlights

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category