Examining the Impact of Budget on BSE Listed Stock Companies

00:00 / 00:00

Overview

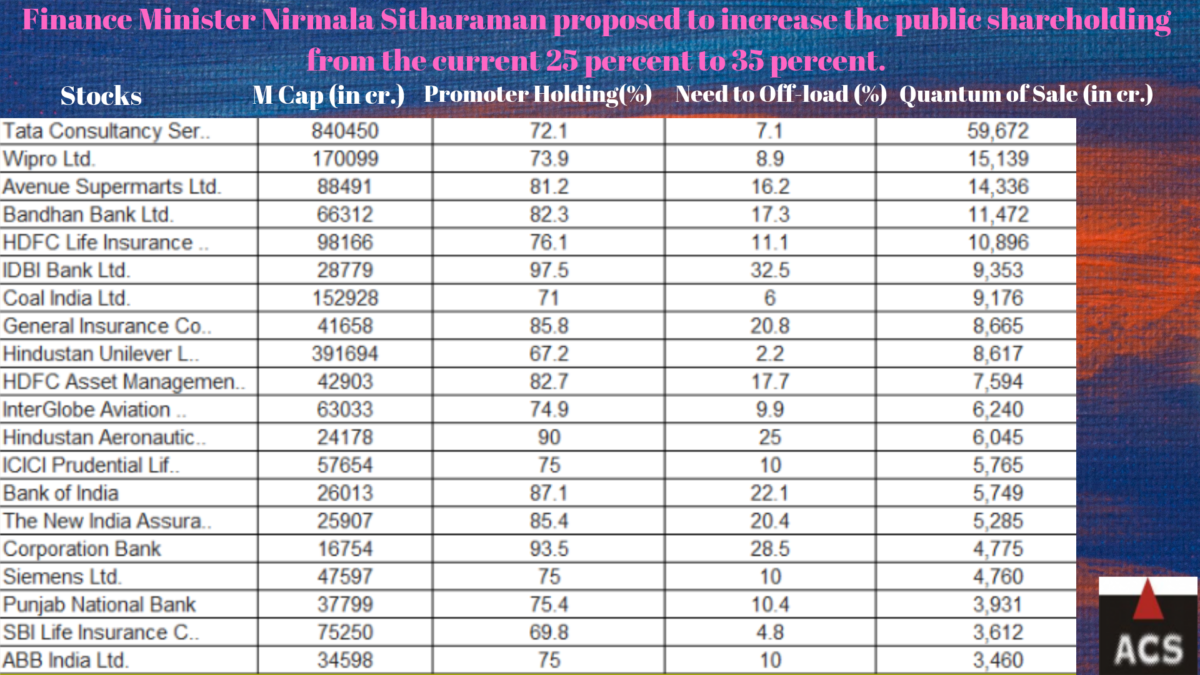

Finance Minister Nirmala Sitharaman recommended to increase the public shareholding from the current 25 percent to 35 percent.

We have come up with the list of Stocks that will be impacted by Budget move .

This move will likely to increase the liquidity in the stock market .Let us first understand what actually does it mean.

You might have heard of concept of minimum public shareholding.

It means that all listed companies in India need to maintain at least 35 percent (25 percent earlier) of their equity shares held by the non-promoters i.e. public.

Under this rule After this budget.

The promoters are asked to compulsorily sell down their stake by placing shares with institutions or issuing rights or bonus shares.

“Budget proposes to increase the public shareholding from 25 percent to 35 percent. This enforce many companies to dilute it stakes in the market by another 10 percent.

Below are the list of few stocks that will be impacted by budget Hugely:

However, the finance minister has provided some comfort for the state-owned companies as they are assured to maintain a public float of 25 percent.

For private companies, Sebi will put a penalty of Rs 5,000 a day for not complying with this measure.

Stocks that will be impacted by Budget from BSE Listed Companies

There are more than 700 firms as per March quarter disclosure data on the BSE that have promoter holding of more than 65 percent .

Of the 500 companies from BSE, 167 will have to divest their stake.

In the largecap space, there are companies like TCS, Hindustan Unilever, Wipro, Bharti Airtel, Coal India, HDFC Life Insurance, Vodafone Idea, DLF, ABB India and Avenue Supermarts.

Who will have to reduce their promoter holding to 65 percent.

At the current market prices, the total quantum of sale that needs to be done by these 1,174 companies works out to about a whopping of Rs 3,87,000 crore.

For this reason Some broking firm and analyst are considering it as bad move where as others are regarding it as better move for future.

Let us wait and see how SEBI will make this changes & its overall impact on india market . Check out these stocks at huge discount of 15-75 % percent available in year 2019.

Also check out stocks with more than 80% Discounts in 2019 .

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category